Receivables management in SAP S/4HANA integrates many comprehensive functionalities.

For example, subledger accounting through accounts receivable, the monitoring and managing of overdue receivables through dispute management and collections management, and the setting up of rules for determining credit scores and credit limits for your customers. Accounts receivable establishes integration with sales and distribution and with the general ledger for subledger accounting. Additionally, accounts receivable has comprehensive receivables management capabilities, which include clearing open debits and credits posted to a customer account, automated cash application, and various receivables management processes such as dunning. Dispute management provides a comprehensive framework for creating and resolving customer disputes, which helps not only improve customer satisfaction but also reduces DSO. Collections management provides an innovative and exhaustive set of related capabilities, from the creation of worklists for collection specialists, to the recording and monitoring of customer contact outcomes. You can create business-driven rules and integrate your system with credit agencies for business partner ratings that calculate credit scores and credit limits for your customers.

We’ll introduce you to key features of each area of receivables management in the following sections.

Accounts Receivable

Accounts receivable is traditionally a book of records containing customer transactions such as customer invoices, incoming payments or down payments, and credit memos. Accounts receivable in SAP has been available since its earliest releases. Accounts receivable is integrated with the general ledger and sales and distribution in real time.

With the introduction of the receivables management functionality, the accounts receivable core functionality has been enhanced to integrate accounts receivable with dispute management, collections management, and credit management. Seamless integration among all these functionalities enables subsequent processes, such as managing customer disputes and the collection of overdue receivables.

Accounts receivable in SAP S/4HANA enables the following core processes.

- Posting accounting documents (customer invoices) for billing documents posted with reference to a sales order in sales and distribution

- Posting accounting documents (customer credit memos) for credit memos posted with reference to a sales order in sales and distribution

- Posting customer invoices or customer credit memos without reference to a sales order

- Creating correspondence to send invoices through various modes (i.e., PDF, email, etc.)

- Creating down payment requests for down payments to be received from the customer

- Posting down payments

- Clearing customer open debits and credits manually as well as automatically

- Posting incoming payments from customers and clearing invoices with payment documents (cash application)

- Importing bank statements or lockbox files from banks into SAP S/4HANA Finance and applying cash to invoices automatically

- Performing dunning processes for sending dunning notices to customers about overdue/outstanding invoices

- Performing period-end processes, such as bad debt write-offs, to close a period in accounts receivable

- Integration with other receivables management functionalities such as dispute management, credit management, and collections management

- Intuitive SAP Fiori analytical apps provide information through various accounts receivable KPIs such as DSO, days beyond terms (DBT), accounts receivable aging analysis, etc.

