SAP Document and Reporting Compliance (also called SAP DRC) is SAP’s end-to-end solution for creating and managing the various types of compliance reporting mandates for an organization.

This includes but isn’t limited to electronic invoicing, e-invoicing, statutory reporting, real-time tax reporting, electronic document (eDocument) exchange, value-added tax (VAT) and Goods and Services Tax (GST) reporting, Standard Audit File for Tax (SAF-T), and other country-specific legal and regulatory requirements for tax and financial compliance.

This post delves into the core functionalities and architecture of SAP Document and Reporting Compliance, providing a detailed explanation of the key components for both the on-premise and cloud-based versions. You’ll gain a thorough understanding of how SAP Document and Reporting Compliance supports eDocument processing and statutory reporting, along with insights into user roles.

Key Frameworks and Architecture

SAP Document and Reporting Compliance enables users to create, process, and monitor eDocuments and statutory reports, while ensuring compliance with local legal obligations. Additionally, SAP Document and Reporting Compliance increases business organizations’ agility to respond to continuously evolving reporting mandates driven by digitalization trends, aiming to achieve a standardized, simplified, and efficient end-to-end reporting process worldwide. These mandates include e-invoicing, real-time financial transaction reporting, automated VAT reporting, and tax compliance monitoring. SAP Document and Reporting Compliance integrates seamlessly with minimal business processes redesign, ensuring accurate and timely submissions to tax authorities.

SAP Document and Reporting Compliance also provides a cloud component, which manages communication to tax authority portals, helping to integrate the solution across business processes and thereby enabling the seamless transmission of eDocuments and reports to tax authorities.

SAP DRC Framework

SAP Document and Reporting Compliance includes two main frameworks:

