Ledgers in SAP S/4HANA are an area in the general ledger application that stores accounting documents based on different accounting principles.

At a minimum, you’re required to have a leading ledger, which always is called 0L and which represents the main accounting principle from a group point of view. Then, you can set up as many nonleading ledgers as required, to represent, for example, local accounting principles, local taxation rules, and so on.

In the old days, you would use a separate financial module called Special Purpose Ledger, which followed this concept of separate ledgers to store postings and data related to different accounting principles or purposes. For example, different special purpose ledgers were used to handle profit center accounting, consolidation, and funds management.

With SAP S/4HANA Finance, nonleading ledgers are fully integrated and post in real time across all applications. So, let’s examine how you can configure ledgers in SAP S/4HANA.

Most importantly, you must define which ledgers are required in your organization from the beginning; subsequent introductions of ledgers can be complicated and will require additional effort. The accounting and taxation reporting requirements must be discussed in detail with the business. The leading ledger should represent the main accounting framework used by the group.

For most companies in Europe and other regions, that main accounting framework would be International Financial Reporting Standards (IFRS)—but in the United States, the main accounting rules are based on US Generally Accepted Accounting Principles (US GAAP). So, most big US companies opt for US GAAP for the leading ledger, then many of them have IFRS in a nonleading ledger. In addition, a wise approach is to set up nonleading ledgers that represent local US GAAP and local tax rules for companies with significant international footprints. Companies that will roll out to various markets would undoubtedly find that, at least in some countries, these ledgers will be required, so we recommend setting them up from the beginning and activating them only for the countries where they’re needed. Some countries are known to have complex local tax requirements, such as Russia and Brazil, among others, and for them, local tax ledgers are a must.