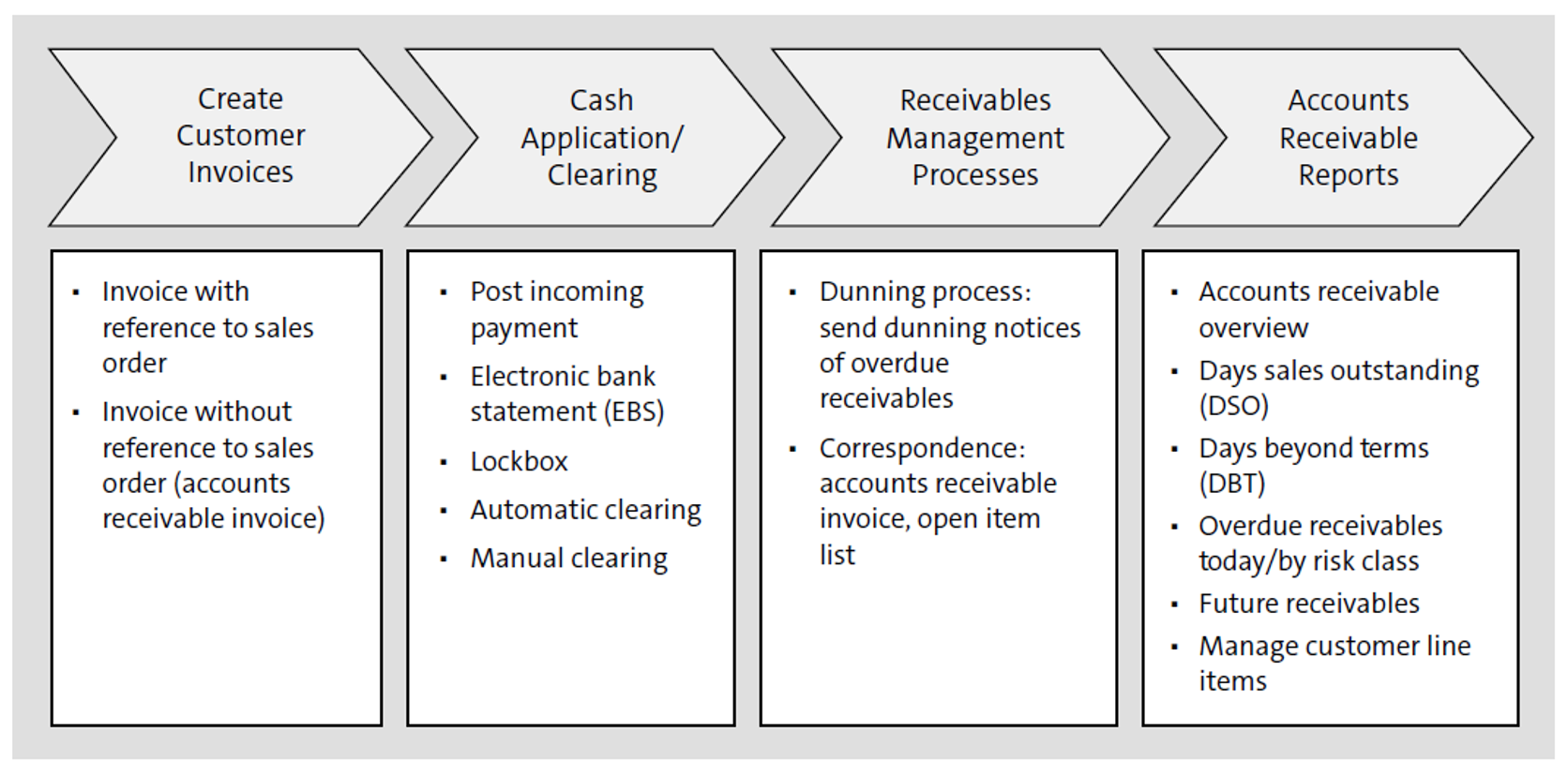

The figure below shows the accounts receivable functionality in SAP S/4HANA.

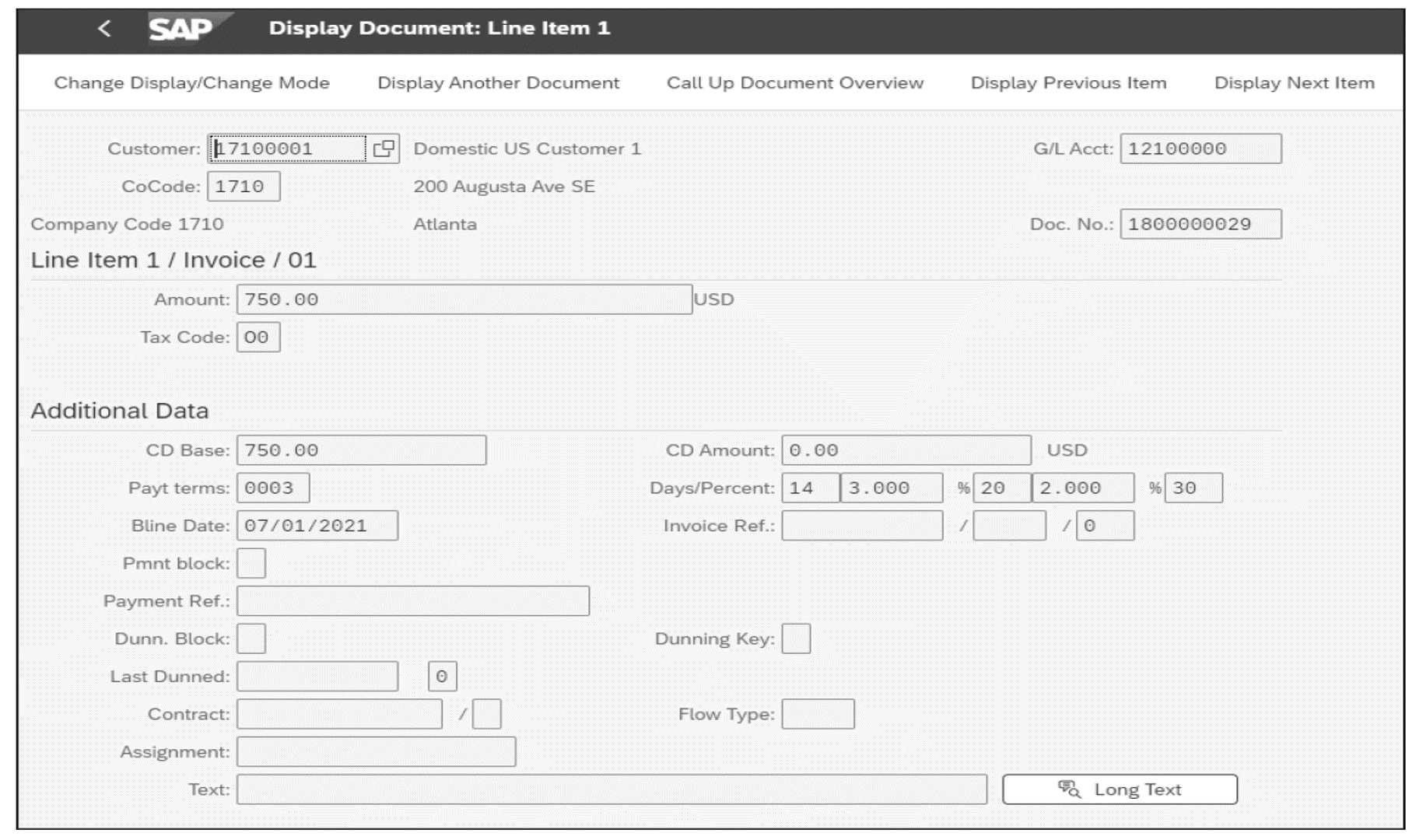

In SAP S/4HANA, you can post customer invoices and credit memos to create open items on the customer’s account. The customer or accounts receivable line item of the customer invoice contains the agreed-upon payment terms and a baseline date, which is the date on which the payment term is applicable for the customer invoice. Together, the baseline date and the payment terms on the line item determine the due date of the customer invoice. The next figure shows a customer (accounts receivable) line item with a baseline date of July 1, 2021, and the payment term 0003.

In this example, the values in the Days/Percent fields, which are derived from the Payt terms (payment terms) field, are 14/3.000%, 20/2.000%, and 30, which means the following rules apply:

- If payment is made within 0 to 14 days after the baseline date, the customer is entitled to a 3% cash discount.

- If payment is made within 15 to 20 days after the baseline date, the customer is entitled to a 2% cash discount.

- The due date of the payment is 30 days after the baseline date.

