The Accounting views (i.e., Accounting 1 and Accounting 2) of the SAP material master hold specific data about how the material is valuated, along with several other accounting properties.

Accounting 1 View

The Accounting 1 view contains five subviews: current period, last period, future costing run, current costing run, and previous costing run.

The subviews for the Current Period and Last Period contain two sections: General Valuation Data and Prices and Values, which are described as follows.

General Valuation Data

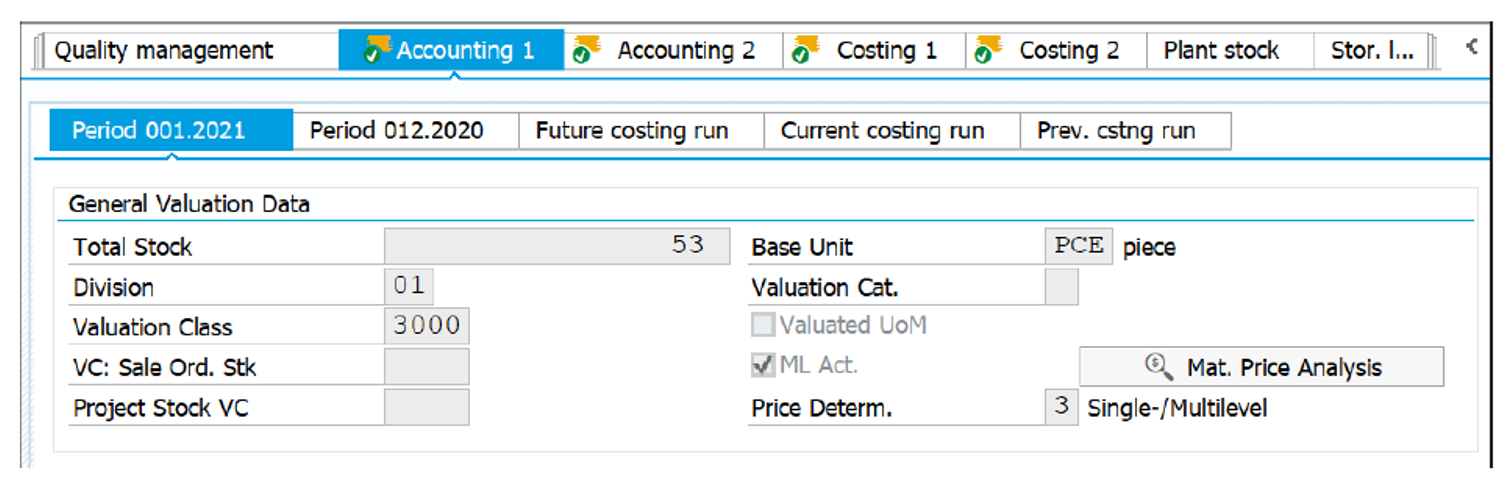

In this section, we will discuss the General Valuation Data of the Accounting 1 view of the material master, as shown in this figure.

Total Stock

Displays the total valuated quantity of a material with the same valuation criteria (i.e., the valuation area and the valuation type).

Base Unit

This is the unit of measure that is used for stock keeping, as already maintained in the Basic Data 1 view.

Division

This is the same as that assigned in the Basic Data 1 view.

Valuation Cat. (valuation category)

If you are using split valuation, then the valuation category is used to determine if the material stocks should be valuated together or separately.

Split valuation allows the materials stocks to be valuated at a procurement type level (produced in-house or externally) or based on stock origin (i.e., batches).

Valuation Class

This determines the G/L account to which material stocks are valuated—for example, you can create one valuation class for raw materials and one for raw materials (interplant).

VC: Sale Ord. Stk (valuation class for sales order stock)

You can use this to assign a different valuation class for sales order stocks so that stocks are posted to different G/L accounts.

ML Act. (material ledger active)

This indicator can be used to specify if the material ledger is active. The material ledger collects transaction data for materials for calculating the prices of the materials to be valuated.

