The financial close process is a complex and critical process that requires a high level of expertise, attention to detail, and coordination across different departments and systems.

It enables organizations to make informed decisions and ensure the accuracy and reliability of their financial statements. In today's business landscape, organizations encounter various economic obstacles such as inflation, high labor expenses, production insufficiencies, shortages of skilled resources, and supply chain complications. Moreover, they must adhere to ever-increasing regulatory demands, stricter compliance rules, and extensive audit and analytical requirements by the regulatory watchdogs. For CFOs, balancing these challenges while facilitating critical accounting processes like month-end close is highly complex. There is immense pressure to provide accurate and timely financial data to both internal and external stakeholders for decision-making purposes. Although the financial close process is a recurring task, it is not always completed on time. To streamline financial operations and achieve business objectives, organizations must understand and tackle the significant hurdles encountered during the financial close process. This necessitates a combination of process improvements, technology investments, and effective collaboration among various teams and departments involved in the financial close process.

Key Challenges of Financial Close

The financial close process is a critical task for organizations as it ensures the accuracy and compliance of financial data and generates accurate financial statements. However, conducting the financial close process comes with a range of challenges that can make it difficult to complete the task effectively and efficiently. Organizations face multiple obstacles during the financial close process, including time constraints, collaboration, and technology. Especially with the Covid-19 effect and the new remote and hybrid work culture continuing to have teams working remotely, the orchestration and coordination of closing steps and tasks have become even more challenging.

These are some of the most pressing issues to financial close.

Time Constraints

The financial close process often has tight deadlines, which can make it difficult for finance teams to complete all necessary tasks on time. According to a leading survey, 61% of finance professionals reported that they have less than five days to complete the financial close process. However, 93% of finance professionals believe that their organization's financial close process could be completed faster, and 51% believe that their organization has too many manual processes that slow down the process.

Complex Landscape

Organizations often use various systems and data sources to manage their financial information, such as ERP systems, general ledger systems, and other financial applications. Research shows that the average industry uses more than five different systems to complete the financial close process. The complexity arises when these systems are not fully integrated, or when data is stored in different formats, making it challenging to reconcile and consolidate financial information.

Global Operations

Organizations that operate globally often have to deal with multiple currencies, tax jurisdictions, and regulatory requirements which need a high level of expertise and knowledge of local regulations, as well as the ability to accurately translate and consolidate financial information across different languages, access to the local systems, etc. Managing this level of coordination across different geographies can make the financial close process more complex. The problem gets even more challenging if some of the processes are outsourced and managed via a shared service center.

Data Accuracy

Ensuring the accuracy of financial data can be challenging, as there may be discrepancies or errors in the data that need to be identified and corrected. Research shows that more than 50% of finance professionals believe that accuracy and completeness are top challenges in their financial close process, resulting in delays in the close process.

High Volume of Transactions

Large organizations with high transaction volumes face more complex financial close processes, as there are more transactions to reconcile and account for. This can be especially challenging when there are manual processes involved or when there is coordination and data review required between different departments, systems, or data sources. Managing some of these issues require effective coordination and accessibility of information on a real-time basis. Often, this is done offline and delays the closing process.

Audit and Compliance Requirements

Organizations are subject to various audit and compliance requirements, which can add complexity to the financial close process. This includes ensuring that financial statements are accurate and comply with accounting standards, as well as meeting regulatory requirements such as SOX, IFRS, and GAAP.

Benefits of SAP S/4HANA Cloud for Advanced Financial Closing

Addressing these challenges requires a combination of process improvements, technology investments, and effective collaboration between different teams and departments involved in the financial close process. Although CFOs and finance leaders understand the advantages of technology investments and automation, they often hesitate to adopt it due to concerns that their current processes are too intricate and unique for automated solutions. Nevertheless, adopting a gradual and systematic approach to automation using tools such as SAP S/4HANA Cloud for advanced financial closing is possible. These can help organizations improve coordination, provide transparency, and enhance the accuracy and efficiency of their close process by introducing a new level of discipline.

