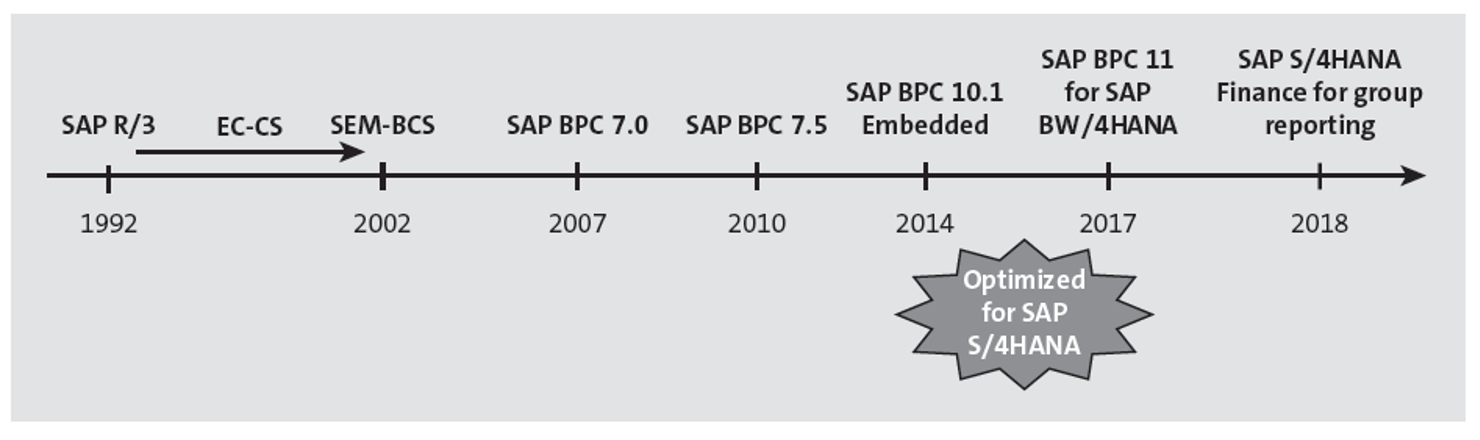

Since SAP launched SAP R/3 in 1992, it has tried to provide a technical solution to support financial consolidations. Technology has evolved since then, and SAP’s underlying architecture has taken advantage of those technology innovations.

The figure below shows how these solutions have evolved from SAP R/3.

What used to be a month-end accounting process following the closing of the books is now something that can be run in near real time throughout the month.

In the following sections, we’ll explore the evolution of consolidation with different SAP solutions, including each of their features and, for some, a look into their architecture. This will help you understand how we arrived at SAP S/4HANA group reporting, the most innovative consolidation solution yet.

The classic model of financial consolidation can’t help organizations if their business demands much faster access to group-wide decision-support information.

They can’t afford to wait for their data to be moved to a data warehouse, run through the various validation and transformation processes, and then consolidated. That’s why SAP set out to develop a new strategy for consolidation that combines the benefits and power of existing solutions into a single consolidation tool by working with a common data model.

Financial Accounting: Legal Consolidation

SAP’s initial consolidation tool was a subcomponent of the overall Financial Accounting (FI) module supported as part of SAP R/3, officially launched in 1992. It gave companies the ability to consolidate their financial statements through the use of transaction codes but lacked any built-in web interface or business process functionality. It was maintained by the IT organization and required a deep knowledge of SAP R/3 to configure and use it. The core features included with Financial Accounting – Legal Consolidation (FI-LC) were as follows:

- Visibility was provided into underlying financial transactions with the ability to aggregate trial balances from multiple companies.

- The key dependency was that all companies in the group were on the common data platform; if not, significant integration and mapping to a single chart of accounts was required.

Enterprise Controlling: Consolidation System

When SAP introduced a complete architecture change from SAP R/3 to SAP ERP 6.0, Enterprise Controlling – Consolidation System (EC-CS) was also introduced as part of SAP ERP 6.0. Upon its release, there would be two common ways to consolidate financials, either using EC-CS or using a custom reporting solution on SAP Business Warehouse (SAP BW).

EC-CS allowed companies to consolidate multiple entities (i.e., company codes) directly within the ledger. EC-CS has similar features that exist in today’s consolidation tools, but it was based on SAP BW technology rather than in-memory computing, which is used in SAP S/4HANA. Additionally, the tool wasn’t as intuitive for business users. Instead, to configure and execute a consolidation in EC-CS, one had to have a deep understanding of transaction codes to make master data changes and to monitor consolidation tasks. While EC-CS did offer both a Data Monitor and Consolidation Monitor, they were GUI-based and not web-based tools as they are today.

