Profit center accounting in SAP S/4HANA provides the tools to analyze internal profitability, assign responsibility areas, and meet legal segment reporting requirements.

Concepts, Roles, and Requirements

Classic profit center accounting is account based. As a result, values are updated in a profit center based on the individual general ledger accounts from the operational chart of accounts assigned to the company code. The general ledger account is assigned to an account type, such as a balance sheet account, nonoperating expenses or income account, primary costs or revenue account, or secondary costs account. These account types determine the usage of each general ledger account in financial accounting and controlling. In SAP S/4HANA Finance, profit centers are derived from various account assignment objects.

Splitting an organization into profit centers helps you analyze areas of responsibility and effectively assign these areas of responsibility to profit centers. Profit center accounting helps you analyze the costs, profits, balances, and key financial figures for each profit center and helps you understand internal aspects of profitability. This approach essentially reflects the success of each profit center in achieving its profitability goals. Profit center accounting determines profits and losses by region (e.g., plants, geographical locations, etc.); by function (e.g., manufacturing, sales, retail, etc.); or by product. The document splitting functionality helps generate balance sheet reports at the profit center level.

Profit Centers in Classic SAP ERP vs. SAP S/4HANA

In the SAP ERP system with classic general ledger accounting, profit centers were purely controlling objects and in a separate submodule. This is not the case in SAP S/4HANA.

With the introduction of the new general ledger in SAP S/4HANA Finance, the profit center became more important in financial accounting because it’s the object used to derive and fulfill the requirements for segment reporting. The profit center was designated for that role because it’s an account assignment that was already integrated into most other components of the system.

Activating Profit Center Accounting in the Universal Journal

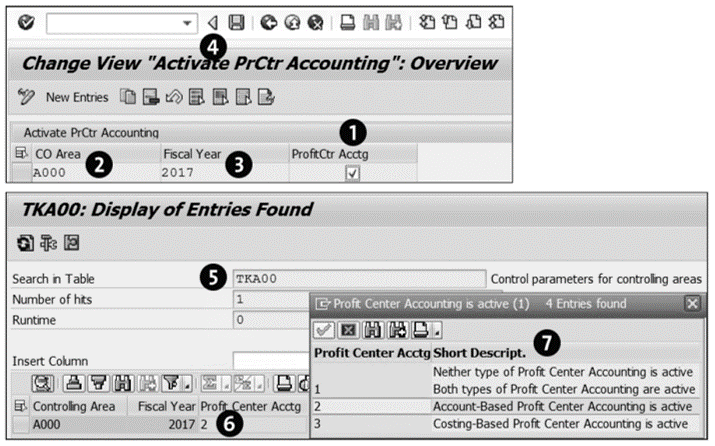

In SAP S/4HANA, profit center accounting is mapped in the Universal Journal by default. This mapping populates profit centers on line items in the Universal Journal. To make this work, you must activate profit center accounting in the Universal Journal by following the IMG menu path Financial Accounting > General Ledger Accounting > Master Data > Profit Center > Activate Profit Center Accounting in Controlling Area. This step opens the Change View “Activate PrCtr Accounting”: Overview screen, shown in this figure.

On this screen, select the ProfitCtr Acctg (profit center accounting) checkbox (1) for the controlling area given in the CO Area column (2). The year shown in the Fiscal Year column (3) represents the start of validity for the controlling area. Click the Save button (4) to activate profit center accounting. As soon as you activate profit center accounting, the system activates some additional validation areas in the background. For example, the system performs profit center consistency checks when posting line items with account assignment objects, such as a cost center or an internal order. The activation of profit center accounting sets the PCRCH field in table TKA00 (5) to the value 2 (6). After the field is set to 2 (Account Based Profit Center Accounting is active) (7), if a posting is made with the profit center or a partner profit center in the line items, the system checks for this profit center (or partner profit center) and updates both in the Universal Journal. SAP doesn’t support profit center accounting across controlling areas; therefore, profit center accounting works only within one controlling area. To support the transition to SAP S/4HANA (on-premise), you can activate classic profit center accounting in SAP S/4HANA. See SAP Note 702854 for instructions on activating or deactivating classic profit center accounting.