- eDocument processing framework

- Statutory reporting framework

Electronic Document Processing Framework

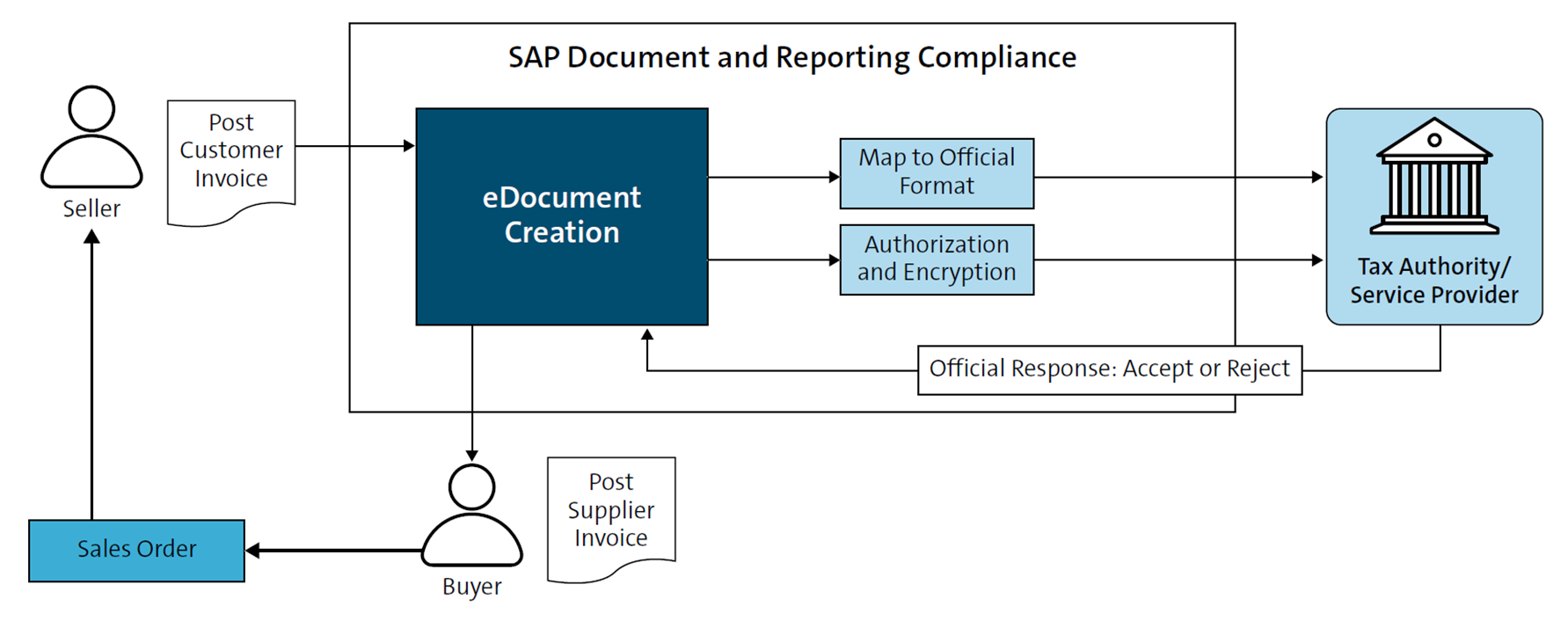

In the framework, eDocuments, such as invoices or transport registrations, comprise business information that is created, stored, and accessed using a structured digital format. Depending on the country’s mandate, the framework has been set up to process these eDocuments to be electronically transmitted to either the tax authority, a business partner, or an authorized third-party provider. For instance, the seller may send an e-invoice via a business partner’s e-invoicing platform with or without tax authorities. In addition, the invoice data can be electronically processed using the government tax authority platform. This framework is designed to comply with legal mandates that are applicable to various business scenarios and local requirements. The below figure illustrates the eDocument process in a business scenario involving buyers and sellers.

As shown, the process begins with the posting of customer invoices initiated by a sales order. These e-invoices are then automatically created and classified using predefined rules and criteria, facilitating easy retrieval and processing. Under SAP Document and Reporting Compliance, these eDocuments are then mapped to the various formats and standards matching external systems or tax authority requirements, thereby enabling seamless integration with mandatory compliance. With appropriate authorization and encryption, these eDocuments are routed to the tax authority by SAP Document and Reporting Compliance. Additionally, throughout this process, SAP Document and Reporting Compliance provides audit trails and tracking capabilities to ensure transparency and accountability.