To summarize, the following core features were included in EC-CS:

- Accounting document principles and logs for transparency into transactions and reconciliation activities.

- Process monitor to actively manage execution of the consolidation process, identifying those processes that aren’t started, in progress, completed, and failed.

- Automatic consolidation of investments and intercompany eliminations.

SAP Strategic Enterprise Management: Business Consolidation System

SAP released the SAP BW version of SAP Strategic Enterprise Management – Business Consolidation System (SEM-BCS) in 2002. SAP SEM offered customers the ability to perform comprehensive simulations and scenario analysis, saving valuable time and modeling effort in the process. BCS offered customers a breadth of flexibility in that it was customer definable with strong integration to SAP BW. For example, customers could define their own consolidation units whether they were entities or profit centers. This allowed for flexibility in performing management consolidations, something SAP Business Planning and Consolidation (SAP BPC) and Real-Time Consolidation (RTC) didn’t offer. However, this new feature is part of SAP HANA Finance for group reporting as of release 1909, called matrix consolidations.

Other common features in SEM-BCS are as follows.

Data Collection

Online data entry, flexible uploads, or loads from an InfoProvider (either SAP BusinessObjects Business Intelligence [SAP BusinessObjects BI] or a connected SAP system) are allowed. Data isn’t real time and must be interfaced or loaded to be consumed in consolidations.

Flexible Hierarchies

Hierarchies can be created for nearly any characteristic from financial master data to specific consolidation dimensions.

Versioning

Versioning allows execution of different consolidations for different types of data (actuals or budget) or to run different what-if scenarios and simulations.

Standard Consolidation Tasks

Currency translation, intercompany eliminations, consolidation of investments, and balance carryforward can be run.

Reporting

SAP BusinessObjects BI reporting is used to analyze financial data with some preconfigured SAP BusinessObjects BI content.

SAP Business Planning and Consolidation

In 2007, SAP acquired OutlookSoft as a strategic acquisition to extend its depth beyond core enterprise resource planning (ERP) software and into the world of corporate performance management with a focus on planning, budgeting, forecasting, and consolidations. OutlookSoft’s largest product was renamed SAP Business Planning and Consolidation (SAP BPC).

SAP BPC has been around for more than 10 years and remains, to this day, a very reliable product that was SAP’s first attempt at a tool that could largely be managed by the business user. At the time of acquisition, OutlookSoft ran on a Microsoft platform, which meant very little maintenance and support. However, as the tool matured, SAP soon integrated SAP BPC with SAP NetWeaver, which allows the tool to run on SAP BW technology.

To date, there are multiple versions of SAP BPC, as follows.

SAP BPC 10.1, Version for SAP NetWeaver

Commonly referred to as classic SAP BPC, this version is an extension of existing SAP BPC software that can be used for both planning and consolidation solutions. Additionally, data must be loaded to the SAP BPC cube either from SAP BW or from external systems, such as flat files. And, finally, SAP BPC 10.1 uses both SAP BW and SAP BPC systems for security configuration as users are created in the SAP BW system and granted permissions for objects and data in SAP BPC.

SAP BPC 10.1, Version for SAP NetWeaver, Embedded on SAP HANA

SAP BPC 10.1, embedded, is for planning only, and the embedded consolidation tool is group reporting. As a result, there is no transfer of data to the SAP BPC cube, rather it uses the SAP BW system and its objects directly. On the security front, most features are configured in SAP BW directly.

SAP BPC Optimized for SAP S/4HANA

SAP BPC optimized for SAP S/4HANA eliminates data replication and leverages the real-time access to both transaction and master data in SAP S/4HANA. Additionally, it runs exclusively on the SAP S/4HANA Finance system and doesn’t require a separate SAP BW system or replication of transactional or master data.

SAP BPC, Version for Microsoft

This business planning, reporting, and consolidation solution built on Microsoft SQL Server technology is designed to be flexible and maintained by the business versus being maintained, historically, by IT.