Profit Center Hierarchy and Maintenance

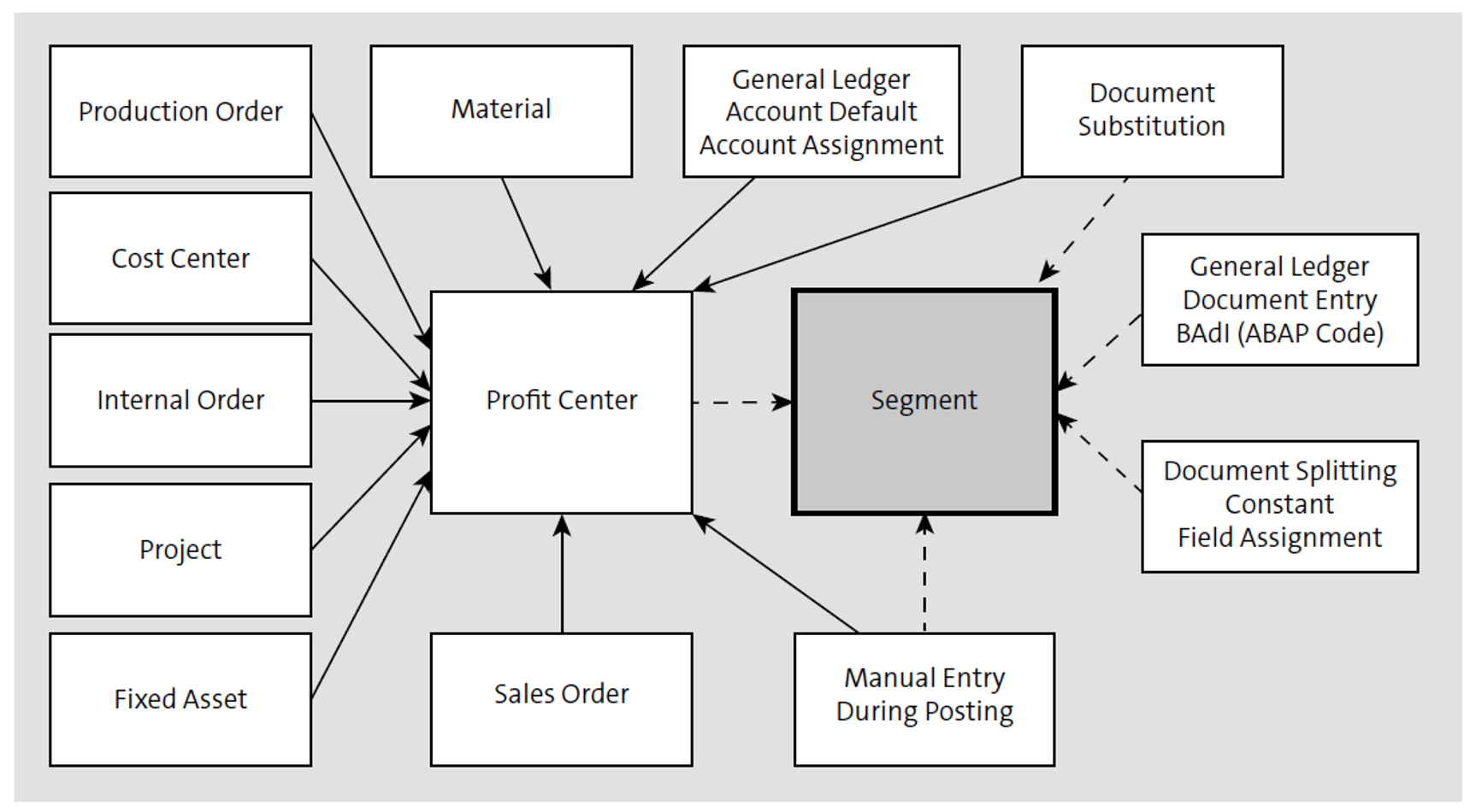

The figure below shows a non-exhaustive list of ways the profit center is derived during posting. In addition, a few options for direct assignment of the segment are also mentioned. Segments should always be derived by the profit center, but there are also a few alternative assignment methods possible, especially for the few cases in which it may not be possible to derive the profit center automatically.

