The efficiency and speed of the SAP HANA in-memory database allowed the introduction of the Universal Journal single line-item tables ACDOCA (actual) and ACDOCP (plan).

In turn, this allows all postings from the previous financial and controlling components to be combined in single items. The many benefits include the development of real-time accounting.

Plan costs are posted prior to a fiscal period. Actual costs occur in real time during a period and result from transactions, which can be divided into two groups:

- Primary costs: External business events result in primary costs.

- Secondary costs: Business transactions between cost objects are secondary costs.

We’ll look at both types of costs in this blog post.

Primary Costs

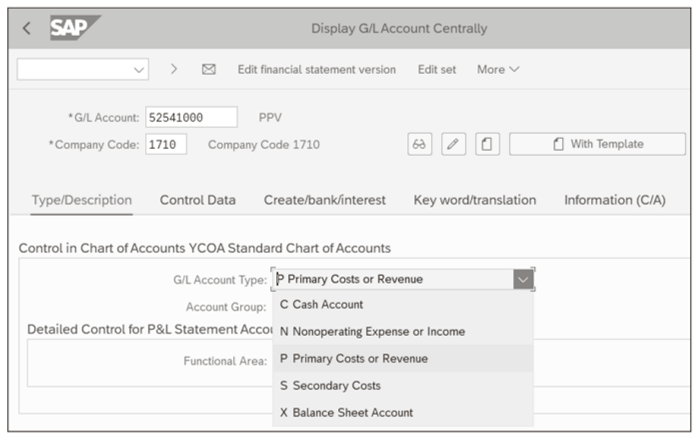

All costs in SAP S/4HANA are identified and controlled by the general ledger account master, which you access with Transaction FS00 or the Manage G/L Account Master Data app. A general ledger account master is displayed in this figure.

In the following sections, we’ll discuss the following general ledger account settings: account type and cost element category. We’ll also discuss cost object assignments as required by certain cost element categories.

General Ledger Account Type

The G/L Account Type is the first setting in the general ledger account master. In controlling, we’re interested in the following three options:

- P Primary Costs or Revenue: Primary costs include, for example, material expenses, salaries, asset depreciation, and energy. You post revenue by selling products and services.

- S Secondary Costs: With these general ledger accounts, you post allocations between cost objects. Examples are the allocation of costs from overhead cost centers to production cost centers; from production orders to customer projects, production orders, or market segments; and from internal projects to cost centers and market segments.

- N Nonoperating Expense or Income: These are profit and loss (P&L) accounts not related to the products and services of the company but belong in the financial statement, such as gains or losses from a foreign exchange market.

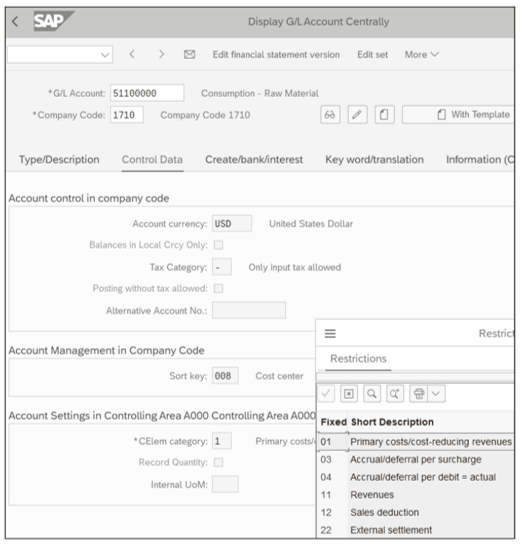

Cost Element Category

The next setting of interest in the general ledger account master is the cost element category. The cost element category determines the processes for which you can use general ledger accounts. You’ll find the CElem category field in the Control Data tab of the general ledger account master, as shown in this figure.

In the CElem category field, following are the possible entries for primary costs or revenues accounts:

- 01 Primary costs/cost-reducing revenues

- 03 Accrual/deferral per surcharge

- 04 Accrual/deferral per debit = actual

- 11 Revenues

- 12 Sales deduction

- 22 External settlement

When you classify a general ledger account with the primary cost or revenue category, it’s relevant for controlling analysis because we’re interested in analyzing and controlling expenses.

Cost Object Assignment

General ledger accounts with a primary cost element category also require a cost object assignment. Let’s follow two typical scenarios in the following sections.

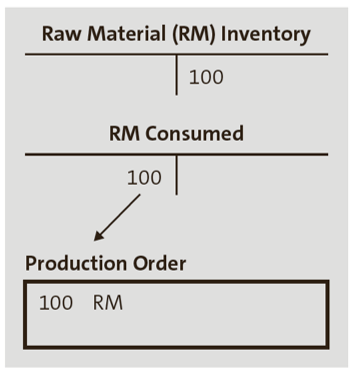

- Goods Issue to Production Order: When goods are issued from inventory, a general ledger balance sheet account is credited, and a P&L consumption (expense) account debited. When the system detects a primary cost element account during a posting to a general ledger account, the P&L line is extended to include controlling information. The production order triggers a reservation for the required components, which is the basis for the material document and subsequent accounting document. The production order is debited automatically because the goods issue is to the production order. The debit value is calculated by multiplying the component standard price by the quantity issued from inventory. The following figure shows an example debit when components with a value of 100 are issued from raw material (RM) inventory to a production order.

