Let’s discuss new functionality available in SAP S/4HANA and what impact it has on tax management.

Most of the innovations are general with impacts on taxes, but there are also some functionalities for taxes based on demand from tax-oriented SAP users.

Simplification List

The SAP S/4HANA simplification list isn’t a new functionality but rather a reference document where you can find the SAP S/4HANA-related advancements of familiar SAP transactions. For some transactions, SAP Fiori apps are now available, and others were simply replaced or suspended. You can find the simplification list at http://s-prs.co/v549500.

The SAP S/4HANA simplification list covers several different releases and is constantly maintained by SAP. You can also find details in related SAP Notes that are published in addition to the SAP simplification list. It covers components, master data, additional information, and—if relevant—different sector solutions.

The simplification list collects new functionality and/or changed functionality and has the style and degree of details comparable to SAP Notes but without detailed customizing settings. You’ll find this helpful for your SAP S/4HANA project especially in the case of a familiar transaction you don’t want to miss in your future tax data management setup.

An important example is the SAP S/4HANA Intrastat functionality. SAP decided to manage international trade processes with SAP Global Trade Services (SAP GTS) in the course of the SAP S/4HANA upgrade. SAP GTS is an additional module to be licensed separately. Selected international trade functionalities are provided with foreign trade as part of materials management in SAP S/4HANA core functionalities; however, in the simplification list, all Intrastat transactions are listed that are no longer available with SAP S/4HANA. Especially in the earlier SAP S/4HANA release 1511, this was one of the major changes and issues during implementation projects.

SAP Fiori User Interface

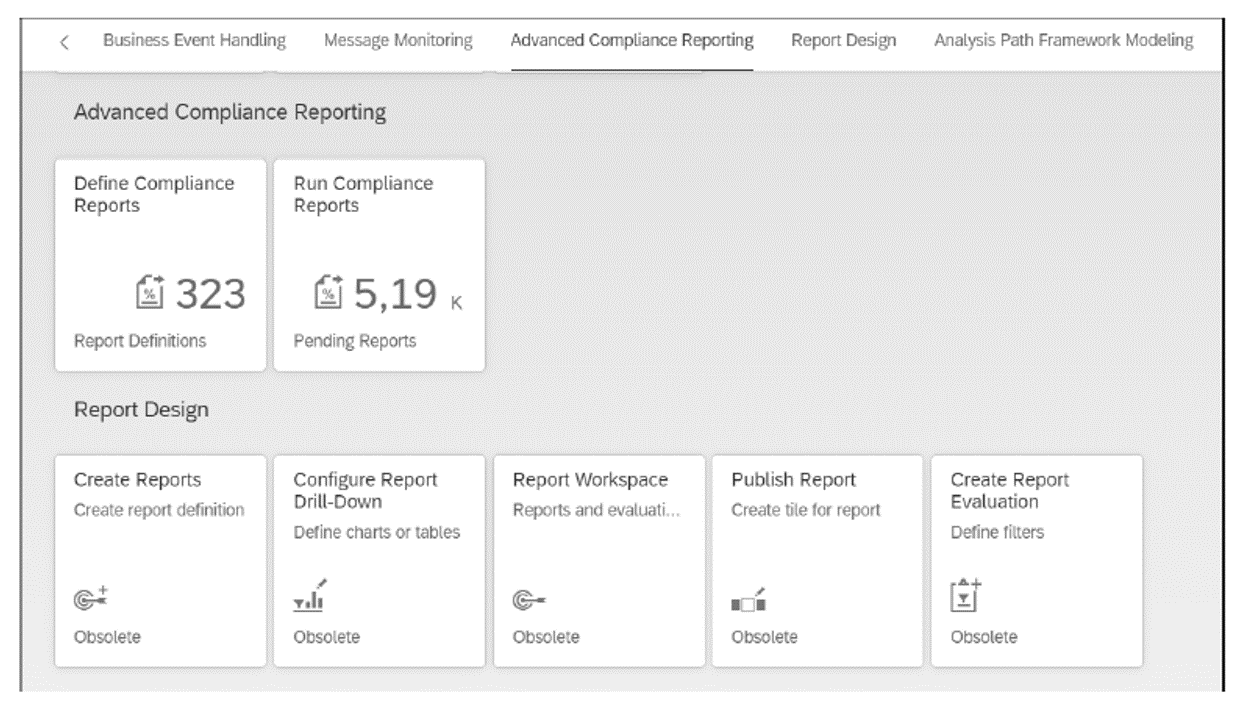

In terms of user-friendliness, the new SAP Fiori 3 user interface opens up new ways of working with SAP S/4HANA. New functions include solutions for integrated internal and external data processing and evaluation, as shown in in this figure.

