From a credit management point of view, important operations include releasing and rejecting blocked documents, credit review, and mass change of customer credit master records.

Let’s take a look at each.

Releasing Blocked Documents

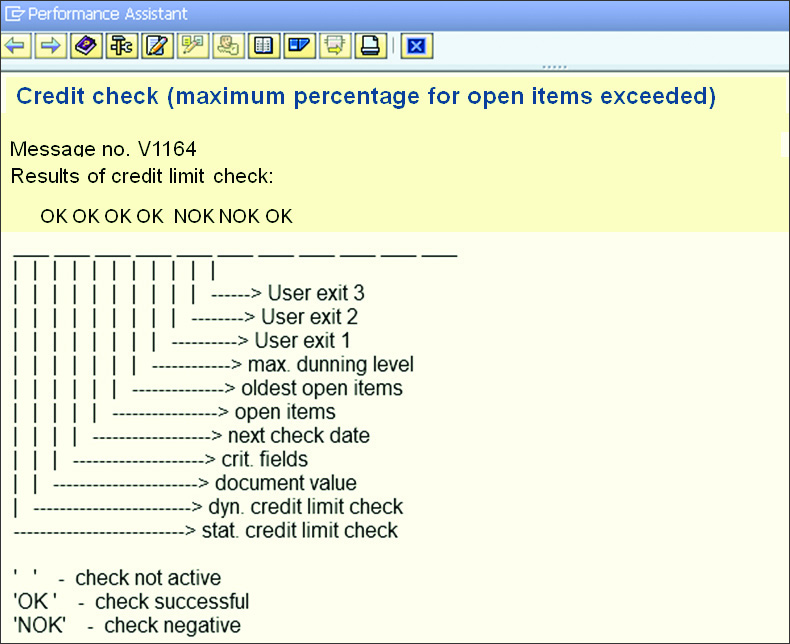

When a sales document is blocked, a warning or error message appears, such as Maximum Percentage Open Items Exceeded. If you click on the question mark, you’ll find the details of the credit checks performed on the document, the ones it cleared (OK), and the ones it failed to clear (NOK). As shown in the figure below, the document was subjected to neither a static credit limit check nor any check for user exit 1, 2, or 3.

It cleared (OK) the check for dynamic credit limit, document value, critical fields, next check date, and maximum dunning level. It failed (NOK) the check for open items and oldest open item. You could still save the document can and have it reviewed by the credit representative by using Transaction VKM1 or following the menu path SAP Easy Access > Logistics > Sales and Distribution > Credit Management > Exceptions > Blocked SD Documents. All of the important information required for making the decision to either release or reject the document is available here.

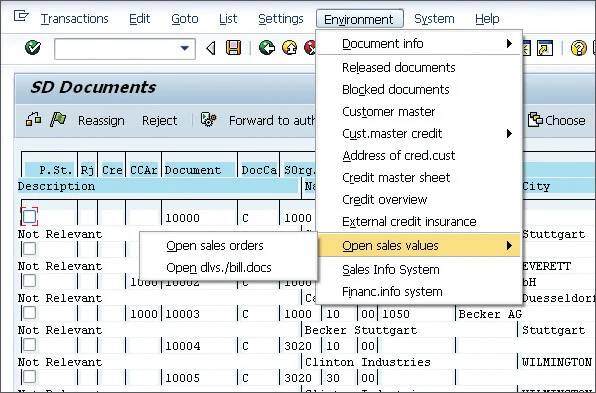

By selecting a document, you can access the customer master record using the menu path Environment > Customer Master, or customer credit master record using the menu path Environment > Cust. Master Credit of the sold-to party for that document. You can see the other open sales using the menu path Environment > Open Sales Values > Open Sales Order, and deliveries or billing documents by using the menu path Environment > Open Sales Values > Open dlvs/Bill Docs.