Component allocations in routings determine how goods movements are assigned to specific work centers and operations, and these goods issues are displayed along with the activity postings at the work center level.

- Universal Journal Posting: The account posting includes RM inventory (balance sheet) and RM consumed (expense) accounts. Cost object assignment in the Universal Journal allows you to analyze all expense postings with standard SAP S/4HANA and compatibility reports, as well as SAP Fiori apps.

- Vendor Invoice Posting: Primary expenses are assigned cost objects during payment of external vendor invoices. Subcontracting may be required for specialized activities or if the workload exceeds the internal work center capacity. An external services expense account is debited, and the goods receipt/invoice receipt (GR/IR) clearing account credited. The production cost center or production order is assigned a corresponding debit in the Universal Journal. You assign the cost object when you create the purchase order with Transaction ME21N and a corresponding line-item category.

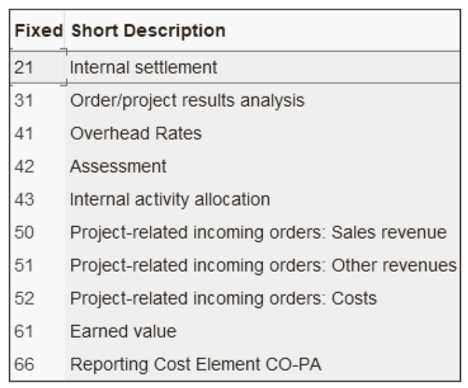

Secondary Costs

Now that we’ve looked at primary expenses, let’s examine secondary postings. The possible cost element categories when you choose secondary costs as the general ledger account type are shown in this figure.

With these general ledger accounts, you post allocations between cost objects. For example, with cost element category 42, you assess costs from overhead cost centers to production cost centers.

Costs are allocated from overhead cost centers to production cost centers during assessment and then onto production orders during activity confirmation with cost element category 43. Let’s examine assessments and activity confirmations in detail in the following sections.

Assessment

Overhead cost centers collect overhead costs that can’t be directly assigned to a production cost center. Assessments move costs from overhead cost centers to production cost centers.

A building may contain several production facilities with corresponding production cost centers. The building lease primary costs are assigned to an overhead cost center. The lease costs are then allocated to production cost centers during assessments using universal allocation.

Universal allocation is done via the Manage Allocations app and Run Allocations app in SAP Fiori. You use the Manage Allocations app to define the assessment cycle that acts as the framework for the allocation, as well as the cycle segments that define the senders and receivers.

You use the Run Allocations app to create a run and then trigger the allocation cycles. The Allocation Results app allows you to display the results of the allocation in a list form and to access the Allocation Flow app.

You can identify resulting debits to the production cost centers and credits to overhead cost centers with secondary cost element category 42 accounts.

Activity Confirmation

In addition to allocating costs from overhead cost centers to production cost centers with assessments, you allocate costs from production cost centers to production orders during activity confirmations.

When production order activities are confirmed, the production order or product cost collector is debited, and the production cost center is credited. The resulting debits to the production orders and credits to the production cost centers are identified with secondary cost element category 43 accounts.

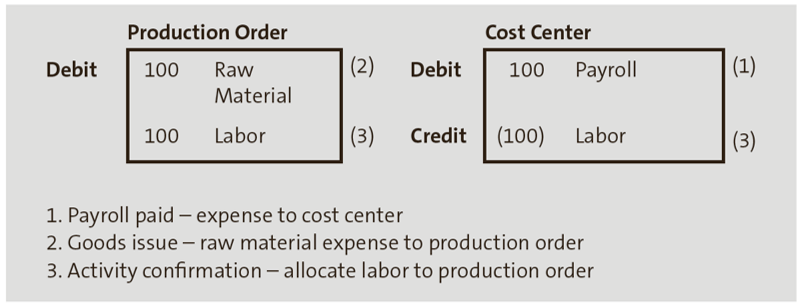

Many products can be manufactured at a work center with activities and facilities paid for by the cost center. Confirmation of labor and overhead activities allocates these costs across many products. The figure below shows an example of labor allocation postings from a production cost center to a production order.

In this example, factory payroll is expensed directly to the production cost center via primary postings and then progressively allocated to each production order with secondary postings during labor activity confirmation. All postings and assignments happen in real time in the Universal Journal.

Overhead Costs: Overhead calculation allocates overhead costs across products from cost centers in a similar way. Overhead costs are distributed with overhead calculation during events.

Editor’s note: This post has been adapted from a section of the book Production Variance Analysis in SAP S/4HANA by John Jordan and Janet Salmon.

Comments