Statutory Reporting Framework

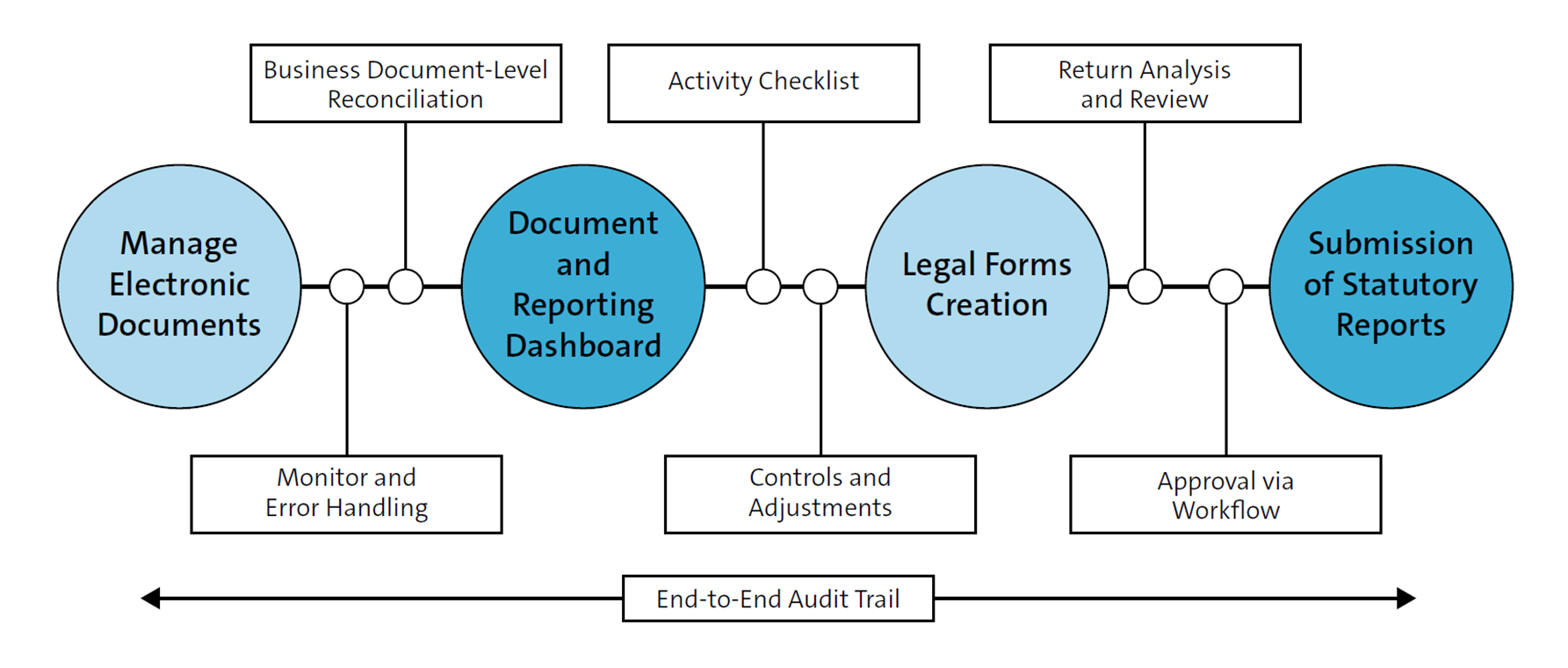

Statutory reporting is a set of tools and reports used to comply with legal and regulatory reporting requirements. Based on the jurisdiction and business scenarios, tax data exchange can be either periodic, real-time, or both. The submission process may be completely electronic or may require manual download or upload. This framework provides an automated solution to streamline tax reporting in country-specific legal formats using system recorded financial data. This figure illustrates the end-to-end process of filing a statutory report.

The process begins by collecting data from posted accounting documents in the source system. The next step involves configuring SAP Document and Reporting Compliance to generate statutory reports, which may include balance sheets, income statements, cash flow statements, VAT reports, and EC Sales List (ESL), tailored to meet specific local regulations.

After the reports are generated, they undergo multiple layers of review and approval process by the business’s tax team with appropriate controls to ensure compliance and accuracy before the submission to regulatory authorities. Throughout this process, SAP Document and Reporting Compliance has the documentation to support transparency and accountability in tax reporting and auditing.