You can also generate the credit master sheet found using Transaction S_ALR_87012218 or following the menu path Environment > Credit Master Sheet; this is a particularly useful report to review the credit status of an individual customer. The report gives more information than Transaction FDK43, but with Transaction VKM3, you can review several customers at once. Based on all of the available information, the credit representative may decide to release the document by selecting the checkbox on P.St. column, as seen below, and then click on the green flag icon to accept, or the Reject button to reject.

Credit Review of Individual Customer

Individual customers are reviewed internally at regular intervals to increase or decrease their credit limits and change their risk categories in the credit master record (Transaction FD32). For a credit review, the credit master sheet report is normally sufficient for individual customers.

To review a large number of customers, you can use the credit overview Transaction F.31 or the menu path SAP Easy Access > Logistics > Sales and Distribution > Credit Management > Credit Management Info System > Overview. The following data is normally useful during credit reviews:

- Total sales

- Days of sales outstanding (DSO)

- Credit utilized

- Payment history

- Due days analysis

Credit Master Record Mass Change

Credit master data maintenance is the joint responsibility of the accounting and sales officials responsible for credit management. In some companies, master data maintenance is a separate function. When Next Review Date is used as a reason to block the orders in credit management, mass maintenance becomes important. It’s important to review customer credit ratings and update the customer credit master records before the expiration of the next review date.

The steps for a mass change of the customer credit master record Next Review Date field are as follows:

- Using Transaction F.34, you can change the Next Review Date field of any number of customers in no time. In the initial screen, select the customers based on the restriction on the following fields of the customer credit master record:

- Credit Account

- Credit Control Area

- Credit Representative Group

- Risk Category

- Last Internal Review

- Next Internal Review

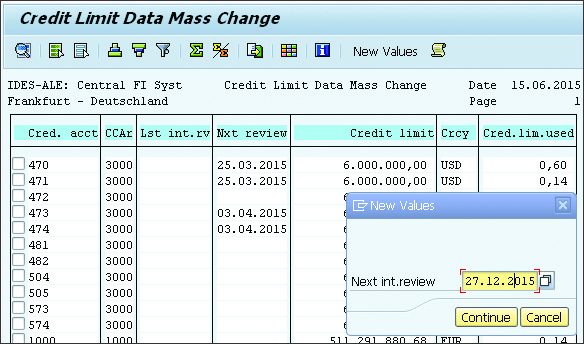

- After entering the required values in the input screen, execute the process to go to the screen shown in the figure below.

- Select all of the customers by pressing [F5] or clicking on the Select All icon.

- Click on the New Values button.

- Enter the new date for Next Internal Review in the pop-up window shown below, and click on Continue.

- You’ll get the message “New values are held and can be saved.” Click on the Save icon.

- For all successful changes, you’ll get the message “Control area data <credit control area> Changed,” and for failed changes the message will be “Account <customer credit account> is currently blocked by another user.”

Conclusion

In this blog post on SAP ERP Sales and Distribution, we explore some important credit management operations. One final note about mass changes of fields such as risk category (KNKK-CTLPC), customer credit group (KNKK-GRUPP), or individual limit (KNKA-KLIME), use Transaction MASS, object KNA1, and then table KNKK or KNKA. For mass changes of the Credit Limit (KNKK-KLIMK) field, you can use Transaction SE16N with the SAP edit (&SAP_EDIT) function.

Learn SD with SAP S/4HANA in Our Rheinwerk Course!

Dig into SD! Understand the organizational structure and master data in SAP S/4HANA. Learn to customize basic and cross-functional settings in SAP S/4HANA, and then focus on SD processes and their configuration: ATP, pricing, sales processing, shipping, and billing. Take a close look at SD simplifications and enhancements to get the most out of your system! Get access to course recordings by clicking the banner below.

Editor’s note: This post has been adapted from a section of the book Configuring Sales and Distribution in SAP ERP by Ricardo Lopez and Ashish Mohapatra.

Comments