Every payroll system needs earnings and deductions to calculate pay for an employee, and these elements are the foundation of everything in payroll.

Earnings are wages earned or provided by the company (salary or bonus) to the employee, and deductions are the income or wages withheld from the employee (taxes or benefits). In this post, we’ll delve into wage types in SAP SuccessFactors Employee Central and how to configure them to meet your requirements. We’ll start with an introduction of the key concepts behind and categories of wage types, but we’ll also cover certain attributes of wage types, including processing classes and cumulations.

Wage Concepts

For a better understanding of wage types, let’s briefly discuss a few basic concepts, as follows:

- Model wage types: SAP-delivered wage types that can be used to copy and create a new wage type. You should never use a standard, predelivered wage type for customer use.

- Earnings: Wages earned or provided by the company for labor or services provided.

- Post-tax deductions: Amount withheld from earnings for purposes of benefits, garnishments, and other purposes after taxes are taken.

- Pre-tax deductions: Amount withheld from earnings for purposes of benefits, and other purposes before taxes are taken. For example, 401k deductions are pre-tax deductions.

- Taxes: A withholding of an amount of money from the employee for the purpose of paying taxes to a tax authority. Could also be employer-paid taxes.

- Net pay: The amount of earnings remaining after all deductions have been taken.

- Permissibility: Controlling access of a wage type by employee type. For example, you may not want an hourly employee to access some benefit plans.

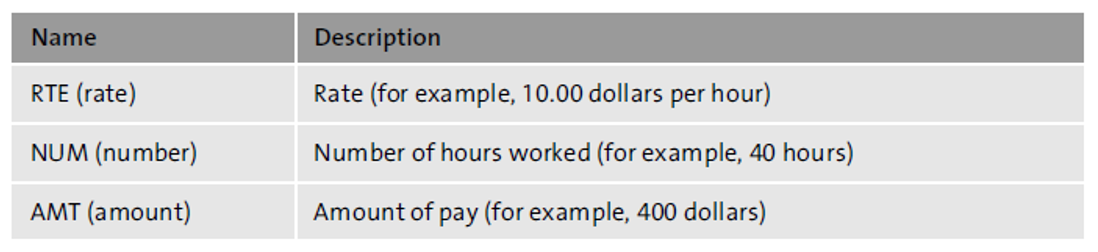

The three elements of a wage type, listed below, work together.

Categories of Wage Types

Two categories of wage types exist: primary and secondary/technical. Primary wage types are further broken into the following two groups:

Dialog wage types are typically used by infotypes to enter data, for example, hourly rates or benefit deductions. These amounts can be earnings or deductions.

Time wage types are created when a time evaluation is run. These wage types are not maintained using infotypes, but in special tables.

Secondary wage types are system generated and not maintained using infotypes. Instead, these wage types are created during the payroll run.

Technical wage types are delivered by SAP and start with a forward slash (/). Examples include total gross wages (/101) or net pay (/559). Most of these wage types are delivered as standard, but you can also create your own technical wage types, for example, a wage type for total hours worked.

Attributes of Wage Types

To create new wage types, you’ll copy model wage types or existing wage types. Then, you’ll want to validate/update the attributes of the wage type to meet your business requirements. In this step, you’ll set the following parameters:

- Deduction wage type: Select this indicator to specify whether this wage type should be considered a deduction or an earning.

- Amount or number: Specifies if this wage type stores a dollar amount or a number.

- Minimum or maximum values allowed: If needed, you can specify the minimum and maximum allowed values for a wage type.

- Indirect valuation allowed: If applicable, this setting would allow values for this wage type to be calculated dynamically.

- Priority: Define the order in which deductions are taken.

- Arrears: This setting is responsible for determining how payroll will be processed if deductions exceed the net pay.

