Most large organizations use SAP, and more than 75% of the world’s transactions happen within SAP systems.

Many of these organizations running SAP have their plants or operations across several countries and execute intercompany transactions. SAP has supported intercompany processing for both variants from the very early days of SAP R/3.

Classic Processing in SAP ERP and SAP S/4HANA

SAP’s intercompany solution in SAP R/3, SAP ERP, and SAP S/4HANA (until the 2022 on-premise release) are referred to as classical intercompany solutions, as SAP released an advanced version of the intercompany solution in the on-premise release of SAP S/4HANA 2022. In the following sections, we’ll cover classic intercompany sales, classic intercompany stock transfer, and the limitations of both.

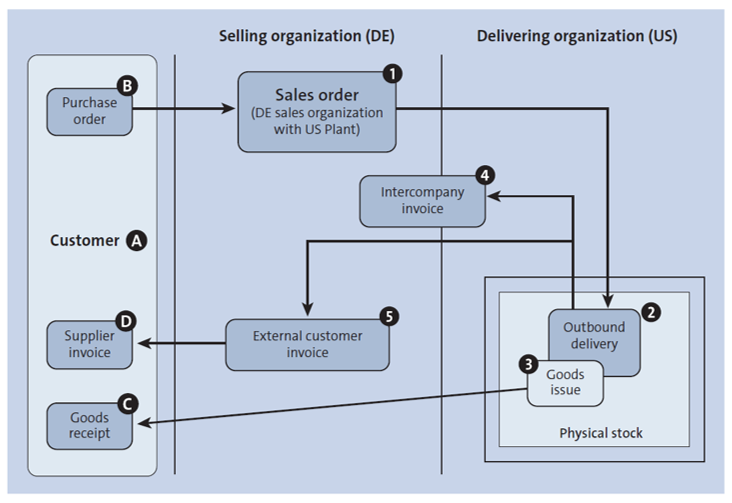

Classic Intercompany Sales

The high-level process flow for intercompany sales is shown in the figure below. A sales order (1) is created with reference to the purchase order (B) from the customer (A) with the selling organization in Germany and delivering plant in the US. This makes the sales order relevant for intercompany transactions because a standard sales order has the sales organization and delivering plant be from the same country or company. An outbound delivery (2) is created at the US delivering plant (organization) for shipping directly to the external customer (A). Goods issue (3) is executed on the outbound delivery (2) for material flow directly to the external customer (A). The US organization creates an intercompany invoice (4) with reference to the outbound delivery with the German organization as the payer for the materials supplied by the US to the external customer. The German company will also create an external customer invoice (5) with the external customer (A) as the payer of the invoice. The external customer then does the goods receipt (C) and creates the supplier invoice (D) in their own system. In classic intercompany sales, materials are directly delivered to the external customer.

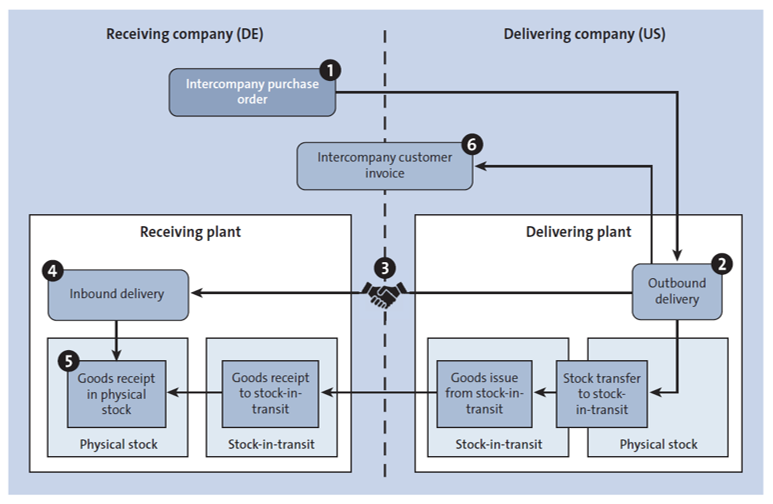

Classic Intercompany Stock Transfer

The high-level process for intercompany stock transfer is shown in the next figure. The receiving company in Germany creates an intercompany purchase order (1) for the procurement of a product from the manufacturing or warehousing unit of their US affiliate. The receiving company in Germany generally starts this procurement based on some forecast for sales or production of another product. The delivering company in the US creates an outbound delivery (2) with reference to the purchase order for the transfer of goods from the US to Germany. A goods issue is posted on the outbound delivery (2), which transfers the stock to stock-in-transit and creates at inbound delivery (4) at the German receiving plant. Stock moves from stock in transit at the delivering plant to stock in transit at the receiving plant with proof of delivery (POD). (3) happening in between the movement of stock from the US to Germany. Then, the goods receipt (5) is posted on the inbound delivery (4) at the receiving plant once they receive the stock physically. An intercompany invoice (6) is created after the goods issue of the outbound delivery (2) with the receiving company in Germany as payer of the invoice. In classic intercompany stock transfer, materials or goods are physically received by the receiving organization.

