Over the past half-decade, dozens of accounting laws have been passed in an attempt to provide more financial transparency among organizations, shareholders, and government.

Two such laws, IFRS 16 and ASC 842, deal with the reporting of lease contracts on documents such as the balance sheet.

For those that perform accounting with SAP, the SAP Flexible Real Estate Management solution is the tool that helps report on these leases. But since leases used to be reported off the balance sheet, it may be confusing to know just how much value to assign them.

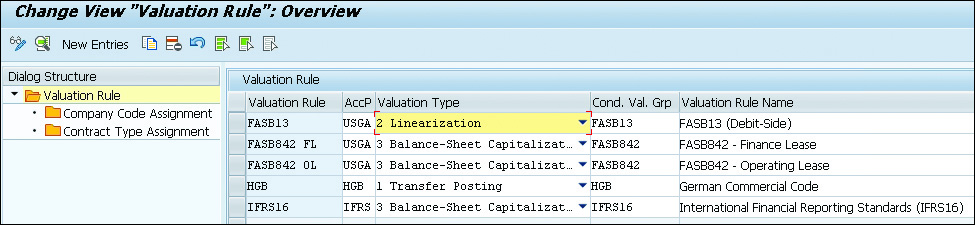

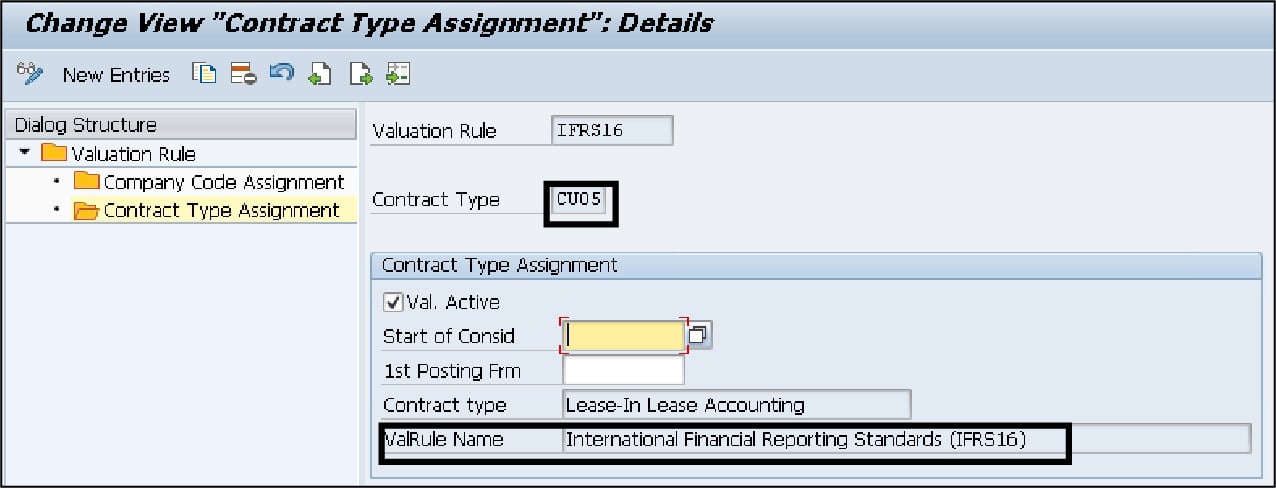

Accountants will be happy to know that there are already some guidelines in place. Valuation rules are defined according to the specifications outlined in accounting principles such as IFRS 16 and ASC 842—or sometimes in a local set of accounting rules. The valuation rule is then subsequently assigned to a company code and contract type.