Overview and Core Components of SAP DRC

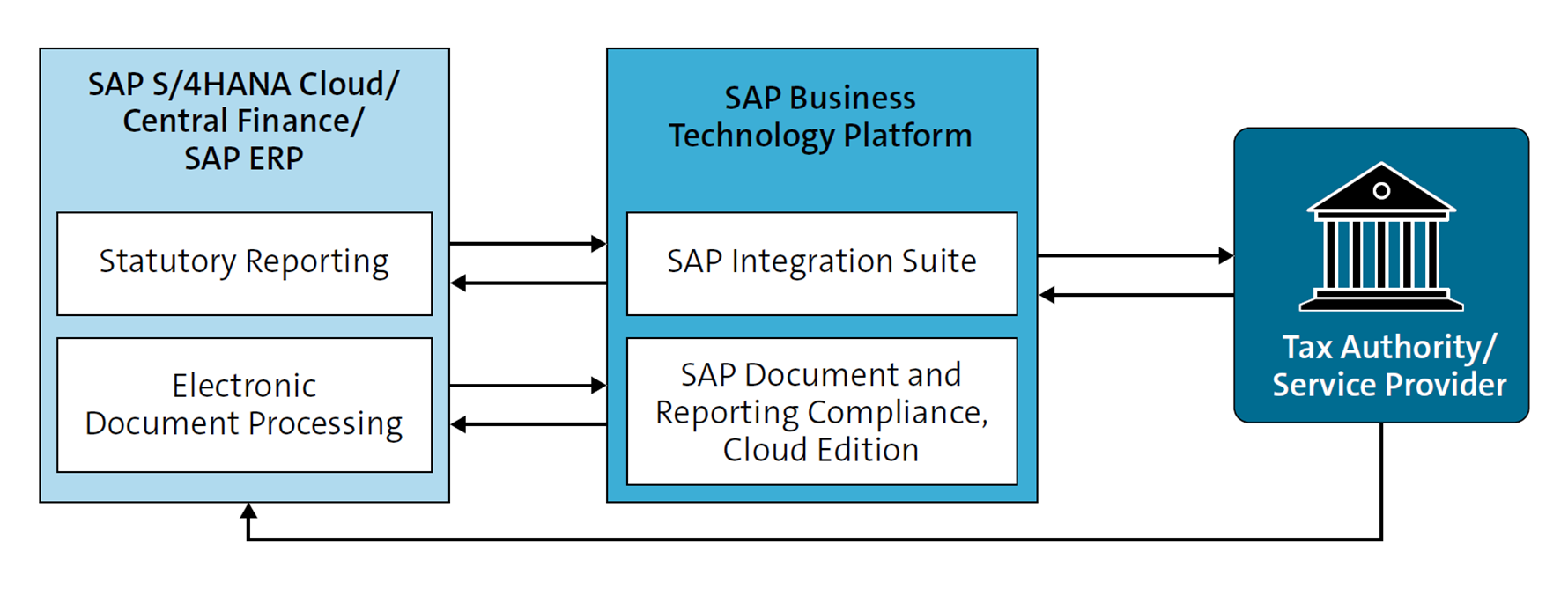

As shown in the next figure, the first component of SAP Document and Reporting Compliance comprises the two main frameworks we learned about in the previous section. From a deployment perspective, SAP Document and Reporting Compliance is available for all of SAP’s ERP installations, including SAP S/4HANA, SAP S/4HANA Cloud Private Edition, SAP S/4HANA Cloud Public Edition, SAP ERP, and Central Finance. Note that when SAP Document and Reporting Compliance is used alongside SAP ERP, it only supports the eDocument processing framework and not statutory reporting.

The second component, which is shown in the second box, displays the communication layer of the solution: SAP Business Technology Platform (SAP BTP). In this layer, the communication of electronic business documents and statutory reports is managed to go out to the tax authorities and other business partners. Communication is managed through SAP Integration Suite or SAP Document and Reporting Compliance, cloud edition. Both methods of transmission deliver the same final reporting content that can be accepted by the tax authorities.

The last component shows the recipient’s validation process. Approval or rejection responses will be sent back from external systems, and SAP Document and Reporting Compliance manages the process seamlessly.

With a basic understanding of the core framework of SAP Document and Reporting Compliance, let’s review some deployment options available for implementation.

SAP DRC Deployment Options

It’s important for businesses to know and understand options available to them to deploy SAP Document and Reporting Compliance capabilities. Let’s look at the four ERP deployment options and corresponding SAP Document and Reporting Compliance deployment for each, as follows:

SAP S/4HANA (on-premise) and SAP S/4HANA Cloud Private Edition

These are two closely related deployment models. SAP S/4HANA is installed and runs on hardware that is physically located in the client’s own data center or a data center they manage, whereas SAP S/4HANA Cloud Private Edition is hosted in a dedicated cloud environment, managed by SAP or a partner, without sharing with other customers.

This deployment option has the most access to SAP Document and Reporting Compliance tasks for both the eDocument processing and statutory reporting frameworks. The system’s user-friendly interface, known as SAP Fiori, offers a wide range of apps to improve productivity, including apps related to SAP Document and Reporting Compliance that we’ll explore later.

SAP S/4HANA Cloud Public Edition

This edition streamlines business processes and offers real-time data analytics and processing capabilities. The cloud-based nature of SAP S/4HANA Cloud ensures scalability and flexibility, allowing organizations to adapt to changing market conditions without the need for extensive IT infrastructure investments. As a public cloud system, multiple tenants use the same environment infrastructure, while tenant-specific data and configurations are isolated from each other.

Due to the system architecture being used by multiple tenants, significant customization of the system is limited to prevent any impact to other tenant systems. With regular updates and enhancements delivered through the cloud, organizations can leverage the latest features and capabilities without disruption, positioning themselves for success in a dynamic business environment. SAP S/4HANA Cloud Public Edition also uses the SAP Fiori interface and can run nearly all the same SAP Document and Reporting Compliance tasks as on-premise SAP S/4HANA and SAP S/4HANA Cloud Private Edition.

SAP ERP

SAP ERP is a traditional ERP solution that many organizations continue to use for managing their business processes. Unlike SAP S/4HANA, which is built on the SAP HANA database, SAP ERP typically runs on different databases—Oracle, Microsoft Azure, and so on—and provides a more conventional approach to ERP. Despite being an older system, SAP ERP remains a viable option for businesses that haven’t yet transitioned to SAP S/4HANA, offering robust functionality across various business domains. For statutory reporting, SAP ERP offers a variety of reports that aren’t part of the SAP Document and Reporting Compliance framework. Instead, these reports are typically developed using ABAP, SAP’s proprietary programming language. ABAP reports are highly customizable, allowing organizations to tailor their statutory reporting to comply with local regulations and business requirements.

