Financial planning is a key activity for organizations of all sizes to accurately manage profitability and establish the company’s direction for the upcoming year and beyond.

A strong business planning process consists of sales and operations planning (S&OP), demand planning, financial planning, budgeting, and forecasting. All three of these planning elements depend on one another to achieve accurate integrated business planning.

Planning, budgeting, and forecasting involves activities at a number of levels, from high-level summarized strategic plans to detailed financial budgets and forecasts. Let’s take a look at each and what they mean for a company.

Strategic Planning

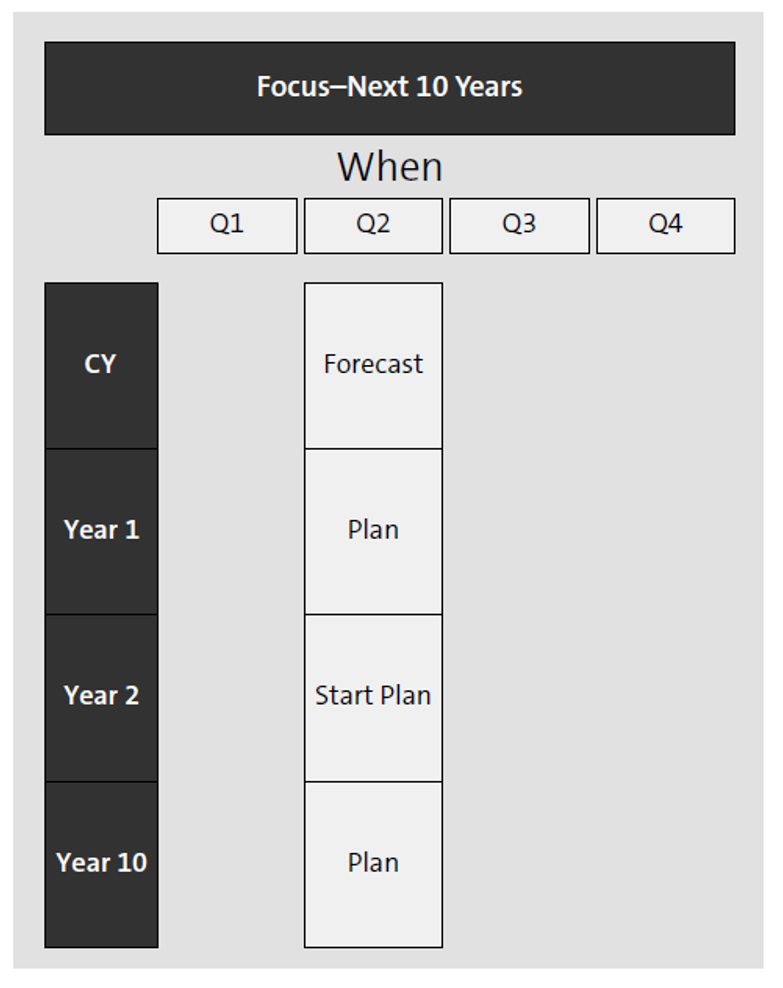

Strategic planning focuses on realizing a 3-5 year vision that addresses most critical market and organizational challenges.

An effective strategic plan translates your business strategy into a simple story about your organization’s future (see figure below). You know that story is clear when people around you understand what leadership has chosen to do—and not do.

Some key questions to ask during the strategic planning process include:

- What business are we in and how do we continue to compete?

- Which choices will make us more money?

- How will we align resources with our strategy?

- How will we measure our progress?

