These days the role of a treasury organization is evolving from being just a function of finance to also being an advisor to the company.

This is done by delivering strategic decisions based on a deep understanding of data received from different parts of the organization that impact the working capital of the organization.

Time and access to such information is becoming more crucial. With the ongoing impact of COVID-19, the biggest challenge companies face is in relation to working capital. Every organization has to constantly review and monitor its cash forecast, and manage cash effectively, to minimize risk and operational impact as well as protect them from market volatility. For the organization to come out of the crisis stronger and still be compliant on all levels, the treasury is often tasked to provide to leadership an action-based solution by reviewing the relevant financial information from all parts of the organization. That way it can measure liquidity status and effectively manage its working capital requirements.

SAP’s One Exposure from Operations solution helps provide such financial exposure visibility. With this option, all transactional data related to financials is structured in one central location (FQM_FLOW), which gives the much-needed insight in a single place, even when working within a distributed system landscape.

Let’s take a look at some of the features of One Exposure from Operations.

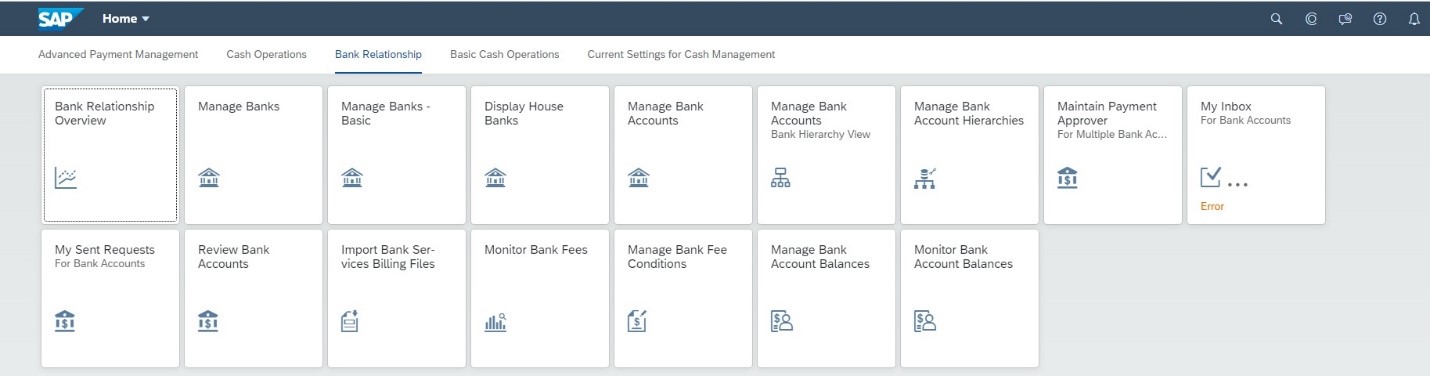

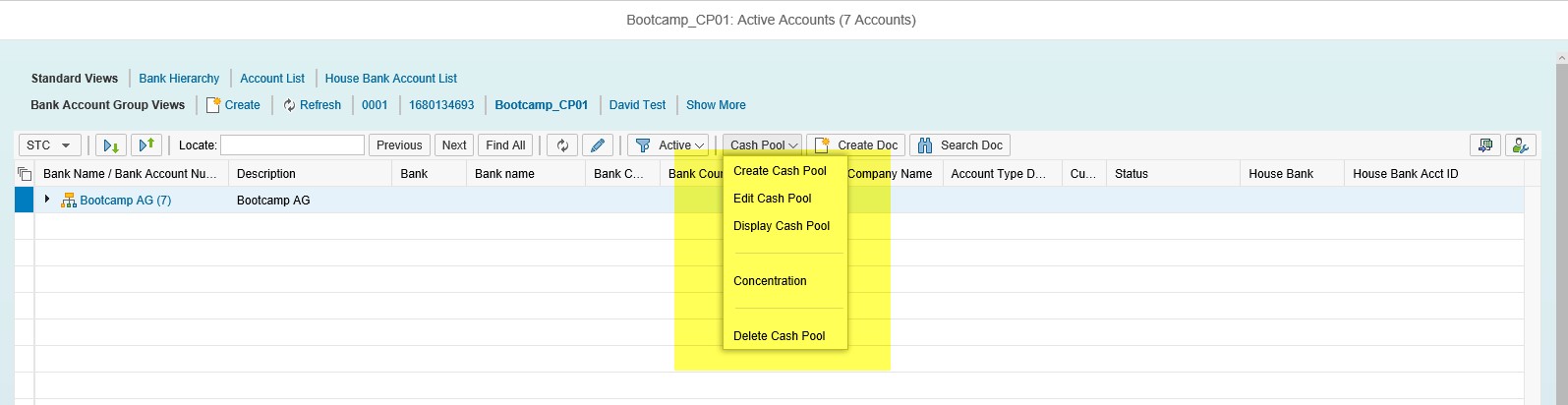

Centralized Bank Account Management

One Exposure from Operations allows you to manage bank accounts for the entire company in a central location; implement robust controls for account opening, closing, and signature management; and support FBAR reporting to be compliant at all levels.

