The depreciation run is a periodic processing program in asset accounting that posts planned depreciation to all relevant assets. Most companies execute the depreciation run every month, although you could run this program on a quarterly or yearly basis.

To execute a depreciation run with SAP S/4HANA Finance, follow the application menu path Accounting > Financial Accounting > Fixed Assets > Periodic Processing > Depreciation Run > AFAB - Execute. Alternatively, you can enter Transaction AFAB directly.

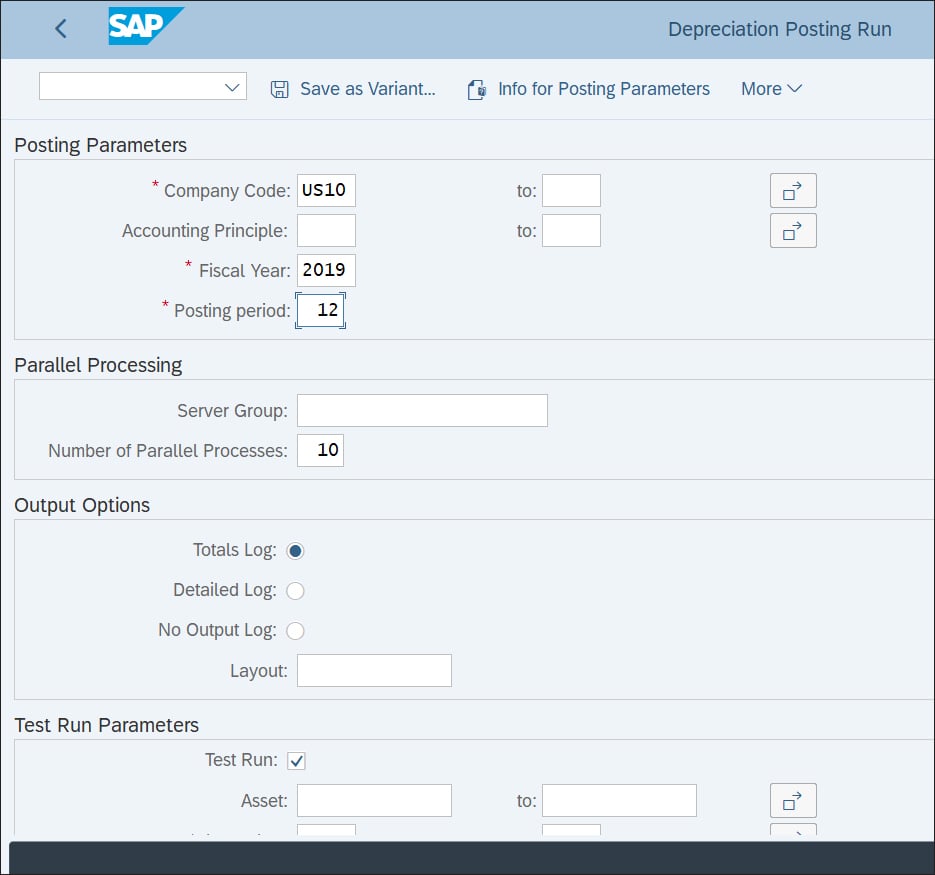

On the selection screen shown in the figure below, enter the company code, fiscal year, and posting period for which to run the depreciation. You can optionally specify an accounting principle if you want to limit the run to one or more specific accounting principles.

You can choose the Totals Log radio button if you want to see only the depreciation totals or choose the Detailed Log radio button to see the depreciation for each asset.

For our example, select the Detailed Log radio button and select the Test Run checkbox, so you can see the results and possible errors before actually executing the run. Proceed by clicking the Execute button.

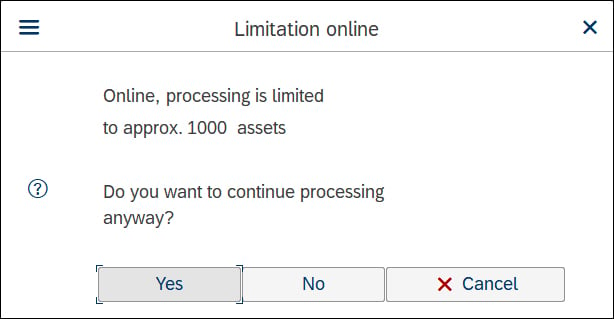

The system issues the message shown below, which notifies you that, in online mode, you can process only up to 1,000 assets. This limitation is in place because the depreciation program consumes a great deal of resources, so if you have more than 1,000 assets, even in test mode, you should run the program in background mode.