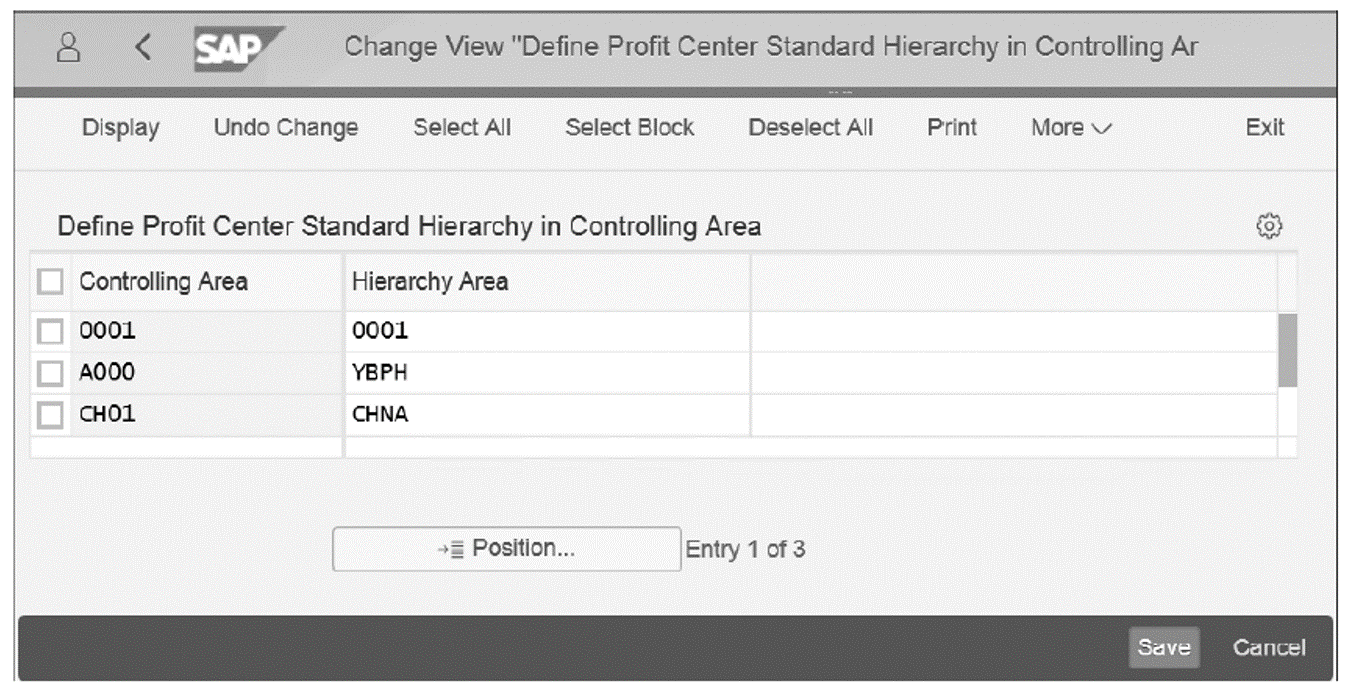

The first step to define profit centers is to design their hierarchy. All profit centers in the client are assigned to a profit center hierarchy, and the profit center hierarchy is assigned to the controlling area in Customizing, as shown in the next figure. This means that all company codes assigned to the controlling area can also potentially post to the profit center.

