In SAP ERP, there were two types of Profitability Analysis (CO-PA): costing-based and account-based.

In costing-based CO-PA, costs and revenues are grouped according to customer-defined value fields, whereas in account-based CO-PA, results are analyzed using general ledger accounts. You were able to activate both costing- and account-based CO-PA at the same time. However, account-based CO-PA had potential performance issues for large data values because it used the same line-item and totals tables as Overhead Cost Controlling (CO-OM) and didn’t offer the flexibility of value fields. Thus, many SAP customers only used costing-based CO-PA in SAP ERP and earlier ERP releases.

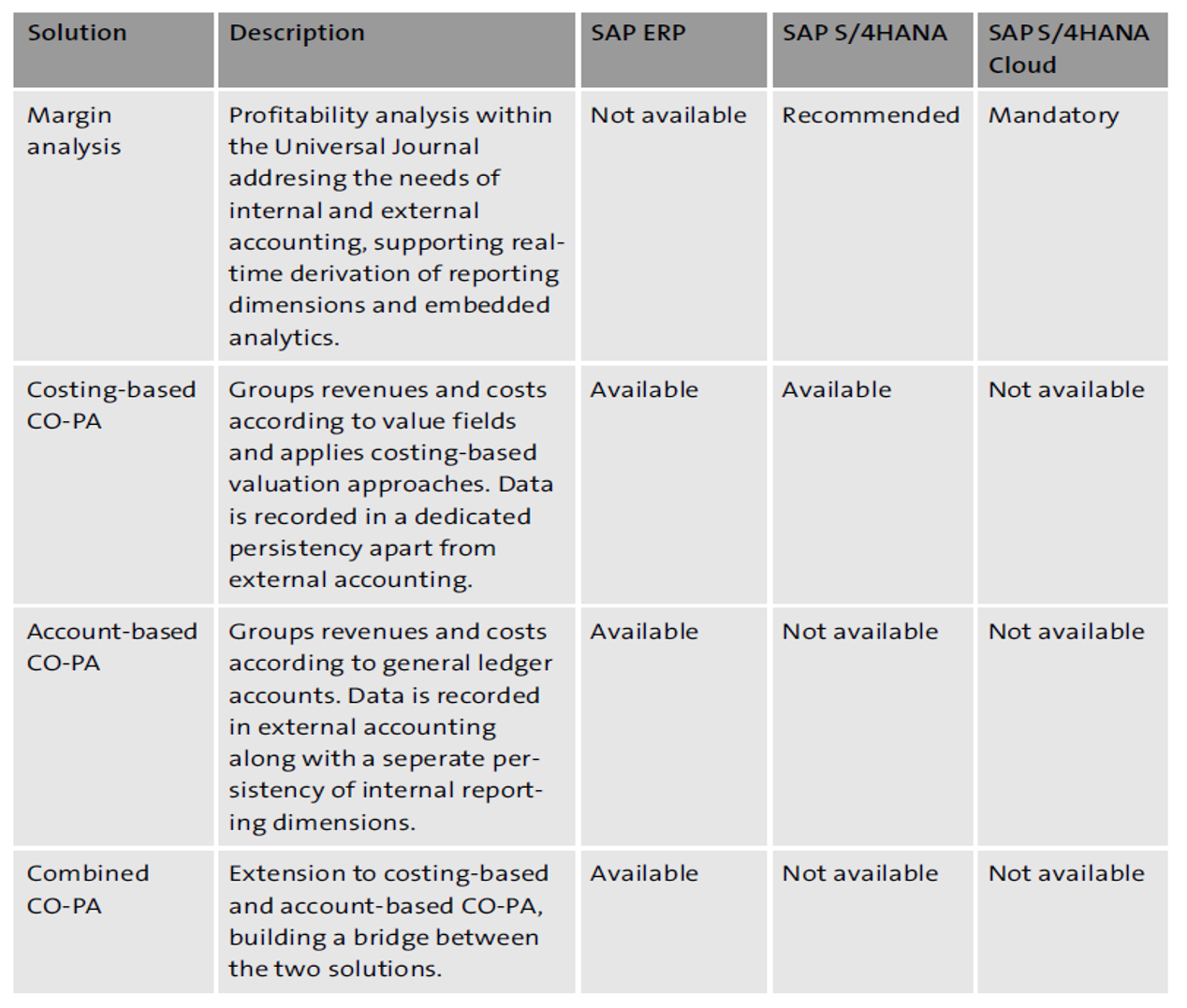

Today, SAP has four Profitability Analysis solutions with different availability across SAP ERP, SAP S/4HANA, and SAP S/4HANA Cloud, as shown in the table below: margin analysis, costing-based CO-PA, account-based CO-PA, and combined CO-PA.