Budgeting

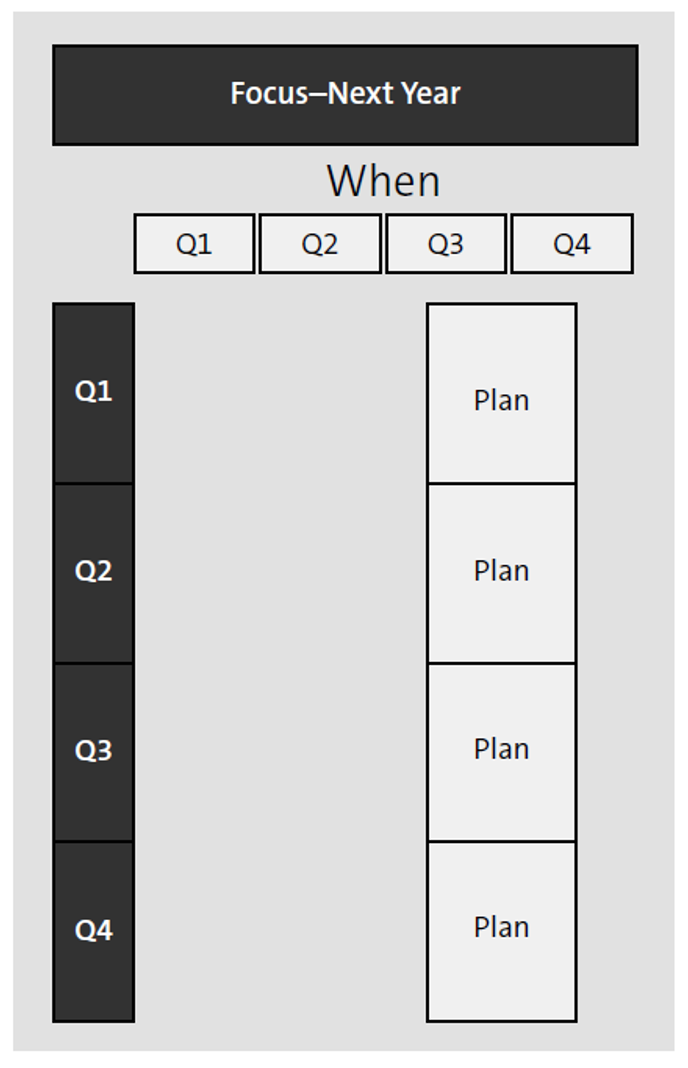

Budgeting is the annual operating plan that occurs once during the year and is not revised. A budget is completed for all quarters of the upcoming fiscal year (see below).

Generally, budgeting refers to the process undertaken prior to the start of a year to set expectations regarding anticipated results for the upcoming fiscal year. The budget creation process will provide accountability to revenue, operating expense, and cash flow targets by oftentimes linking certain elements of employee compensation to performance against targets set during the budget.

Some key questions to ask during the budgeting process include:

- How will we ensure accountability and encourage behaviors needed to execute the strategy?

- Should we leverage prior year actuals as a starting point for this year’s budget or should we leverage a zero-based budgeting method? In other words, should we create a bottom-up budget without using prior year actuals as a baseline?

Forecasting

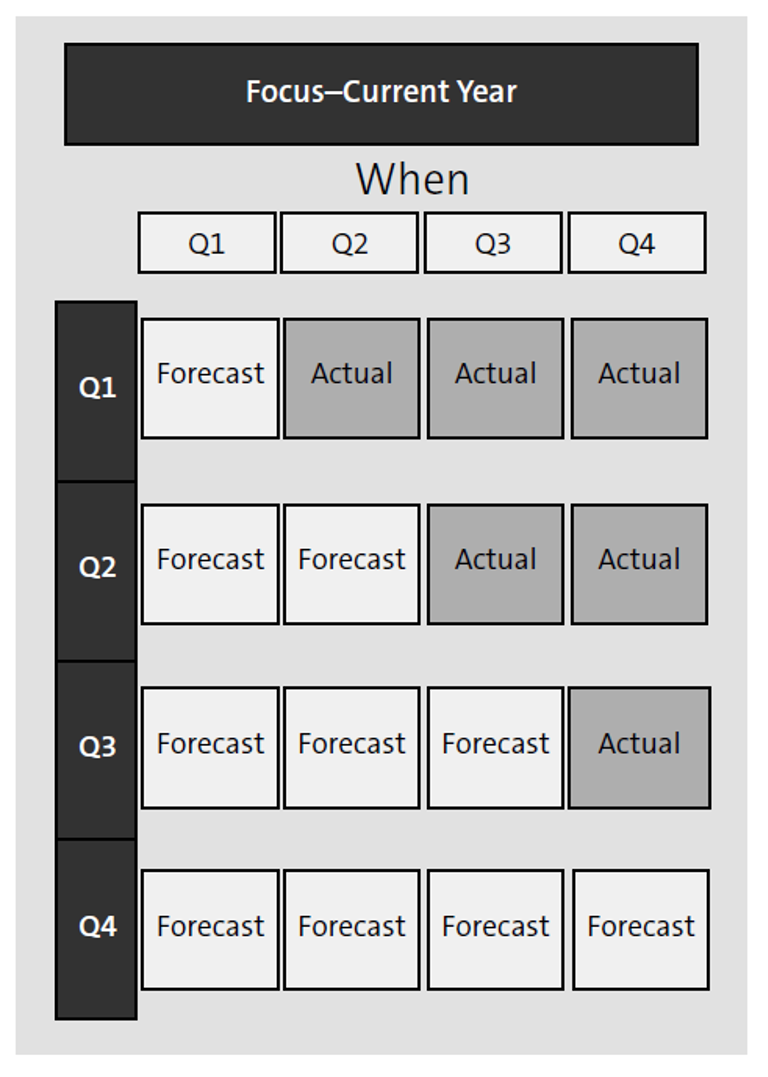

Forecasting is a monthly or sometimes quarterly view of how business is performing against expectations. Closed quarters are generally populated with actual data as depicted in this figure.

