You use depreciation areas to calculate the value of fixed assets according to different accounting principles or for other separate valuation purposes.

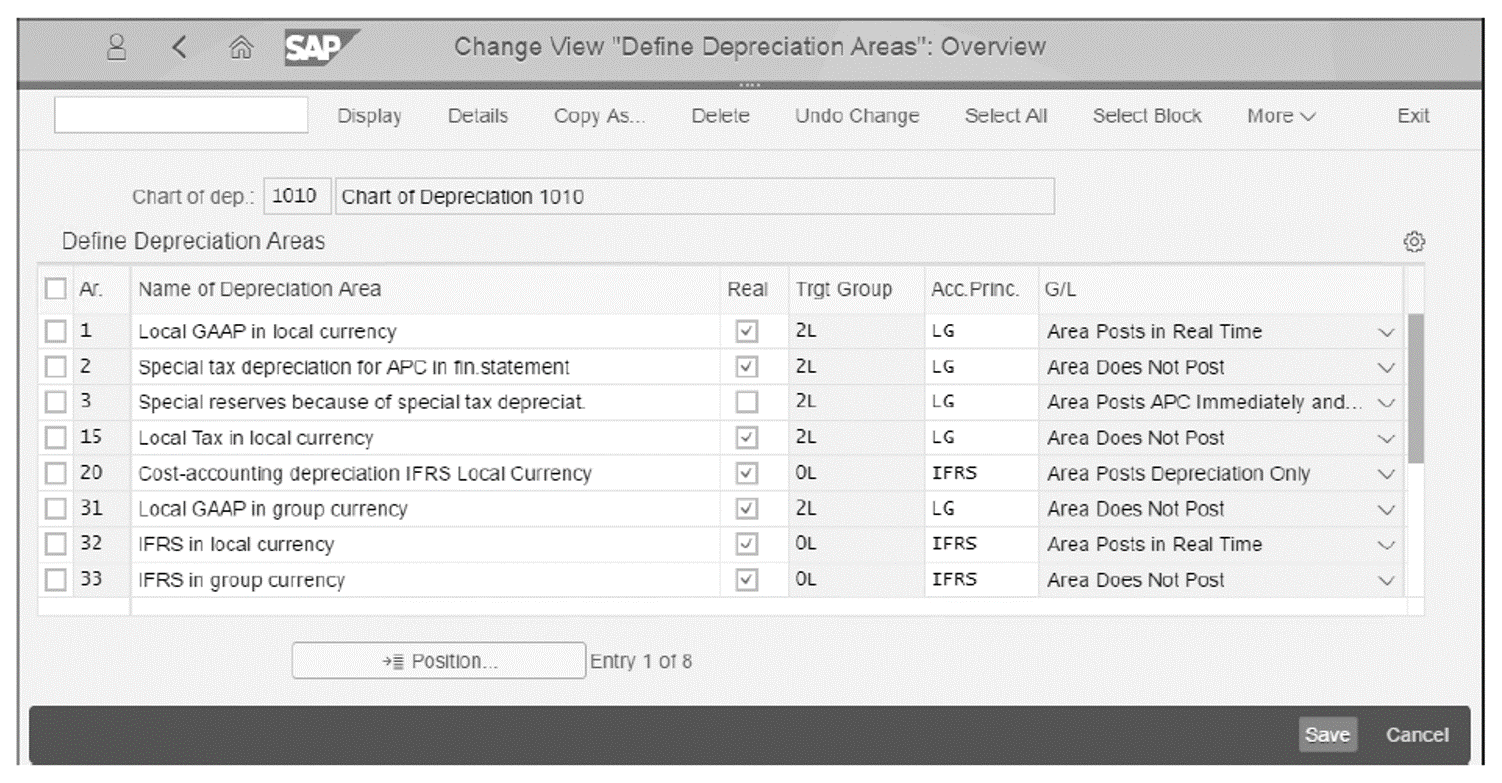

You manage the depreciation terms and values necessary for the valuation in the depreciation areas assigned to each asset, as shown in the figure below. A depreciation area can serve to update the general ledger through posting in accounting or to calculate statistical values for reporting purposes. A chart of depreciation can have up to 99 depreciation areas.