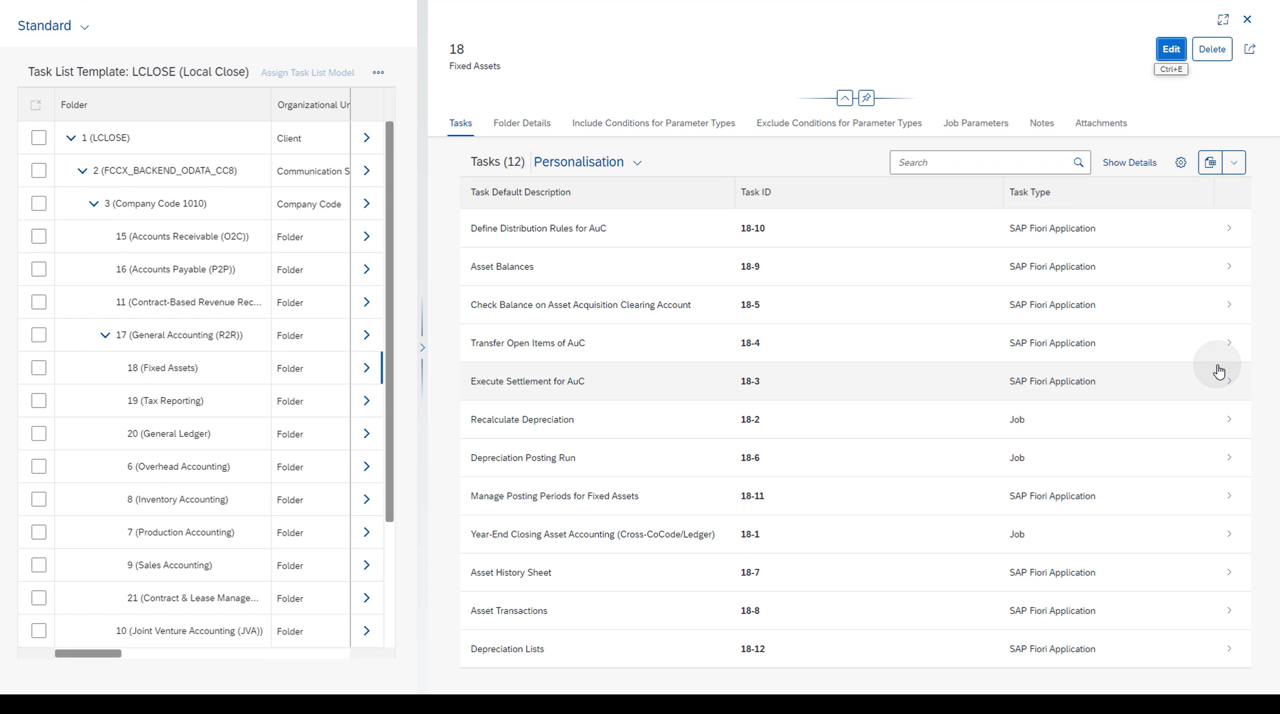

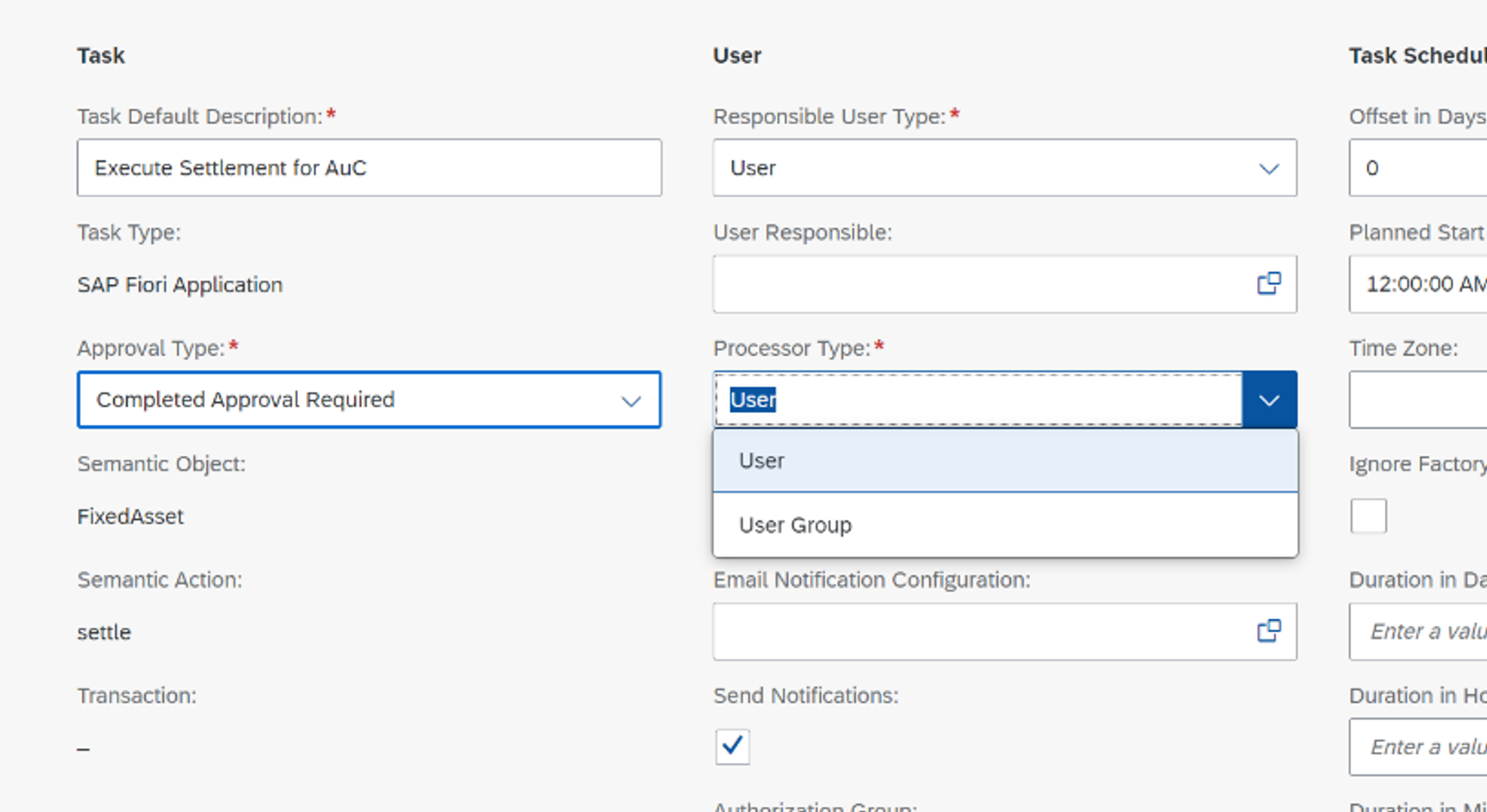

SAP S/4HANA Cloud for advanced financial closing offers flexibility to configure templates that contain all the closing tasks, outlining standard closing steps between various subprocesses across geographies. This improves collaboration and provides a unified workspace for all stakeholders to work together, reducing the risk of miscommunication or conflicting objectives.

Additionally, organizations can also add manual steps to the templates and set up approval to improve controls and compliance. Templates from the solution provide transparency into the financial close process by clearly outlining the required tasks and procedures, enabling stakeholders to track progress and ensuring that all necessary tasks are completed accurately and in a timely manner. Overall, SAP S/4HANA Cloud for advanced financial closing’s pre-configured templates helps organizations to streamline their financial close process, improve accuracy, and reduce the risk of errors or discrepancies in financial reporting.