Project Stock VC (valuation class for project stock)

You can use this to assign a different valuation class for project stocks so that stocks are posted to different G/L accounts.

Price Determ. (price determination)

Price determination enables the selection of methodology for determining whether the material should be valuated at a per unit cost or based on the transaction (material movement). The cost determined is updated in price in the Accounting 1 view of the material master record.

Prices and Values

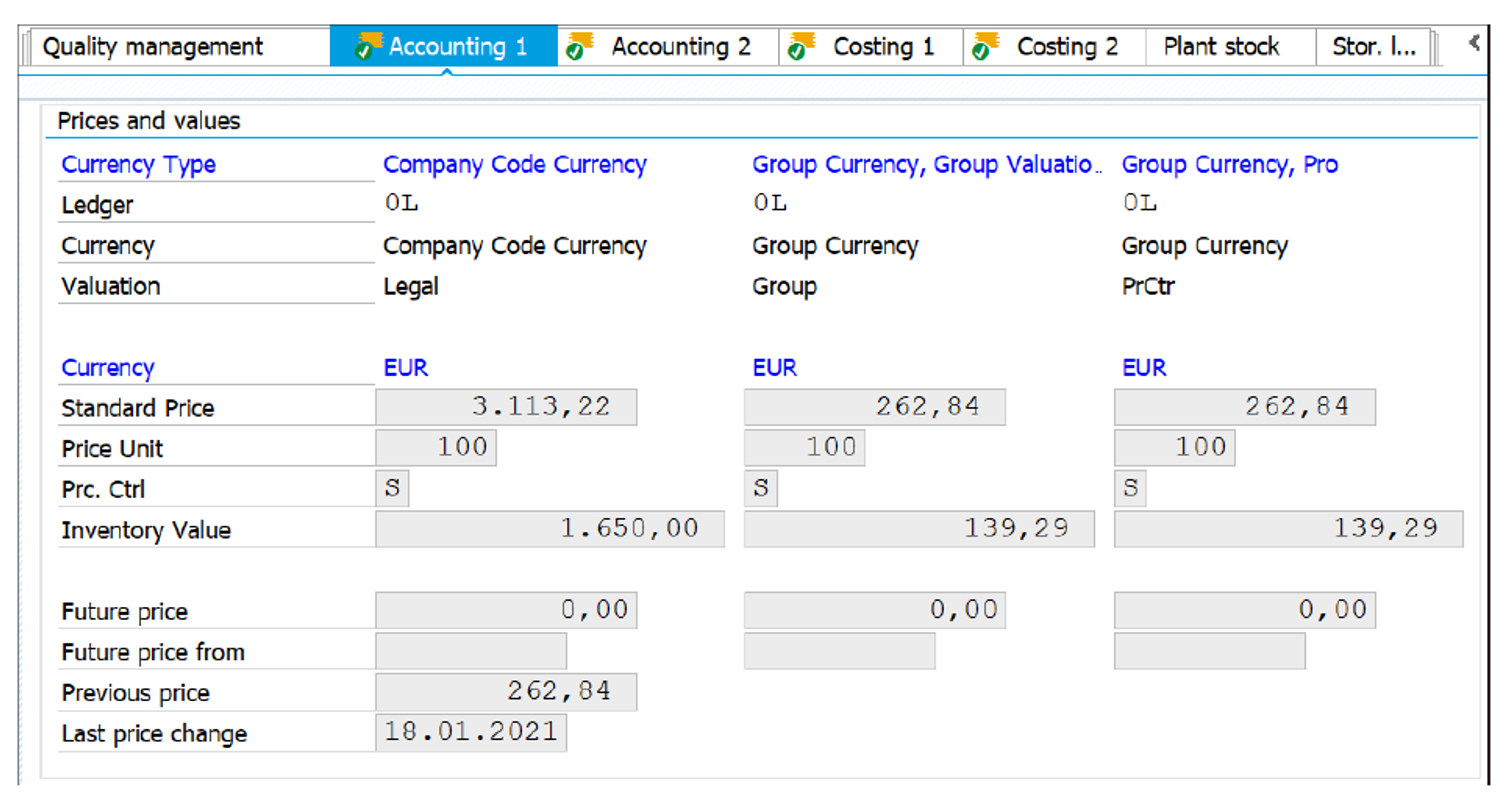

In this section, we will discuss the Prices and Values section of the Accounting 1 view of the material master, as shown in this figure.

