Every transaction that updates the general ledger in SAP S/4HANA is done in at least one currency.

The definition of the currency depends on several organizational units, such as the transaction, client, country, company code, controlling area, and master data. In SAP, a single transaction could contain multiple currencies depending on the currency types that have been set up. In this blog post, we’ll discuss SAP’s standard currency types and how they are defined in the Universal Journal.

Standard SAP Currency Types

Currency types specify what the currency is being used for. The currency key (e.g., EUR, USD, etc.) that is assigned to a currency type is configured in different ways, depending on the function of the currency type. The following standard currency types are available in SAP.

Document Currency (00)

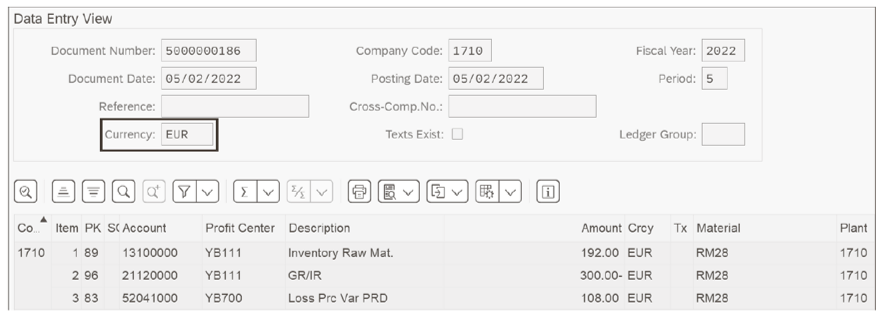

This is the currency that an accounting document is posted in. The currency that is entered (either manually or automatically) in an accounting document is the document currency. You can see in the figure below that the document is posted in EUR; therefore, EUR is the document currency for this posting.

Company Code Currency (10)

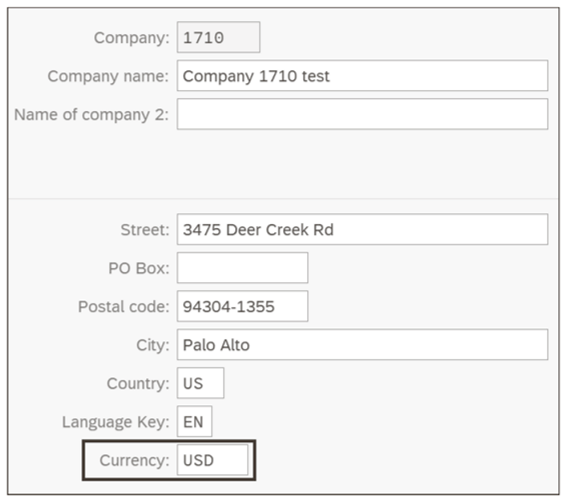

This currency of the company code usually coincides with the currency of the country that the company code resides in. The company code currency is part of the company code settings in Transaction OX02. Below, you can see that in the configuration of Company Code 1710, the Currency USD has been defined. Therefore, USD is the company code currency for this company code.

If company code currency 10 is combined with a valuation view, then the last digit of the currency type will represent the valuation view. For example, currency type 11 represents company code currency/group valuation, and currency type 12 represents company code currency/profit center valuation.

Controlling Area Currency (20)

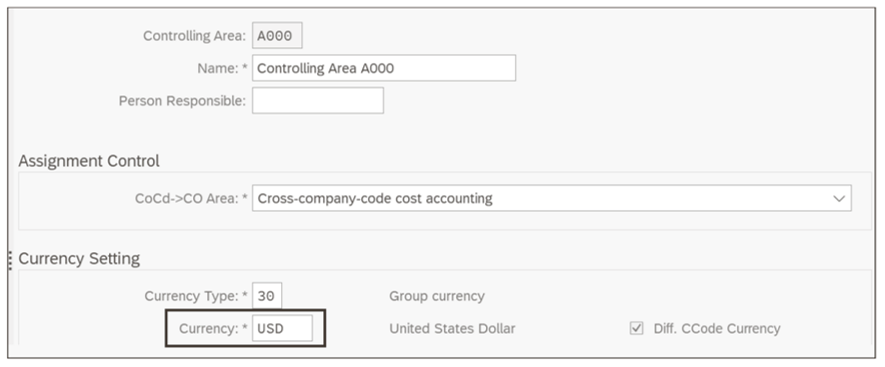

This currency of the controlling area is set up in the configuration settings of the controlling area (Transaction OKKP). In the next figure, you can see that the Currency USD has been assigned to Controlling Area A000. Therefore, USD is the controlling area currency for any company codes assigned to controlling area A000.

You’ll notice that the Currency Type that was set up for the controlling area is Group currency (30). This is because the controlling area currency (20) can only be used in controlling, and not in financial accounting. Therefore, to have better integration between the financial accounting and controlling currencies, the group currency is set as the controlling area currency. We’ll discuss group currency next.