Tax-related functionalities are accessible intuitively via SAP Fiori tiles. In addition, SAP Fiori enables their use on mobile devices and the mapping of role-based functions. Especially for home office and remote work, these are very useful functions.

As shown above, SAP S/4HANA solutions come with their own SAP Fiori tiles such as the Run Compliance Reports app in the case of advanced compliance reporting (replaced by SAP Document and Reporting Compliance). But if you want to create your own SAP Fiori apps and tiles, you can use the SAP Fiori launchpad content manager. The SAP Fiori launchpad content manager simplifies the creation and adaptation of business catalogs. You can use it both to explore existing content and to create your own catalogs by copying existing ones and adapting them to your needs.

Another tool is the SAP Fiori launchpad application manager, which serves to manage the application and technical catalogs. The SAP Fiori app Manage Launchpad Spaces and Pages is available to manage a homepage that allows users to structure the layout of a page using drag and drop. Furthermore, SAP CoPilot supports SAP users with multilingual voice input and offers functions for managing and organizing tasks.

Universal Journal

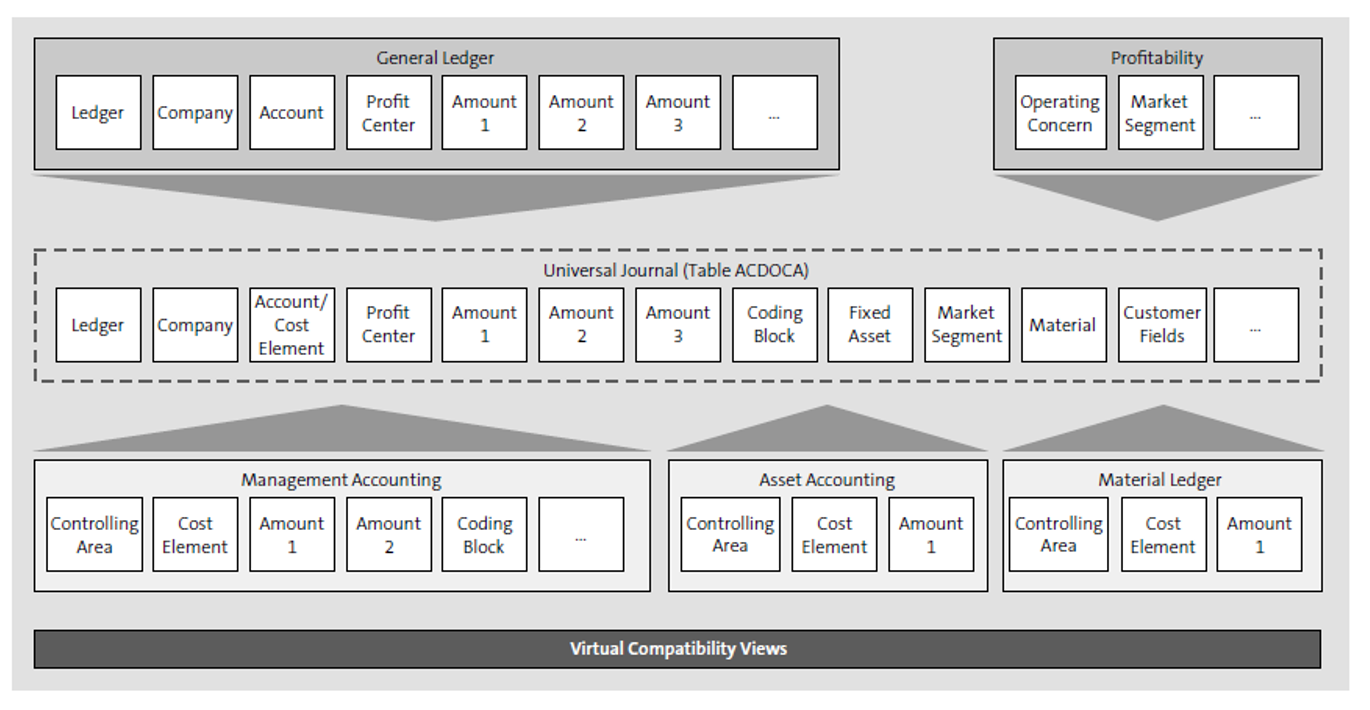

The SAP HANA in-memory database technology and the revised architecture of the core components in the finance area of SAP S/4HANA enable the Universal Journal, which combines data from previously different sources (financial accounting and management accounting) in one single SAP data table. Individual line items are now the basis for the balance sheet instead of balances that were separately stored.