With this solution, the cash manager will have full control of bank statements and be able to monitor and set up cash pools directly in bank account management. This provides complete control and flexibility of cash, along with an insight on the accuracy of bank balance data, therefore providing the information to better manage cash more tightly.

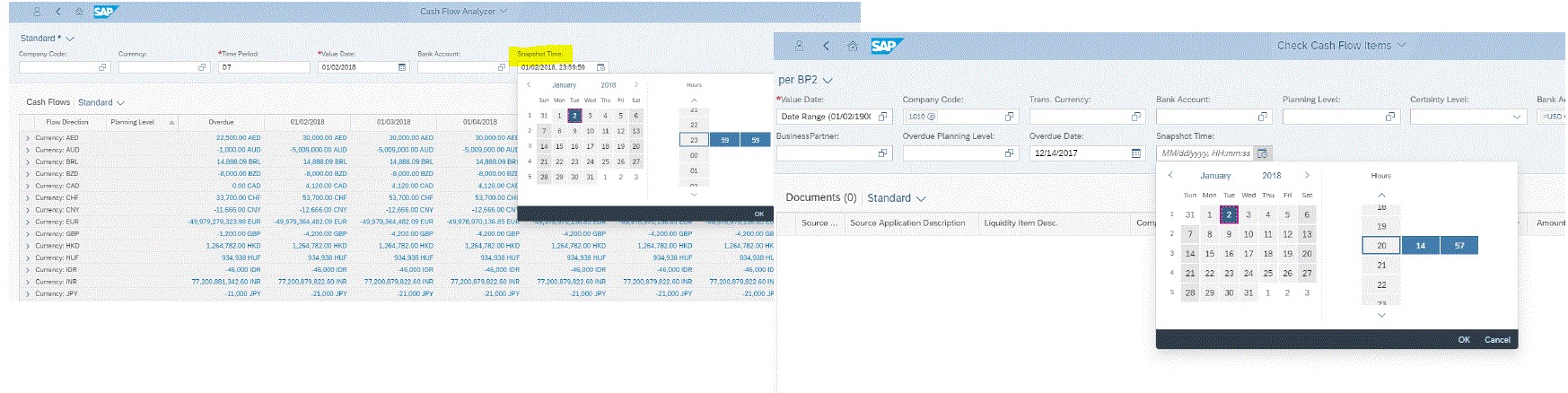

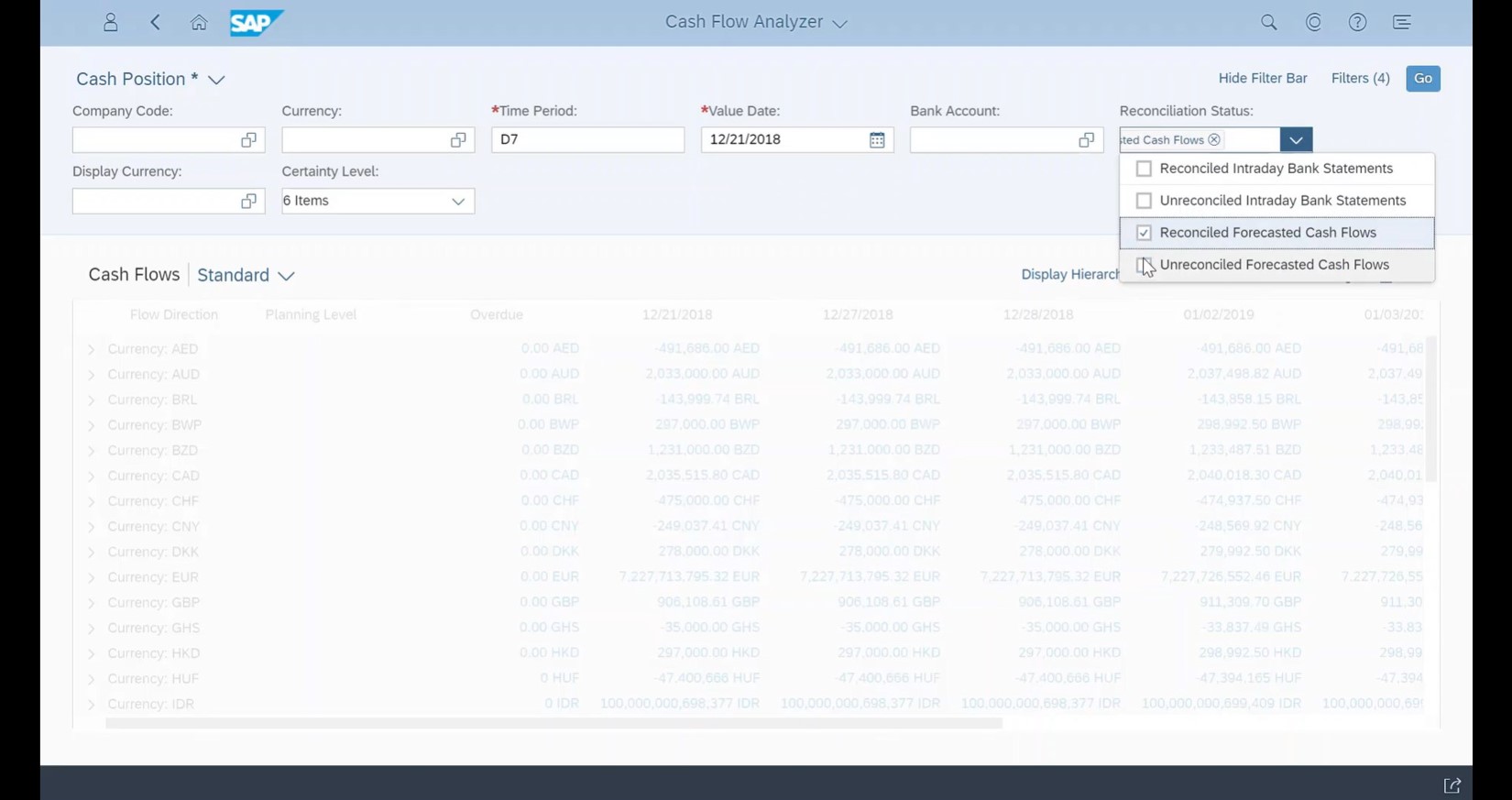

Cash Flow Analyzer

To get a snapshot of cash history, a manager can go back in time to view previous forecasts to gain a better understanding of what was expected at a certain time and then compare it to the actual result (first figure below). They can then automatically reconcile intraday bank statement items against forecasted items to easily identify unfinished and unknown payments directly in the Cash Flow Analyzer SAP Fiori app (second figure).

Cash managers also have the ability to directly initiate cash movements between different bank accounts and generate FX trade requests directly from the Cash Flow Analyzer app. This would automatically update the cash forecast to improve the accuracy of cash position.

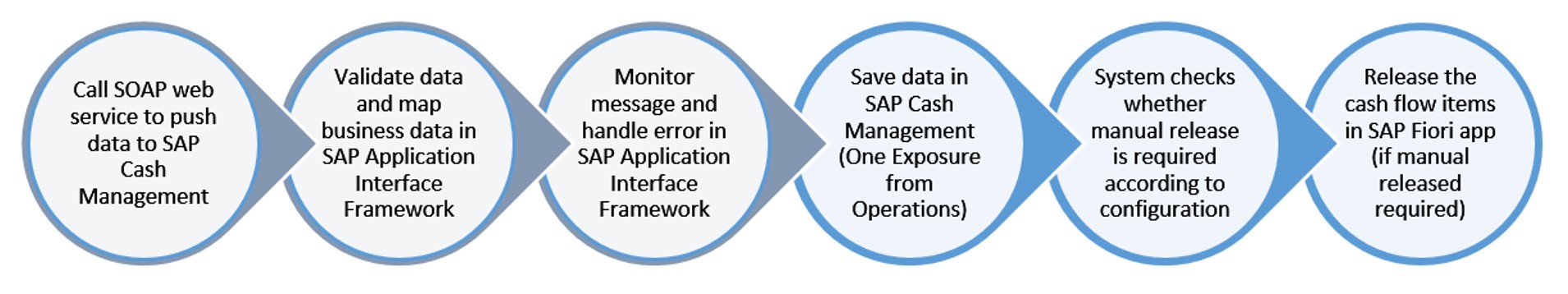

Connection to Cash Management

The web service in One Exposure from Operations brings a whole new level of flexibility to allow organizations to bring an external cash forecast data directly into One Exposure, meaning treasury managers can view and analyze cash flow data from a single place—even original data generated outside of SAP.

Support for the Central Finance deployment option (for organizations with multiple instances of SAP ERP) helps users centralize cash and payment functions, and provide the ability to identify, move, pay, and invest excess cash or borrow funds quickly from a single place.

Integration Options

Businesses can integrate their systems with financial institutions using SAP Multi-Bank Connectivity to reduce errors, refine information, and simplify treasury operations by updating payment status and cash positions automatically in the SAP ERP system.

Furthermore, SAP advanced payment management helps build a foundation for payments that are frictionless, instant, secure, and cost-effective. It serves as a central hub to lower the cost of payment processing with higher visibility, flexibility, and control.

Conclusion

One Exposure from Operations, integrated with SAP’s core financials offerings such as SAP S/4HANA Finance, provides detailed visibility on global cash positions and forecasts. This helps treasury managers take necessary action and mitigate the working capital risk, along with centralizing the entire company’s bank account operations.

This post was originally published 7/2021.

.png?height=600&name=Exploring%20SAP%20S4HANA%20Advanced%20Financial%20Closing%20(AFC).png)

Comments