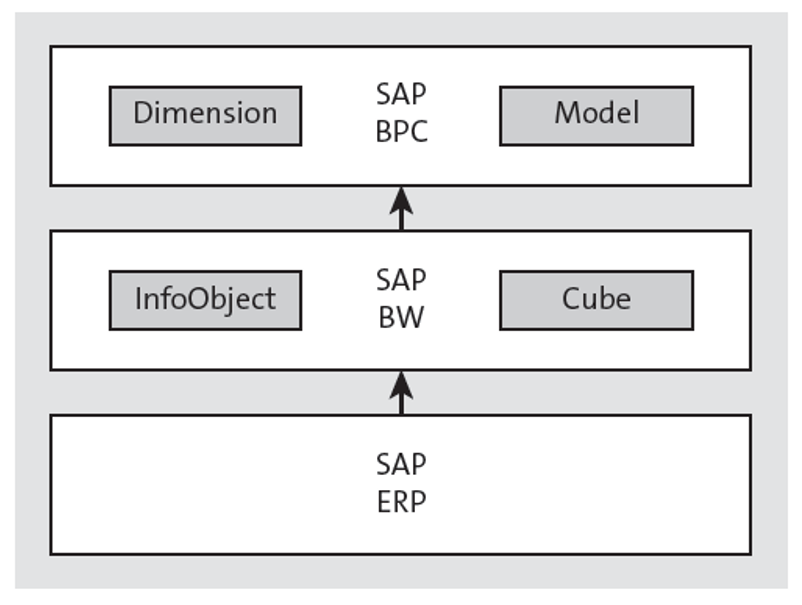

Before looking at the features, it’s worth taking a peek at a high-level conceptual architecture feeding information from SAP ERP into SAP BW and then into SAP BPC. As you can see in the figure below, data is moved between SAP ERP, SAP BW, and SAP BPC, which is no longer the case when using group reporting.

Additionally, SAP BW and SAP BPC both have to be modeled to consume the information for use in consolidation and thus financial reporting. SAP BPC would have specific consolidation models defined to consume data from the source systems, in this case, SAP ERP, but you could also have flat files feeding SAP BPC as well.

Standard SAP BPC 10.1 is a planning, consolidation, and reporting solution based on SAP BW technology that includes the following features:

- Users: SAP BPC is designed to be used and maintained by finance (business) users with minimal maintenance required.

- Data collection: Integrations need to be built between SAP BW and SAP BPC through interfaces, which means there is no real-time access to data.

- Data modeling: Modeling occurs through the web client instead of using SAP GUI.

- Scripting: Scripting is written with Script Logic only.

- Standard consolidation tasks: Currency translation, intercompany eliminations, consolidation of investments, and balance carryforward can be run.

- Reporting: Enterprise Performance Management (EPM) is the Excel-based add-in used for executing packages, data inputs, and reporting.