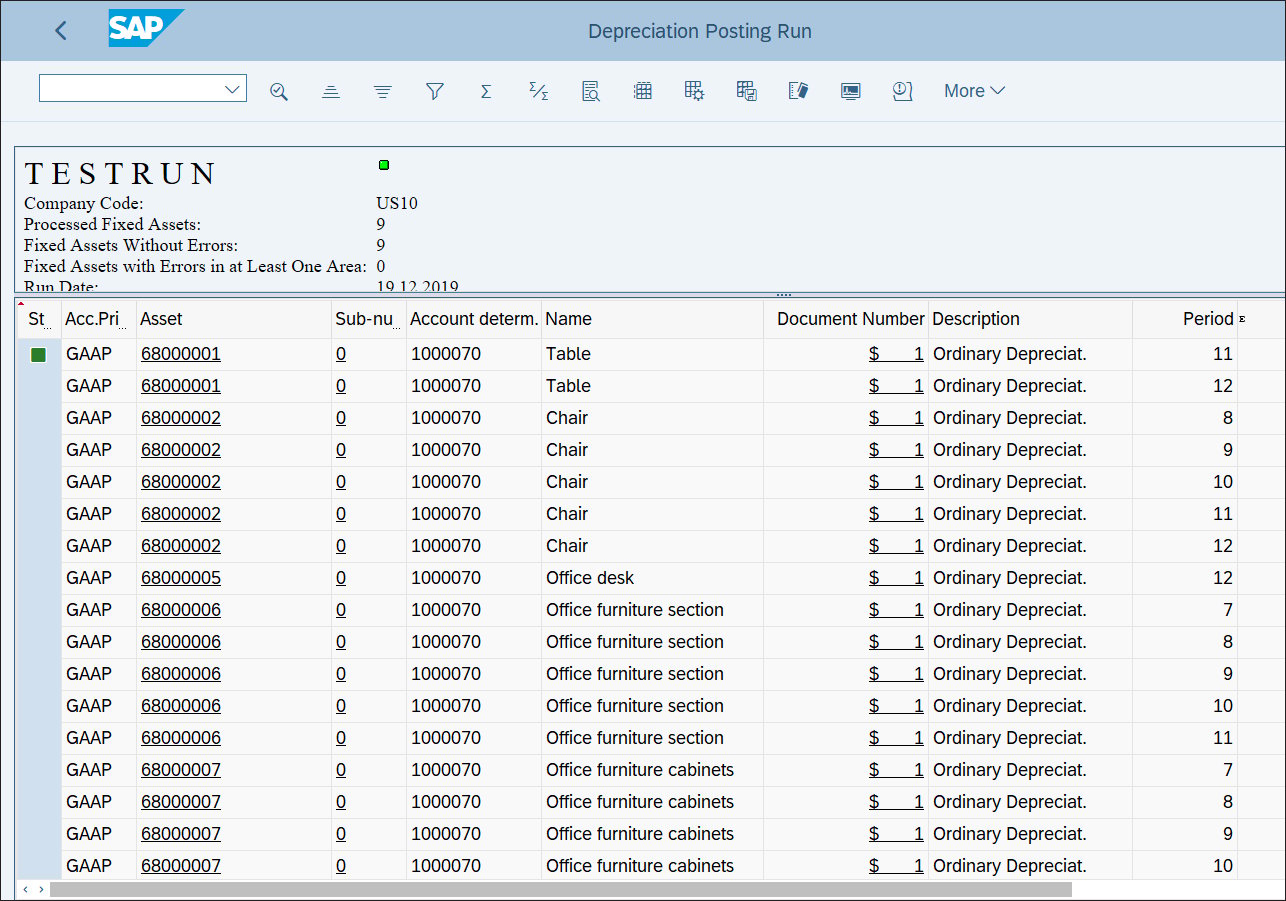

Proceed by clicking the Yes button. On the next screen, shown below, you’ll see the proposed depreciation amounts for each asset.