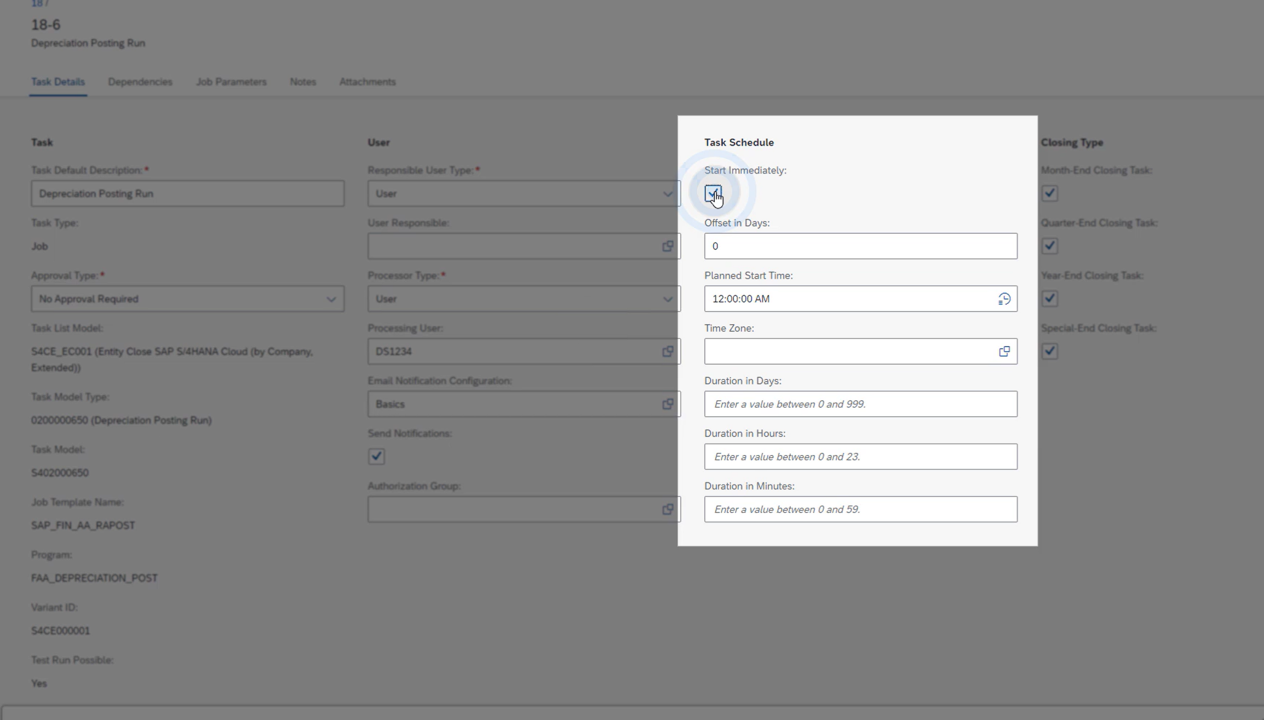

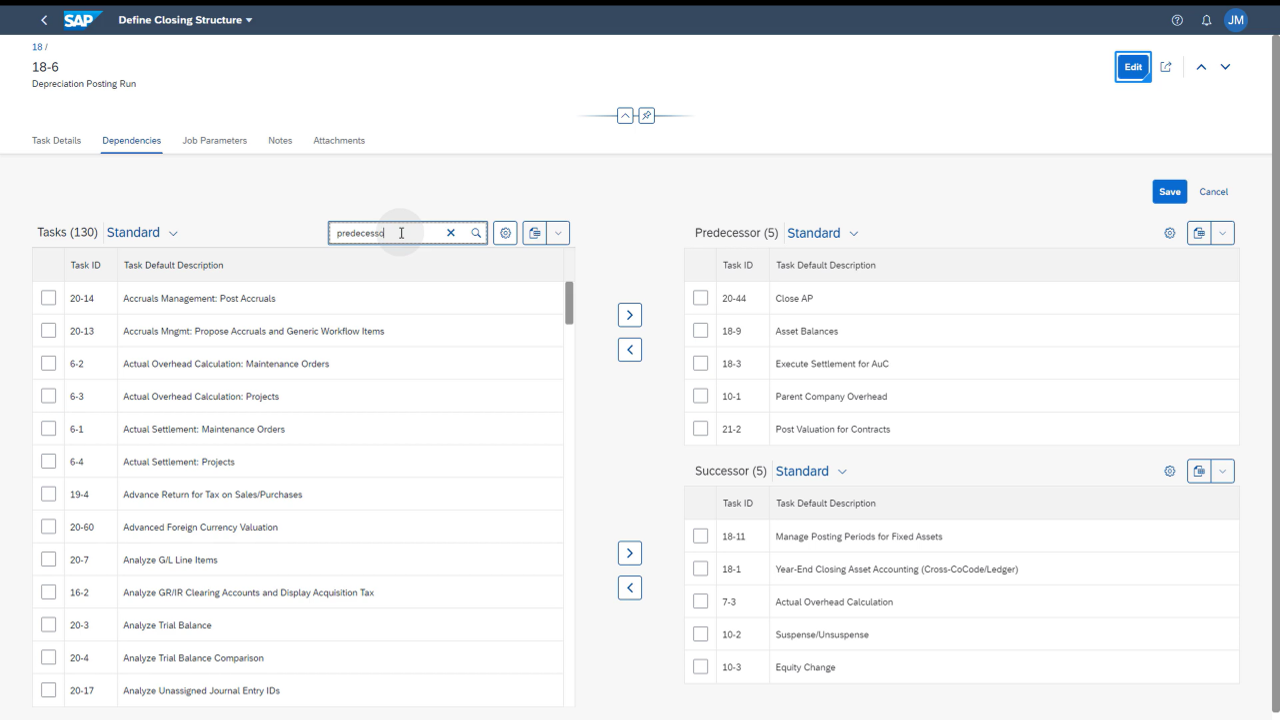

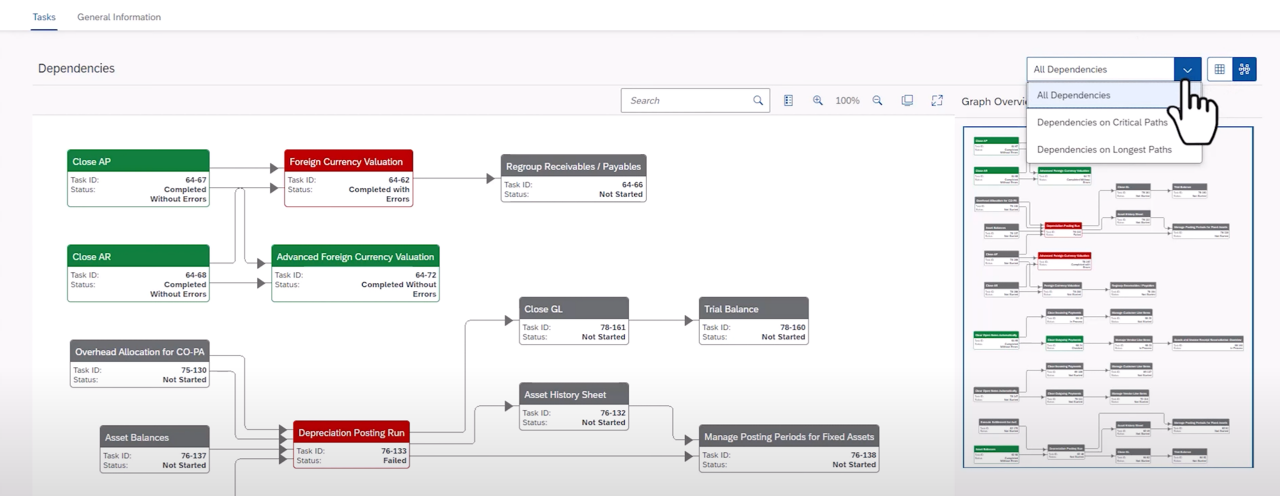

Furthermore, templates can improve the efficiency of the financial close process by eliminating the need for manual processes and reducing the time and effort required for each task. By automating repetitive tasks by clearly defining the dependency and successor path, organizations can complete the financial close process more quickly and efficiently.

