Let’s examine taxes in accounts receivable processes in SAP S/4HANA Finance.

Sales (output) tax codes are used, which usually are entered manually in financial accounting invoices and automatically determined in integrated sales and distribution billing documents.

Taxes in Financial Accounting Invoices

When you enter an outgoing invoice directly in financial accounting, normally, you would enter the tax code manually, unless some substitution is in place that can determine the tax code automatically.

When posting a customer invoice in financial accounting using Transaction FB70, in the header section, under the Tax tab, you can enter the necessary tax information, as shown in this figure.

Select the sales output tax code and, if necessary, the tax jurisdiction code, which will use a tax rate based on a specific US jurisdiction. If you select the Calculate tax checkbox, taxes will be calculated automatically by the system.

No additional configuration is required to make this work other than properly setting up your tax codes, and enabling the relevant tax codes in the outgoing financial accounting invoice Enjoy screen.

Tax Determination in the Sales Process

Tax codes can be automatically determined in the sales process using the same condition technique used by other elements of the pricing procedure we discussed. In fact, the tax is a separate condition type in the pricing procedure, which is on the sales order level.

Let’s take a look at this screen.

Double-click on condition type UTXJ: Tax Jurisdict.Code. As shown below, the system determines tax codes O0 based on the condition record found.

Tax determination in sales uses a similar condition technique as purchasing (condition, access sequences, condition tables) to automatically determine the taxes. Special pricing conditions for taxes can be used to determine the proper tax code based on fields configured for use in condition tables.

To define a condition type, follow the menu path Sales and Distribution > Basic Functions > Pricing > Pricing Control > Define Condition Types. Then, select the Set Condition Types for Pricing activity. The system shows the sales condition defined, as shown in the figure below. The standard SAP condition for output tax is MWAS, which you can copy as your own condition starting with Z or Y if needed.

Double-click MWAS to see its configuration, as shown below.

The following fields are important:

Condition Class

This field determines the usage of the condition type. In our case, the condition class is set to D: Taxes, which defines this condition as a tax condition.

Calculation Type

Specifies the type of calculation and is set to A: Percentage because the output sales tax should be calculated as a percentage.

Condition Category

Classifies the conditions and for tax conditions should be D: Tax.

Item Condition

Should be selected for taxes because this checkbox ensures that the calculation occurs at the item level, which is required for taxes.

By clicking the Records for Access button, you which records for access are maintained for the condition types, which determine the tax codes.

Now, let`s define our own custom access sequence ZMWS, which is a copy of the standard MWST but accesses different tables. To set up this access sequence, follow the menu path Sales and Distribution > Basic Functions > Pricing > Pricing Control > Access Sequences > Set Access Sequences. This table is a cross-client table, and after confirming the warning message, you’ll see a list of defined access sequences, as shown here.

Select MWST and then select Copy As… from the top menu. Now, rename the new access sequence to “ZMWS” and change its Description to “Taxes on Sales.” Select Accesses from the left side of the screen and modify the condition tables to access, as shown in the next figure. The sequence of their access is determined by the step number in the first Access column. The Exclusive checkbox controls whether the system will stop searching for a record after the first successful access finds a value.

Select the first step and click Fields from the left side of the screen to see the fields that are being used by the condition table access sequence.

As shown in the following figure, the Country (ALAND) and Destination Country (LAND1) fields are used in our access sequence. Therefore, when searching using this step, the system will look for matches in both the sending and destination countries of the goods. If a match exists, the tax code maintained for the combination will be determined.

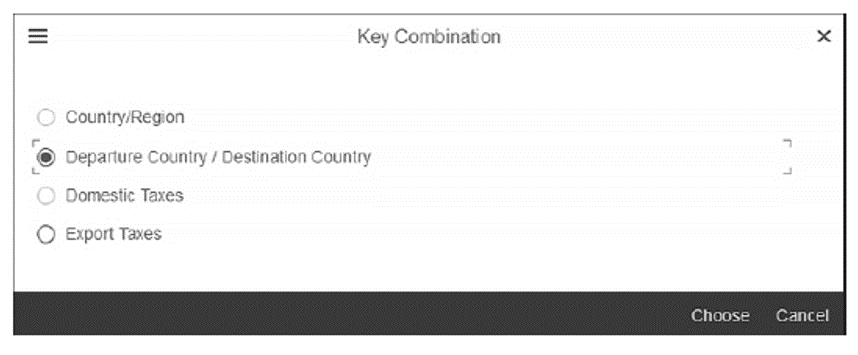

You can maintain these condition records using Transaction VK11. Condition records are considered application data, and you can also navigate to these settings through the application menu path Logistics > Sales and Distribution > Master Data > Conditions > Select Using Condition Type > VK11—Create. Now, enter condition type “MWST” to see a popup window asking for the combination of characteristics for which you want to create records, as shown below. These characteristics are dependent on the configuration of the condition record.

Select the Departure Country/Destination Country to see the next screen, in which you’ll enter your condition records. As shown in the next figure, in the header, enter the source country from which goods or services are sent, and then in the lines below, you can enter multiple records per destination country.

The following fields are considered:

- Destination Ctry/Reg: This field is the country to which the goods/services are supplied.

- Valid From/Valid To: In these fields, you’ll specify the validity period of the tax code. Tax rates change from time to time, and with these fields, you have the flexibility to add more condition records when tax rates change.

- Tax Code: This field is the tax code, which should be assigned automatically when the criteria outlined in the condition record are met.

Save your entries, and sales documents that match these condition criteria will automatically receive the assigned tax codes.

Editor’s note: This post has been adapted from a section of the book Configuring SAP S/4HANA Finance by Stoil Jotev. Stoil is an SAP S/4HANA FI/CO solution architect with more than 25 years of consulting, implementation, training, and project management experience. He is an accomplished digital transformation leader in finance. Stoil has delivered many complex SAP financial projects in the United States and Europe in various business sectors, such as manufacturing, pharmaceuticals, biotechnology, chemicals, medical devices, financial services, fast-moving consumer goods (FMCG), IT, public sector, automotive parts, commodity trading, and retail.

This post was originally published 2/2022 and updated 12/2024.

Comments