Profitability analysis with SAP S/4HANA Finance is an extremely important area for FICO users of the new suite.

It provides detailed analysis of the profitability of a company, thus enabling accurate contribution margin calculation. It can calculate the profitability on the level of numerous characteristics, which can be configured when implementing SAP S/4HANA.

But what exactly is profitability analysis and how has it evolved in SAP? What are the differences between the two types of profitability analysis? This blog post will lay it out.

Organizations have different requirements now as they face a more competitive and innovative market. As a result, there is a high demand for real-time information analysis and flexibility in profitability reporting, and that demand only continues to increase.

Profitability Analysis Overview

For a long time, profitability analysis was a core component of controlling in SAP because it provides answers to the most important questions for high-level management: How profitable is the company? How well is this segment performing? How profitable is this product? What is the contribution margin of that division? And so on.

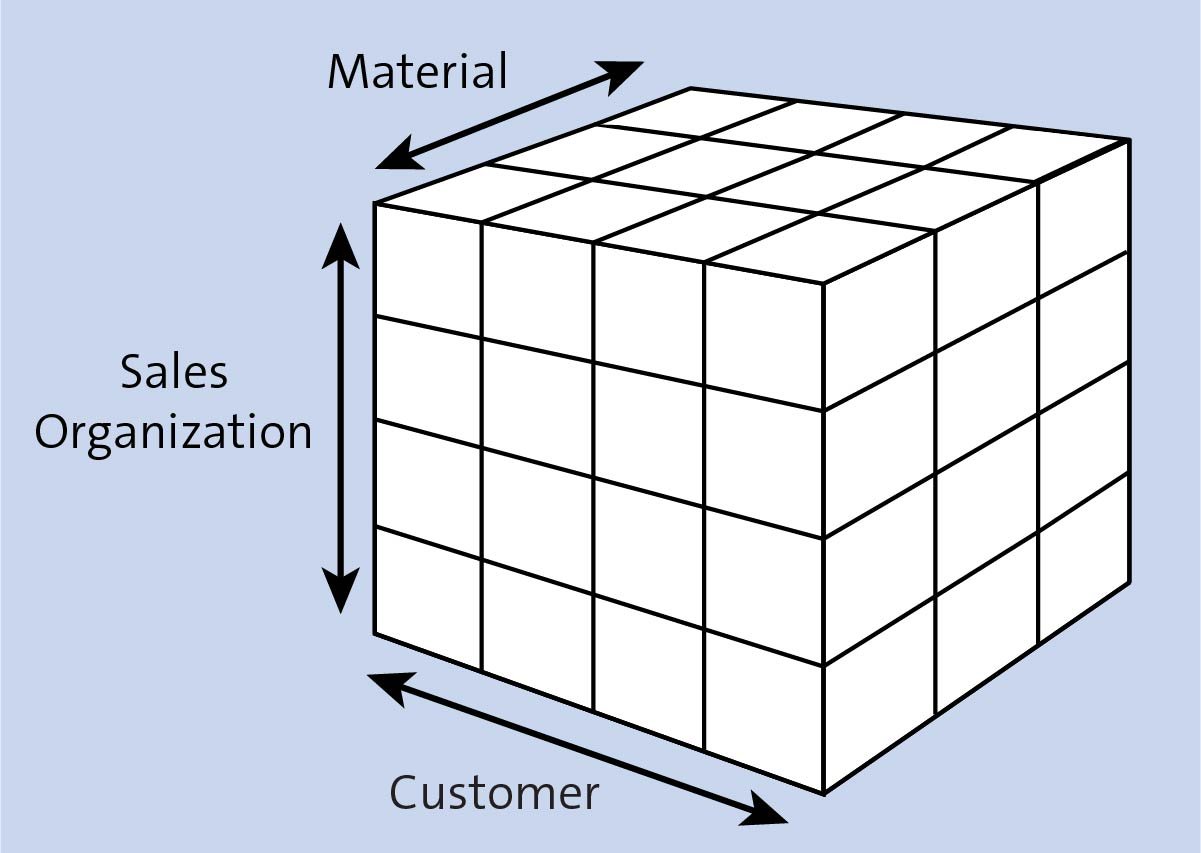

But the power and flexibility of profitability analysis mostly lies in its multidimensional structure. You can analyze profitability not in only one or two dimensions, but in as many dimensions as are needed and configured in the system. Therefore, profitability analysis is often referred to as a multidimensional cube, as shown below:

The dimensions are the different characteristics by which the data is sliced and diced from a profitability analysis point of view, such as material, customer, sales organization, and so on. Each posting transferred to profitability analysis contains several characteristics, which together constitute a multidimensional profitability segment.

Profitability analysis is a subcomponent of controlling with SAP S/4HANA and is used to support managers during their decision-making process. The data used in profitability analysis is enriched with characteristics derived from the value flow of predecessor documents, and therefore can be displayed and analyzed from various angles.

Two types of profitability analysis exist: account-based (margin analysis) and costing-based. We’ll explain these types in detail in the following sections.

Costing-Based Profitability Analysis

Costing-based profitability analysis (sometimes referred to as CBCOPA) analyzes profitability using value fields such as material costs, discounts, revenues, and so on. These value fields can be regarded as buckets into which similar values are grouped. Costing-based profitability analysis was the most used type of profitability analysis in previous SAP releases.