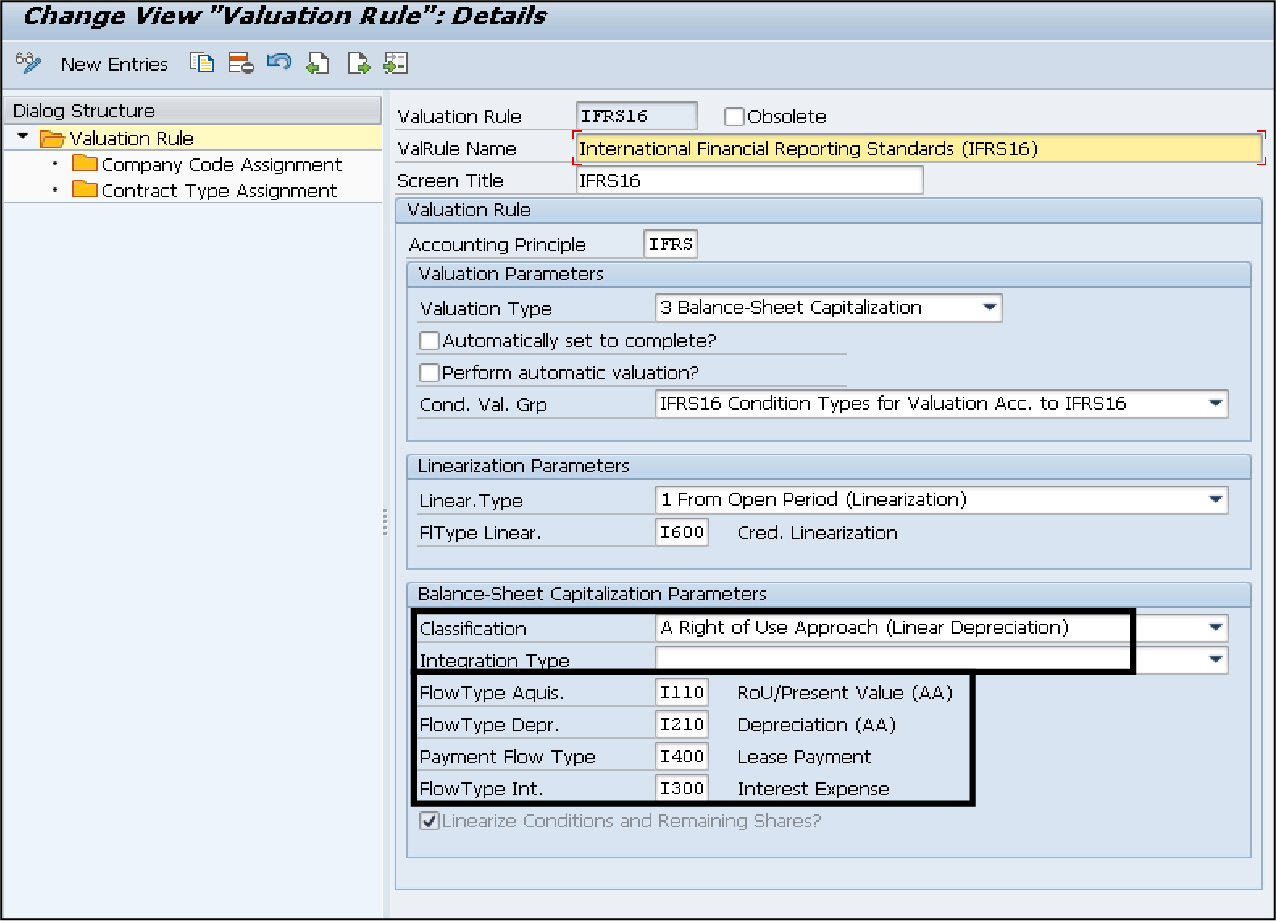

To configure valuation rules in SAP Flexible Real Estate Management, follow the IMG menu path: Flexible Real Estate Management (RE-FX) > Balance-Sheet Valuation of Contracts > Valuation Rule.

A valuation rule has an associated set of conditions combined in a condition valuation group.

A valuation rule must contain a valuation type. Select one of the following options from the dropdown menu in the Valuation Type column, as shown in the first figure:

- Transfer Posting: The associated conditions are transfer-posted to the account assignment object specified in the valuation rule (e.g., HGB).

- Linearization: The associated conditions are linearized over the contract term (e.g., FASB 13).