In SAP S/4HANA, the Universal Journal is the new home for all postings from internal and external accounting, stored as a common database table. Accounting and controlling data combine in table ACDOCA, as shown in the next figure. The table name includes AC for accounting, DOC for documents, and A for actuals. The table combines the document information from bookkeeping, asset accounting, cost accounting, and the Material Ledger.

Cost element and financial accounting accounts are synchronized. Therefore, each controlling posting also generates a financial accounting document. In addition, due to the harmonization and enrichment of the data, there is no need to reconcile financial accounting with the subledgers:

- Financial accounting (general ledger)

- Profitability analysis

- Controlling 1

- Asset accounting

- Material Ledger

Nevertheless, the original tables remain as database views (e.g., tables BSEG or COEP), which isn’t equal to primarily database storage. The standard reports and transactions previously used in SAP ERP by customers can continue to be used. This also plays a role in the area of tax reporting and data provisioning, especially data generated from table BSET or table BSEG. The tax data for the accounting document remains updated in table BSET. In addition to table ACDOCA, table BKPF for the header data also remains in place.

It’s also possible to implement additional fields (customer-specific fields) for special tax purposes to use them for reporting. As trial balances have been omitted, it’s also possible to navigate from the balance sheet down to the level of the individual items and view detailed information for tax validations.

Material Ledger

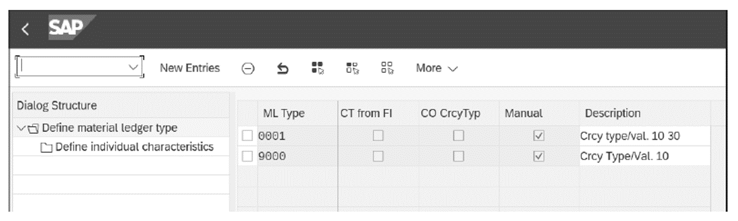

Information related to materials management is stored in the Material Ledger. Material movements are managed in table MATDOC. The header data of the material document MKPF and the line item data of table MSEG were transferred to table MATDOC.

As you can see in the next figure, you can choose between different Material Ledger types and currency types. With the Material Ledger, you can use parallel currencies (maximum three currencies for mapping the stocks), have parallel evaluations running (e.g., for transfer pricing purposes), and optionally use the actual cost for externally procured and internally created materials (instead of having either the moving average price or standard price).

Overall, the Material Ledger increases the transparency of all material movements and thus of the company stock.