This flexibility is crucial for businesses operating in multiple jurisdictions with varying compliance standards. Although SAP Document and Reporting Compliance is primarily designed for SAP S/4HANA systems, SAP does provide integration options to connect SAP ERP with SAP Document and Reporting Compliance. However, the scope of SAP Document and Reporting Compliance is substantially more limited than the SAP S/4HANA systems—containing less than half the supported compliance tasks.

Central Finance

This solution is designed for heterogeneous system landscapes, ideal for businesses that run on various source systems. Central Finance acts as a centralized hub that aggregates financial data from various SAP and non-SAP systems, enabling real-time financial reporting and analysis. The primary advantage of Central Finance is its ability to harmonize financial data without requiring a full-scale migration of existing systems. By replicating financial transactions into a central SAP S/4HANA system, organizations can achieve a consolidated view of their financial status, improving decision-making, and strategic planning.

This approach allows businesses to maintain their existing ERP systems while benefiting from the advanced features of SAP S/4HANA, such as enhanced reporting, real-time analytics, and streamlined financial operations. As Central Finance is a centralized data hub containing replicated financial transactions, SAP Document and Reporting Compliance functionality is limited to the statutory reporting framework and therefore has less compliance tasks available than the SAP S/4HANA systems.

In summary, the eDocument processing framework and statutory reporting framework are available for both SAP S/4HANA Cloud Private Edition and SAP S/4HANA Cloud Public Edition. Organizations who haven’t yet started their transformation journey to SAP S/4HANA can still leverage SAP Document and Reporting Compliance in SAP ERP and Central Finance, but to a lesser extent.

