Customer invoices and credit memos without reference to sales orders are posted in accounts receivable directly. The following configuration activities are required to enable this direct posting functionality:

- Document types and number ranges

- Payment terms

Document Types and Number Ranges

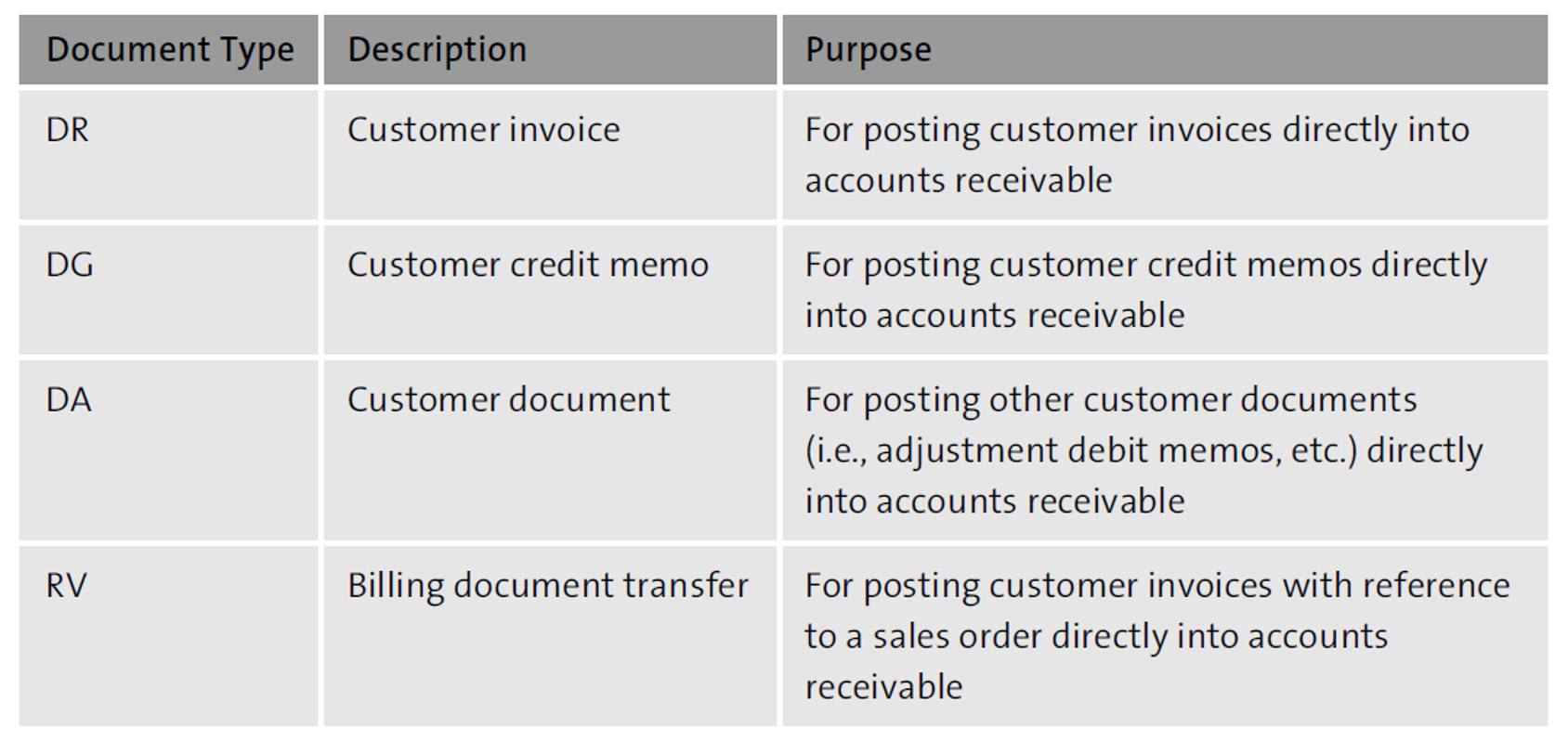

Document types classify different types of documents based on the category, purpose, and origin of the document. For an example, the document type for customer invoices in SAP S/4HANA with reference to a sales order is RV, and invoices without reference to a sales order is DR. Several document types are commonly used for customer invoices and credit memos, as listed in the table below.