One of the key advantages of SAP S/4HANA Cloud for advanced financial closing is its ability to connect multiple financial systems and applications. It provides seamless integration with SAP's financial management software as well as other third-party systems, allowing organizations to streamline their financial close process and ensure that all financial data is accurate and up to date. This capability helps eliminate the need for manual data entry and reduces the risk of errors or discrepancies in financial reporting. With the ability to connect multiple systems, SAP S/4HANA Cloud for advanced financial closing enables organizations to centralize their financial data, simplify their financial close process, and make more informed decisions based on accurate and timely financial information.

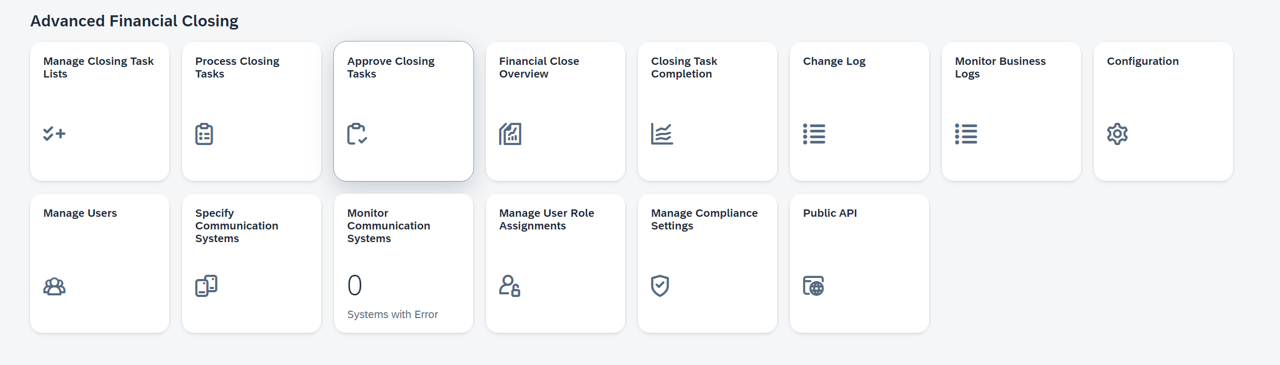

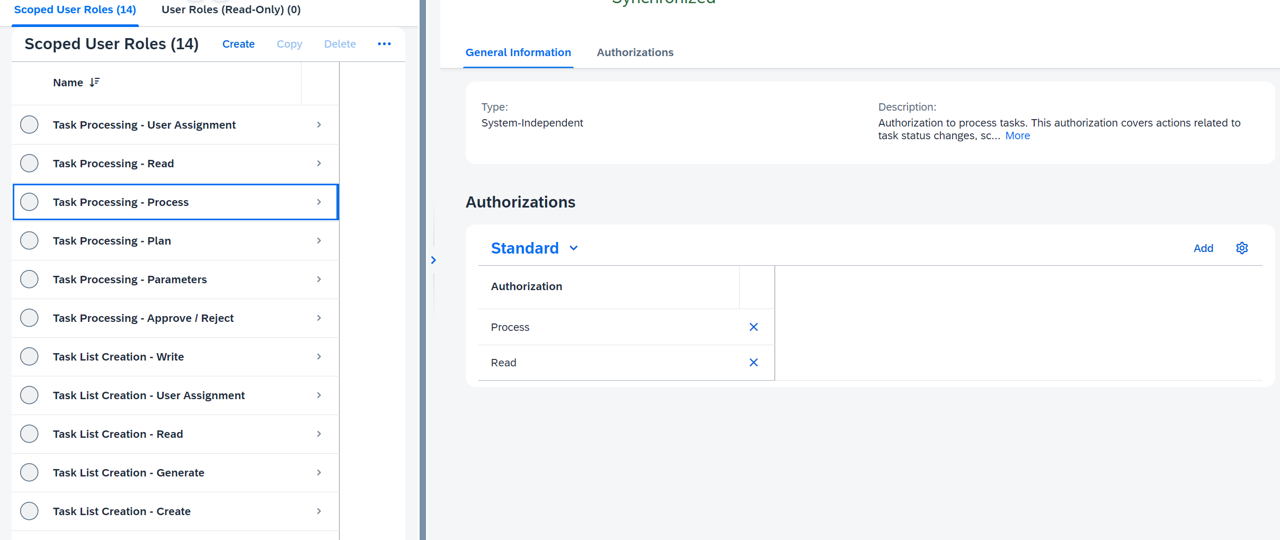

SAP S/4HANA Cloud for advanced financial closing’s architecture allows finance professionals to access the platform from anywhere, at any time. It offers a user-friendly interface that allows finance professionals to manage many business functions like closing, template, closing tasks, user roles, etc., without extensive IT knowledge. This reduces the need for IT assistance or support, enabling finance professionals to manage their closing tasks independently and efficiently.

