Financial consolidation is the aggregation of the financial statements of a group of companies into one as a consolidated financial statement.

Those who have not spent time working in corporate accounting or implemented consolidation systems such as SAP Business Planning and Consolidation (SAP BPC) may not have a good idea of what the month-end process entails.

This blog post will show you the fundamentals of consolidation with SAP BPC. You’ll learn the four major steps in the process: prepare, collect, consolidate, and report. Then you’ll discover business rules to follow. The nice thing about the information outlined in this piece is that no matter which version of SAP BPC you’re working with, you’ll be able to follow along.

Let’s get started, shall we?

Why Companies Consolidate Financial Data

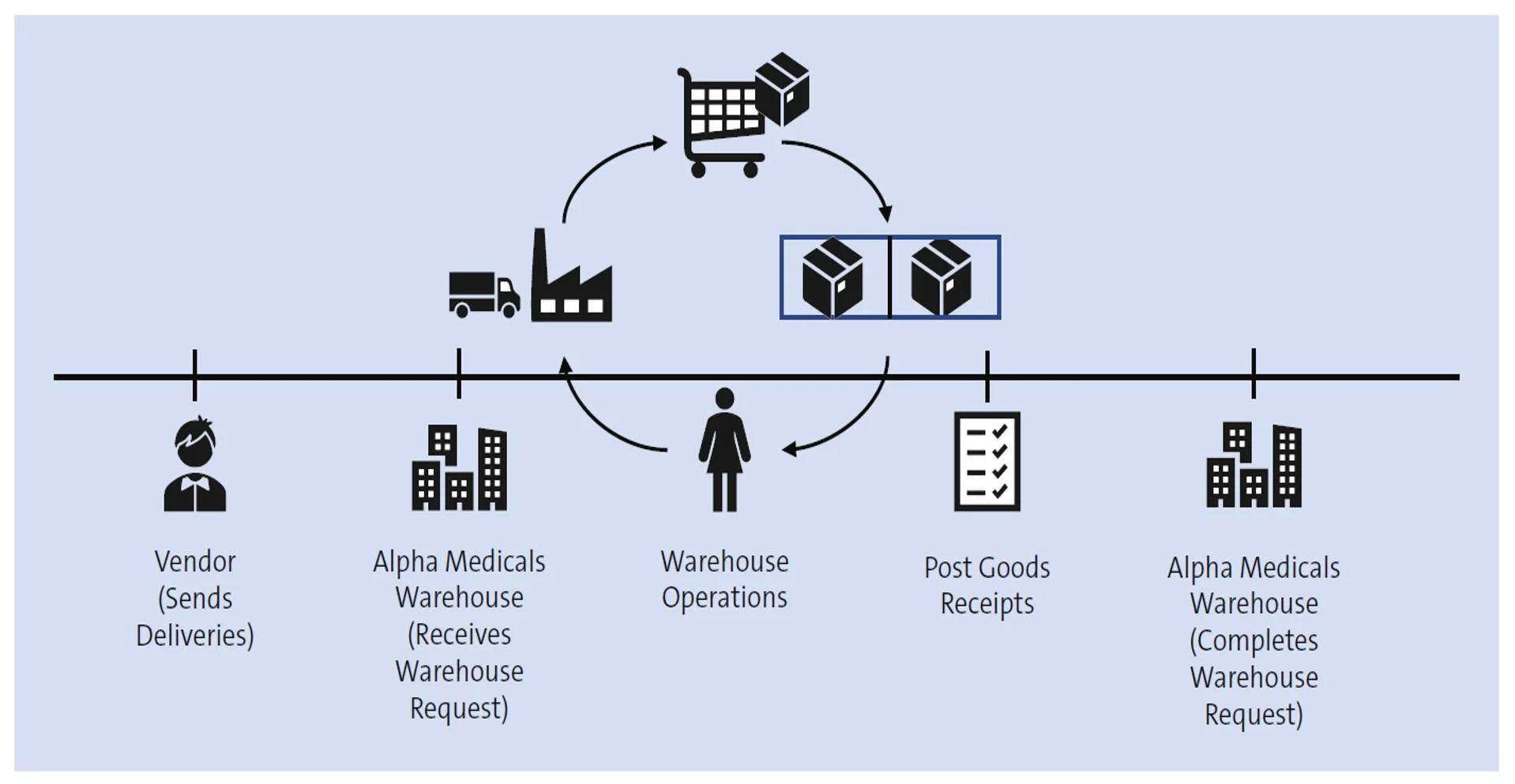

The primary reason corporations need to consolidate their financials at month end is that they are made up of multiple legal subsidiaries in one or more countries. As an example, the figure below outlines an ownership investment structure. In this example, the corporate holding company is C9000, and it’s based in the United States.

This corporation operates in a few different countries in the Americas, Europe, and Asia Pacific, and therefore it uses a few different local currencies and may also use multiple accounting standards such as US Generally Accepted Accounting Principles (US GAAP) and International Financial Reporting Standards (IFRS).

In addition, subsidiaries can have a variety of ownership relationships, such as total ownership, like Japan in the figure above (C9000 owns 100% of C5000), or the UK subsidiary, which has 80% of its shares owned by Germany. In the Europe group, for example, the financial statements at the group level must reflect the fact that Germany has an ownership interest in UK’s equity.

Also, there are usually transactions between the subsidiaries, so each company can have intercompany sales, cost of goods sold (COGS), intercompany accounts payable (IC AP) and receivables (IC AR), and the like on its books.

Using the prior example as a backdrop, the goal of the consolidation process is to generate a set of group financial statements in the group currency with values that reflect the group accounting standards. Because this corporation is based in the United States, the group currency will be USD, and US GAAP will be the set of standards to go by.