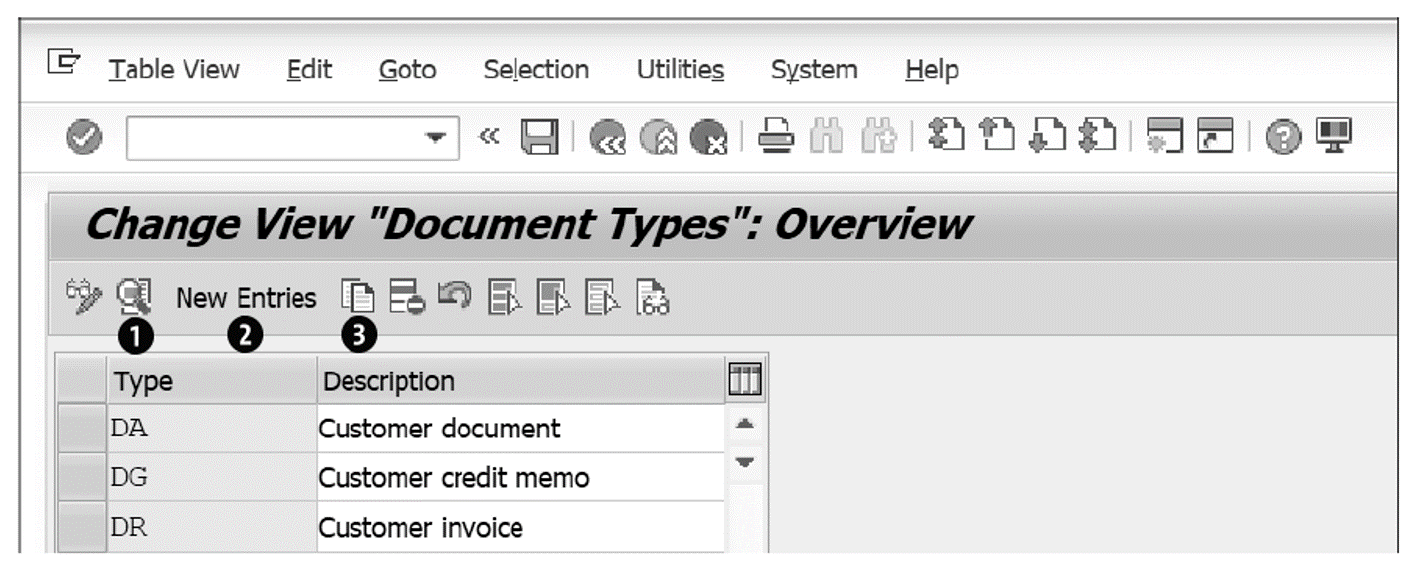

To configure document types in accounts receivable, follow the IMG menu path Financial Accounting > Accounts Receivable and Accounts Payable > Business Transactions > Make and Check Document Setting > Define Document Types. The figure below shows document types DA, DG, and DR.

