Some companies are obliged to have a process in place to monitor the transport of excise goods under excise duty suspension due to their business activities.

In this blog, this process of excise duty monitoring within SAP Global Trade Services (SAP GTS) is discussed.

Customs authorities in the EU Member States have an Excise Movement Control System (EMCS) to monitor the movement of goods under excise suspension. This excise duty processing applies to alcohol, tobacco, and energy products, for example. EMCS is used only in the EU.

Let’s continue on with the business and system processes, as well as relevant Customizing and master data.

Business Process

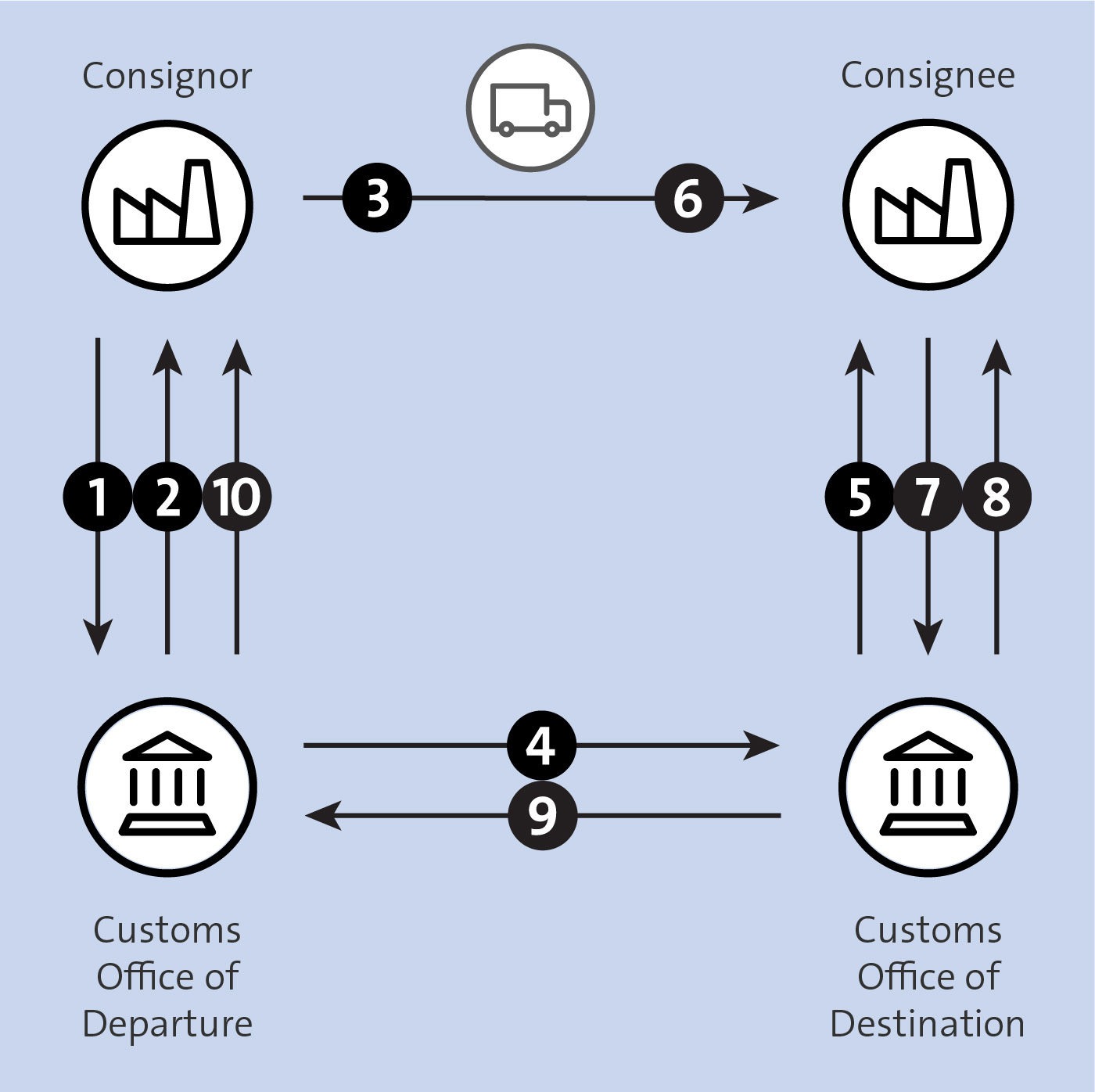

The first figure displays the overall business process for EMCS, including all the parties involved and the sequence in which all transactions take place.