SAP DRC User Experience

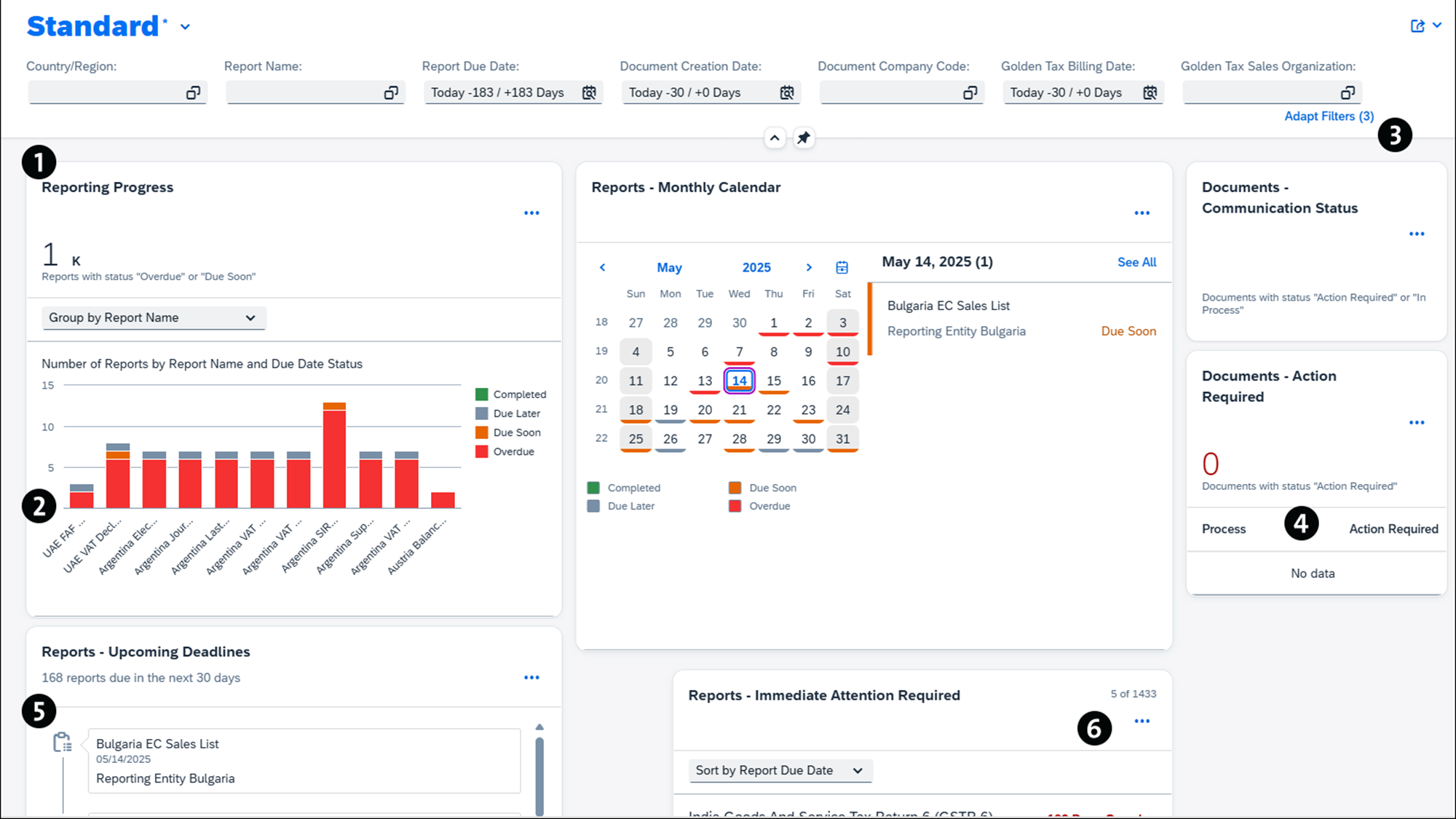

SAP Fiori is a user experience platform designed to streamline and simplify interactions with SAP applications, offering a role-based, responsive interface across devices. Built on SAP Fiori’s user-centric design principles, the Manage Document and Reporting Compliance dashboard offers a unified and harmonized method of displaying and addressing document and reporting processes. You can use this dashboard to monitor, process, and submit required documents in line with local and international regulations.

As indicated in the above figure, the dashboard is a centralized cockpit that delivers real-time business insights (1), enabling you to efficiently filter information by country, region, document status (2), and other relevant parameters to quickly ascertain the status of specific processes (3). It further provides tailored statistics on pending documents or action items based on each user’s business role (4). All sections in the dashboard are customizable, and you can create personalized views that are suitable for your business needs. By offering comprehensive end-to-end process visibility (5), this dashboard greatly improves your ability to promptly identify and address any inconsistencies (6).

