In SAP S/4HANA, cost center under/overabsorption can be allocated to products, with the additional period-end process of revaluation at actual prices.

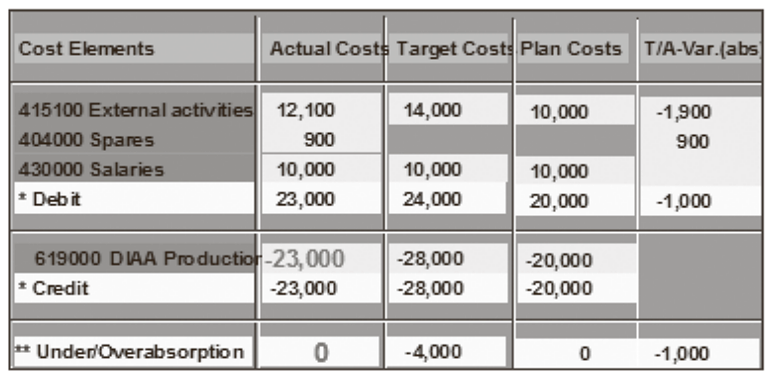

This process calculates the incremental planned activity price needed to allocate all cost center balances. Orders are then revalued with the incremental debits, and the cost center receives corresponding credits. Following revaluation, the cost center actual balance is zero in the actual costs column and the under/overabsorption row of the target/actual cost center report shown in this figure.

The actual costs credited to the cost center, which were -28,000 before revaluation, are reduced to -23,000. The original product cost collectors and manufacturing orders receive a credit calculated with the formula: Consumed quantity (Original price – Actual price).

Product cost collectors need to be resettled following revaluation due to the incremental debit received during revaluation. There are two requirements for carrying out revaluation: a version configuration setting and an activity type setting. Let’s discuss each in turn.

Version Configuration

You maintain version configuration with Transaction OKEQ or via IMG menu path Controlling > General Controlling > Organization > Maintain Versions.

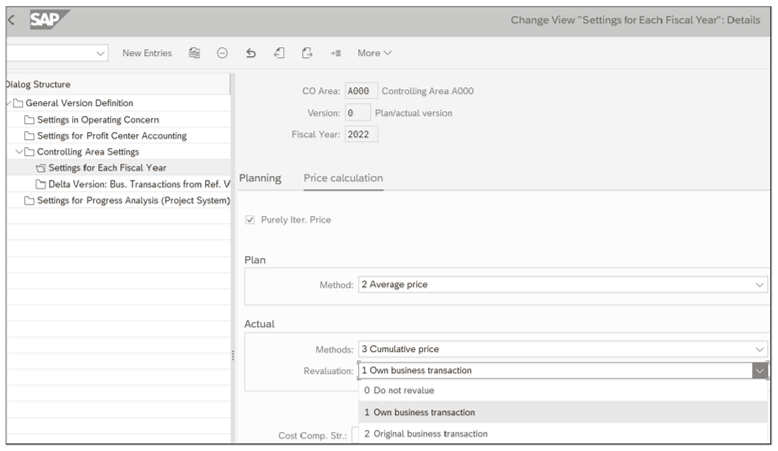

You’re presented with a screen like the one displayed in the next figure. Use the following steps to navigate to the version configuration setting displayed:

- Select Version 0.

- Double-click on Settings for Each Fiscal Year.

- Double-click on the current Fiscal Year.

- Click on the Price calculation

The screen shown is displayed.

Now that we’ve navigated to the correct tab, you make the configuration setting with the following steps:

- Click in the Revaluation

- Choose Own business transaction.