With SAP S/4HANA, SAP introduced margin analysis, which enables profitability analysis within Universal Journal to address the needs of both financial and management accounting. The Universal Journal includes all profitability analysis characteristics to support multidimensional reporting by market segment. All revenue and cost of goods sold (COGS) postings are automatically assigned to the relevant profitability analysis characteristics in Universal Journal at the time of posting, so no reconciliation is required. Costing-based profitability analysis is still available in SAP S/4HANA; however, SAP encourages its customers to move to margin analysis, where all the innovation and investment are focused. The combined profitability analysis’s primary purpose is to help SAP ERP customers prepare to move to margin analysis and combine costing-based and account-based CO-PA (check SAP Note 2344093 for more details). In simple terms, account-based CO-PA is closest to margin analysis as both are based on general ledger accounts; however, there are many differences in architecture, reporting, and apps. In summary, margin analysis is the new account-based CO-PA solution on Universal Journal with lots of innovations from SAP.

SAP recommends implementing margin analysis to take advantage of all the benefits from the Universal Journal, where all the information is included and unified. It’s the mandatory solution in SAP S/4HANA Cloud. Margin analysis is fully integrated with the Universal Journal and derives the appropriate characteristics on every journal posted to the Universal Ledger that can feed into SAP Analytics Cloud. SAP will continue to do all innovations in margin analysis in the future. In this post, our primary focus will be SAP’s margin analysis solution.

Note: The technical basis for margin analysis is account-based profitability analysis, so the Account-Based CO-PA flag in the operating concern is activated for margin analysis.