If the customer fails to make a payment after 30 days from the baseline date, this invoice becomes overdue for payment and is subject to collections efforts such as dunning notices, collections worklists, customer contacts, and so on.

Thus, the payment terms and the baseline date are important drivers of collection processes in receivables management since this information determines when an invoice is due for payment. If the payment is not received by the due date of the invoice, this overdue invoice is now subject to the collection process.

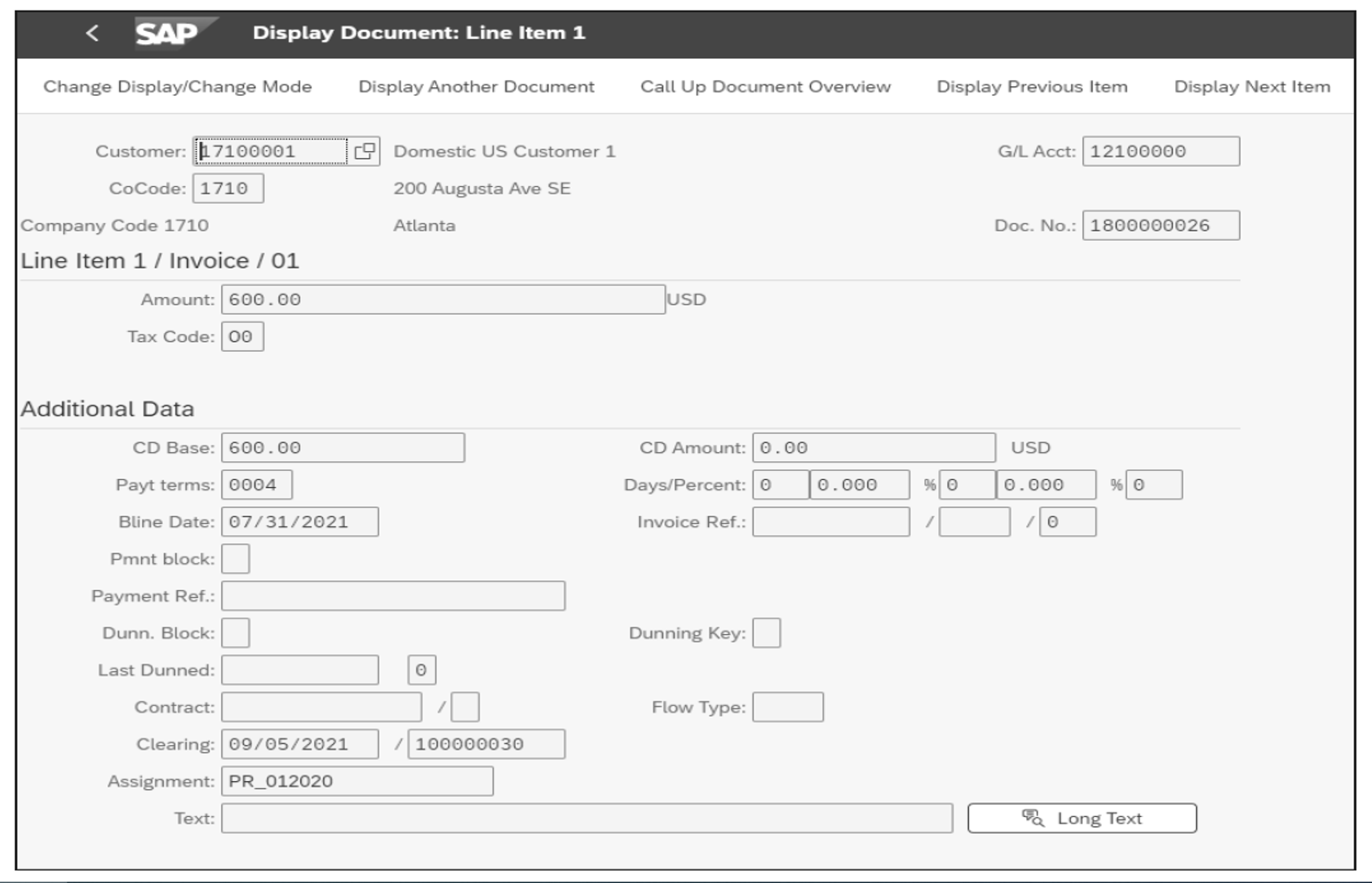

Another important receivables management process in SAP is called clearing, which is the process of matching and assigning open debits on customer accounts (i.e., customer invoices) and open credits (i.e., incoming payments from customers, customer credit memos). For example, when you receive full payment on an invoice and assign the invoice to a payment document, the payment document clears both itself and the customer invoice. SAP invokes the clearing process through specific clearing transactions or through various incoming payment transactions. SAP clearing transactions include automatic clearing (Transaction F.13) and manual clearing of customer items (Transaction F-32). You can configure the fields used for automatic clearing. If open line items are not cleared through automatic clearing, these items can still be cleared using manual clearing transactions. Since most debit line items are customer invoices and most credit line items are customer payments, SAP S/4HANA provides a built-in clearing functionality when a user posts a payment document through various transactions.

Banks usually send bank statements containing details about the transactions posted to the bank account, thus capturing the incoming and outgoing cash from your organization’s bank account. Bank statements usually contain a reference to the invoice for which a customer has made a payment. Cash application is the process of identifying and clearing invoices from the invoice reference on the bank statement. The incoming payment transaction is posted in SAP S/4HANA as the bank statement is imported into the system.

The following figure shows the cleared invoice, in the Clearing fields, which capture the clearing date and the document for the customer line item. Cleared invoices are invoices that receive a credit amount from an incoming payment, a credit memo, etc. equal to their due amounts. Cleared invoices are not subject to collections efforts. Thus, the clearing process is also an important task in receivables management and forms the basis of future collections efforts.