While budgeting refers to the process undertaken prior to the start of a fiscal year to set expected results, the forecast updates that baseline budget throughout the year by taking actual performance into account. Adjustments to the baseline budget will occur each forecast cycle to accommodate actual results and shifting business conditions as the year progresses.

Some key questions to ask during the forecast process include:

- How can we adjust to reflect changing conditions in order to meet or exceed our budgeted expectations?

- How often should we re-forecast in order to drive business decisions effectively (i.e.: monthly versus quarterly forecast)

How Does Planning, Forecasting, and Budgeting in SAP Address Key Challenges?

With the introduction of SAP Business Planning and Consolidation (BPC), version for SAP S/4HANA and SAP Analytics Cloud, companies are now able to address several of their key challenges through the implementation of the latest SAP technology, supported by the appropriate business process changes.

SAP BPC, version for SAP S/4HANA resides within the SAP S/4HANA server, which streamlines the data integration process by serving as an extension to the core ERP, without requiring a separate database or instance.

SAP Analytics Cloud is a cloud-based planning, reporting and analytics solution, which provides native integration to SAP S/4HANA and can source data from various source systems.

In order to understand the key benefits of the SAP planning solutions let’s take a deeper look into how they can help address some of the key budgeting and forecasting pain points discussed earlier.

With the evolution SAP BPC, version for SAP S/4HANA, SAP Analytics Cloud, and SAP BPC 11, organizations can now mitigate many of the key challenges previously discussed during the planning, budgeting, and forecasting process.

Some of the key planning, budgeting, and forecasting challenges SAP can help mitigate

include:

Reduce Budgeting and Forecasting Cycle Time

Through improved data integration, budgeting and forecasting cycle time can be greatly reduced. The budgeting and forecasting cycles can often times take longer than expected when companies do not have a central planning system that collects all of the data from various source systems required to create their forecast. SAP BPC, version for SAP S/4HANA integrates in real time with the ACDOCA table which stores all of the FI and CO data from SAP S/4HANA. The ability to read data directly from the ACDOCA table eliminates the need to load and replicate data from the general ledger to the planning systems.

This is a tremendous benefit to the business as it eliminates the need to wait on long data load times and it enables real time planning, reporting, and analysis. Planners can now spend less time waiting on data and more time analyzing the data, leading to shorter budgeting and forecasting cycles.

Improved Forecast Accuracy

Both SAP BPC and SAP Analytics Cloud provide standard input templates, reports and calculations which can enable top-down and bottom-up planning. By leveraging standard content and technical concepts such as FOX code, predictive models, and SAP HANA stored procedures, complex planning models can be developed that will read large volumes of data in real time to provide accurate forecasting results.

Enhanced Reporting Capabilities and Data Analytics

To facilitate data-driven business decisions, SAP has enhanced reporting capabilities and data analytics. SAP BPC, version for SAP S/4HANA also leverages master data directly from SAP S/4HANA, which provides consistent master definitions across the ERP and planning solutions without having to load and refresh master data consistently.

Furthermore the real-time integration between SAP BPC and SAP S/4HANA provides planners and reporters with the ability to view and react to the latest organizational changes through real-time master data integration. SAP Analysis for Microsoft Office reporting tool provides the ability to slice and dice data in real time, while SAP Analytics Cloud supplements the capabilities of SAP BPC through more in depth visualization capabilities.

Reduce the Total Cost of Ownership for Planning Systems

Both SAP BPC and SAP Analytics Cloud provide organizations with solutions that can be implemented with reduced total cost of ownership due to lower data duplication and native integration to SAP S/4HANA Finance. SAP Analytics Cloud is a cloud-based solution with out of the box content that can be leveraged for both planning and visualization, while SAP BPC is integrated with SAP S/4HANA and leverages the same master data and Universal Journal.

Conclusion

Financial planning, budgeting, and forecasting are important parts of a business that can easily be hung up with a poor finance system. In this post, we discussed how SAP S/4HANA, SAP Analytics Cloud, and SAP Business Planning and Consolidation can help a business overcome the pain points brought about by planning, budgeting, and forecasting.

Editor’s note: This post has been adapted from a section of the book SAP S/4HANA Finance: An Introduction by Maunil Mehta, Usman Aijaz, Sam Parikh, and Sanjib Chattopadhyay.

Comments