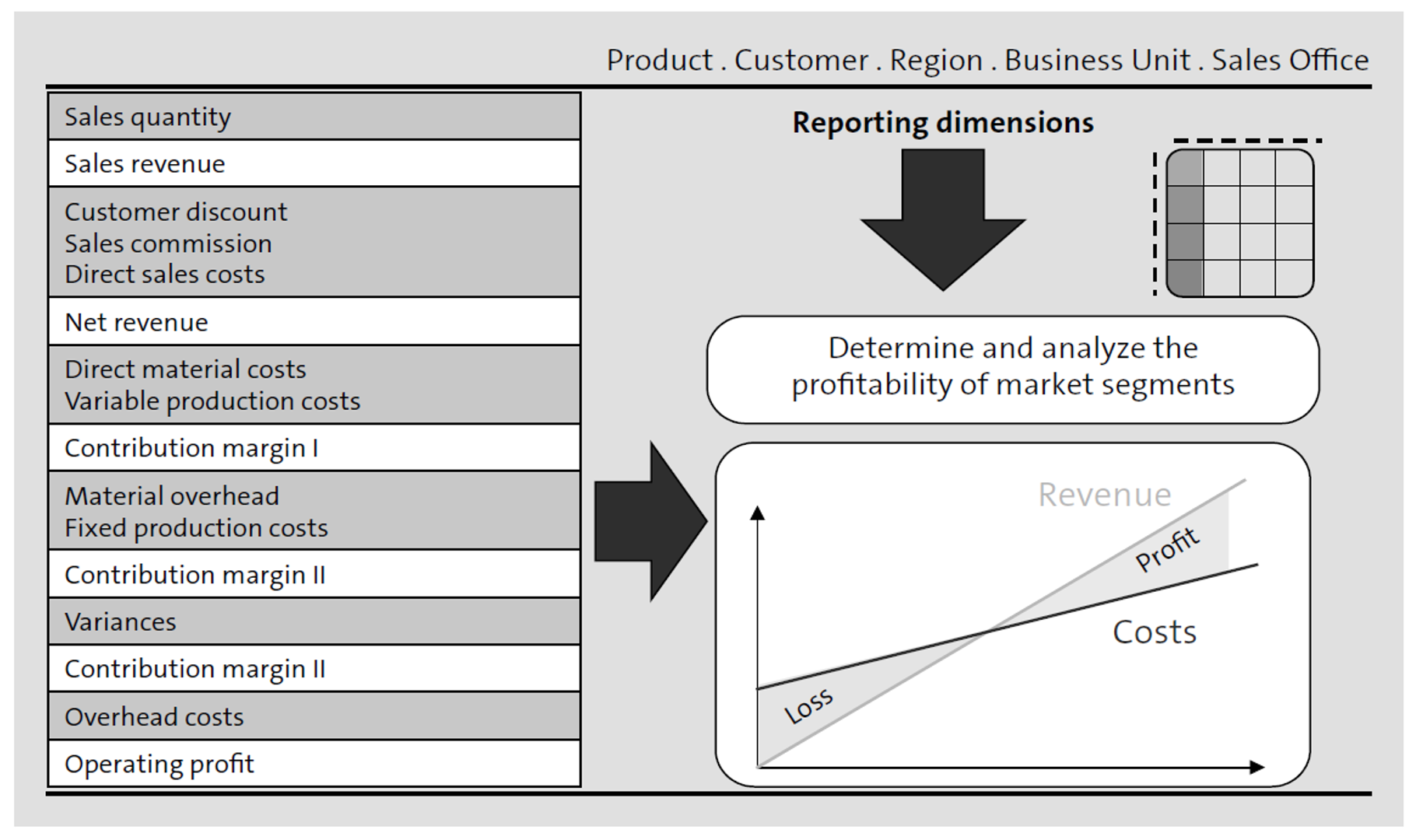

The income statement, also known as a profit and loss (P&L) statement, summarizes the company’s revenues and expenses over a discrete period. Breaking down the income statement into additional dimensions, such as product, customer, region, business unit, sales office, and so on, is one of the key objectives of margin analysis (see figure below). This also allows for a more detailed analysis of the contribution margin to determine sales effect upon profitability. With margin analysis, management accountants have the opportunity to have detailed cost-volume-profit analysis to make informed profitability decisions based on real-time data.

When implementing any SAP product or module at a very high level, we always have two types of reports: standard and custom. Out-of-the-box standard reports delivered by SAP require minimum or no configuration. Custom reports are built using various SAP tools and products, and they require some customization and coding. Prior to SAP S/4HANA, CO-PA had only two standard reports, and the rest had to be built using CO-PA drilldown reporting tools (Transaction KE31). The two standard reports are Display Plan Line Items (Transaction KE23) and Display Actual Line Items (Transaction KE24). The other profitability report building options were to use ABAP, ABAP Query, SAP Business Warehouse (SAP BW), or third-party data warehouse or analytics solutions.

With SAP S/4HANA, profitability reporting changed significantly due to various factors such as the SAP HANA database, Universal Journal, embedded analytics, predictive analytics innovations, new reporting products, reporting based on virtual database models (VDMs) based reporting, and so on. Let’s now briefly get an overview of various reporting options and their capabilities with a focus on margin analysis reporting:

Traditional Reports

With SAP S/HANA, profitability line-item and drilldown report functionalities continue to work as they worked for SAP ERP. Display Actual Line Items (Transaction KE24) will only show revenues and costs booked to profitability segments (Account Assignment Object Type EO). Classic profitability analysis drilldown reports can be executed via Transaction KE30. Costing-based profitability analysis continues to be supported; however, it won’t benefit from any further development by SAP. Note that traditional reporting won’t fully support the innovations in SAP S/4HANA Finance, such as parallel ledgers, additional currencies, and so on. Both costing-based and account-based profitability analysis are able to use the traditional reports with these restrictions. Note that traditional reports will benefit from the SAP HANA database, as the SAP HANA database will provide improved performance and shorter report runtimes.

SAP Fiori Apps Based on SAPUI5

SAP Fiori apps have been developed based on the SAPUI5 framework for user interfaces. The SAPUI5 framework also allows SAP customers to build a frontend custom application that follows the SAP Fiori design guidelines. The framework provides a set of applications that are used in regular business functions such as financial apps, calculation apps, embedded analytics apps, and, of course, reporting and analytics apps.

SAP Fiori apps that are built with SAPUI5 technology can be consumed via web applications and across various platform devices. The SAP Fiori launchpad is used to launch and consume SAPUI5 apps. The business data used by the apps is retrieved at runtime from the backend systems by using OData services.