- Balance-Sheet Capitalization: Balance-sheet capitalization is carried out with creation of the ROU asset and lease liability (e.g., IFRS or US GAAP).

Transfer Posting

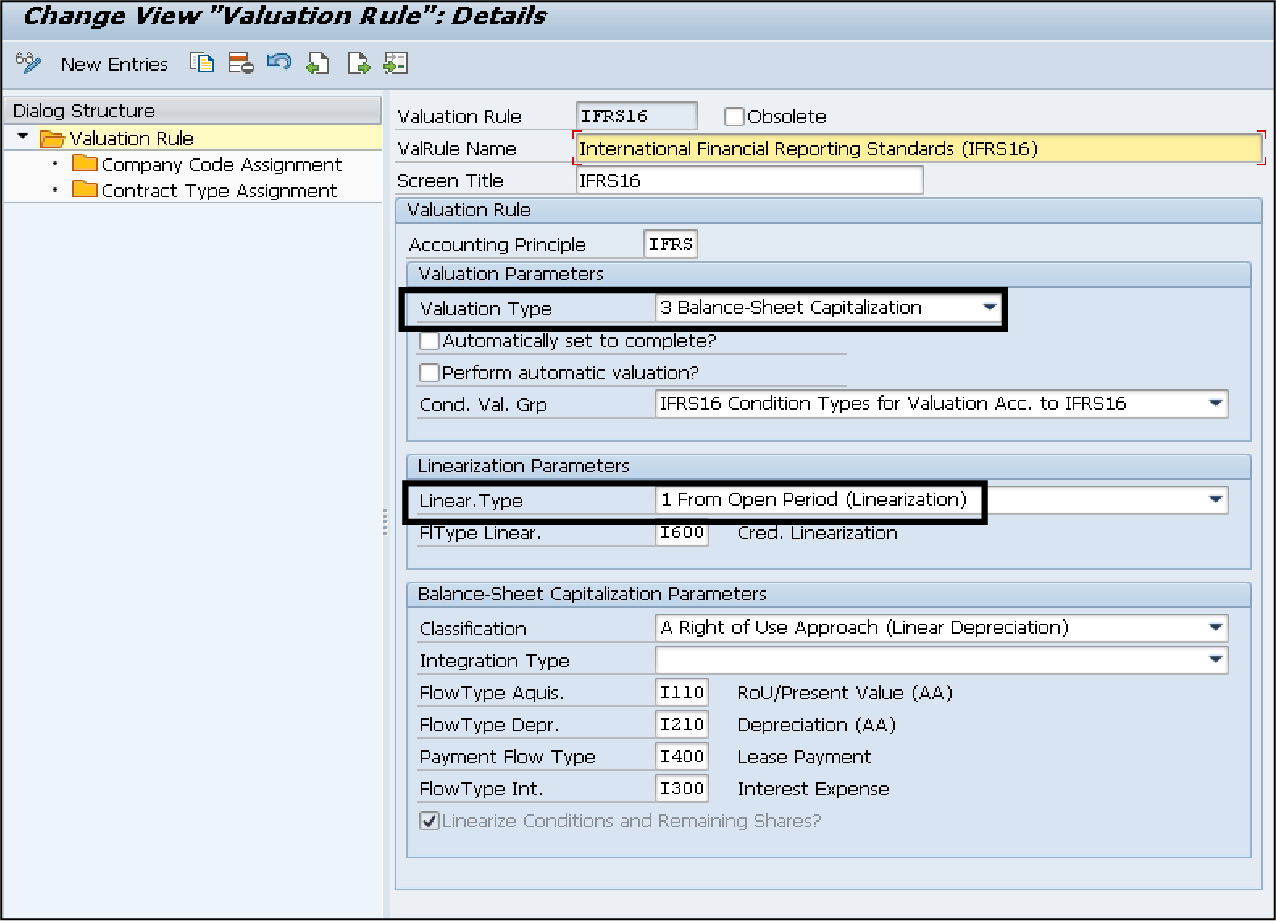

For linearization over time, select one of the following options in the Linearization Type dropdown menu, shown in the figure below:

- From Open Period (Linearization): The date of the first open period of the linearization cash flow is used as the new start date. As a rule, linearization is not changed retroactively. However, if a contract is terminated or conditions are changed so that all periods are already posted at the contract end date, the calculation determines the remaining value and posts this value as a one-time adjustment, if necessary, retroactively to the period of the contract end date.