Business Partner

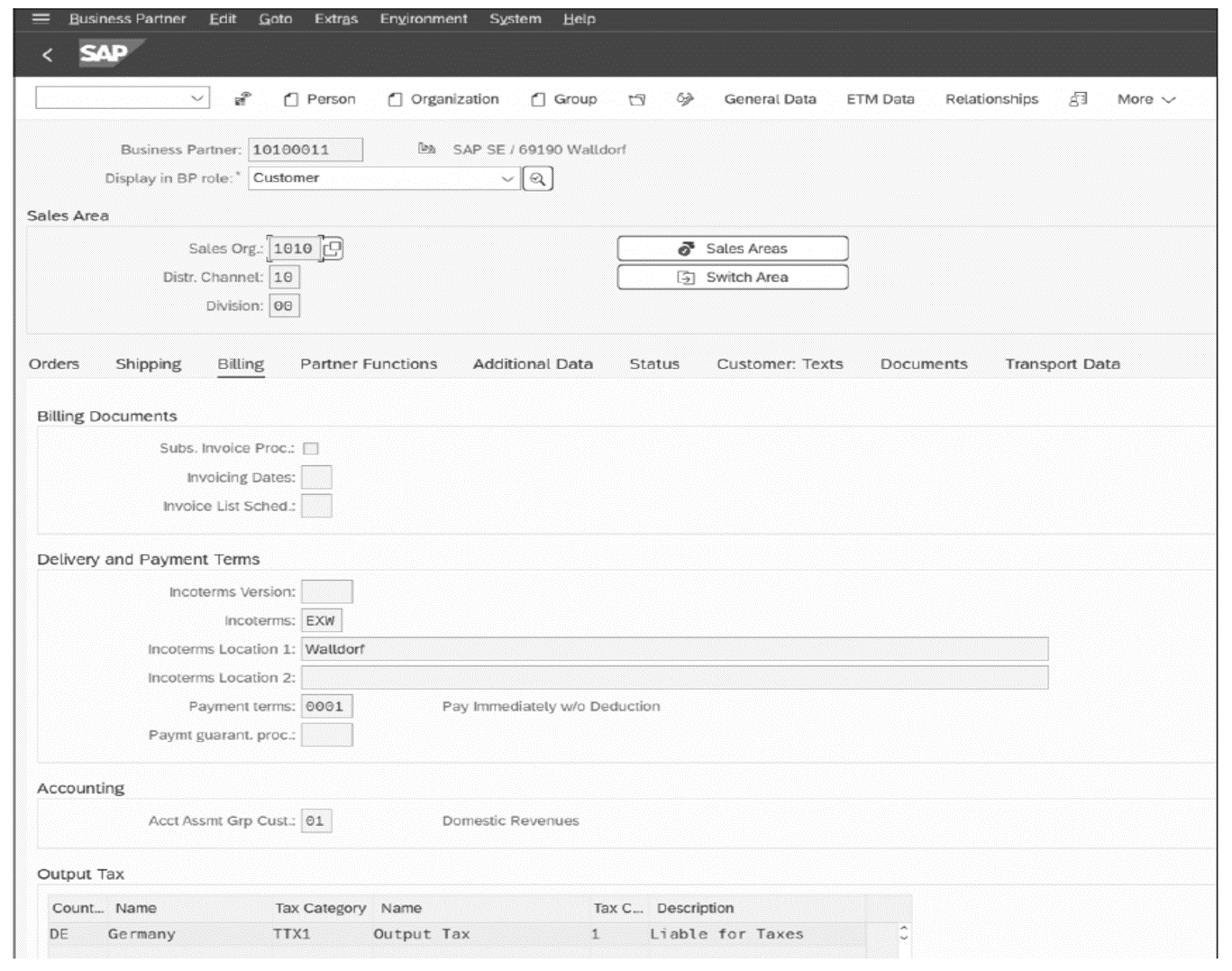

Although it’s not completely new, one major innovation in SAP S/4HANA is the business partner concept that was introduced also on the financial accounting level. The business partner concept enables master data unification, which leads to fewer redundancies, less maintenance effort, and higher data quality.

Every organization has different business-to-business (B2B), business-to-consumer (B2C), business-to-government (B2G), or business-to-tax (B2T) relationships. A business partner of each nature can be both a customer and a supplier in one person or in one organization.

The business partner concept replaces some parts of the vendor and customer master records that were originally maintained separately. Irrespective of the business partner’s classification (customer/vendor), a unique business partner number is assigned to it. However, the central business partner represents the leading master data object. In the background, the central business partner continues to work with two other master data objects (customers and accounts payable). Relevant SAP table names usually start with BP. Whenever business partner data is maintained, the synchronization only takes place in one direction: business partners to customer/supplier master data.

With regard to tax data management, some points are important to mention:

- General data can be used in several business partner roles.

- Different addresses of a business partner can be maintained.

- Central maintenance of business partner data can be used by different SAP components (in particular by creating different roles).

The figure below shows the maintenance of the business partner (here, as a customer’s organization). In the Billing view, the customer tax classification is set up. In this case, as you can see in the Output Tax table at the bottom of the screen, it’s a customer liable to taxes which represents tax classification 1 in the country Germany.

1

Transaction BP can be used to maintain all business partner data. Further information on Transaction BP is stored in the simplification list as mentioned earlier in this section. The documentation shows which transactions are replaced by Transaction BP. For example, the former Transaction FK03 for displaying the vendor was transferred to Transaction BP. The same applies to the transaction codes for maintaining customers, debtors, suppliers, and creditors.

In connection with the concept of the central business partner, a few classifications are of importance. A new business partner is maintained or created using the person, organization, or group options, corresponding to whether the business partner is a single individual, a single organization, or a group of organizations.

Editor’s note: This post has been adapted from a section of the book Tax with SAP S/4HANA:

Configuration and Determination by Michael Fuhr, Dirk Heyne, Nadine Teichelmann, and Jan M. Walter.

Comments