Web Dynpro for ABAP-Based Reports

The Web Dynpro for ABAP framework technology is used for developing applications in ABAP. The framework is composed of an environment that consists of the graphical development tools of Web Dynpro for ABAP. It can be used for standard SAP-delivered apps and for developing customer-specific apps and reports integrated with ABAP environment applications.

Web Dynpro for ABAP is the recommended reporting tool for SAP S/4HANA, as it provides features that aren’t available in SAP Lumira, designer edition. Some of these features are as follows:

- SAP’s accessibility standard

- PDF download functionality

- Exception reporting

SAP Lumira, Designer Edition, Reports

SAP Lumira, designer edition, is used to create analysis applications and dashboards. It’s based on SAP BW, SAP HANA, and universe data sources, and was intended to be the successor of the SAP Business Explorer (BEx) Web Application Designer tool. The application offers a design tool that allows you to create applications easily and intuitively without the need for native HTML UI programming skills, and it supports the what you see is what you get (WYSIWYG) design principle.

Even though many of the SAP standard app reports were developed using SAP Lumira, designer edition, at the time of writing this post, it remains an optional reporting tool. Web Dynpro is the recommended reporting tool for SAP S/4HANA.

SAP Analytics Cloud Reports

SAP Analytics Cloud is software as a solution (SaaS) for analytics, planning, and smart prediction. Currently, SAP provides two types of SAP Analytics Cloud platform options: embedded SAP Analytics Cloud and stand-alone SAP Analytics Cloud. The embedded SAP Analytics Cloud is fully managed by SAP S/4HANA Cloud and exposes the embedded SAP Analytics Cloud functionality via SAP Fiori apps. With standalone options, each tenant has a dedicated SAP Analytics Cloud tenancy. In both options, each tenant’s data is isolated and remains invisible to other tenants. In terms of architecture, SAP Analytics Cloud accesses the ABAP core data services (CDS) views live, using the transient analytical queries generated automatically for the CDS views. SAP Analytics Cloud UIs will be embedded in iFrames and be published on the SAP Fiori launchpad.

SAP BW/4HANA Reports

SAP BW/4HANA is SAP’s strategic data warehousing solution. SAP BW/4HANA combines with SAP S/4HANA to manage operational and analytical reporting using the same data as the underlying applications. With the concept of the logical data warehouse approach, SAP BW/4HANA eliminates the data replication, storage, and the need to move data from an organization’s applications.

Use of Semantic in Reports

Semantic tags are financial data objects aiming to simplify and enhance financial statement (FS) items, general ledger account, and functional area use in analytical applications. Semantic tags are short text IDs that tag FS items and general ledger accounts with or without a functional area. As a result, you define semantic tags centrally for an organization, and they can be reused across many analytical applications. They are flexibly used in the report columns, rows, various calculations, and key performance indicators (KPIs).

The organization has the flexibility to define the financial reporting items, such as revenue, COGS, labor, sales deductions, recognized margin, and so on, as semantic tags. The report creator then uses these semantic tags in the various margin analysis or financial reports instead of defining them each time a query is built. In cases where there is a need to adjust the definition of a semantic tag, that is, a new functional area is introduced, semantic tags can then be centrally updated. All the queries and analytical apps using these tags will be automatically updated.

SAP delivers standard semantic tags that are used in analytical apps. These tags are assigned to general ledger accounts under chart of accounts YCOA and defined for financial statement versions (FSV) such as YPS2. Many analytical apps covered in this chapter use these standard semantic tags. It’s important to note that these SAP pre-delivered tags must not be changed or deleted or the reports and KPIs will no longer work. Therefore, it’s recommended to define organization-specific semantic tags and use them in the organization-specific custom analytical applications and custom queries. Check SAP Note 2538634 for more information on semantic tags.

Learn Margin Analysis in Our Rheinwerk Course!

Your deep-dive into margin analysis (formerly known as account-based profitability analysis) with SAP S/4HANA! Master value flows from sales and distribution, financial accounting, materials management, and controlling. Optimize reporting using summary reports, line-item reports, and SAP Fiori apps! Get access to course recordings by clicking the banner below.

Editor’s note: This post has been adapted from a section of the book Financial Reporting with SAP S/4HANA by Aylin Korkmaz.

.png?height=600&name=How%20to%20Establish%20Business%20Reporting%20with%20SAP%20S4HANA%20(1).png)

Comments