Real-Time Consolidation in SAP S/4HANA

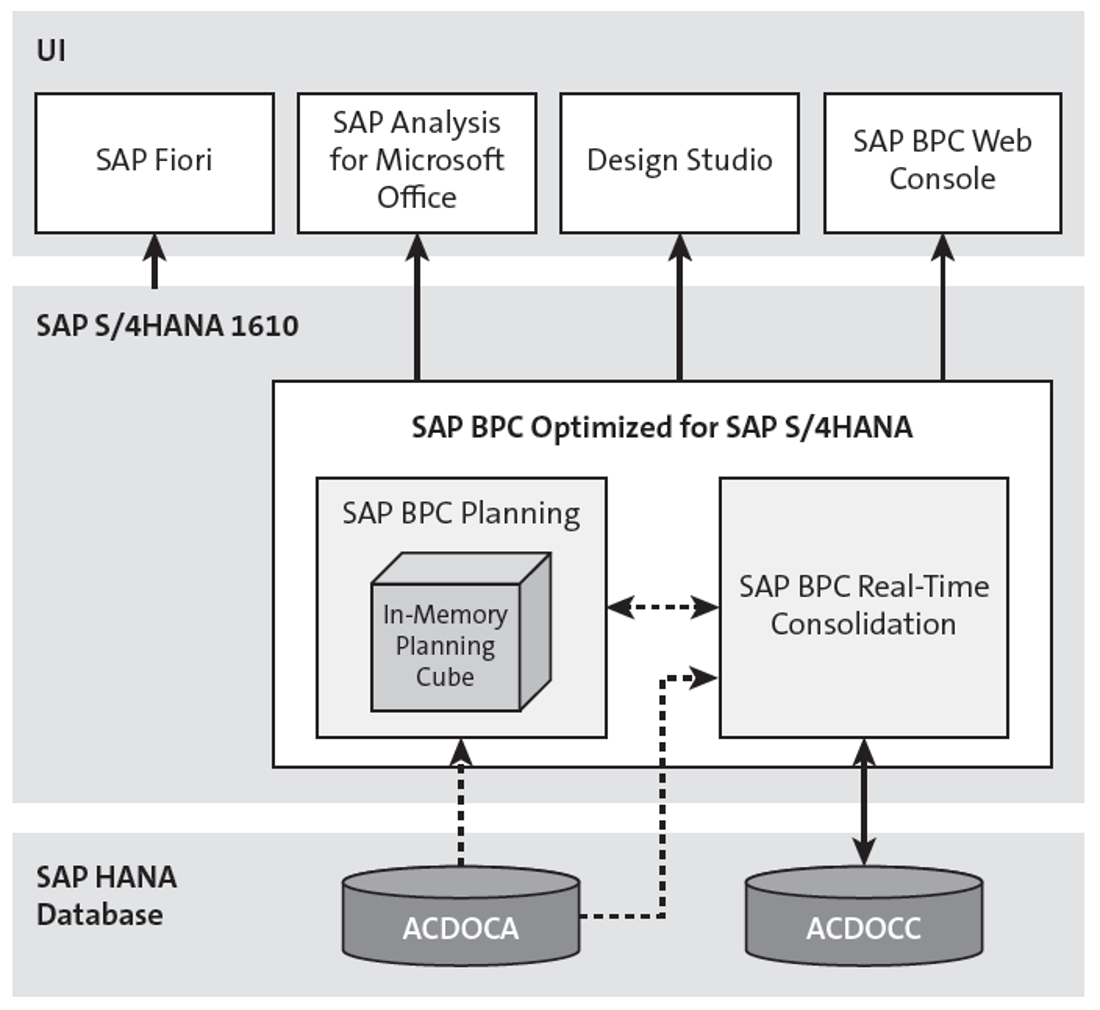

In 2016, Real-Time Consolidation (RTC) was introduced as part of the 1610 SAP S/4HANA release. Prior to release of SAP S/4HANA, SAP didn’t have a fully integrated planning and consolidation tool within the SAP HANA suite of tools. In summary, RTC was intended to be the next-generation consolidation tool that offered integration between SAP S/4HANA and SAP BPC by allowing direct access to the Universal Journal and leveraging the consolidation capabilities offered by SAP BPC.

The next figure illustrates the RTC architecture as part of the RTC release 1610 FSP 01. As you can see, RTC allows users to perform legal and management consolidations and contains two tables in the SAP HANA database: table ACDOCA, the Universal Journal, which contains all financial line item documents, and table ACDOCC, the consolidation journal, which is an extension of table ACDOCA. All planning and consolidations take place within SAP S/4HANA, and users can consume all information from SAP HANA via the frontend tools of SAP Fiori, SAP Analysis for Microsoft Office, Design Studio, and the SAP BPC web console.

RTC includes the following features:

- Integrated, common master data across RTC and SAP S/4HANA, eliminating the need to perform dual maintenance and addressing inconsistent data.

- Requires use of group chart of accounts to facilitate aggregation of operational chart of accounts.

- No longer needs to replicate and load data as the Universal Journal can be accessed in real time for consolidation.

- Option to use SAP S/4HANA to perform currency translation in the Universal Journal prior to the consolidation process starting or executing within SAP BPC itself.

- Ability to execute preliminary consolidation on actuals, supporting finance’s desire to execute a continuous close throughout the month or simulate a certain business scenario.

- Continued use of the web client to update business rules, Consolidation Monitor, and ownership structures.

- Reporting performed in SAP Analysis for Microsoft Office, the newest version of the Excel add-in tool.

While RTC did offer SAP’s first integrated consolidation solution supporting “real time” consolidations, it had some architectural challenges that required a change to the long-term solution that SAP would support on its road map:

- Performance memory challenges were reoccurring with RTC due to the fact that the number of records could increase dramatically given the ability to map any field from table ACDOCA to table ACDOCC (the consolidation table). Additionally, the currency translation code wasn’t optimized, requiring increased attention to the application of new SAP Notes.

- Master data also faced some issues, including missing descriptions in the Consolidation Monitor and reverse sign functionality.

- Only one key figure could be used in the consolidation model, and it can be a challenging concept for business users to understand that they can only use one group amount. Certainly, this could be mitigated, but it required some customization.