The Lifecycle

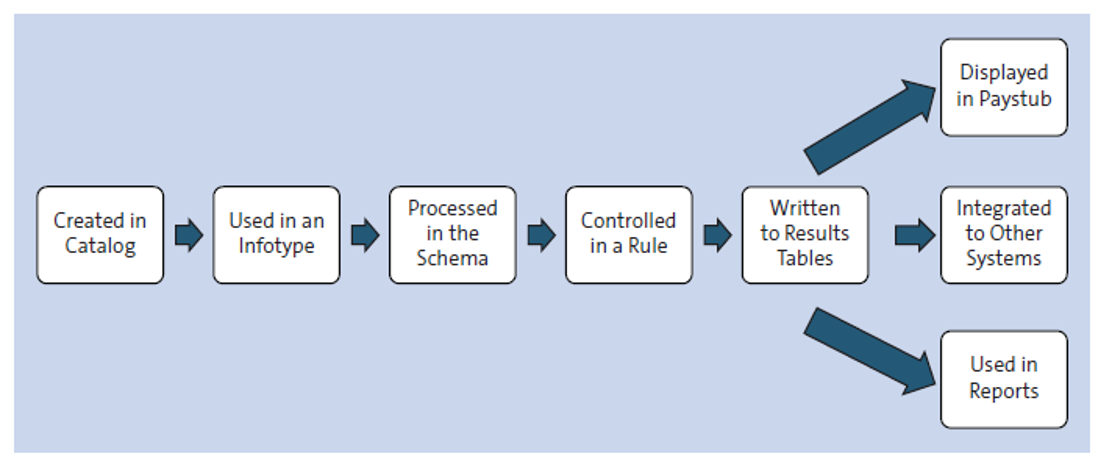

The figure below shows the end-to-end process of a dialog wage type from wage type creation to after payroll. This diagram will help structure our discussion of wage types and how they are used in payroll.

This lifecycle starts with the documentation of requirements, the copying of a wage type, and either standard processing or updating a schema or rule (for special processing). The result of the payroll processing is a wage type written to the payroll results table, which can then be used on paystubs and reports or sent to third-party systems or vendors.

Processing Classes

Processing classes determine how wage types will be processed during a payroll run. SAP has provided processing classes 1 through 89, which can be set for each wage type, but custom processing classes can be created between processing classes 90 and 99.

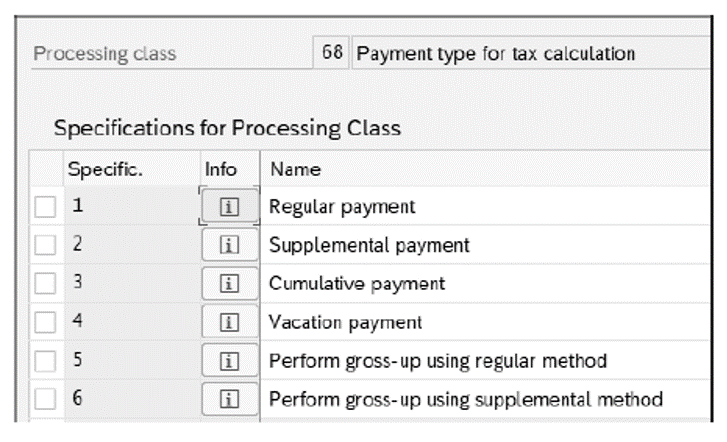

Each processing class has a set of specifications that define how a wage type should be handled. The next figure shows processing class 68 (Payment Type for Tax Calculation), which determines how an earning should be handled in tax processing—regular payment, supplemental, etc. By setting this processing class for all earnings, the payroll processor can tax that earning appropriately.