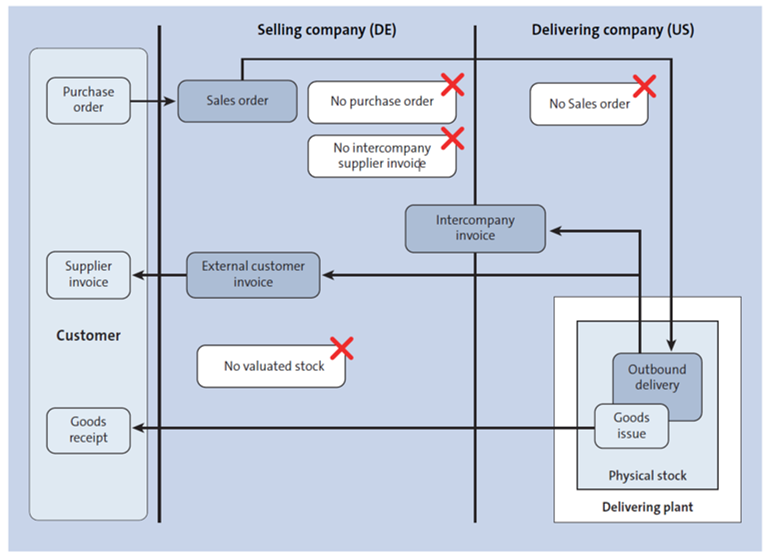

Limitations of Classic Intercompany Processing in SAP

Classic intercompany solutions have existed in SAP ERP for more than 30 years, but there are several limitations from both logistics and finance perspectives for intercompany sales, as highlighted in the next figure, and intercompany stock transfer.

The major limitations for intercompany sales in SAP are as follows:

- The selling company procures the goods from the delivering company, but there is no purchase order placed at the delivering company by the selling company.

- The delivering company delivers goods without any sales order placed to their sales organization.

- There is no supplier invoice at the selling company for the supplied material, only an accounting document generated through the intermediate document (IDoc) output from the intercompany invoice.

- There is no valuated stock posting at the selling company, so there is no proper product costing or landed cost at the selling company.

- The delivering company is the cost carrier or cost object even though the actual sale is happening through the selling organization.

- The period-end closing (results analysis, settlement) can be carried out only at the delivering company, and there is no key performance indicator (KPI) reporting for the selling company.

- The intercompany invoice requires a complex pricing mechanism.

- There is a fixed sequence for invoicing (first intercompany invoice and then external customer invoice).

- Event-based revenue recognition (EBRR) with the International Financial Reporting Standards (IFRS) accounting principle isn’t supported.

- Universal parallel accounting (UPA) isn’t supported.

Likewise, the intercompany stock transfer process also has similar limitations:

- The delivering company delivers goods without any sales order placed to their sales organization.

- The intercompany invoice requires a complex pricing mechanism.

- EBRR with the IFRS accounting principle isn’t supported.

- UPA isn’t supported.

Advanced Intercompany Sales in the SAP S/4HANA 2022+ Release

SAP has released a new intercompany functionality called advanced intercompany sales and advanced intercompany stock transfer with the SAP S/4HANA 2022 release to eliminate the limitations of the classic intercompany functionality. This advanced intercompany solution also provides a new orchestration and monitoring framework for end-to-end logistic and finance processes with the SAP Fiori app called Monitor Value Chains. This advanced intercompany sales and advanced intercompany stock transfer solution is just the initial solution and will evolve in upcoming releases.

Advanced intercompany sales and advanced intercompany stock transfer need to be activated separately in SAP S/4HANA with additional configurations, settings, master data, and so on because they don’t come as a default advanced intercompany solution in SAP S/4HANA.

Note: An additional license isn’t required to use advanced intercompany sales and advanced intercompany stock transfer in the SAP S/4HANA 2022+ release. This solution can’t be down ported to earlier releases such as SAP S/4HANA 2021.

Editor’s note: This post has been adapted from a section of the e-book Introducing Advanced Intercompany Sales and Stock Transfer with SAP S/4HANA by Mrinal K. Roy. Mrinal is an SAP S/4HANA and supply chain architect with more than 20 years of SAP experience. He has worked in the design, development, and implementation of SAP ERP, SAP S/4HANA, SAP APO, SAP EWM, SAP TM, SAP Yard Logistics, SAP S/4HANA for advanced ATP, and SAP Business Network projects in several countries. Mrinal holds ten SAP certifications and has strong business process knowledge and hands-on configuration skills.

This post was originally published 3/2024.

Comments