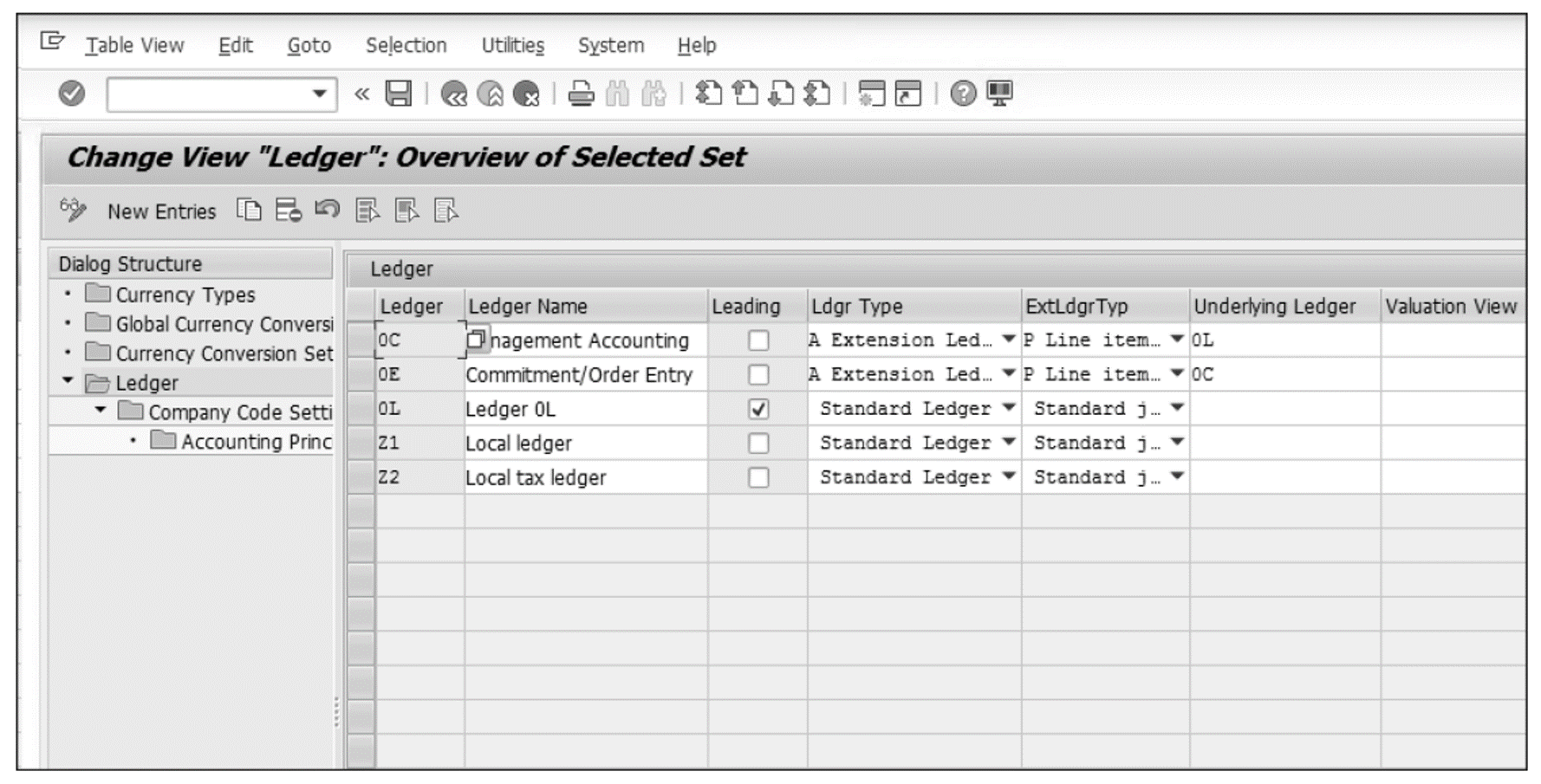

Now, let’s delve into the configuration for ledgers. Follow the menu path Financial Accounting > Financial Accounting Global Settings > Ledgers > Ledger > Define Settings for Ledgers and Currency Types, which shows a list of ledgers already in the system, as shown in the figure below.

On this screen, you can define new ledgers by selecting either New Entries or Copy As… from the top menu. In our example, we’ve set up our leading ledger, which is always called 0L, to represent US GAAP valuation, and we’ve created two nonleading ledgers: Z1 to represent local GAAP and Z2 to represent local tax. The checkmark in the Leading column indicates that 0L is the leading ledger; only one ledger can be marked as leading. The Ldgr Type (ledger type) column determines whether the ledger is standard or an extension. Most ledgers are defined as standard. An extension ledger extends a standard ledger and contains the postings of its linked standard ledger. This kind of ledger is used to make additional manual entries, such as adjustments needed for a specific accounting principle.