- Save the configuration.4

Activity Type Setting

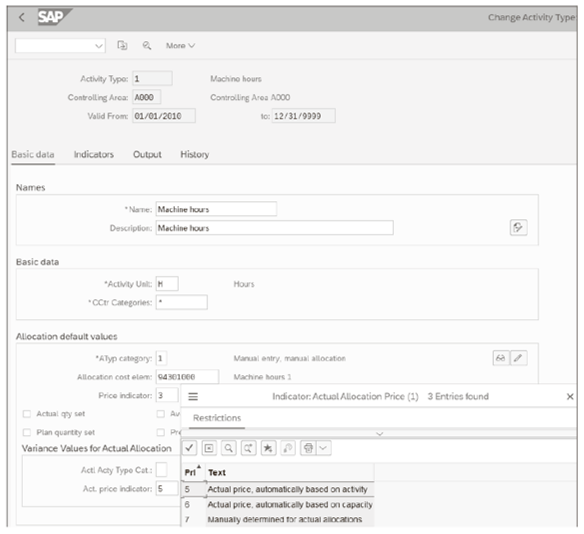

The second requirement for carrying out revaluation is setting the actual price indicator for activity types to be revalued. You set the actual price indicator with Transaction KL02 or via menu path Accounting > Controlling > Cost Center Accounting > Master Data > Activity Type > Individual Processing > Change. Complete the Activity Type field, and press (Enter) to display the screen shown here.

You make the Activity Type setting with the following steps:

- Click in the price indicator field shown at the bottom of the above figure, and choose Possible Entries.

- Choose Actual price, automatically based on activity.

- Save the configuration.

Actual Price Calculation

Now that we’ve ensured that the configuration and activity type settings are correct, we’re ready to carry out actual price calculation. Revaluation occurs automatically during actual price calculation.

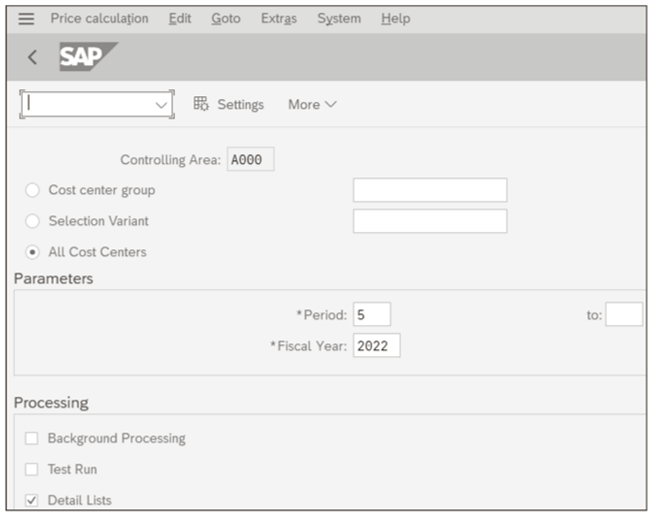

You carry out actual price calculation with Transaction KSII or via menu path Accounting > Controlling > Cost Center Accounting > Period-End Closing > Single Functions > Price Calculation. The screen shown below is displayed.

Enter your Period and Fiscal Year, select the Detail Lists checkbox, and click on the Execute button (not shown) to run the transaction.

You analyze the results of the actual price calculation in the information system with Transaction KSBT or via menu path Accounting • Controlling > Cost Center Accounting > Information System > Reports for Cost Center Accounting > Prices > Cost Centers: Activity Prices. You can compare plan and actual activity prices with the report.

As long as you’ve set the Revaluation indicator in the Version, as shown earlier, and set the Act. price indicator in the activity type, also shown earlier, revaluation automatically occurs during actual price calculation. You can confirm the cost center balance is zero following revaluation with the standard actual/target cost center report.

Actual price calculation and revaluation allow you to post cost center variances to product cost collectors and manufacturing orders. If you need to allocate all purchasing and manufacturing differences to finished products as well, you should consider actual costing with the Material Ledger in SAP S/4HANA.

Editor’s note: This post has been adapted from a section of the book Production Variance Analysis in SAP S/4HANA by John Jordan and Janet Salmon.

Comments