As illustrated in our example invoice shown earlier, once an invoice starts accruing DBT, that is, the invoice is open for one or more days from the date defined by payment terms after the baseline date, the invoice is overdue and is subject to collection processes. One core traditional collection process is dunning. With this process, you’ll send a dunning notice, containing a list of overdue invoices, to the customer as a reminder to make payment on those invoices. SAP has provided a dunning functionality since its earliest releases since dunning is a traditional process of collections. SAP S/4HANA’s dunning functionality has been enhanced to integrate dunning with the dispute management and collections management modules, for instance, using valuation scores from collections management to determine dunning levels, defining legal procedures for dunning, establishing dunning blocks on disputed invoices, or creating promises to pay to exclude invoices from dunning.

SAP S/4HANA offers both SAP Smart Business apps and analytical SAP Fiori apps. Many SAP Fiori apps display KPI information on their tiles on the SAP Fiori launchpad. The Days Sales Outstanding, Days Beyond Terms, and Overdue Receivables apps are examples of smart SAP Fiori apps that display KPI information and offer comprehensive chart and/or table reporting options. Additionally, some apps like the Days Sales Outstanding – Detailed Analysis app provide various built-in analyses, including the ability to analyze various parameters. Additionally, SAP S/4HANA provides list reports, such as the Display Customer Balances app and the Manage Customer Line Items app. The first report displays customer balances for each period, while the latter displays customer line items based on selection filters.

Credit Management

The exchange of goods and services has long been the foundation of the economy. Businesses are based on creating goods and/or services and selling them for money. When you sell goods or services, you can either demand payment in advance or agree to receive payment after the delivery of goods or services. The latter case carries a risk of default by your customer. To avoid this risk, the buyer and seller can involve a third party to guarantee payment to the seller on fulfillment of the seller’s commitments. The third-party guarantor may take the full payment in advance from the buyer or accept a guarantee from the buyer’s bank. High transactional costs are involved in such escrow services. Your business may extend credit to customers beyond the amount guaranteed, for various valid reasons. In several industries, managing credit and the risk associated with credit is the key to success.

Managing credit and the associated risk is credit management. From a narrow perspective, this process involves deciding when to stop sales to a customer. From a broader perspective, credit management involves proper communication and follow-up with the customer, handling customer complaints, gathering accurate credit-related information about customers from internal and external sources, and several other activities. We’ll focus SAP S/4HANA credit management functionality in this section.

As an integrated real-time system, SAP provides great opportunities for managing credit. Over the years, the credit management functionality has evolved in SAP. The fundamental difference between functionality in SAP Business Suite and SAP S/4HANA lies in the database. SAP Business Suite can have an SAP HANA database, but for SAP S/4HANA, an SAP HANA database is mandatory. With SAP S/4HANA, SAP has also removed several legacy functionalities, for instance, classic credit management (FI-AR-CR and SD-BF-CM).

In SAP S/4HANA, the credit exposure and payment behavior of a particular customer, such as DSO, last payment, etc., are automatically updated in the business partner master record. A customer’s credit limit is also updated in real time using formulas. If the customer’s credit exposure is more than the allowed credit limit, then the customer is blocked in credit management. Also, you can block sales based on other criteria like DSO, the document value, the oldest open item, the dunning level, etc. Thus, even when the credit limit itself is not breached, sales can be blocked in credit management based on these criteria. When the sales to a customer is blocked, an authorized person can decide whether to allow an individual sales document to be released or blocked. This functionality in case management, called a documented credit decision in credit management, is used to record detailed reasons for the rejection or approval of credit to help in future analysis. Instead of releasing or rejecting individual sales documents, a credit manager can also request a new credit limit.

Many easy-to-use SAP Fiori apps are available for credit management. A few examples include the Manage Credit Accounts, the Manage Business Partner Master Data, the Rebuild Credit Management Data, the Analyze Credit Exposure, the Credit Limit Utilization, the Manage Documented Credit Decisions, and the Schedule Credit Management Jobs apps, among others.

Dispute Management

Disputed invoices indicate some element of customer dissatisfaction with your organization. Short payments or no payment at all on dispute invoices raises DSO and makes predicting cash flows difficult. The costs and time associated with manual dispute resolution (especially to your customer’s satisfaction), with finding the root causes of customer disputes, and with preventing similar disputes in the future from happening are key drivers for a system-driven and automated dispute management process.

Customer disputes can contain a variety of information, such as invoice number; reason for the dispute; the disputed amount (i.e., full invoice amount or partial amount); short payments; or the lack of payment. The reason for a dispute can potentially include quantity issues (i.e., short shipments); quality issues (i.e., damaged goods); pricing issues (i.e., eligible discounts, contract price); trade promotions; and more. Once dispute information is received from your customer, you’ll need to assign a priority; a dispute case processor (the person responsible for working to resolve the dispute); a coordinator (the person accountable for dispute case resolution); and dates (i.e., the dispute case creation date, planned closure date, planned date for the next action, etc.). Additionally, a receivables management team member working on the dispute case (known as the dispute case processor) will need to connect with various people inside and outside your organization and maintain detailed notes about these contacts to resolve customer disputes. Thus, SAP S/4HANA offers the ability to maintain notes of customer contacts. Additionally, for managing customer disputes overall, various attributes of the dispute (i.e., status and root cause) will need to be maintained. Various date fields and amount fields will be required, and thus, customer disputes require significant records maintenance.