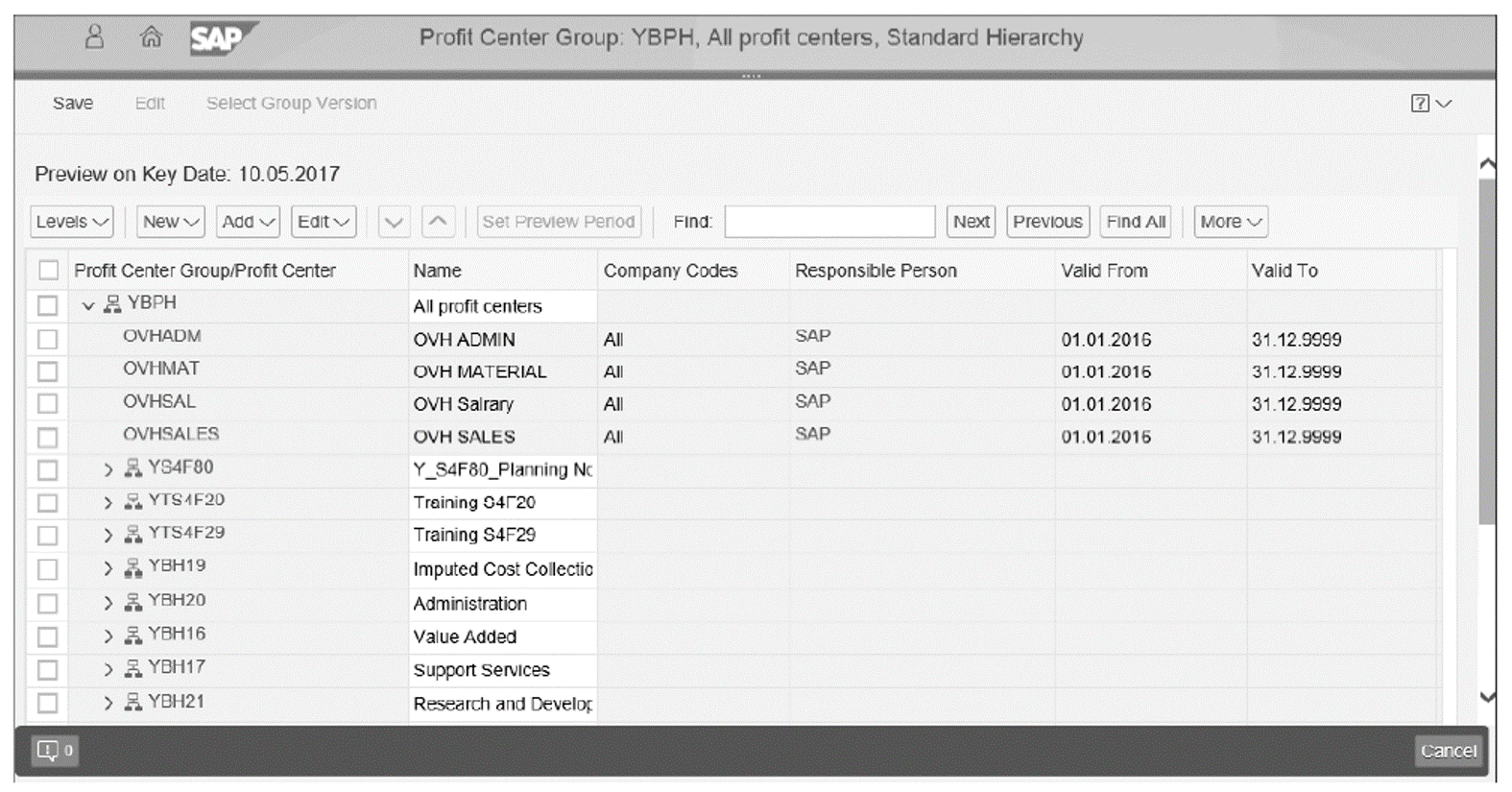

In a second step, you assign the profit centers to the hierarchy. The hierarchy can be flat or structured. Structuring the hierarchy into groups and subgroups makes sense for selection during reporting, planning, and so on. This figure shows a hierarchy structured into groups.