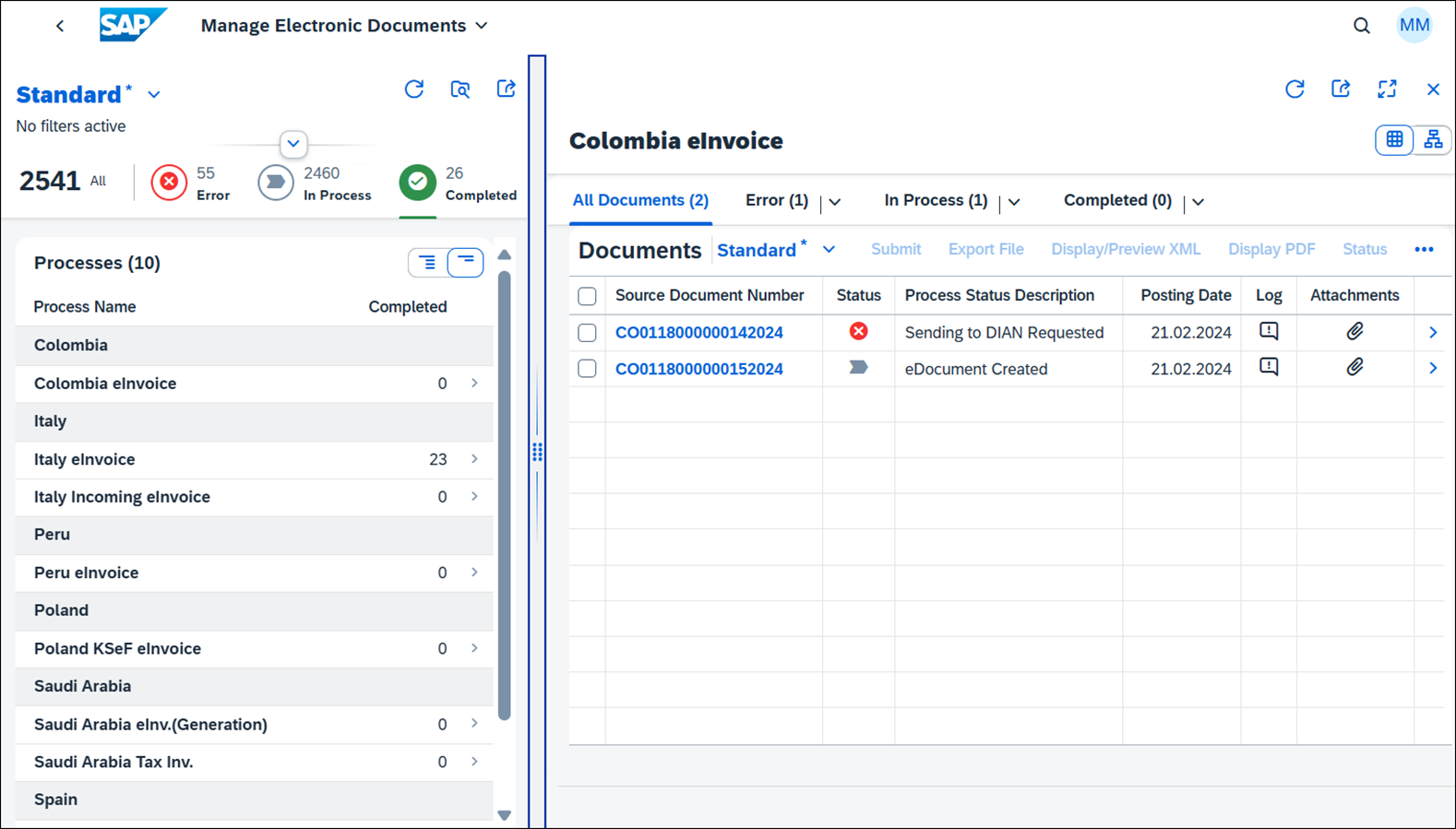

In addition to the dashboard, SAP has introduced the Manage Electronic Documents app. With this SAP Fiori app, you can monitor compliance activities and generate accurate reports, supported by advanced analytics and visualizations for informed decision-making.

The main console page of the Manage Electronic Documents app consists of two primary components: a status overview for all eDocuments and a view of eDocuments for a specific country/region process. As shown in the previous figure, under Standard view, you can search for documents using the filter options located in the top-left corner. The bottom left displays a central monitor for all scenarios that you’re authorized to view. This view provides you with a breakdown of the number of eDocuments that are complete, in process, or with errors. On the right side, the system overview bar displays a detailed view of documents for each country/region. Specifically, you can generate a PDF for each eDocument, navigate to the interface monitor, or trace back to the source document. More importantly, this component enables local capabilities that allow you to switch to contingency, import data from non-SAP systems, forward documents to customers, and accept or reject the documents.

If you expand the country-specific view as shown in the next figure, you can select one or more documents and perform different actions for the selected set via the selection options listed in the top-right corner, such as Submit, Display/Preview XML, and so on. By selecting a document and clicking the right arrow, users can view more detailed information about the chosen document. Drilling down each document, you can perform root-cause analysis on documents with errors. Clicking Logs displays all messages for the chosen document. If the document contains errors, you can click Go to Error Analysis to see the SAP-recommended actions for error-resolution options.