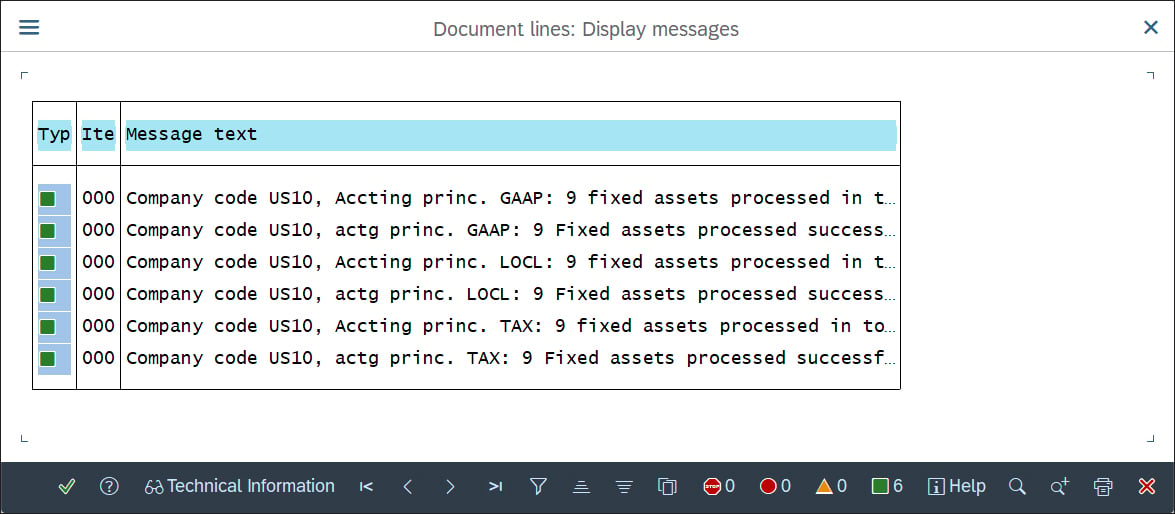

Click on the button in the top menu to access the message log, as shown below. If any errors arose during the depreciation run, you’ll see text in red.

If you’re satisfied with the depreciation test results, go back, deselect the Test Run checkbox, and execute the program in real mode. The program must run in the background. Start by following the top menu path More > Program > Execute in Background.

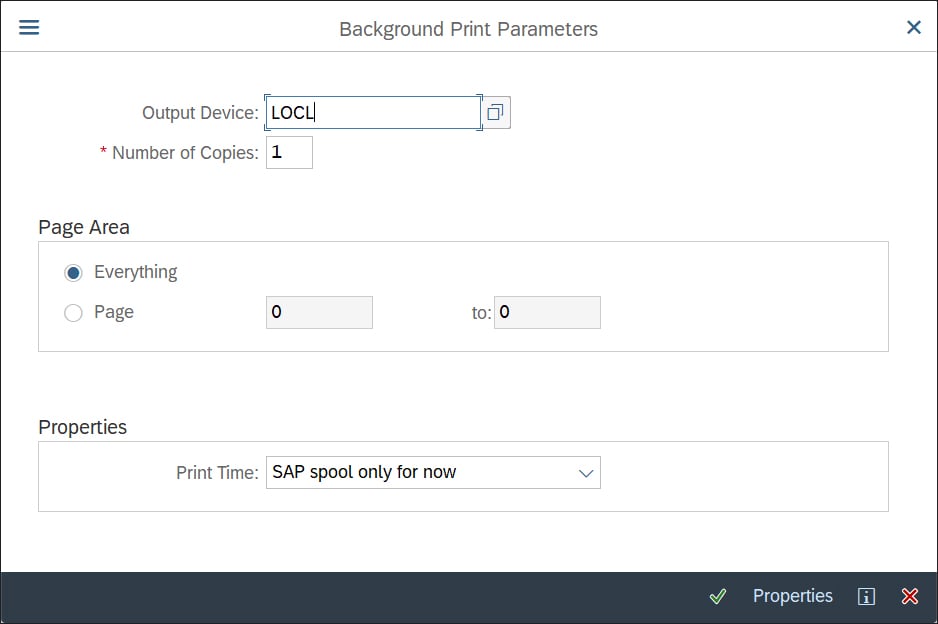

Then, the system will prompt you to specify background print parameters, as shown here:

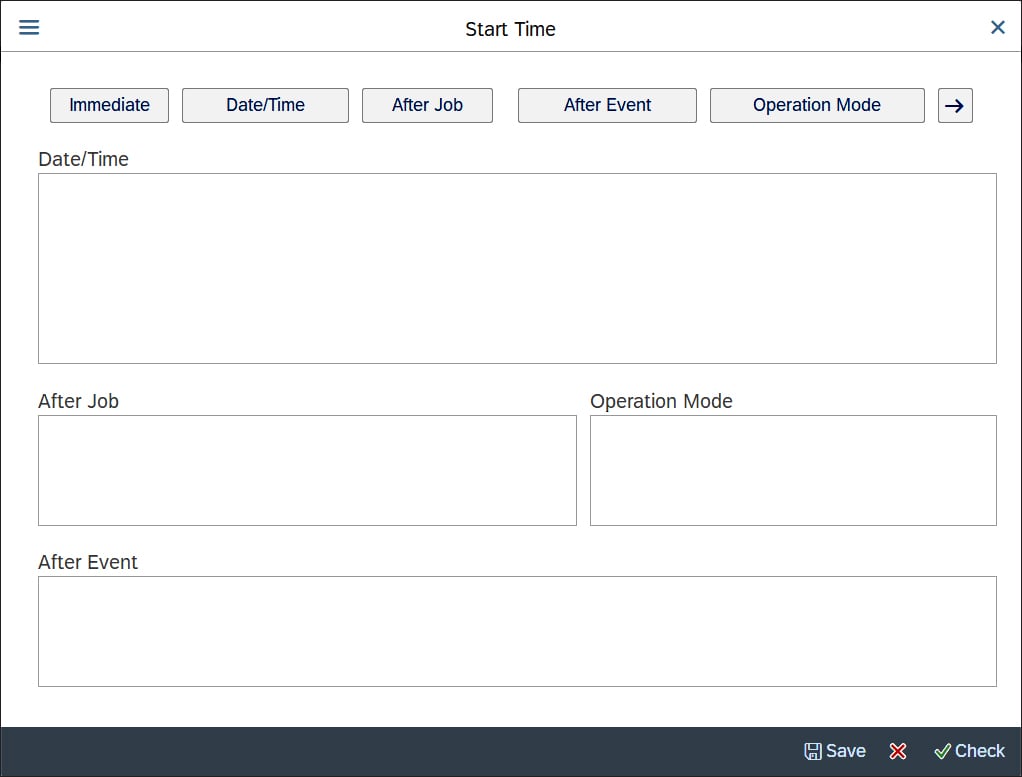

You can specify the printer on which depreciation results should be printed in the Output Device field. Continue by pressing (Enter). Then, you’ll see the screen shown below, where you must specify the start time for executing the program in the background.

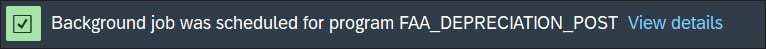

You can enter specific time and date with the Date/Time button, schedule the run after another job or event, or execute the run immediately with the Immediate button. Save your settings by clicking the Save button. On the bottom of the screen, you’ll see the information message shown in the figure below. This message lets you know that program FAA_DEPRECIATION_POST, which is the depreciation run program, has been scheduled.