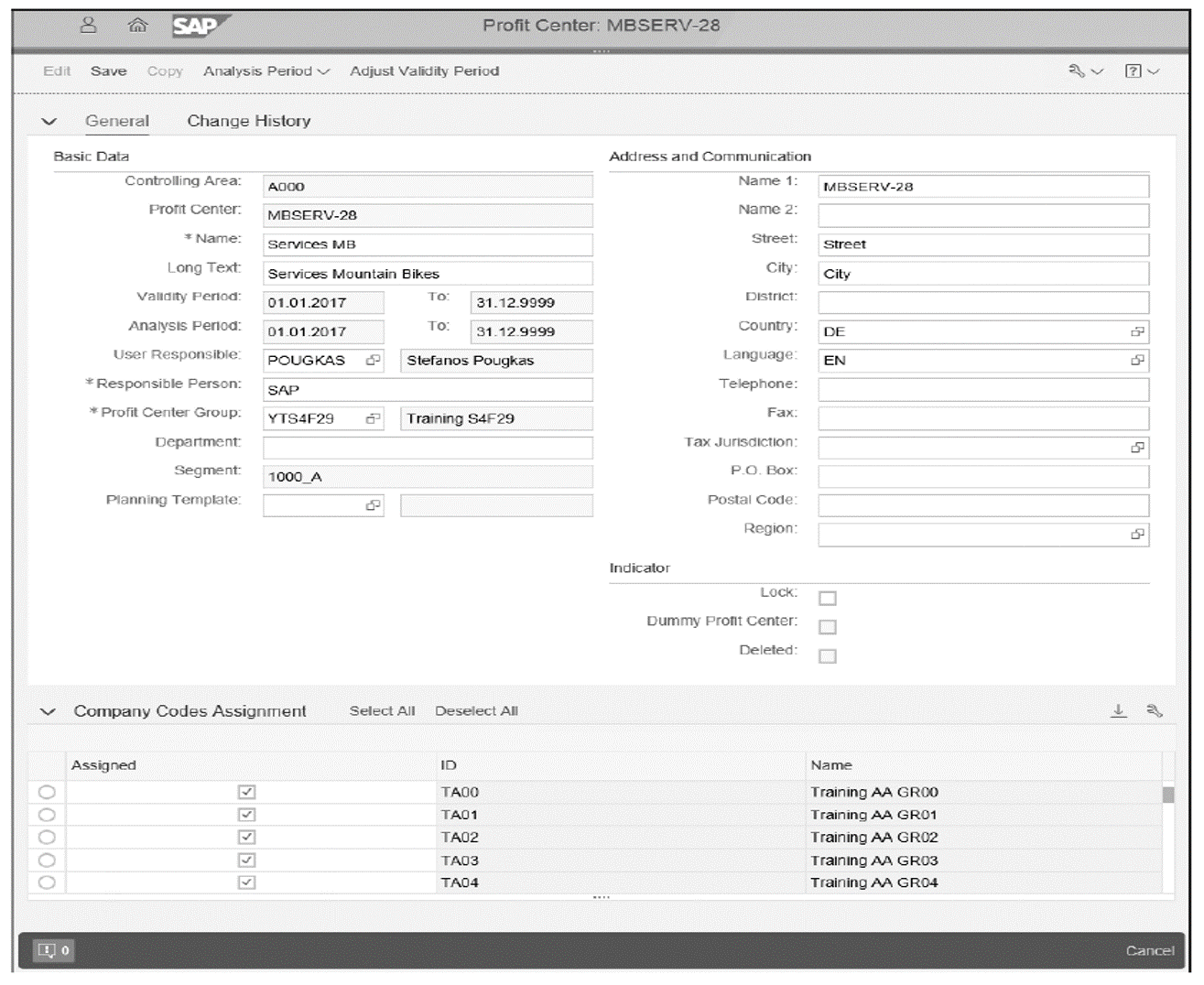

When you create a profit center, you select the controlling area and then assign the company codes the profit center is valid for, as shown below. You must assign the profit center to the hierarchy by indicating the profit center group it belongs to. You also maintain the relevant segment to be derived from the profit center.