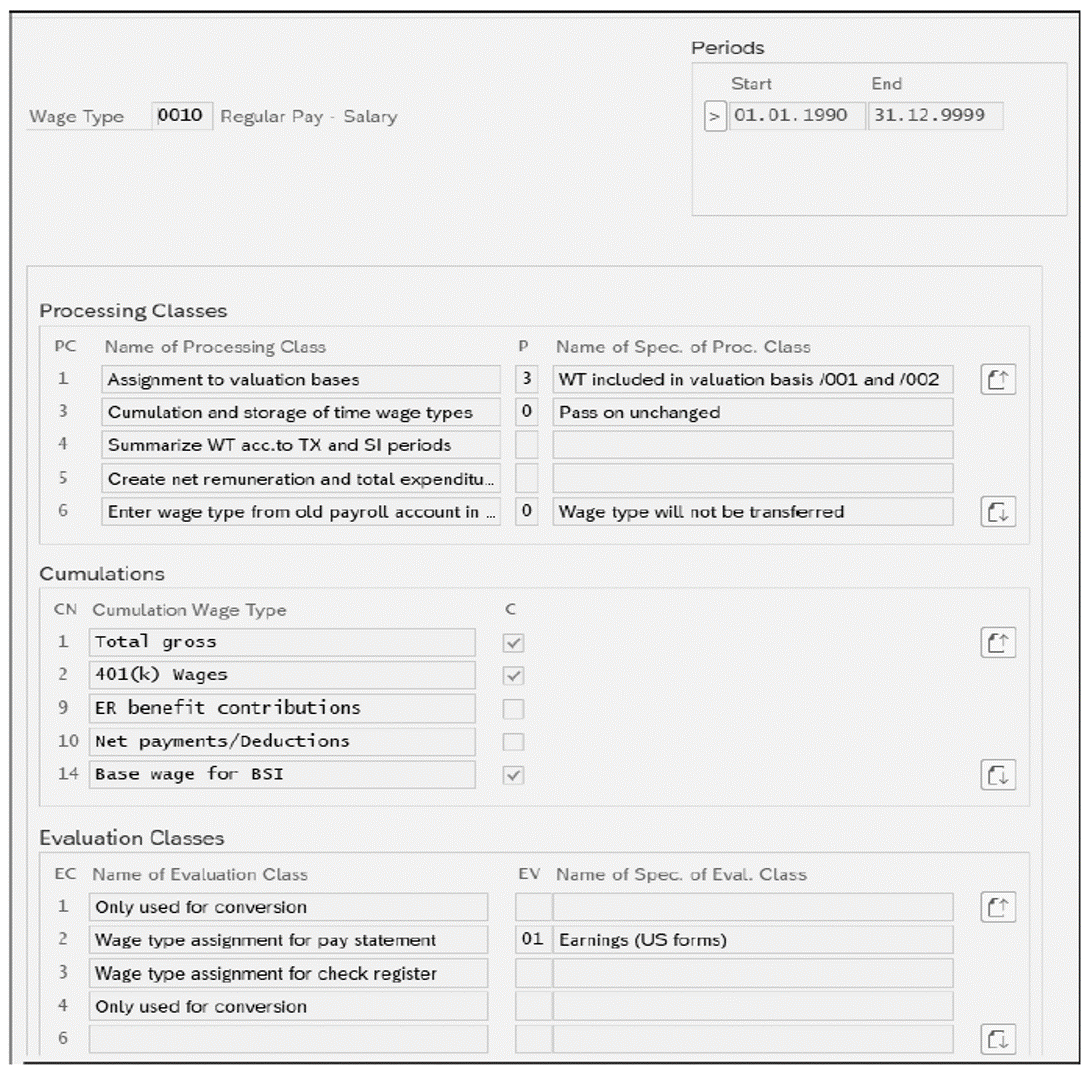

A good way to view all the processing classes set for a wage type is Transaction SE16 and view V_512W_D, as shown in the next figure. Using this report, you can also view the appropriate cumulations and evaluation classes.

In some situations, you may need to create a custom processing class and will need to create one within the range from 90 to 99.

To create a custom processing class, follow the menu path Payroll > Payroll: USA > Basic Settings > Environment for Maintaining Wage Types > Processing Classes and Evaluation Classes > Maintain processing classes and their specifications.

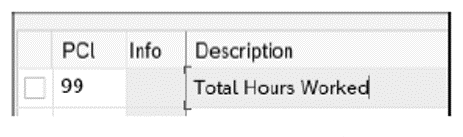

After you select New Entries, define the number and description for your processing class. Then, click Save. In our example shown below, we’ve created processing class 99 for total hours worked.

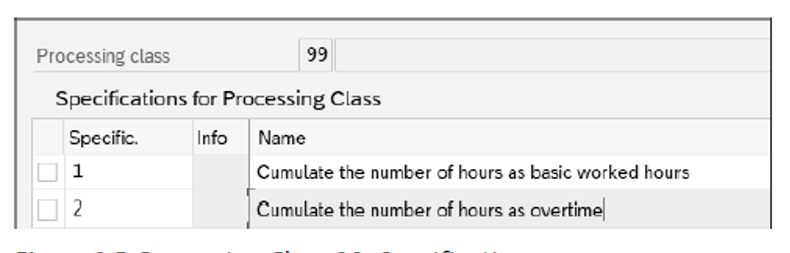

Select your processing class specifications and processing class and then select New Entries. You can now define the specifications needed for the new processing class. In our example shown in the next figure, our new processing class has two specifications: 1 for the number of hours as basic worked hours and 2 for the number of hours worked overtime.

Wage types that make up the total hours worked can now use this processing class.