- From Start: The original start date of the calculation is always used as the calculation start date. Any linearization rates posted are always corrected retroactively and distributed over the complete calculation interval.

- From Start of Analysis Period: The consideration start date (which could be a future date) is used as the new start date. Any retroactive changes to relevant conditions can also lead to retroactive corrections to the linearization.

- From Open Period (Payments): The first open period of the partner cash flow is used here.

Here’s what configuring linearization settings may look like for your business:

Classification

In the Balance-Sheet Capitalization Parameters area, you’ll have to specify a classification, which controls how the depreciation values are calculated, from one of the following options:

- <empty> = not relevant: Select this option of the valuation rule is not used to carry out a balance sheet capitalization. As a result, no acquisition, depreciation, interest, or payment schedules are created.

- A = Right of Use Approach (Linear Depreciation): Select this option if depreciation is linear.

- B = Straight-Line Lease (Linearized Commitment): Select this option if depreciation values should be calculated as the linearized commitment minus the interest.

- C = Finance Lease without Depreciation: Select this option if the finance lease amount is to be calculated without depreciation.

In this screen, you can also define whether to use Integration with Asset Accounting (default setting) or Direct Balance Sheet Postings. If you choose Integration with Asset Accounting, then a separate subledger asset is created for the ROU asset, and the periodic depreciation for this ROU asset is managed through FI-AA. If you choose Direct Balance Sheet Postings, then postings for the creation and the depreciation of the ROU asset are made directly on the designated general ledger account.

Finally, a number of flow types must be entered for the valuation rule, as shown at the bottom of the final figure. Flow types are used to control all automatically generated postings into the general ledger. Flow types are freely definable through a 4-character key; you’ll assign certain properties to a flow type to determine how the system will act during automatic postings:

- Flow Type Acquisition: This flow type is transferred to the cash flow for asset transactions (acquisitions and retirements) in FI-AA. The general ledger accounts used for postings are derived from this flow type. Note that reference flow types for delta changes must also be defined in the Customizing for these flow types.

- Flow Type Depreciation: This flow type is transferred to the cash flow for depreciation transactions (depreciation and write-up) in FI-AA. The general ledger accounts used for postings are derived from this flow type. Note that reference flow types for delta changes must also be defined in Customizing.

- Payment Flow Type: This flow type is transferred to the cash flow for payment flows on the lease liability. The general ledger accounts to be used for postings are derived from this flow type. Note that reference flow types for delta changes must also be defined in Customizing.

- Flow Type Interest: This flow type is transferred to the cash flow for interest transactions on the lease liability. The accounts to be used for postings are derived from this flow type. Note that reference flow types must also be defined for delta changes in Customizing.

Valuation rules are just one aspect of configuring the valuation-specific enhancements found in SAP Flexible Real Estate Management. We hope that this blog post was able to clear up some questions about crating and assigning these rules, and we encourage you to continue the learning!

Learn Contract and Lease Management in Our Upcoming Rheinwerk Course!

Learn to manage the full lease lifecycle with SAP S/4HANA! Ensure compliance with IFRS 16 and ASC 842 with from contract creation through reporting. Explore migration, configuration, and extensibility for efficient lease management from end to end. Click on the banner below to learn more and order your ticket.

Editor’s note: This post has been adapted from a section of the book Lease Accounting with SAP: IFRS 16 and ASC 842: SAP RE-FX and SAP Lease Administration by Nakisa by Hanno Hofmann, Pamela Lim, Joy Mabborang, and Louis Teunissen.

Comments