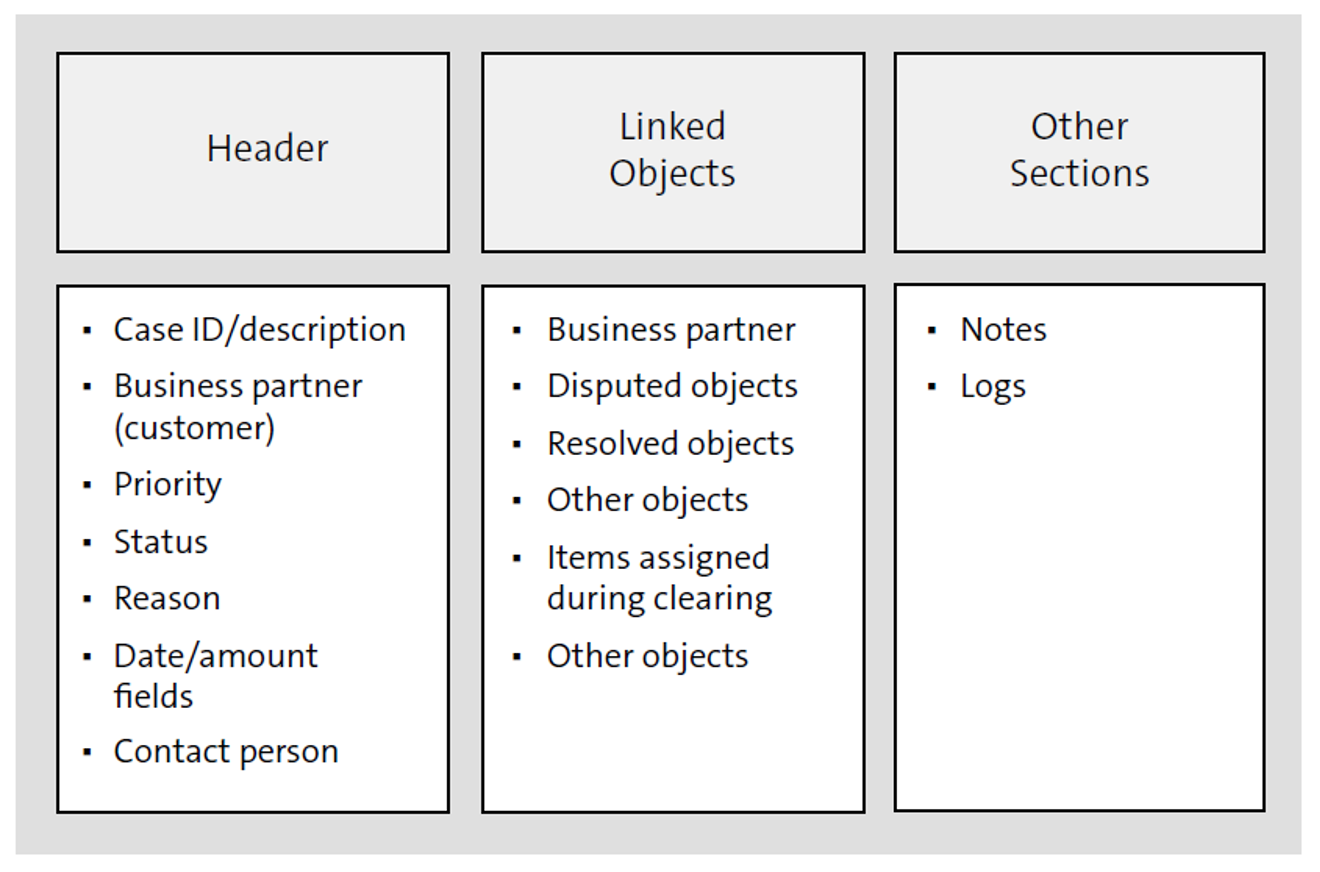

SAP S/4HANA’s dispute management capability uses SAP’s case management and record management functionalities to provide a folder structure for the electronic records created in the course of resolving customer disputes. Customer disputes are created in the SAP S/4HANA system as dispute cases, which consist of three elements. First, the header contains data fields and attributes; second, a folder structure known as linked objects contains various folders such as business partner, disputed objects, etc.; and finally, notes make up the final element of a dispute case. The folder structure of linked objects in a dispute case is derived from case management.

The next figure shows the dispute case structure subdivided into three parts: the header, linked objects, and other sections. The header contains the case ID, description, status, priority, reason, amounts, and contact person.