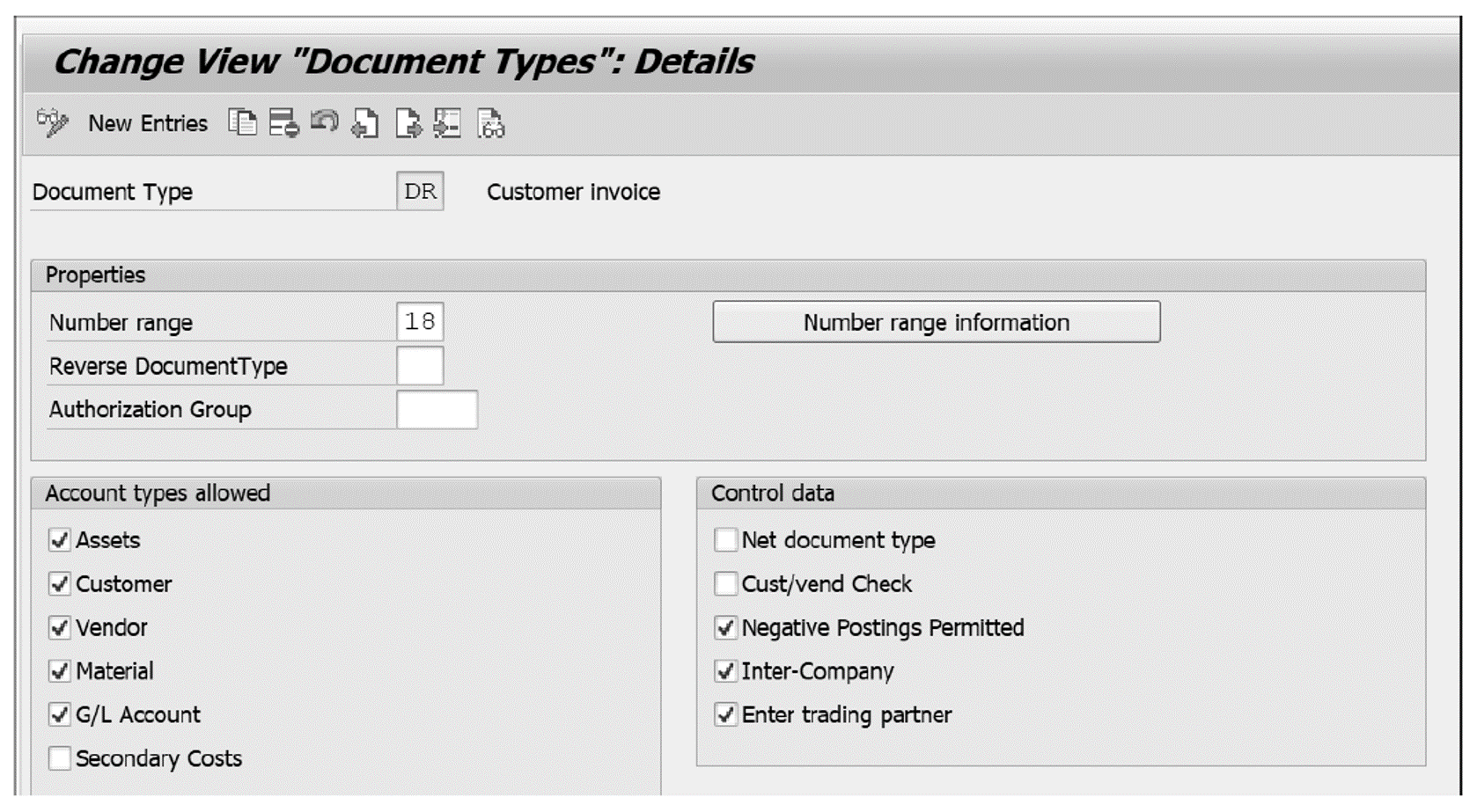

After selecting a document type (the standard document type DR, in our example), click the magnifying glass icon shown in the figure above (10 to open the document type configuration screen, shown below. The internal number range 18 is assigned to document type DR. You can also configure new custom document types if the standard document types do not meet your specific requirements. Click the New Entries button (2) to configure a new document type, or click the Copy button (3) to configure a new document type by copying the attributes of an existing document type. Since a customer invoice contains one customer (accounts receivable) line item and since offsetting line items may post to any of the other account type, the default configuration of DR allows posting to all account types selected under the Account types allowed section.

Under Control data, various options are available for configuration:

- Net document type: This indicator is relevant for vendor invoices when the system should deduct cash discounts from a vendor invoice. This checkbox is not relevant for customer invoices, and thus, by default, this indicator is not selected.

- Cust/vend Check: If selected, this option allows only one customer or one vendor in the document posted with the document type. This check is not selected in the default configuration to enable flexibility with posting; otherwise, some transactions result in errors.

- Negative Postings Permitted: To reverse documents with incorrect entries, this indicator must be set on the document type.

- Inter-Company: Select this indicator to facilitate intercompany postings when the line items of the documents may belong to different company codes.

- Enter trading partner: If selected, this indicator allows the entry of a trading partner manually for intercompany postings or for cross-company code postings.

To create a new document type with the same or similar attributes as document type DR, click the Copy button, which will open the screen shown, with the Document Type field ready for entry. Enter a new document type ID in a suitable number range and then make the required changes to the default configuration attributes of your new document type.

Payment Terms

Now, let’s look at the configuration of payment terms in this section. Payment terms represent the agreement between your company and your customer for the payment of customer invoices. Payment terms are assigned to business partner master data (customer master data), which are then used as default values in customer documents like customer invoices. Payment terms determine when a customer invoice is due for payment and forms the basis of several receivables management processes and reports (i.e., dunning, collections management, and aging analysis on open customer invoices).