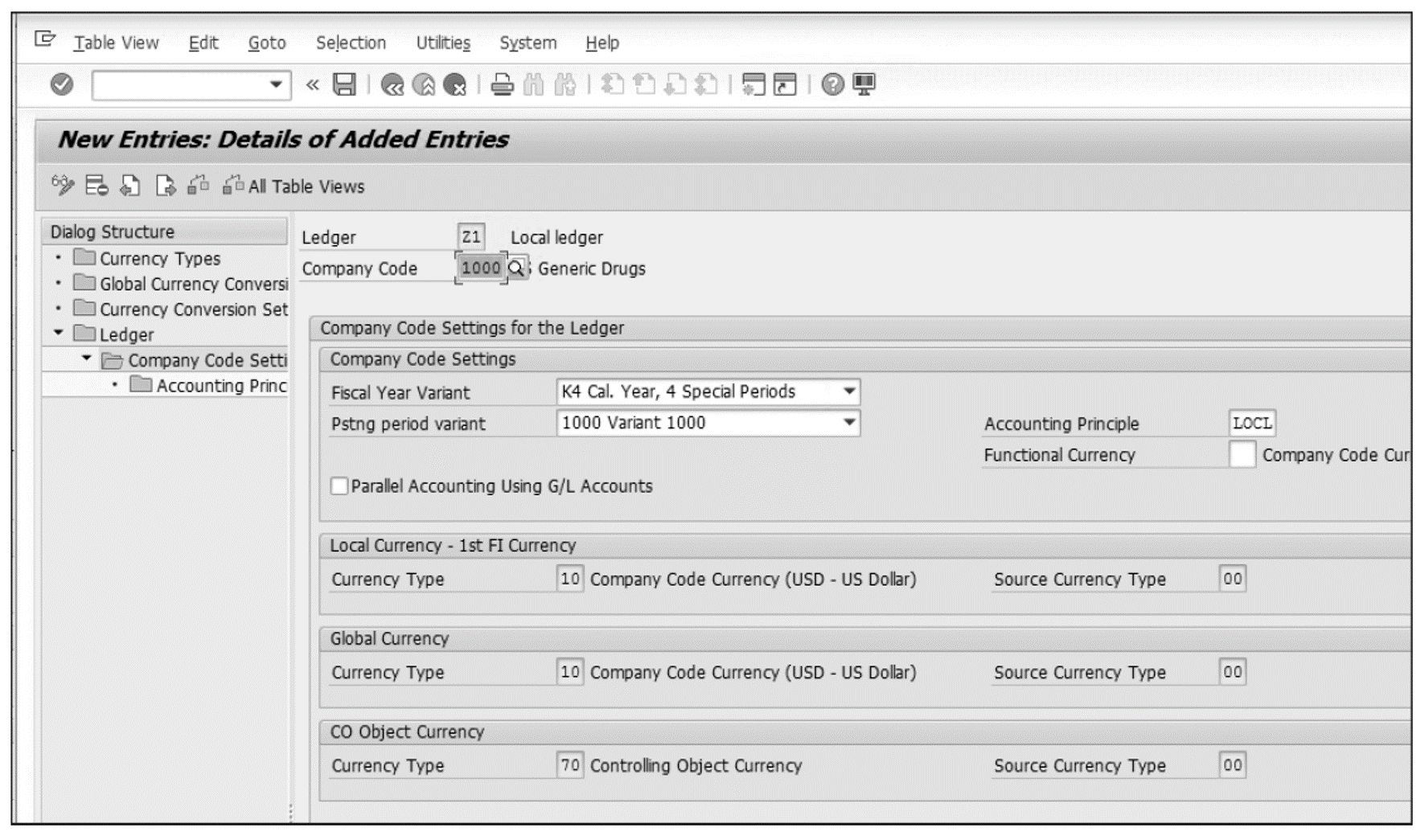

Now, you should make the company code and currency settings for each ledger. Select each ledger individually and click the Company Code Settings for the Ledger option on the left side of the screen. Then, using the New Entries command from the top menu, you can add the required company codes. The figure below shows the following important settings:

- Fiscal Year Variant: This setting specifies the fiscal year variant used for this ledger. Different ledgers can have different fiscal year variants, which is normal; different valuation principles may require different fiscal years. For example, the 4-4-5 calendar variant used often in the United States doesn’t correspond with the calendar year, which is used most often throughout the world.

- period Variant (posting period variant): The posting period variant in SAP determines which periods are open and closed for postings. This variant provides separate options to open and close periods for various types of accounts (general ledger, customer, vendor, assets, and so on). Here on the ledger level, you can specify a variant.

- Accounting Principle: The accounting principle assigned to the ledger.

- Parallel Accounting Using Additional G/L Accounts: This checkbox indicates that, for this ledger, parallel general ledger accounts will be used instead of different ledgers to portray parallel accounting principles. This option is rarely used, generally when one ledger needs to portray parallel accounting principles.

- Local Currency: In this field, you’ll specify the currency type of the local currency of the ledger. The local currency is the main currency of the company, is stored in each posting, and is maintained at the company code level. However, you can also have different local currencies for each ledger.

- Global Currency: In this field, you’ll specify the currency type of the global currency of the ledger. The global currency is the group currency of the company and is stored in parallel to the local currency for each posting.

- CO Object Currency (controlling object currency): In this field, you’ll specify the currency type of the controlling object currency of the ledger. This currency is used in the controlling objects master and may differ from the transaction currency.