In an SAP S/4HANA Finance system, you create a depreciation area for each additional currency type maintained on the ledger/company code level so that values are available in all relevant currencies.

The depreciation areas are identified by two-digit numeric keys. You should assign a meaningful description to the area. Each depreciation area must be assigned to an accounting principle and—through the accounting principle—to a ledger group.

Configuring Depreciation Areas

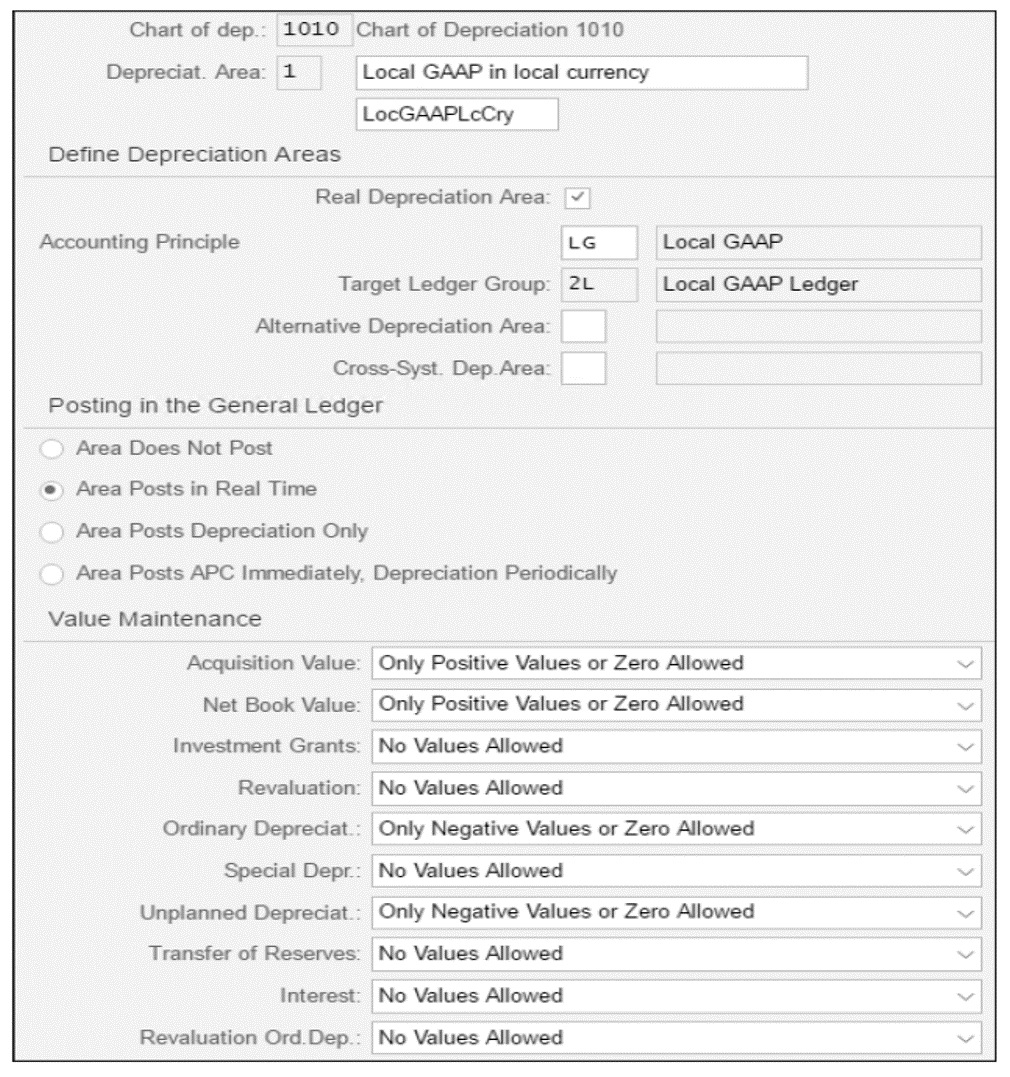

For each depreciation area, you can access the details screen to configure the settings further, as shown in the next figure.

Here are the main settings.

Real Depreciation Area

For a real depreciation area, values are normally committed to the database. When you don’t select this checkbox, the depreciation area is a derived area, meaning its values are based on values of other areas.