When you’re done entering the data, you activate the profit center and can then enter it during posting and assign it to other objects.

Profit Center Accounting with Profitability Analysis

SAP S/4HANA provides profitability analysis and profit center accounting as key accounting tools to analyze your organization’s profit and progress. Profitability analysis evaluates the performance of your organization and provides market-driven information to managers responsible for decision-making. This information is derived from segments (e.g., products, locations, customers, etc.) and internal organizational units (e.g., company codes, business areas, etc.). Profit center accounting in SAP S/4HANA evaluates the performance of specific internal areas or units of the organization set up as profit centers, which are created based on product, location, or function. Document splitting generates data for balance sheet reporting at the profit center level. The assignment of segment accounting objects to a profit center generates information for segment reporting and fulfills legal requirements codified in International Financial Reporting Standards (IFRS) and Generally Accepted Accounting Principles (GAAP) in the US.

Profitability analysis provides results for planning and decision-making at the organization level, which helps in defining profitability segments and analyzing the performance of these segments. Profit centers are management-oriented organizational units used for internal control. Splitting your organization into profit centers helps you analyze areas of responsibilities and assign responsibilities to each profit center.

Methods of Profit Calculation

In this section, we’ll provide a general overview of the methods used to calculate the profit and loss (P&L) for a profit center in SAP S/4HANA. Profit centers reflect the management-oriented structure of your organization and are used for internal control. The performance of each profit center is measured from the operating results of the profit center. You can calculate operating results (P&L) using either of the following methods. Both methods generate the same results.