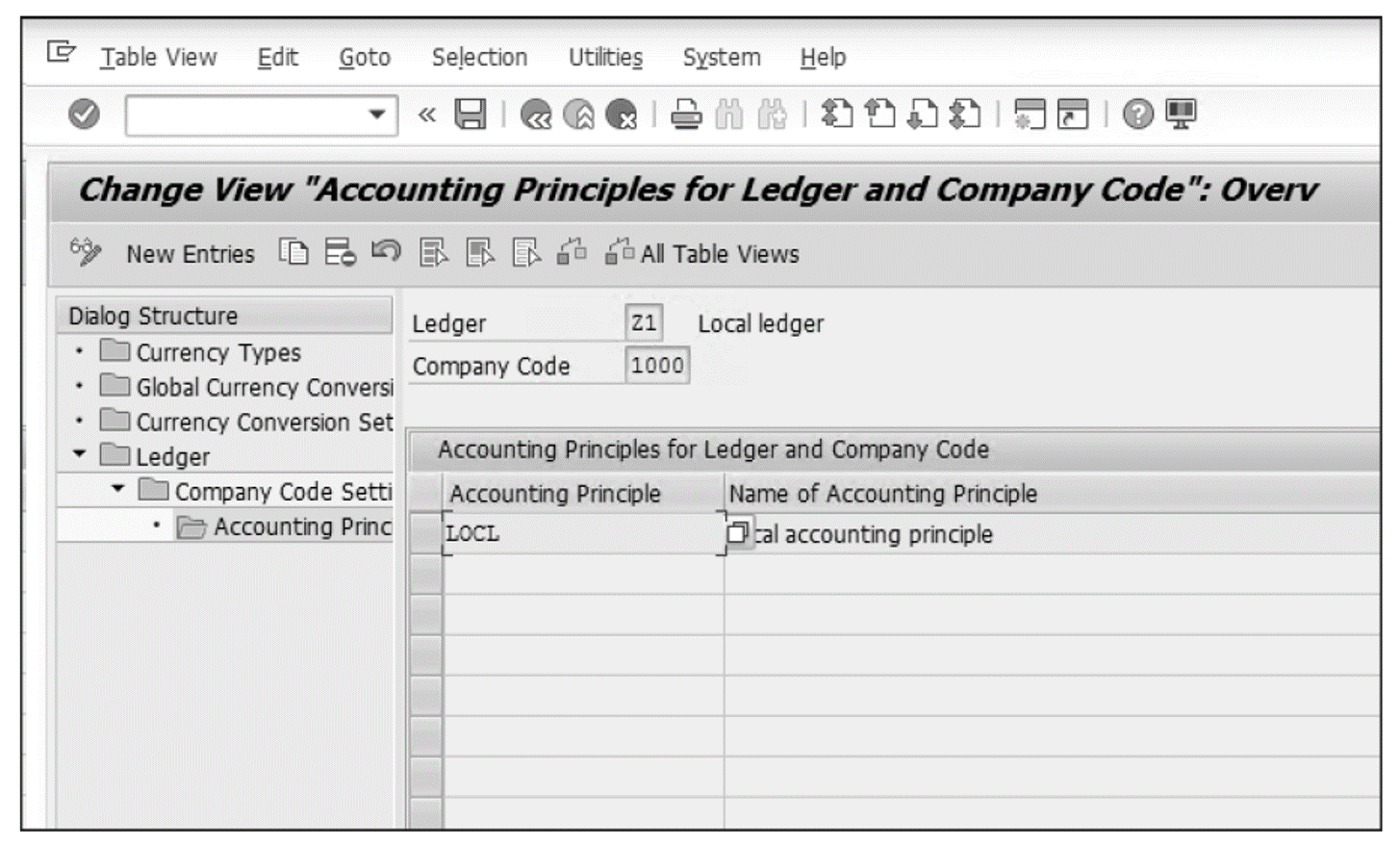

The next step is to define the accounting principles for the ledgers. The accounting principle is a new configuration object in SAP S/4HANA (the ACC_PRINCIPLE field). This object maps the ledger with the relevant accounting framework that it needs to portray. To view the accounting principle for the ledger, click the Accounting Principles for Ledger and Company Code activity on the left side of the same configuration screen.

As shown in the next figure, accounting principle LOCL, which represents local accounting standards, has been mapped to ledger Z1.