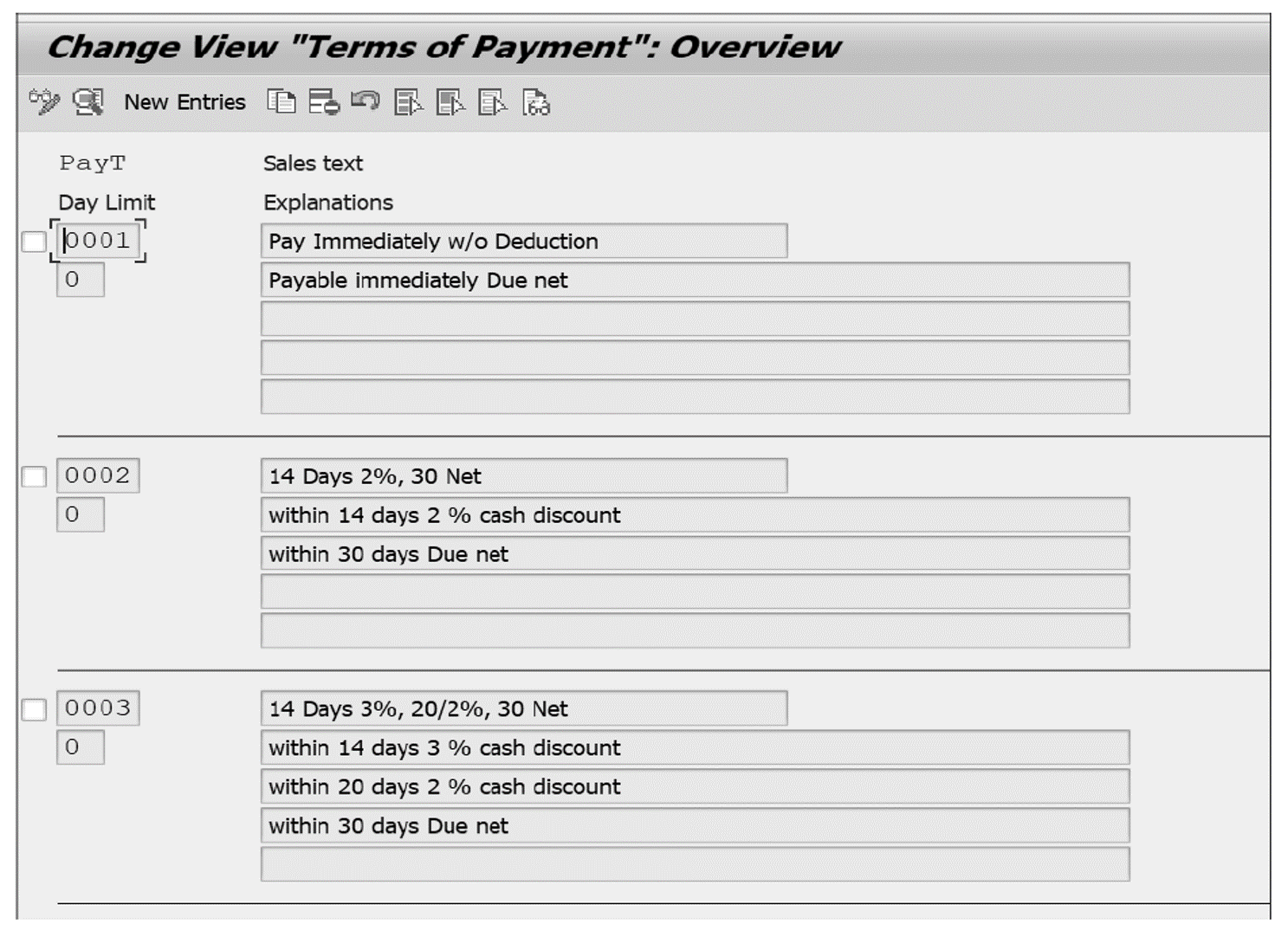

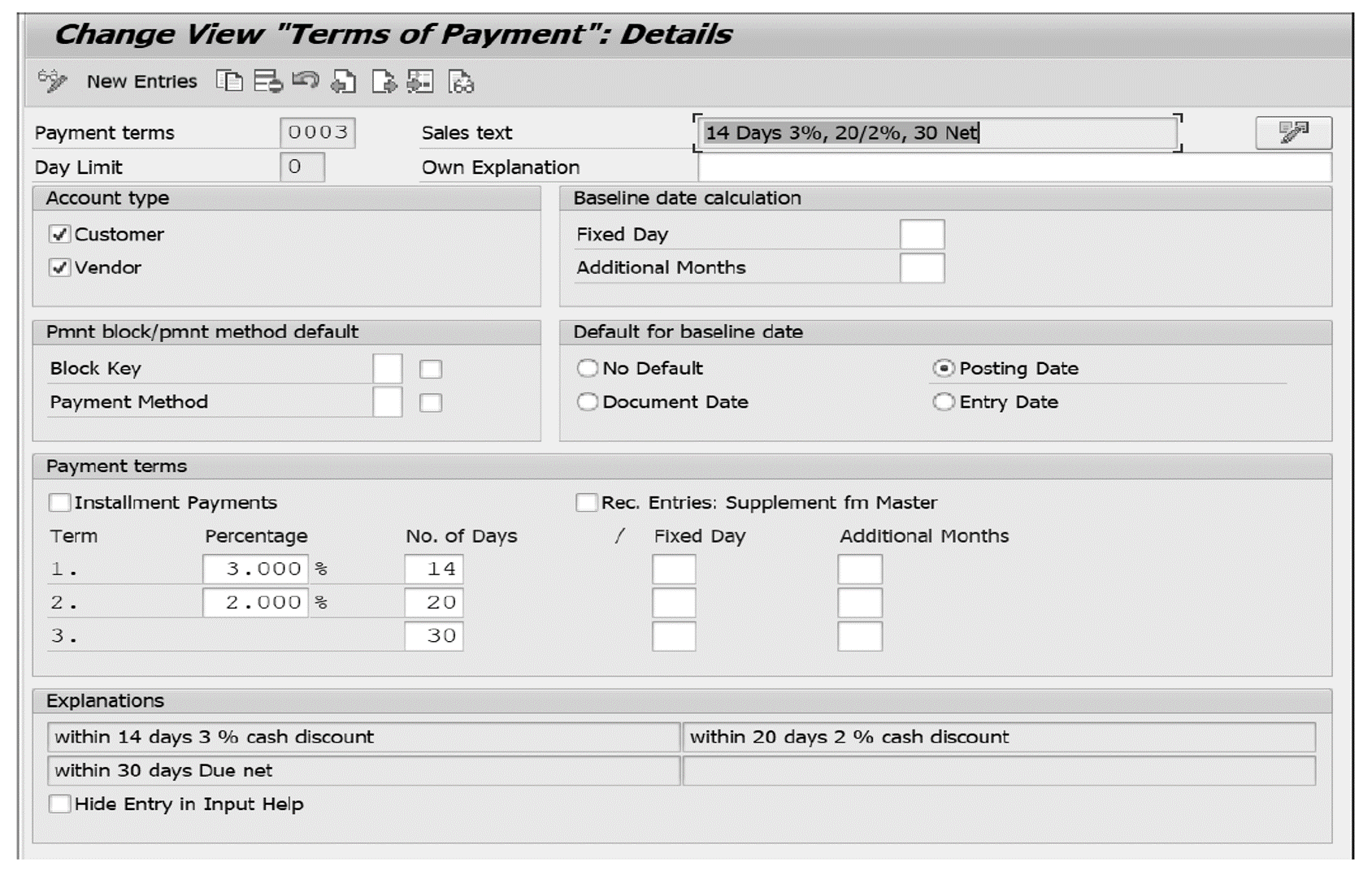

To configure payment terms, follow the IMG menu path Financial Accounting > Accounts Receivable and Accounts Payable > Business Transactions > Incoming Invoices/Credit Memos > Maintain Terms of Payment. On the screen shown below, select the checkbox next to PayT 0003 and click the magnifying glass icon in the upper lefthand corner.

The next figure shows an example configuration of payment term 0003. Payment term 0003 (14 Days 3%, 20/2%, 30 Net) calls for a 3% and 2% cash discount if payment is made within 14 days or 20 days, respectively, from the baseline date, which is the date on which the payment term comes in force. If a payment is made between 21st day and 30th day, no cash discount is applied, but the invoice is not actually due for payment until the 30th day from the baseline date.

To configure our example payment term 0003, as shown above, enter values for the following fields:

- Payment terms: This ID field is a 4-character alphanumeric key.

- Sales text: Enter a description of the payment term.

- Day Limit: This value is specified as 0 in our example payment term. However, if two separate payment terms must be invoked based on the invoice date, this field is used.

- Account type: Specifies whether a payment term is applicable for customers, for vendors, or for both.

- Pmnt block/pmnt method default: In general, the payment method and the payment block for a payment term in a customer invoice defaults from the customer master data. We also specify default payment terms on the customer master data. However, you can use this section for country-specific requirements where particular payment terms should default the payment method and the payment block. By checking the Block Key and Payment Method options, the payment block and the payment method will be transferred in the event that we change the default payment terms.