Group Currency (30)

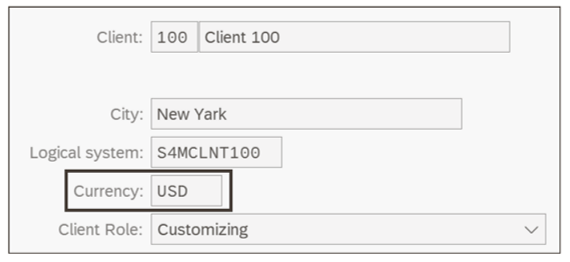

This currency type is defined for the client in the settings for the SAP client in Transaction SCC4. You can see in below that Client 100 is set up with a Currency of USD. Therefore, USD is the group currency for any company codes in this client.

If group currency 30 is combined with a valuation view, then the last digit of the currency type will represent the valuation view. For example, currency type 31 represents group currency/group valuation, and currency type 32 represents group currency/profit center valuation.

Hard Currency (40)

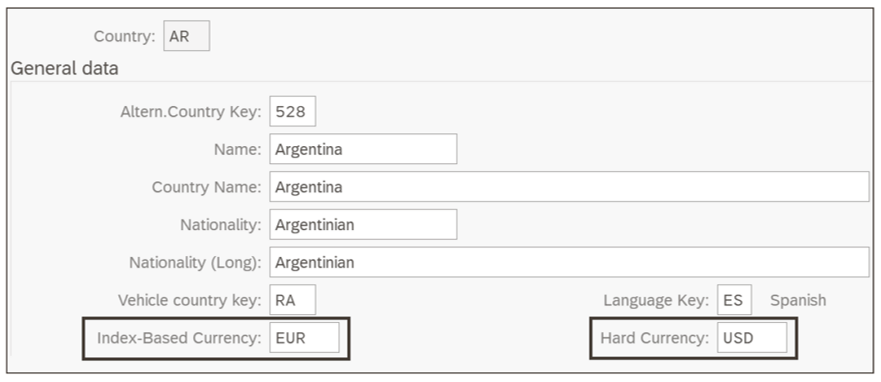

This currency is used for external reporting for some countries with high inflation. It’s assigned to the Country settings in Transaction OY01. The figure below shows a Hard Currency of USD being assigned to the country Argentina.

2

Index-Based Currency (50)

This currency is used for external reporting for some countries with really high inflation. It’s assigned to the Country settings in Transaction OY01. The previous figure also shows an Index-Based Currency of EUR being assigned to the country Argentina.

Global Company Currency

This currency is assigned to the company (trading partner) configuration in Transaction OX15.

Note that a company is different from a company code. A company is a consolidation unit that defines a company code, vendor, or customer, as a trading partner. A company code is assigned to a company, and the company code and company are usually given the same number.

The next figure shows that Company 1710 has been assigned to Currency USD. Therefore, USD is the global currency for company 1710.

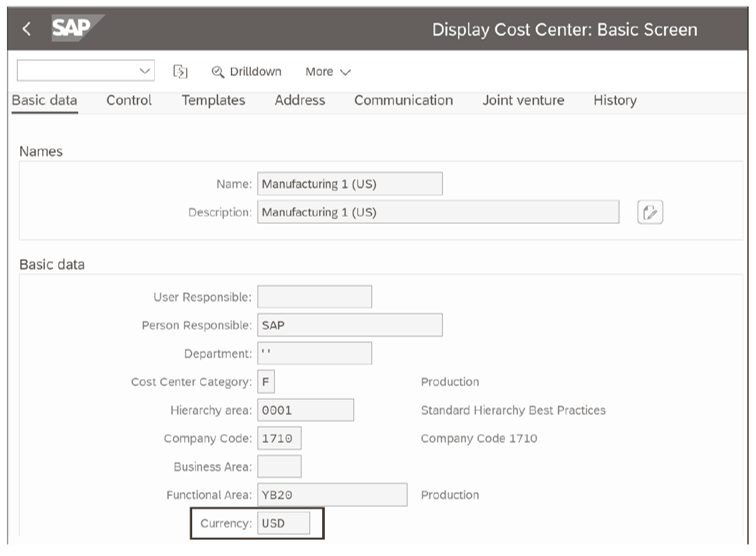

Controlling Object Currency

This is the currency type of the controlling object, such as a cost center, internal order, production order, or work breakdown structure (WBS) element. The next figure shows the Currency USD assigned to Manufacturing 1 (US). Therefore, currency USD is the controlling object currency.

The company code currency usually defaults as the controlling object currency; however, the controlling object currency can be changed if the company code currency is the same as the controlling area currency.

Defining Standard Currency Types in the Universal Journal

In the SAP ERP system, you had the option of having three currency types in the Financial Accounting (FI) module for each company code (unless you used the special purpose ledger, in which case, you could add an additional currency type), two currency types in the Controlling (CO) module, and three currency types in the Material Ledger.