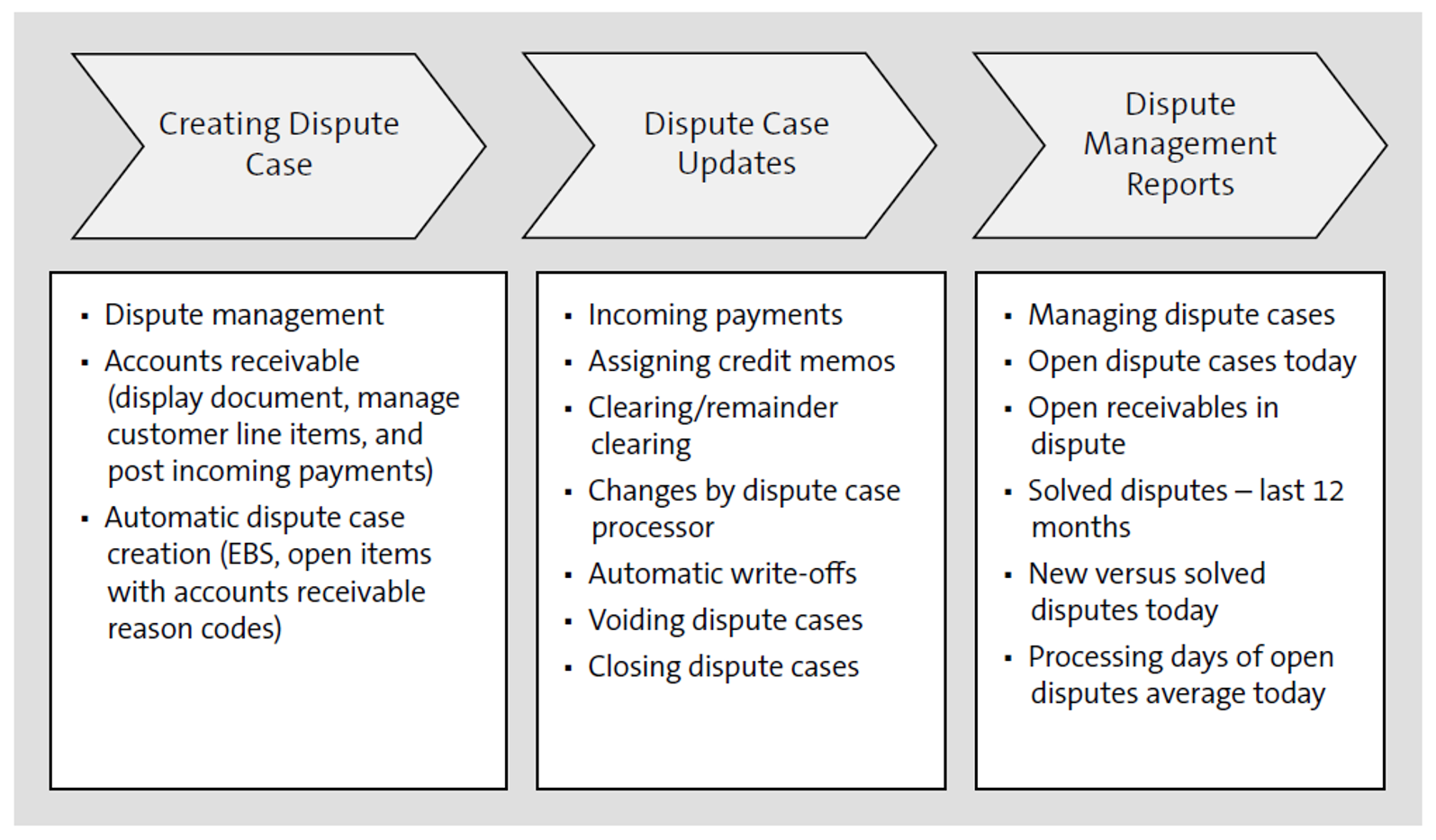

SAP S/4HANA dispute management is seamlessly integrated with accounts receivable. SAP S/4HANA enables you to create dispute cases from several accounts receivable transactions. The header fields and linked objects of an existing dispute case also be updated through various accounts receivable processes. Additionally, dispute management processes, such as automatic write-offs, not only close a dispute case but also post a write-off document in accounts receivable to credit the customer account and debit bad debt accounts. The figure below shows SAP S/4HANA’s dispute management functionality and its processes.

You can create dispute cases from enquiries or reporting transactions (i.e., Display Document or Display Customer Line Items) and SAP Fiori apps (i.e., the Display Journal Entries app or the Manage Customer Line Items app). You can also create dispute cases through accounts receivable processes, such as incoming payments, through SAP Fiori apps like the Post Incoming Payments app and the Reprocess Bank Statement Items app.

SAP S/4HANA’s accounts receivable functionality includes the use of accounts receivable reason codes to capture the reason behind, for instance, a short payment. An SAP S/4HANA dispute case contains a reason attribute for capturing the reason behind a customer dispute. Through SAP S/4HANA configuration, you can map accounts receivable reason codes with reason attributes from dispute cases.

Usually, you’ll post incoming payments through automated interfaces. For example, SAP S/4HANA’s EBS functionality imports and processes prior-day or intraday bank statements you’ll receive from your banks. Similarly, in the US, banks send lockbox files containing specifically the incoming payments from your customers. When your customer makes a payment through your bank, the bank will send you a payment advice, through EBS or a lockbox file, containing the invoices for payments have been made as well as any reason for a short payment. Reason codes from banks for short payments are configured in SAP S/4HANA as external reason codes. You can configure the assignment of these external reason codes with SAP S/4HANA accounts receivable reason codes. Since accounts receivable reason codes are also mapped to dispute case reasons, an external reason code from a bank can be transformed to both an accounts receivable reason code in the payment journal entry posted in accounts receivable and a reason attribute in the dispute case created for the short payment. SAP S/4HANA also provides functionality to create dispute cases automatically while processing lockbox files or bank statements. Therefore, SAP S/4HANA provides numerous ways to create dispute cases manually or automatically from various accounts receivable processes.

Integration between accounts receivable and dispute management also updates dispute cases in real time whenever various accounts receivable processes are executed, such as the following.

Invoice Clearing

The clearing of disputed invoices, for instance, through incoming payments or other credit line items, changes the status of a dispute case in real time. When a dispute case is found to be invalid or unjustified, the customer becomes liable to make payment. If the customer makes a payment for the disputed amount, the SAP S/4HANA system automatically closes the dispute case when processing the incoming payment for the disputed amount. Similarly, if the dispute case found to be valid, you can create and post a credit memo to credit the customer account.

Credit Memos

Additionally, you can assign a credit memo to the one or more disputed invoices through SAP S/4HANA. The dispute case status changes to closed when you assign a credit memo to a disputed invoice through this process.