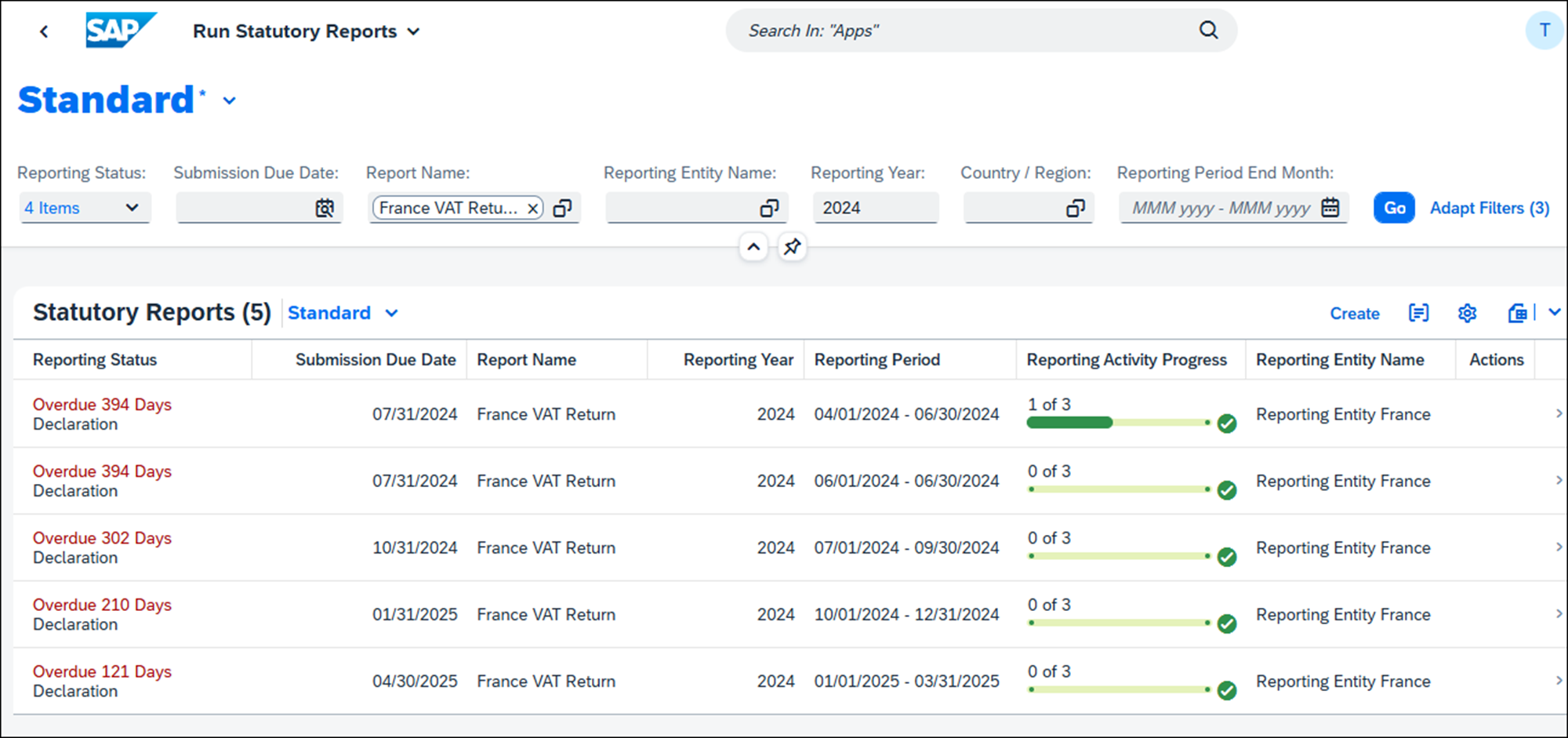

In addition to eDocument management, SAP Fiori apps are also extended to streamline statutory reports. The Run Statutory Reports app in SAP Fiori is a specialized app designed to facilitate the generation, management, and submission of statutory reports required by regulatory authorities.

This application provides a streamlined interface that guides you through the entire compliance reporting process. You can select the relevant statutory report type and reporting period, then trigger data extraction and report generation based on predefined templates and regulatory formats. The application enables users to validate report data, review errors or warnings, and make necessary corrections before submission. Where supported, reports can be submitted electronically to authorities, or alternatively, exported in required formats such as XML, PDF, or TXT. Additionally, the app allows you to track the status of each report submission and maintain an audit trail, ensuring robust compliance and transparency throughout the reporting lifecycle.

As shown in the next figure, the Standard view of the Run Statutory Reports app displays a list of statutory reports based on the user-defined parameters and an overview of the reporting status of each statutory report. Additionally, you have options to drill down into the activity progress of each statutory report and complete an end-to-end workflow from return generation to submission, which will be touched on in detail in later chapters.

Conclusion

This post provided a comprehensive introduction to SAP Document and Reporting Compliance, beginning with an exploration of its key frameworks and architecture, including an overview of core components, deployment options, and the user experience.

Editor’s note: This post has been adapted from a section of the book SAP Document and Reporting Compliance: The Comprehensive Guide for Finance and Tax by Genevieve Watson, Eliza Alberts-Muller, and Iain MacIntosh. Genevieve is an experienced tax ERP and transformation leader, and a Partner within Deloitte's Tax Technology Consulting team. Eliza is a Partner within Deloitte‘s Tax Technology Consulting team with close to 20 years of experience in (indirect) tax and tax technology gained both in industry and consulting. Iain is a Principal at Deloitte with more than 25 years of experience implementing SAP.

This post was originally published 10/2025.

Comments