Prc. Ctrl. (price control)

You can use this indicator to specify how the stocks of the material are valuated. The system allows you to choose one of the following methods for stock valuation:

- Price Control (S) Standard Price: This is a fixed price that is maintained manually.

- Price Control (V) Moving Average Price/Periodic Unit Price: This is a variable price that is calculated based on the goods movement and invoice postings.

Price Unit

This specifies the base quantity in which a price is maintained—for example, a tire costs €50, so the price is €50 and the price unit is 1. Similarly, 12 cans of beer cost $8, so the price unit is 12.

Moving price

The moving average price is calculated by the system automatically, dividing the value of the material by the quantity of the material in stock after each goods movement or invoice entry. The system calculates the moving average price and updates the material master, even if you are using the standard price for reporting purposes.

When compared to SAP ERP, the statistical moving average price is no longer available in SAP S/4HANA.

Standard Price

This is the constant price at which a material is always valuated. Standard price can be maintained manually, but it should be a result of the costing run. This price is not changed with goods movements and invoice postings, like in moving average price calculation.

Inventory Value

This displays the total value of the valuated stocks for the material. The value displayed is the currency shown above in the “Currency” field.

Valuation Based on the Batch-Specific Unit of Measure

You can use this indicator when you want the material to be valuated at a batch-specific unit of measure. You can maintain a valuation price for the batch unit of measure, which is used to determine the stock valuation of the material at the batch level based on the proportion quantity or product quantity.

Future Price

Let’s assume the price of your material will increase in the coming months; then you can maintain the new price in Future Price with Valid from Date. The future price is the price at which materials will be valuated.

Valid from Date

This specifies the date from which the future price will be active.

Previous Price

The field displays the last price of the material just before the price was changed manually. It is updated by the system automatically.

Last Price Change

This specifies the last date when the price was changed manually.

Previous Period/Year

If you click on this button, a new pop-up screen is displayed, which shows material valuation data like valuation class, price control, standard price, moving price, and so on for the previous period and previous year. This field is no longer available in SAP S/4HANA and is only available in SAP ERP.

Standard Cost Estimate

If you click on this button, a new pop-up screen is displayed that shows cost estimate data like price updated by cost estimates for the current period, previous period, and so forth. This field is no longer available in SAP S/4HANA and is only available in SAP ERP.

Accounting 2 View

The Accounting 2 view contains two sections: Determination of Lowest Value and LIFO Data.