Area Does Not Post

This is for areas you create purely for reporting purposes, such as areas for other currencies.

Area Posts in Real Time

When using the ledger approach to parallel valuation, this is the standard setting for depreciation areas that post both acquisition and production costs (APC) and depreciation to the general ledger. With the accounts approach to parallel valuation, only one area has the real-time setting (for technical reasons only).

Area Posts Depreciation Only

This is for areas that don’t post APC values but only post depreciation. The most common such area is one that is used for cost-controlling valuations.

Area Posts APC Immediately, Depreciation Periodically

This is used when using the accounts approach for all areas that post both types of values to the general ledger, minus the one that is set to post in real time.

Value Maintenance

This area contains various rules that define what kind of values are allowed for various valuations.

Tip: Depreciation is always posted periodically; there is no such thing as real-time depreciation posting because it’s a periodic activity. On the other hand, the calculation of depreciation is always a real-time activity and is performed with any change that affects the value or useful life of an asset.

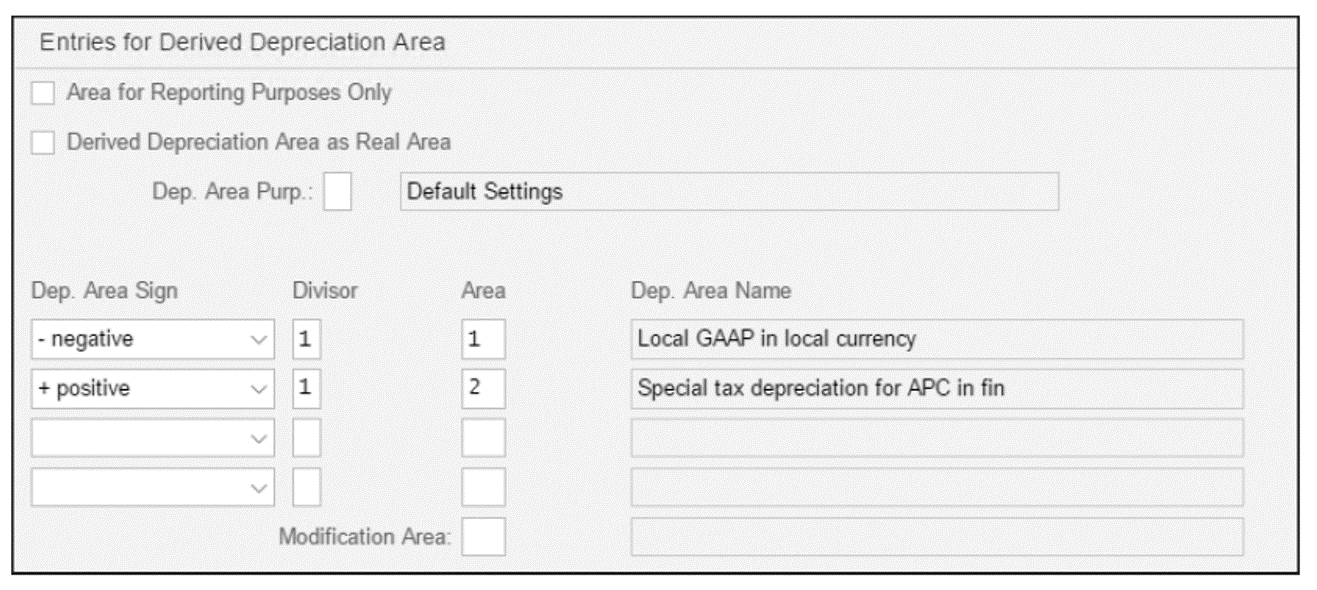

Derived Depreciation Areas

Derived depreciation areas are usually areas for which the values are calculated from combining values of two or more other areas (adding or subtracting values from each), as shown in the final figure. They are commonly delta areas, which give an immediate view of the difference between two valuations.

Tip: Derived areas were common in SAP ERP because they were required for handling parallel asset accounting with ledgers before the introduction of new asset accounting with SAP ERP 6.0 EHP 7.

Editor’s note: This post has been adapted from a section of the book SAP S/4HANA Financial Accounting Certification Guide: Application Associate Exam by Stefanos Pougkas.

Comments