Dunning

Relevant dispute management processes also update the relevant journal entries or documents in accounts receivable in real time. For example, SAP S/4HANA automatically inserts dunning blocks on disputed invoices when you create dispute cases. Dunning is a collections process to send details about overdue invoices as a list to a customer (the dunning notice). Invoices with dunning blocks do not appear on dunning notices.

Since disputed invoices should be excluded from dunning notices and ultimately from collections efforts, automatically inserting a dunning block on disputed invoices helps to meet this business requirement with ease. The dispute case status drives the status of the dunning block on accounts receivable invoices. In other words, when a dispute case is created, the dunning block is automatically inserted by the SAP system, and when dispute case is found to be unjustified, a status change would remove the dunning block automatically, and now the customer is liable to make a payment for this invoice.

If the customer still refuses to pay an invoice with an unjustified dispute case, this dispute case needs to be written off through the automatic write-off transaction in dispute management. In this process, dispute management closes the dispute case but also posts a journal entry or document in accounts receivable to credit the customer account and debit the bad debt account in real time.

Similarly, dispute management is seamlessly integrated with collections management. For instance, the Process Receivables app displays the collections worklist items assigned the collection specialist. When the collection specialist contacts a customer for overdue invoices on the collections worklist, and the customer raises a dispute, the collection specialist can create the dispute directly from the Process Receivable app or the Process Receivables screen in the My Worklist SAP GUI transaction (Transaction UDM_SPECIALIST). Cross-navigation to various accounts receivable analytical apps or to the Process Receivables app is available from several of SAP Fiori’s analytical dispute management apps.

Collections Management

Collections management is needed to communicate with your customers about overdue receivables, which helps you receive payment on overdue invoices and reduce the incidence of customer default. Often, many customers have poor payment behaviors, and in the absence of follow up, a customer may utilize their cash resources for priorities other than paying your company. These customers often respond better to personal contacts than to correspondence such as dunning notices. The dunning process is a common traditional collections management process. However, in a modern business environment, the dunning process alone may not be sufficient. Poor payment history not only increases the DSO but also impacts the relationship with the customer. Due to nonpayment, a customer’s credit exposure increases, and their overall credit/risk profile may also shift. Often, businesses with the customer may suffer, and thus, a proactive collections management function is essential to increase on-time payments, reduce the need to write of bad debt, and to decrease outstanding receivables. SAP S/4HANA provides comprehensive and innovative collections management processes for all these activities.

Before we discuss SAP S/4HANA collections management, let’s briefly discuss the overall challenges solved by collections management first.

High Volume

Often, organizations that need receivables management have a high volume of transactions. Due to this high volume, receivables managers face difficulties when assigning the priority specifying which customers should be contacted first versus contacted later. Also, having all the information handy is crucial when following up with a customer for the collection of outstanding receivable amounts.

Analysis/Identification of Customer Accounts

For effective collections follow-up, collection specialists should be able to access analysis on various parameters (i.e., the period for which customer invoices are overdue for payment, customer risk classes and credit scores, credit limit utilization, etc.). Defining a collection strategy is essential to selecting and then prioritizing customer accounts to be contacted during collections efforts.

Preparing Worklists and Assigning Worklist Items

Manual or partially system-driven processes in a high-volume environment often fail to make all of the requisite information for the customer available and may hinder the analysis of overdue receivables and the preparation of collections worklists. SAP S/4HANA provides a comprehensive framework involving the collections management organizational structure and also provides the ability to configure collection strategies with a variety of collection rules. Through these elements, SAP S/4HANA creates collections worklists and then assigns worklist items to collection specialists. With this capability, collections management in SAP S/4HANA evenly distributes worklist items to collection specialists.

Recording/Tracking Customer Contact Outcome

When the collections department contacts a customer for overdue receivables, the outcome of that contact depends on the reason behind the nonpayment of invoices. A customer may have missed the chance to pay on time and now promises to pay the invoice within a certain timeframe. Another possibility is that the customer is not happy with the product or service and may raise a dispute case for the invoice. Without a system to streamline collections management processes, the recording and reporting of customer contacts and their outcomes may not be consistent.