Cumulations

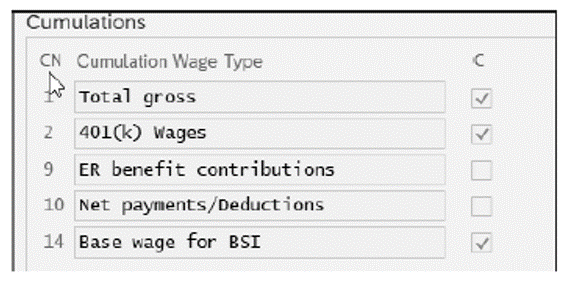

SAP provides the cumulation functionality to sum up several wage types into another wage type. Cumulation wage types are technical wage types and start with a /1. The next figure shows the cumulation for an earning wage type that should be included in the total gross (/101), 401k wages (/102), and base wage for Business Software Incorporated (BSI) wage types (/114).

A common wage type is /101 for total gross wages. All wage types that should be added to a total gross wage should check for processing class 1. When payroll is processed, /101 is created as a summation of all wage types with this check and can be used for other calculations in schemas or rules or by reports or interfaces.

Creating a New Wage Type

Creating wage types is a task you’ll need to perform for every project and then as the business changes. Previously, we discussed several different aspects of a wage type—now let’s create a wage type.

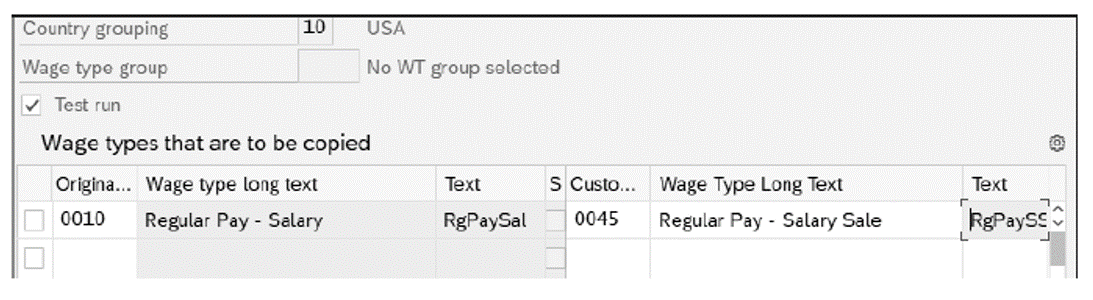

As mentioned earlier, you should never use a standard-delivered wage type, nor should you create one from scratch. Instead, copy either a model wage type or another existing wage type, which copies all its attributes. Update this copy as needed by following menu path Payroll > Payroll: USA > Basic Settings > Environment for Maintaining Wage Types > Create Wage Type Catalog > Copy.

As shown in the next figure, for example, we’re using wage type 0010 (Regular Pay - Salary) to copy to a new wage type (0045), and this new wage type will be used for a different group.

2

If needed, you can update attributes, processing classes, and permissibility, as needed, but ideally, you should find the closest wage type to what you want to create so only a few updates are required.

Documentation and Numbering

As mentioned earlier, wage types are critical in payroll calculations and require detailed design and documentation to maintain consistency and integrity. Most companies end up with hundreds, even thousands, of custom wage types to meet specific business requirements. Thus, defining and developing great documentation are crucial to the success of the implementation and ongoing maintenance of your Employee Central Payroll system.

The first step in this goal is defining good number ranges. While smart numbering for codes (i.e., having meaningful numbering) is not always recommended, having defined ranges increases clarity. Before you start creating/configuring wage types, you should define your wage type number ranges.