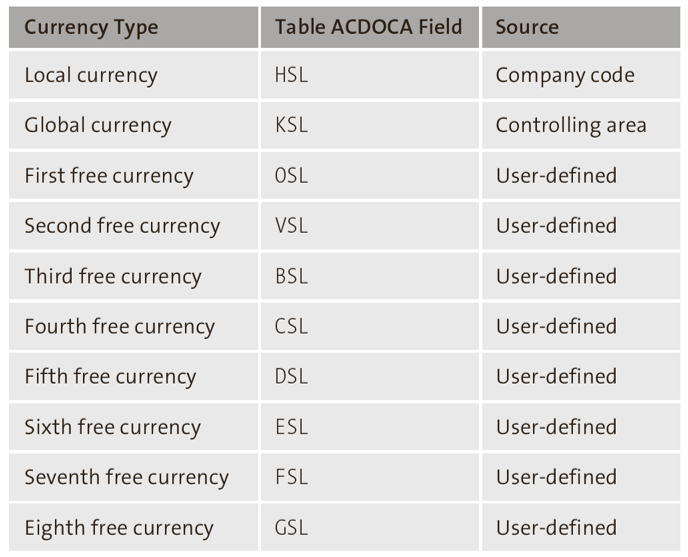

In SAP S/4HANA, the Universal Journal now allows the addition of eight extra userdefined currency types. When added to the company code currency and the global (controlling area) currency, this means that there are now 10 available currency fields in financial accounting. These currency types, along with their associated field names in the Universal Journal (table ACDOCA), are shown in this table.

Note that even though you now have up to 10 fields available in the Universal Journal, that doesn’t mean you need to use all of them. In fact, many companies will use only two of the currency types—local and global. However, this expansion of currencies gives you more options to use additional currency types in your company code. The local and global currency types are available for all ledgers; however, the user-defined currency types are ledger-dependent.

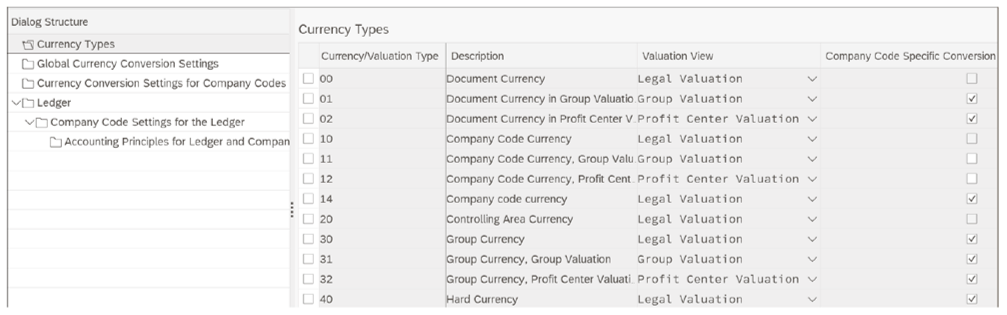

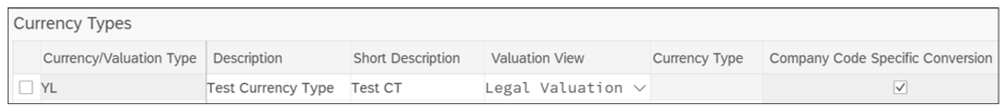

Let’s now define the standard currency types for the Universal Journal. To do so, go to the configuration menu path Financial Accounting > Financial Accounting Global Settings > Ledgers > Ledger > Define Settings for Ledgers and Currency Types or use Transaction FINSC_LEDGER. In the subsequent screen, double-click the Currency Types folder, which will take you to the screen shown here.

The columns shown are described here:

- Currency/Valuation Type: Two-digit key that represents the currency type.

- Description: Currency type description.

- Valuation View: The view that is used for transfer pricing purposes.

- Company Code Specific Conversion: Definition level for the currency type settings that determines whether the currency type is to be used for all company codes (when the box isn’t checked) or can be selected for particular company codes (when the box is checked). As you can see, this field is gray for some of the currency types, which means the standard system setting is fixed, and you can’t change it. Fields in white are changeable.

Now create one user-defined currency type by clicking on the New Entries button to open the screen shown below.

Select your Currency/Valuation Type (YL, in this example) as a Legal Valuation currency type, and enter a Description and Short Description of the currency type. In addition, select the Company Code Specific Conversion checkbox, which means that you’ll be able to further define this currency type based on the company code.

A note on currency type naming: A user-defined currency type can only be created starting with a Y or Z. In addition, unlike the standard currency types, the second digit of the user-defined currency type doesn’t need to represent the valuation view.

Editor’s note: This post has been adapted from a section of the book Material Ledger in SAP S/4HANA: Functionality and Configuration by Paul Ovigele.

Comments