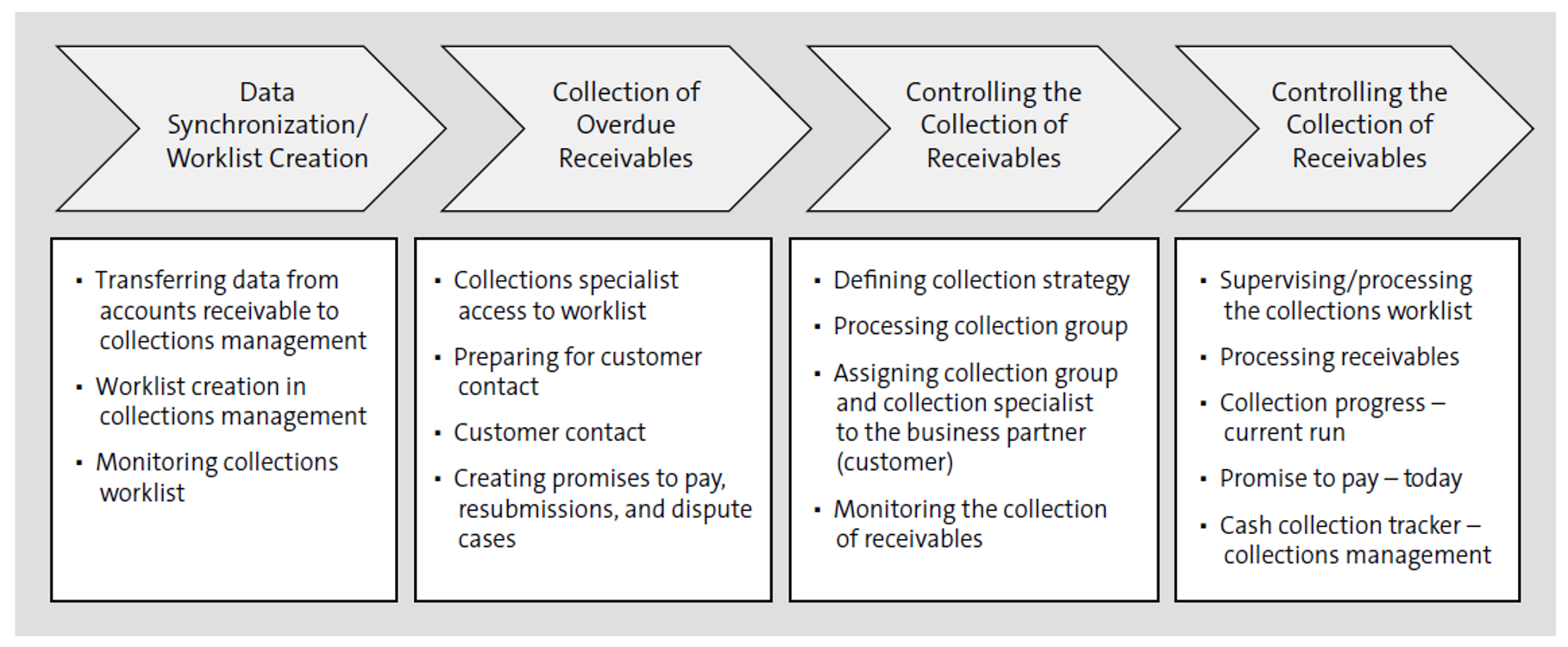

SAP S/4HANA provides innovative and comprehensive collections management processes for recording promises to pay and for creating dispute cases through the integration of collections management with dispute management. The next figure shows the SAP S/4HANA collections management framework, including its processes, reporting capabilities, and KPIs.

Like other receivables management functionalities, SAP S/4HANA collections management is seamlessly integrated with accounts receivable. We first explain the ways customer master data integrates accounts receivable and collections management.

SAP S/4HANA business partner functionality entails different business partner roles, and receivables management-relevant business partner roles are financial accounting customer (FLCU00), collections management (UDM000) and credit management (UKM000). The first step is assignment of collections management role (UDM000) to the business partner for enabling collections management processes for that customer in SAP S/4HANA. Through the assignment of the collections management role to the business partner, we can further assign collections management organizational structure elements with business partners. The collection profile is the highest organizational structure element of collections management. With the assignment of a collection profile, we can assign other organizational structure elements lower in the hierarchy of the collections management organizational structure. The assignment of relevant collection segments enables the assignment of company codes and collection groups. Selecting a relevant collection group enables the assignment of collection specialists, who manage the collection effort with the customer. Additionally, collection group assignment determines the collection strategy.

Transactional data from accounts receivable, such as overdue open invoices, balances, and KPIs, are transferred to collections management to its general collections worklists. Once accounts receivable data is transferred to collections management, a collections worklist can be generated and assigned to a collection specialist assigned to the business partner (customer) master data. If a collection specialist is not assigned to a customer, collections management also provides a functionality to assign worklist items automatically and evenly among collection specialists. SAP S/4HANA can also derive priority-based collection rules configured for a collection strategy, which is indirectly assigned to a customer through the assignment of a collection group in business partner master data. Prioritization helps your collection specialists focus their efforts by highlighting which customers should be contacted first.

In SAP S/4HANA, the collection of receivables starts with a collection specialist accessing a collections worklist and then establishing customer contacts. Collections management in SAP S/4HANA facilitates recording customer contacts, including the outcome of the customer contact. One of the most common outcomes of a customer contact is that the customer promises to pay off overdue invoices by a certain date. SAP S/4HANA calls this agreement a promise to pay. Using the Process Receivables app or the Process Receivables screen in the My Worklist transaction, a collection specialist can enter a promise to pay, which has different statuses such as created, kept (if the customer pays by the promised date), broken (if the customer fails to pay by the promised date), etc. A broken promise or a kept promise also can be taken in consideration when setting up an overall valuation score for a customer and thus deriving a priority for the collections efforts for that customer. SAP S/4HANA also enables you to create installment plans if the customer agrees to pay off an overdue amount in installments.

Collections management in SAP S/4HANA is also integrated with dispute management. Dispute cases can be created from the Process Receivables app or via SAP GUI transactions in real time. Proactive collection strategies can also be configured in SAP S/4HANA to communicate with a customer days in advance to avoid invoices from becoming overdue as well as to guide customers to potential cash discounts for paying early.

Like dispute management, invoices with promises to pay can be excluded from the dunning notice run by inserting a dunning block on the invoice automatically once a promise to pay is created for that invoice. A resubmission is created when a customer should not be contacted until certain date.

Editor’s note: This post has been adapted from a section of the book Receivables Management with SAP S/4HANA by Chirag Chokshi. Chirag is an SAP S/4HANA Finance solution architect with more than 20 years of consulting experience. He works as a senior principal with Infosys Consulting. He is an accomplished digital transformation leader in finance and a recognized subject matter expert for the latest SAP S/4HANA functionalities including Central Finance, cash management, and receivables management. Chirag has led and delivered many complex, global SAP financials projects across different countries and various business sectors such as consumer products, life sciences, process manufacturing, retail, and fashion management. Chirag has also published multiple SAP financials white papers. He has been recognized by SAPInsider as a featured expert for the year 2020.

This post was originally published 7/2022.

Comments