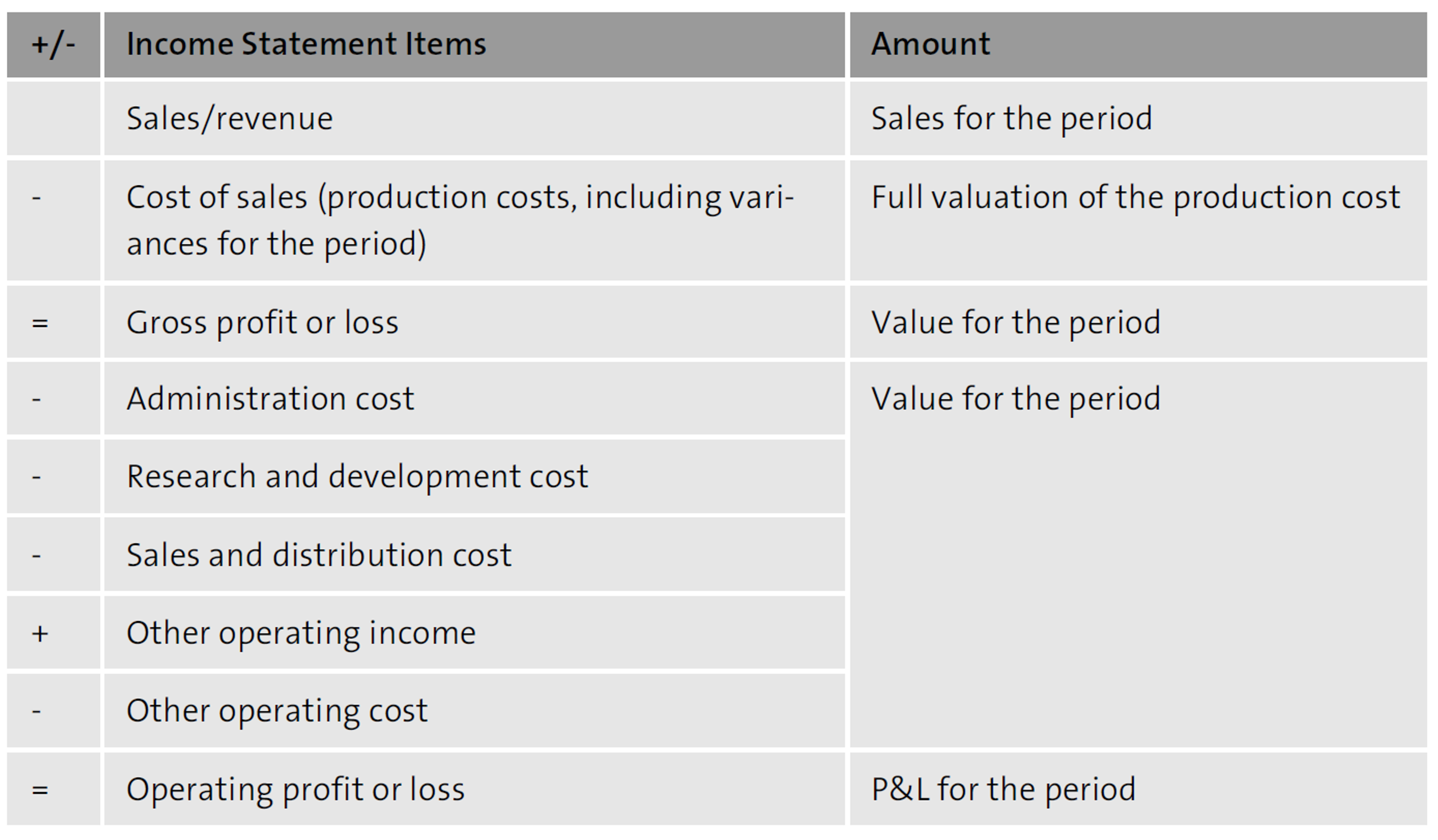

Cost of Sales Method

The cost of sales method compares sales revenues to the cost of sales. The cost of sales includes costs or expenses incurred for the generation of sales. The table below shows the income statement you would prepare in the cost of sales method.

Sales for the period are directly linked to the production costs of sales, and you can’t see the change in inventory in the financial statement. These costs and expenses are economic values for the resources used in generating sales and may include costs from the previous period. These resources are determined based on functional areas, such as production, research and development, management, and sales and distribution. In SAP S/4HANA, functional areas are derived from controlling objects, such as cost center, profit center, internal order, work breakdown structure (WBS), and product cost collector. The production cost includes proportional costs and structural costs accrued from production. Variances for the period represent the proportional and structural costs included in the production cost for the period.