For example, when a manufacturer of tobacco in Belgium wants to send its products to a customer located in Poland, it follows these steps:

- The consignor submits a notification to the customs office of departure in Antwerp, Belgium, which indicates that the goods are relevant for EMCS.

- The local customs office of departure replies with a confirmation message if the shipment of the goods is accepted. The customs office also provides the company with an Administrative Reference Code (ARC) number that has to be printed; this is a unique reference number of the declaration.

- After receiving this acceptance, the company can dispatch the excise goods. The goods are physically shipped to the location of the consignee.

- The customs authorities send a message to the customs office of destination in Poland. The purpose of this message is to provide the information regarding the EMCS-relevant shipment to the customs office of destination.

- The customs office of destination forwards this message to the consignee.

- The goods arrive at the place of destination.

- The consignee submits a report of receipt.

- The customs office of destination sends a receipt of the notification to the consignee.

- The customs office of destination forwards this report of receipt to the customs office of departure.

- The customs office of departure closes the loop by sending the information back to the consignor. These last two steps run simultaneously.

In this way, all concerned parties are informed about the departure and receipt of the excise goods under excise duty suspension.

The section of EMCS process flow relevant for the consignor is illustrated in the following figure.

System Process

Similar to previously described functionalities in the Customs Management module, every business process step can be linked to a transaction in SAP GTS. In this section, a link will be made between the EMCS business process and the system process.

Inbound Activities

When a supplier sends goods under duty suspension, an electronic incoming message from the local customs authority appears in SAP GTS. This implies that the process starts in SAP GTS without integration with the feeder system. In this way, your company is informed of the incoming shipment. The message contains the ARC number provided by the customs authorities.

After the goods arrive, the receiving company can compare the number of goods that are physically delivered to the expected number. The receiving company can accept the shipment if all goods are delivered in the correct quantities.

If there is a discrepancy in quantity or goods delivered, the consignee can accept the goods with restrictions. If the discrepancy isn’t acceptable, the goods are rejected. You’ll need to provide the local customs authorities with this status update.

After the customs authorities approve the report of receipt filed by the consignee for the concerned shipment, the inbound process is closed. By closing the inbound process, the consignor is released from its responsibilities.

In SAP GTS, an inbound EMCS document from which the communication with the customs authorities can take place is created. From the inbound perspective, there is no link between the feeder system and SAP GTS.

Outbound Activities

A company that wants to ship excise goods under duty suspension to its customer has to ask permission from the customs authorities before sending these goods. In the outbound process, a transfer of information from the feeder system to SAP GTS is required to create an outbound EMCS document.

The communication with the customs authorities follows the same e-filing process as for the standard export process.

Customizing

Aside from the general Customizing activities required to set up Customs Management, there is no need for additional Customizing activities to facilitate the EMCS process. However, it’s important to note that the interaction between the feeder system and SAP GTS doesn’t occur via the standard SAP GTS plug-in.

You have to set up a customized interface to enable the transfer of information and company-specific triggers to transfer information. SAP GTS provides a function module to enable this process (/SAPSLL/API_6800_EMC).

SAP GTS provides a standard interface between EMCS and customs exports to communicate the ARC number in the export document. As such, the export confirmation also determines the closing of the EMCS document for the outbound flow.

Master Data

To successfully perform e-filing, both the consignor and consignee of the process must have a tax warehouse number maintained in the system. There is no standard interface for this information, meaning that the tax warehouse number must be entered manually in SAP GTS. A customer-specific development is required to automate the transfer from the feeder system to SAP GTS if the data is maintained in the feeder system. To identify whether a product is EMCS relevant, you must classify the products with excise product codes.

Conclusion

For businesses shipping certain restricted goods within the European Union, the Excise Movement Control System plays an important part in your trade. With SAP GTS, you’re able to monitor your goods and duties levied as part of the shipment and delivery of those goods. This blog outlined the features of this tool; with this information, how can you improve your goods management with SAP S/4HANA Logistics?

Editor’s note: This post has been adapted from a section of the book Implementing SAP Global Trade Services by Nick Moris, Pablo LeCour, and Li Yu.

Comments