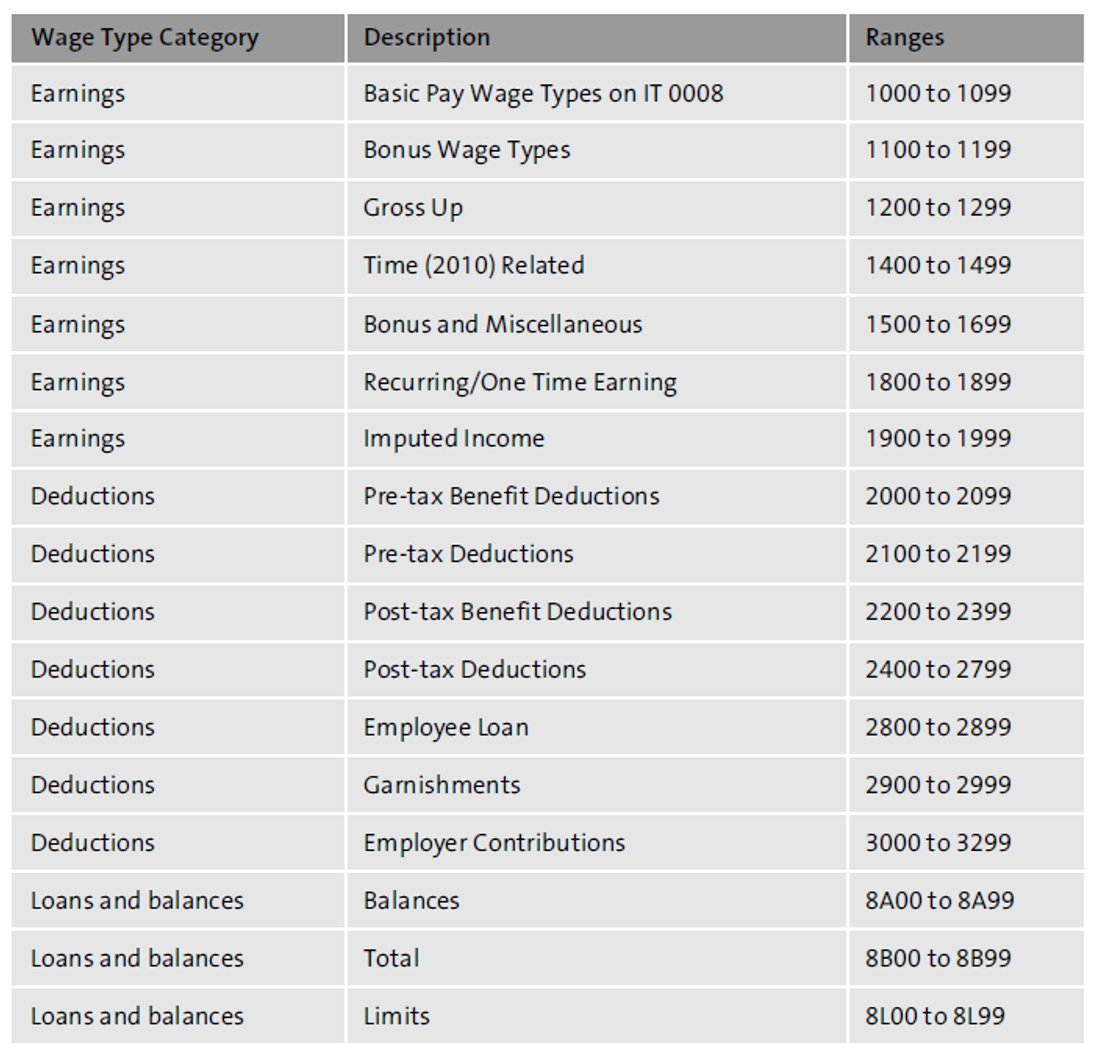

Standard ranges that are used include the following:

- 1*** for earnings

- 2*** for employee deductions

- 3*** for employer contributions

- 8*** for loans and balances

- 9*** for system generated or internal wage types

This table shows an example of how you can define number ranges for wage types.

Another key form of documentation is the wage type catalog. This documentation provides a clear view of the wage types that have been created, where and how they are used, and how they are built. A good catalog includes the following attributes:

- Wage type number, short text, and long text

- Attributes (processing class, evaluation class, cumulation, priority, arrears, deduction flag, min/max, amount/number)

- Date of last update

- Infotype permissibility

Tax wage types are defined by SAP and delivered with a specific structure and format, /XYY, as follows:

- /X describes what type of tax wage type. Following are some of the most common ones:

- /3XX stands for taxable gross (TG) and represents all wages eligible for that tax type and authority.

- /6XX stands for taxable base (TB) and represents TG minus all pretax deductions.

- /7XX stands for reportable earnings (RD) and represents TB with limits applied.

- /4XX stands for tax (TX) and represents the actual tax.

- /QXX stands for taxable but not taxed (TNTD) and represents wages eligible for taxation but not actually taxed.

- YY describes the tax, for example, in the following format:

- 01 for withholding

- 02 for EE (employee) Social Security

- 04 for ER (employer) Social Security

- 10 for unemployment

Editor’s note: This post has been adapted from a section of the book SAP SuccessFactors Employee Central Payroll by Deepankar Maitra and Stacy Wilkins.

Comments