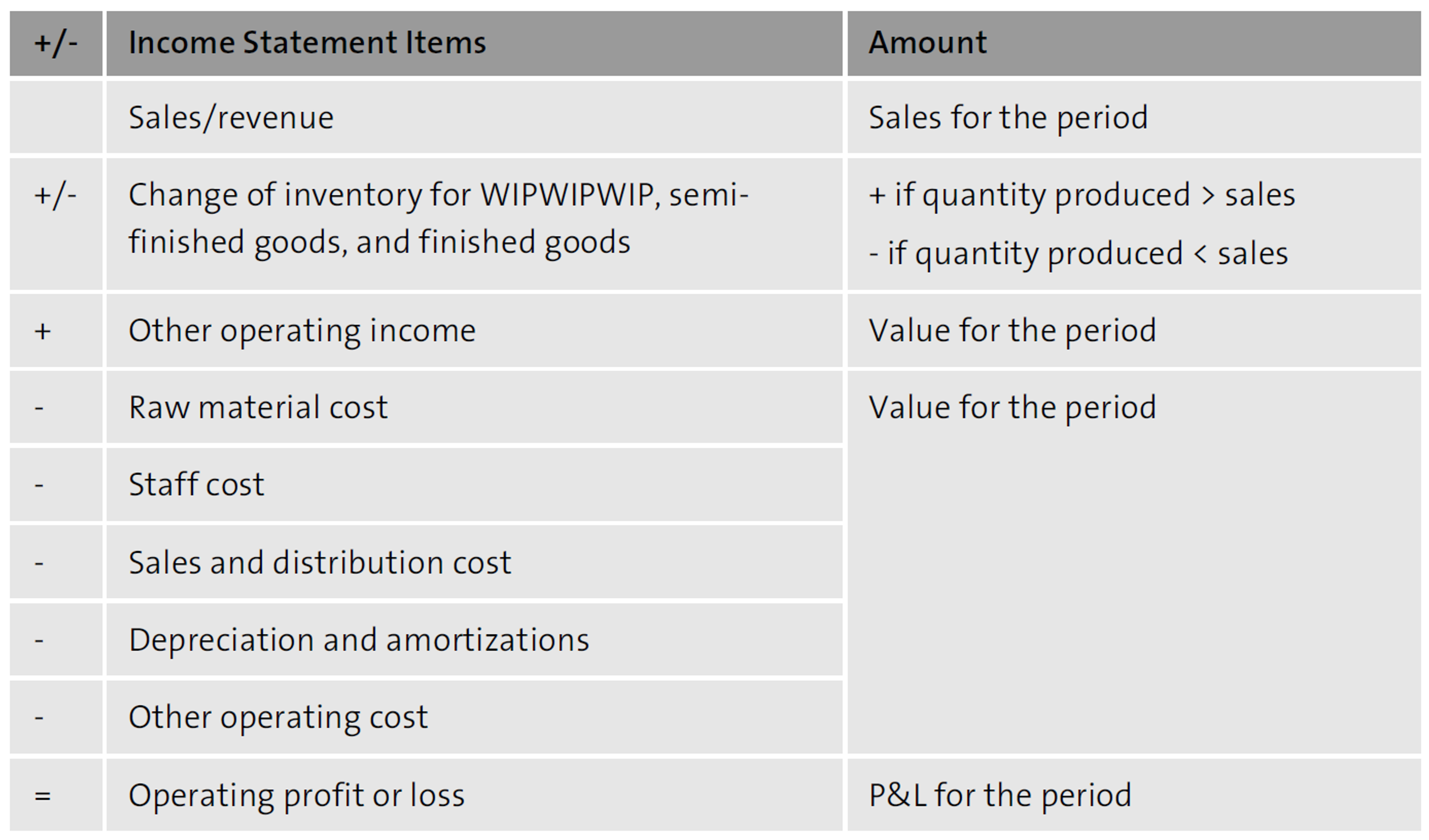

Period Accounting Method

The period accounting method compares market-driven sales for the period to the total expenditures—that is, the value of the actual goods and services consumed for the generation of sales—for the same period. Therefore, in this method, differences in cost arise because the quantity sold is not the same as quantity produced. This difference represents a change in inventory for work in process (WIP), semi-finished goods, and finished goods. The following table shows an income statement you would prepare in the period accounting method.

Conclusion

Profit center accounting in SAP S/4HANA unifies financial and managerial reporting by tying profit centers directly into the Universal Journal. With clear activation steps, structured hierarchies, and multiple methods of profit calculation, organizations can track performance by region, function, or product. Combined with profitability analysis, this approach equips decision-makers with the detailed insights they need for both compliance and strategic control.

Editor’s note: This post has been adapted from a section of the books SAP S/4HANA Financial Accounting Certification Guide: Application Associate Exam by Stefanos Pougkas and General Ledger Accounting with SAP S/4HANA by Anand Seetharaju and Mayank Sharma. Stefanos is the certification exam owner for the SAP S/4HANA Financial Accounting 1909 and 2020 exams, and has led the effort to design and write questions for these exams. Anand is a certified SAP S/4HANA financial and management accounting consultant. He holds active CPA and CMA licenses and has more than 25 years of experience in business process design, consulting, and implementation of accounting systems. Mayank is an SAP S/4HANA Finance application delivery lead. He has more than 30 years of accounting and finance experience and more than 15 years of experience implementing general ledger accounting.

This post was originally published 12/2021 and updated 8/2025.

Comments