Determination of Lowest Value

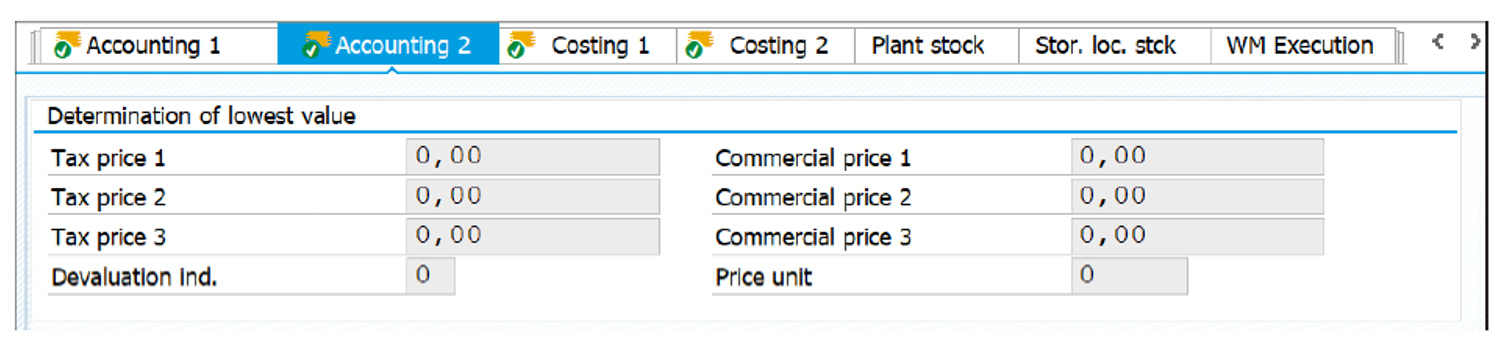

In this section, we will discuss the Determination of Lowest Value section of the Accounting 2 view of the material master, as shown below.

Tax Price 1

Specifies the price at which the material should be valuated for calculating taxes.

Commercial Price 1

Specifies the price at which the material should be valuated for commercial purposes.

Tax Price 2

Specifies the price at which the material should be valuated for calculating taxes by considering the lowest price of the previous year. Tax Price 2 is calculated based on the range of coverage and movement rate.

Commercial Price 2

Specifies the price at which the material should be valuated for commercial purposes by considering the lowest price of the previous year. Commercial Price 2 is calculated based on the range of coverage and movement rate.

Tax Price 3

Specifies the price at which the material should be valuated for the reasons of tax law, calculated by the FIFO (First in First Out) valuation of the previous year.

Commercial Price 3

Specifies the price at which the material should be valuated for the reasons of commercial law, calculated by the FIFO valuation of the previous year.

Devaluation Ind. (devaluation indicator)

You can use this indicator for slow-moving or non-moving materials; it specifies the number of years a material is not fast-moving. The valuation rule for devaluation is defined in customization, which is used for calculating reduced prices based on the number of years of slow-moving or non-moving.

Price Unit

Specifies the unit of measure for which the material is valuated for tax and commercial prices.

LIFO Data

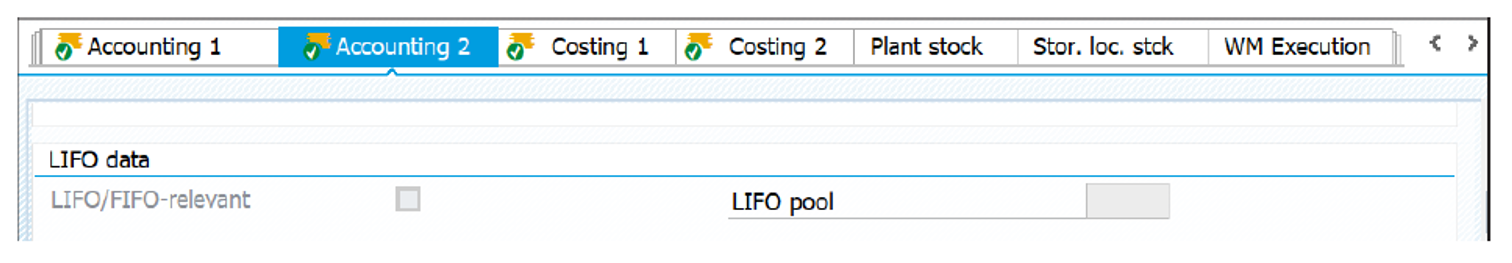

In this section, we will discuss the LIFO Data section of the Accounting 2 view of the material master, as shown here.

LIFO/FIFO-relevant

Indicates if the material is relevant for inventory flow methods based on LIFO (last in, first out) or FIFO (first in, first out). If one activates this indicator, the batches produced first are sold first to the customer (FIFO) or the component batches received last are consumed first (LIFO).

LIFO pool

When using LIFO for material movement, you can group materials together using an alphanumeric LIFO pool key. Materials with the same LIFO pool key will be valuated together in a pool.

See why the material master is important in SAP S/4HANA here.

Editor’s note: This post has been adapted from a section of the e-book Introducing the Material Master in SAP S/4HANA by Himanshu Goel.

Comments