- Baseline date calculation: The baseline date is the date on which payment terms becomes valid (i.e., comes into force). The Fixed Day field overwrites the default baseline date populated from the options in the Default for baseline date section, replacing that default baseline date value with the day specified in this field. Similarly, the Additional Months field adds the specified number of months to the default settings for the baseline date.

- Default for baseline date: Options for the default baseline date include the posting date, the document (invoice) date, or the entry date in the system. Usually, the posting date or the document date is used. Recall our earlier discussion of the Baseline date calculation options (Fixed Day and Additional Months). Let’s say we select Posting Date as the default for the baseline date and enter “15” into the Fixed Day field and enter “1” in the Additional Months If the Posting Date of the customer invoice is July 10, 2021, the baseline date would be August 15, 2021, that is, 15 (the fixed day) and August (1 additional month).

- Payment terms: This section displays payment terms organized by days from the baseline date. In our example, we’ve set a 3.000% cash discount within 14 days of the baseline date and a 2.000% cash discount within 20 days of the baseline date. No cash discount is applied if payment is made within 30 days.

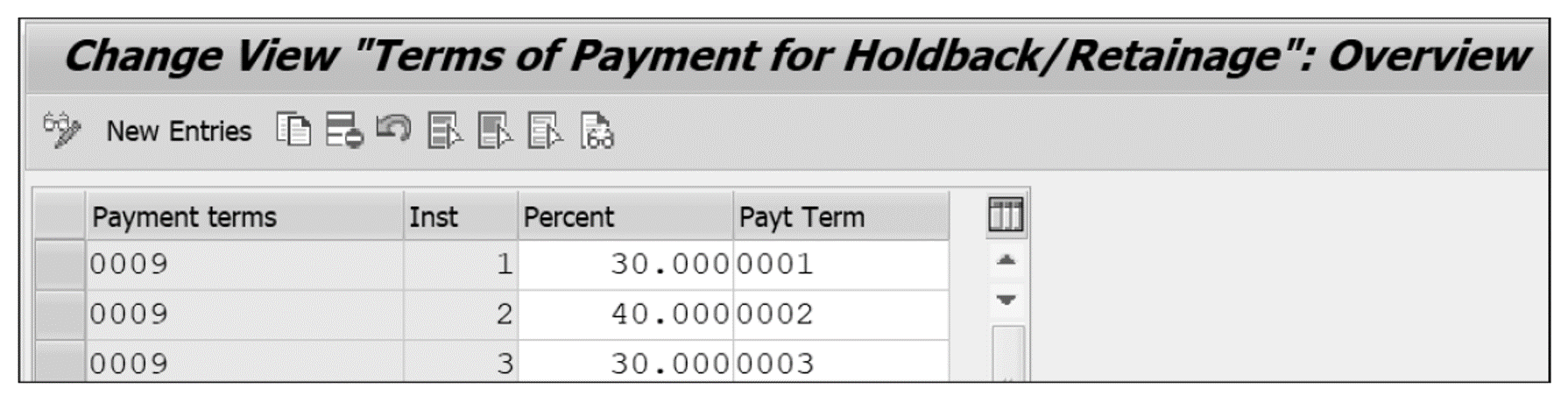

You can also configure payment terms for payments to be made in installments. To create payment methods for installment payments, follow the IMG menu path Financial Accounting > Accounts Receivable and Accounts Payable > Business Transactions _ Incoming Invoices/Credit Memos > Define Terms of Payments for Installment Payments. Assign existing payment methods to each installment and the percentages applicable for each installment, as shown in the final figure.

Editor’s note: This post has been adapted from a section of the book Receivables Management with SAP S/4HANA by Chirag Chokshi. Chirag is an SAP S/4HANA Finance solution architect with more than 20 years of consulting experience. He works as a senior principal with Infosys Consulting. He is an accomplished digital transformation leader in finance and a recognized subject matter expert for the latest SAP S/4HANA functionalities including Central Finance, cash management, and receivables management. Chirag has led and delivered many complex, global SAP financials projects across different countries and various business sectors such as consumer products, life sciences, process manufacturing, retail, and fashion management. Chirag has also published multiple SAP financials white papers. He has been recognized by SAPInsider as a featured expert for the year 2020.

This post was originally published 10/2022.

Comments