That long-term solution would be SAP S/4HANA Finance for group reporting.

Group Reporting with SAP S/4HANA

SAP S/4HANA Finance for group reporting version 2023 combines the best of all existing consolidation solutions into one solution that customers can deploy either on-premise or in the cloud.

Consolidation Requirements

The single consolidation tool needed to accomplish several things:

-

Create a Fully Unified Framework: As its work on consolidation progressed, SAP developed a consolidation process that placed the SAP Business Planning and Consolidation (SAP BPC) engine on top of the Universal Journal. In theory, this approach, known as Real-Time Consolidation, offered a group closing directly on the nonconsolidated entity information, meaning that the local close and group close was already based on a single source of truth. However, because of the SAP BPC–specific user interface, Real-Time Consolidation didn’t bring a fully integrated experience to the end user; a fully unified framework for local and group-level reporting was still missing.

- Cover the Entire Data Flow: It was critical that the solution differentiate between planned, actual, simulated, and predicted data, as well as varying reporting cycles. For this reason, tight integration with SAP Analytics Cloud would be key.

- Connect Quantitative and Qualitative Data: For group-level reporting, both nonfinancial measures and notes and other qualitative data are as important as the numbers themselves. A new framework should support not only annotations but also communication between stakeholders when preparing group reports.

- Be Deployable in the Cloud: Today, many organizations deploy a combination of on-premise and cloud applications as the source of their financial consolidation data. In the future, cloud-based consolidation may be the only preferred method, so a new solution should be deployable in the cloud or on premise to help organizations as they transition their IT and financial operations to the cloud.

In a nutshell, this is the next-generation consolidation solution integrated in the SAP S/4HANA platform that offers native integration with accounting, planning, and reporting.

The following group reporting 2023 features are differentiators for the product.

Improvement 1: Data Quality

Let’s consider the impact of running legal and management consolidation integrated in SAP S/4HANA. The first big improvement centers on data quality. You don’t need to move or transform your data, which eliminates the risk of reconciliation issues. This architecture means that both entity close and group close can be based on shared master data in the form of accounts, cost centers, profit centers, and so on.

But it also means that when running local accounting and group accounting in a single environment, postings can be validated immediately on release to the group reporting solution because the validation rules (which are part of the consolidation engine) are immediately available. The same logic applies to other preparatory consolidation steps, like translation into group currency. The group reporting solution uses the figures for reporting dimensions captured in the Universal Journal, but it also has its own entities, such as consolidation units (used to structure the various business units for the purposes of elimination), consolidation groups (used to bring the consolidation units into a hierarchy), and financial statement items (used to group the accounts).

Improvement 2: Continuous Close

The second improvement relates to the realization of continuous close on the consolidated level. Being able to validate entries at the source means you can translate a financial posting into group currency at the time of the initial posting. The consequence is that time-consuming preparation tasks for consolidation no longer need to be executed as part of the group closing process. Therefore, group reporting supports the move toward continuous accounting.

The figure below shows what happens when the preparation steps for consolidation (data upload, currency translation, validation checks on the nonconsolidated figures, intercompany reconciliation) are executed in both a classic approach and the SAP S/4HANA integrated approach. As shown at the bottom of the figure, the group reporting solution moves tasks out of the period close so that only the genuine consolidation steps remain to be performed within the close. In the new workflow, because the data load is no longer needed and the currency translation is already complete, the only steps left to execute at period end are the intercompany elimination and specific consolidation calculations. Therefore, the time spent to run the consolidation process is significantly reduced.

In addition, time can be saved by performing data validations immediately to check the plausibility of the data from the subsidiaries. These might be simple checks such as whether the data for certain items exceeds a threshold compared with the previous period, or they can include more complex logic to determine whether the posting is allowed. The group reporting solution includes a new validation rules framework that makes it easy for non-expert users to set up rules and validate against these rules; this way, group accountants can be sure that they’re dealing with reliable financial data in the steps that follow.

Moreover, a consolidation run within a period becomes an option—at least when the relevant postings are available from the subsidiaries. Consequently, the principle of continuous accounting now also can be enlarged to include group financial figures as well. Do note that we don’t expect SAP to provide real-time legal consolidation because some of the underlying postings will be missing during a period, such as the revaluation of open receivables and payables. Instead, we expect SAP to work on providing a managerial view of the situation that gives detailed insight into the income statement by delivering divisional or group-level figures.