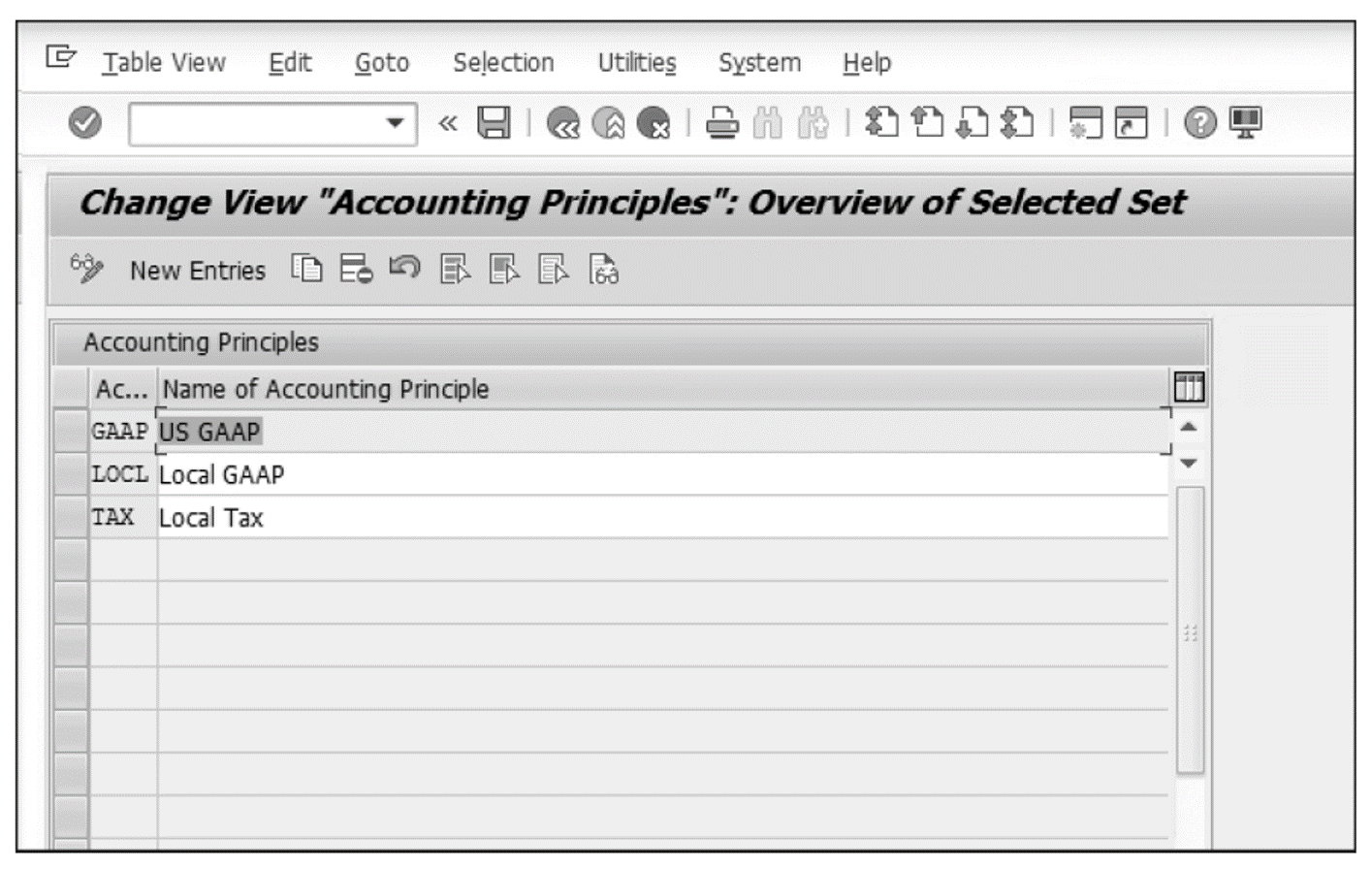

For the actual creation of accounting principles, follow the menu path Financial Accounting > Financial Accounting Global Settings > Ledgers > Parallel Accounting > Define Accounting Principles, where you can define accounting principles, as shown in the next figure.

In our example, we defined three accounting principles to portray US GAAP, local GAAP, and local tax rules.