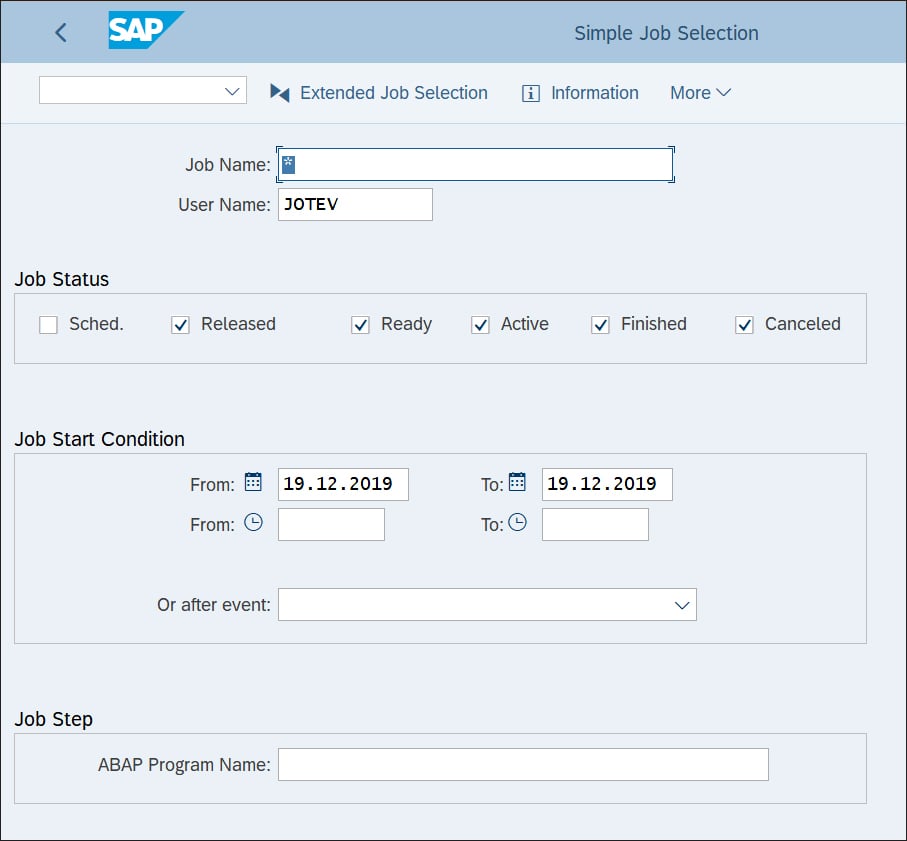

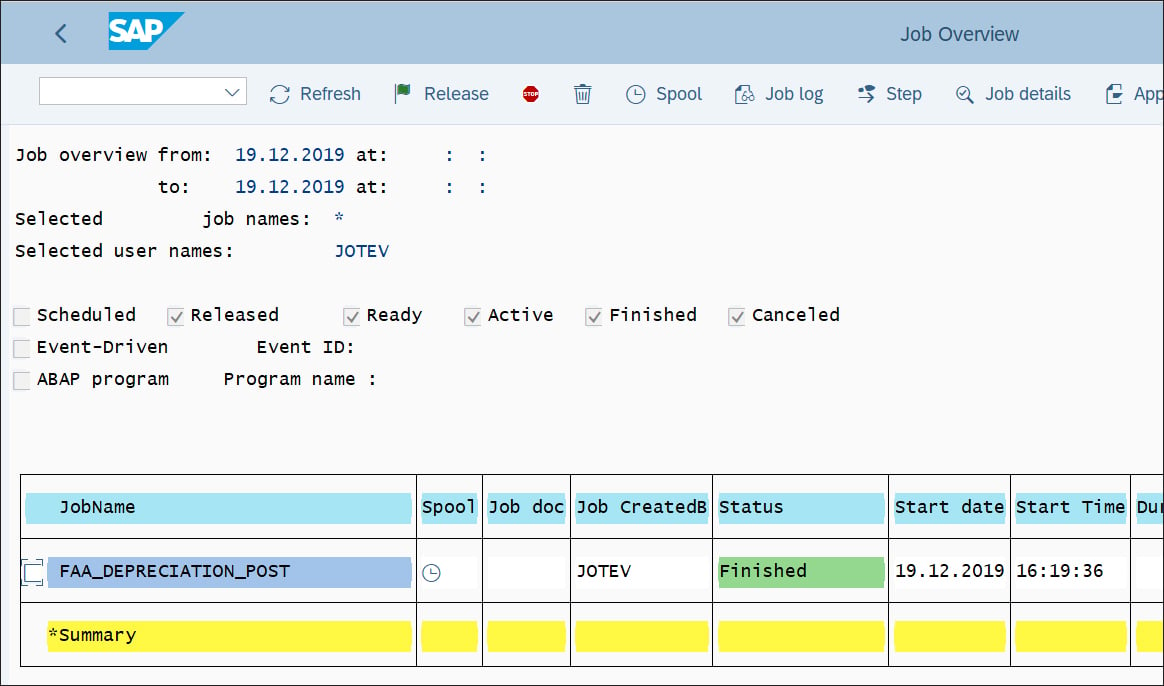

You can also check the status of the background execution with Transaction SM37. In this transaction, you can select the background job scheduled by user name and date, as shown here:

Proceed by clicking the Execute button. You’ll see the job name and its status, as shown in the next figure. Once the job has finished, the status will change to Finished and be displayed in green.

Note that most companies schedule their depreciation runs in the background and to run on specific dates based on the month-end schedule, rather than manually executing Transaction AFBP at the end of each month. Then, you could monitor the job status, as shown in the figure above, to analyze errors.

Learn Asset Accounting in Our Rheinwerk Course!

Take ownership over asset accounting! Blending detailed business processes with high-level configuration, this four-day course walks through the full lifecycle of asset accounting, from acquisition and transfer to capitalization and retirement. Get access to course recordings by clicking the banner below.

Editor’s note: This post has been adapted from a section of the book Asset Accounting with SAP S/4HANA by Stoil Jotev. Stoil is an SAP S/4HANA FI/CO solution architect with more than 25 years of consulting, implementation, training, and project management experience. He is an accomplished digital transformation leader in finance. Stoil has delivered many complex SAP financial projects in the United States and Europe in various business sectors, such as manufacturing, pharmaceuticals, biotechnology, chemicals, medical devices, financial services, fast-moving consumer goods (FMCG), IT, public sector, automotive parts, commodity trading, and retail.

This post was originally published 9/2020.

Comments