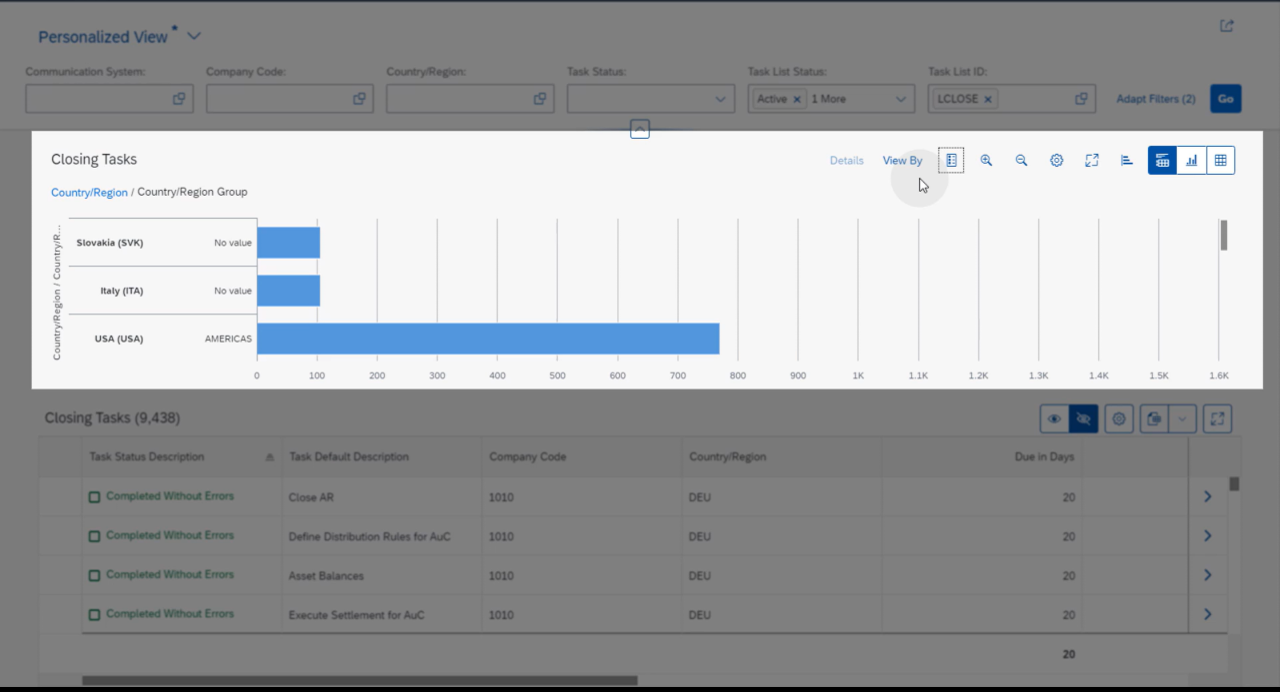

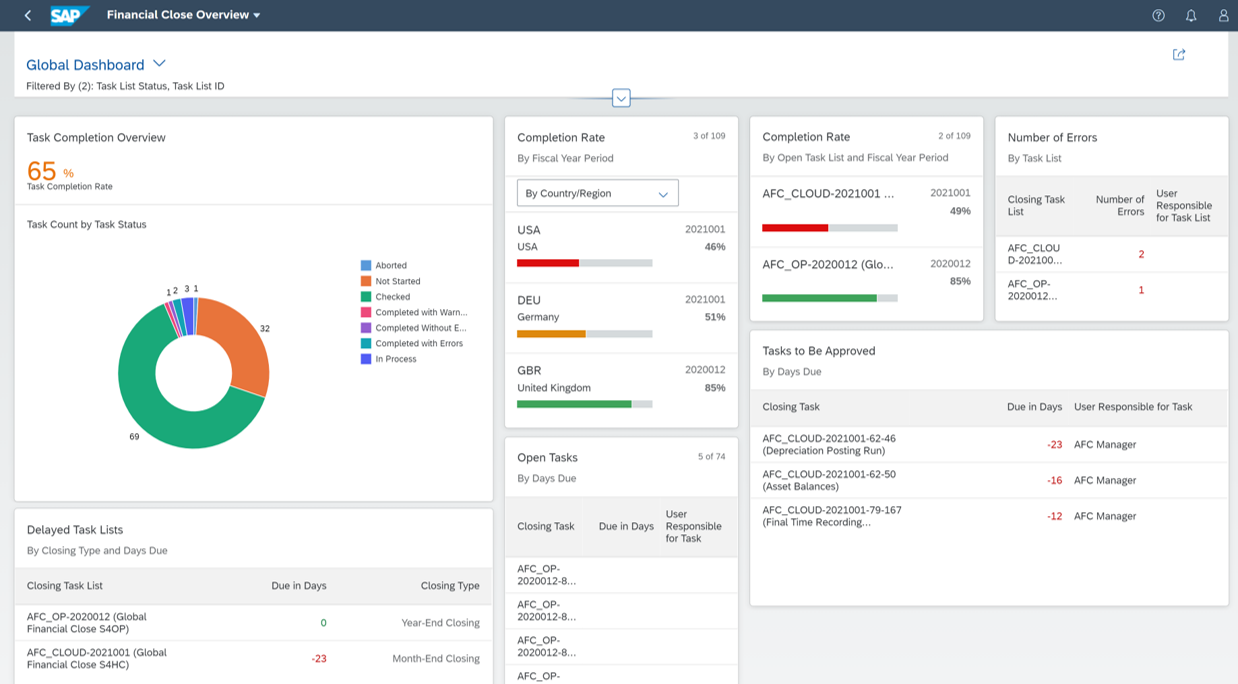

Real-time monitoring and analytics take financial close process management to the next level. It enables you to monitor your closing activities in real-time through an intuitive SAP Fiori dashboard, providing instant visibility into the progress of the financial close process. This enables users to monitor the data, identify bottlenecks, and take corrective actions where required.

Additionally, SAP S/4HANA Cloud for advanced financial closing empowers you to identify the most critical and time-consuming tasks in the closing process, allowing you to take proactive measures to mitigate potential delays and stay on track to meet the closing deadline. This feature provides valuable insight to the organization, allowing it to focus on areas of improvement that have the greatest impact on the overall efficiency of the closing process, leading to better performance and increased productivity.

Conclusion

SAP S/4HANA Cloud for advanced financial closing is a comprehensive and efficient solution that addresses the challenges faced by organizations in their financial close process. Its range of functionalities, including process orchestration, task management, and performance analytics, enable organizations to optimize their financial close process. By combining process improvements, technology investments, and effective collaboration, organizations can streamline their financial close process, improve accuracy, and reduce the risk of errors or discrepancies in financial reporting.

This post was originally published 5/2023.

Comments