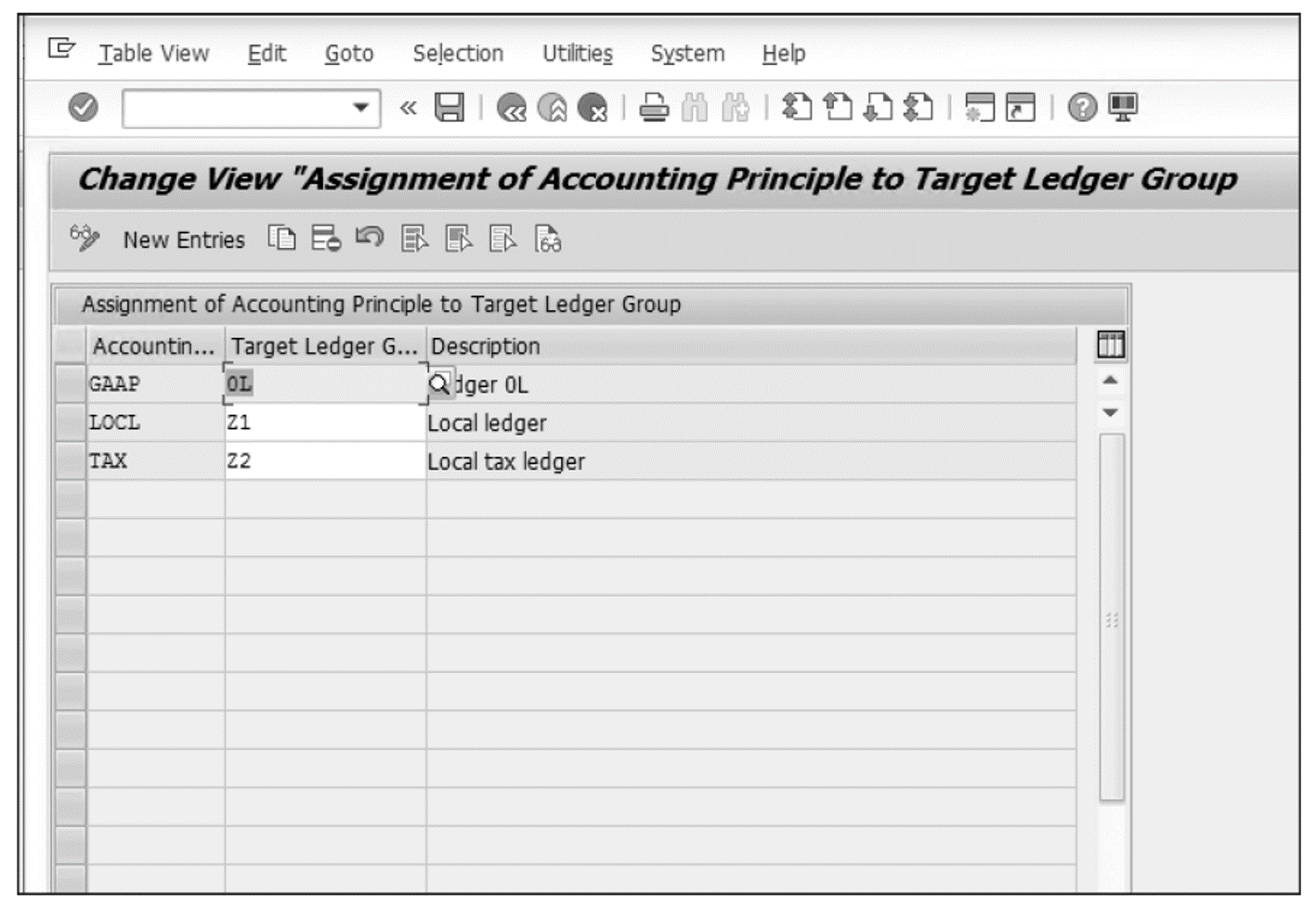

In the next step, you’ll assign these accounting principles to ledger groups. A ledger group normally contains one ledger (the system automatically creates a ledger group for each ledger you define), but you can have multiple ledgers in one ledger group. The assignment of accounting principles is at the ledger group level. Follow the menu path Financial Accounting > Financial Accounting Global Settings > Ledgers > Parallel Accounting > Assign Accounting Principle to Ledger Groups, where you can assign accounting principles to ledger groups, as shown in the final figure.

This step is where the link between the ledger and the accounting principle, shown earlier, comes from.

Editor’s note: This post has been adapted from a section of the book Configuring SAP S/4HANA Finance by Stoil Jotev. Stoil is an SAP S/4HANA FI/CO solution architect with more than 25 years of consulting, implementation, training, and project management experience. He is an accomplished digital transformation leader in finance. Stoil has delivered many complex SAP financial projects in the United States and Europe in various business sectors, such as manufacturing, pharmaceuticals, biotechnology, chemicals, medical devices, financial services, fast-moving consumer goods (FMCG), IT, public sector, automotive parts, commodity trading, and retail.

This post was originally published 11/2021 and updated 12/2024.

Comments