Improvement 3: Transparency

The third improvement is that this setup provides unprecedented transparency. Organizations can drill down from consolidation items to the document line items of the entity because all data is found back in the single source of financial information: the Universal Journal. This immediately builds trust in the user community that the figures are valid and allows users to reallocate their effort from manual checks to value-adding activities.

This all ties back into the overall view to run financial reporting directly from the SAP S/4HANA environment itself by making use of the embedded reporting capabilities: no matter whether you run an entity-level report in an SAP Fiori–based analytical application or run it on the divisional or group level, the way you report is exactly the same.

As you can see in the group balance sheet report in the first figure below and group cash flow statement in the second figure, embedded reporting capabilities are applied in the same way to deliver instant insights on the group level. The only difference is that the account hierarchy is based on financial statement items, rather than being in a flat list. Notice also how the local reporting dimensions are available for drill-down alongside the group reporting-specific consolidation units and consolidation groups in the left-hand Dimensions panel.

SAP BPC Functionality Ported to SAP S/4HANA Finance

One of SAP BPC’s strengths inherited by the group reporting solution is its rule-based reporting, which classifies individual reporting lines for embedded reporting. The setup of reporting lines is illustrated below, where you can see the link between the financial statement items and the reporting lines. This means that reports can be built dynamically for a relevant version and period, but the account structure and posting logic in the underlying data remain stable.

Linked to this, the so-called flow principle is inherited from the SAP Financial Consolidation solution. This concept is specifically used for balance sheet items, supporting the creation of a consolidated cash flow statement that takes into consideration the correct cash movements.

Notice the column SI Cat. (subitem category) in this context, which is used to identify the movements for the cash flow statement. These flows can be visualized in the Cash Flow Analyzer SAP Fiori app.

One of the key strengths of the SAP Enterprise Controlling Consolidation System (SAP EC-CS) and SAP Business Consolidation (SAP SEM-BCS) solutions was the accounting document principle, which means that each consolidation task results in an auditable consolidation posting. These consolidation postings cover the initial data load; automatic postings for interunit eliminations, investment eliminations, and so on; and manual postings for corrections. This is also how consolidation postings are added to the Universal Journal.

The application of this document principle is illustrated in the figure below, which shows an example of a reclassification item. Looking at the details, you can see the line items of each posting, including the item type that identifies the type of posting, the financial statement item posted to, and both the consolidation unit and partner.

The consolidation process itself is another area in which the group reporting solution leverages previous development. It uses two monitors that were previously used in the SAP EC-CS and SAP BCS solutions: the Data Monitor to track data collection and preparation tasks, and the Consolidation Monitor (shown below) to follow up on the consolidation steps themselves.

Note that the Consolidation Monitor is helpful for monitoring the group closing process, but the long-term goal is to have a single process follow-up in place for both local close and group close. This is where an evolution to the advanced financial closing solution comes into play.

Conclusion

Financial consolidation has a long and interesting past. With group reporting, SAP has brought together the strongest elements of previous solutions while eliminating the inefficiencies of data movement, replication, and disconnected processes. Companies now benefit from continuous accounting, improved data quality, and unprecedented transparency—all within a unified platform.

As consolidation continues to evolve, SAP S/4HANA Finance for group reporting stands as the strategic solution moving forward.

Learn Group Reporting in Our Upcoming Rheinwerk Course!

Consolidate your organization’s finances using “Group Reporting with SAP S/4HANA!” From master data setup to intercompany eliminations and stakeholder-ready reports, master every step of the corporate close cycle and reconciliation process. Click on the banner below to learn more and order your ticket.

Editor’s note: This post has been adapted from a section of the book Group Reporting with SAP S/4HANA by Eric Ryan, Thiagu Bala, Satyendra Raghav, Azharuddin Mohammed, and Sumit Kukreja. Eric is an executive leader in the finance transformation and enterprise performance management (EPM) space with more than 18 years of experience. Thiagu is the solution owner for several next-generation consolidation solutions at Deloitte, where he leverages a modern digital finance architecture to drive innovation and efficiency. Satyendra is a specialist in the finance and EPM practice at Deloitte. Azharuddin is a financial consolidation subject matter expert at Deloitte. Sumit is a manager in the finance practice at Deloitte with more than 15 years of strong technical and financial accounting experience.

This post was originally published 2/2021 and updated 8/2025.

Comments