Costing-based profitability analysis is very powerful because these value fields can be defined as required in each SAP client, thus allowing for a great degree of flexibility. From a data point of view, costing-based profitability analysis uses the following tables:

- CE1xxxx (actual line item table)

- CE2xxxx (plan line item table)

- CE3xxxx (segment level)

- CE4xxxx (segment table)

In this nomenclature, xxxx stands for the operating concern name. For example, if the operating concern is 1000, the actual line item table will be CE11000, the plan line item table will be CE21000, and so on.

There are some limitations to costing-based profitability analysis. For example, it’s quite challenging to reconcile costing-based profitability analysis with financial accounting. This stems from the very essence of costing-based profitability analysis: the value fields don’t match the accounts used in financial accounting.

Furthermore, there are differences in the value flow to financial accounting and the value flow to profitability analysis. The basic sales process involves creating a sales order, then delivery with goods issue, and finally sending an invoice document to the customer. In financial accounting, the cost of goods sold is posted with the goods issue and the sales revenue with the invoice. In costing-based profitability analysis, however, both the sales revenue and cost of goods sold are transferred with the invoice document. This leads to mismatches between financial accounting and profitability analysis at month end.

These considerations prompted many companies to use account-based profitability analysis.

Account-Based Profitability Analysis (Margin Analysis) in SAP S/4HANA

Margin analysis uses accounts (cost elements) to collect profitability values. Therefore, by design, margin analysis is easy to reconcile with financial accounting. However, in SAP ERP and earlier versions, it had some considerable limitations. COGS couldn’t be split among different cost components, which is possible in costing-based profitability analysis. In addition, variance analysis was only possible for total variance, but not by variance category.

Profitability analysis in SAP S/4HANA has been revolutionized with margin analysis so that it gives users a snapshot of their management reporting not only in the past and present, but also in the future, in addition to improved analytical capabilities.

Margin analysis is fully integrated in the Universal Journal. Therefore, it’s reconciled by design. The internal and external views in accounting are harmonized and allow comprehensive reporting with drilldown functionality in P&L statements and balance sheets.

Thus, costing-based profitability analysis was the choice for most companies prior to SAP S/4HANA, and account-based profitability analysis was sometimes implemented in parallel to facilitate accounting reconciliation processes.

SAP has made huge improvements to profitability analysis with SAP S/4HANA, and more specifically to margin analysis. Now, in SAP S/4HANA, the advantages of costing-based profitability analysis are available in margin analysis, combined with easy reconciliation with financial accounting. Cost component splits are now possible in margin analysis. In addition, variance analysis is made possible by variance categories. Therefore, in SAP S/4HANA, you can construct a profit and loss (P&L) statement with a contribution margin calculation, very much like in costing-based profitability analysis.

With these considerations in mind, in SAP S/4HANA, margin analysis is not only the recommended approach but is also the required approach. You can activate costing-based profitability analysis in addition if you choose. However, our recommendation for a greenfield SAP S/4HANA implementation is to use only margin analysis. You’ll enjoy all the benefits of costing-based profitability analysis now in the account-based version. For brownfield implementations, continuing to use the costing-based approach together with the now mandatory account-based approach makes sense.

From a technical point of view, account-based profitability analysis doesn’t create any additional tables. The segment postings update table ACDOCA, the Universal Journal, thus making the profitability analysis fully integrated with financial accounting.

To better understand these changes, it helps to compare how profitability analysis worked in SAP ERP versus in SAP S/4HANA.

Profitability Analysis: SAP S/4HANA vs. SAP ERP

In SAP ERP, account-based profitability analysis (CO-PA) wasn’t used as widely because of its limitations compared to costing-based CO-PA. With SAP S/4HANA, margin analysis closes those gaps, while SAP has stopped investing in costing-based CO-PA beyond on-premise support. The future direction is clear: margin analysis is the recommended and strategic approach.

Conclusion

Profitability analysis in SAP S/4HANA has evolved into a unified, reconciled approach with margin analysis, giving organizations real-time insight into profitability across dimensions while ensuring alignment with financial accounting.

Learn Margin Analysis in Our Rheinwerk Course!

Your deep-dive into margin analysis (formerly known as account-based profitability analysis) with SAP S/4HANA! Master value flows from sales and distribution, financial accounting, materials management, and controlling. Optimize reporting using summary reports, line-item reports, and SAP Fiori apps! Get access to course recordings by clicking the banner below.

Editor’s note: This post has been adapted from a section of the book Configuring SAP S/4HANA Finance by Stoil Jotev. Stoil is an SAP S/4HANA FI/CO solution architect with more than 25 years of consulting, implementation, training, and project management experience. He is an accomplished digital transformation leader in finance. Stoil has delivered many complex SAP financial projects in the United States and Europe in various business sectors, such as manufacturing, pharmaceuticals, biotechnology, chemicals, medical devices, financial services, fast-moving consumer goods (FMCG), IT, public sector, automotive parts, commodity trading, and retail.

This post was originally published 11/2019 and updated 8/2025.

Comments