The consolidated financial statements also need to only reflect third-party transactions, not intercompany, so all intercompany sales, COGS, IC AP, IC AR, and so on need to be eliminated.

Next, let’s go over a typical month-end close from a functional perspective.

Performing Consolidation with SAP BPC

From a broad perspective, there are four key steps when preparing for and executing consolidation.

1 Prepare

The prepare step includes the setup of the dimensions, loading the master data, creating the business rules, and configuring the security to support the process of consolidation.

2 Collect

The collect step involves collecting data via manual entry, file uploads, SAP ERP integration, and journal entries (JEs). Then the data is validated, and currency translation is performed.

3 Consolidate

The consolidate step involves running the eliminations, reclassification, and data validation.

4 Report

The report step involves analyzing the data via the Enterprise Performance Management (EPM) add-in for Excel, drilling through to SAP Business Warehouse (SAP BW) queries and SAP ERP, and using SAP BusinessObjects Dashboards.

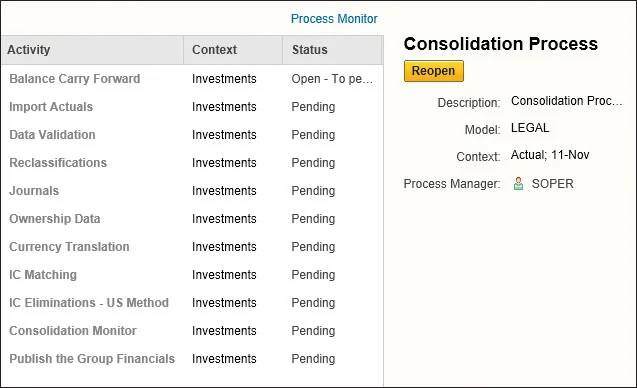

Now, let’s walk through a more detailed set of month-end activities. A sample list of steps can be viewed from the business process flow (BPF) in the figure below. The following list includes the steps in a typical consolidation BPF:

Balance Carry Forward

The classic first step is to carry forward the prior year balance sheet closing balances into the current year opening balances.

Import Actuals

Then the current month’s financial data from the local subsidiaries is imported into planning and consolidation.

Data Validation

A data validation to perform integrity checks such as assets = liabilities and owner’s equity can be run at this point, as well as later in the process.

Reclassifications

Automated adjustments can be run at this point in the process, as well as later.

Journals

Manual adjusting entries to meet the group standards can be entered at this point in the process, as well as later.

Ownership Data

The ownership methods and percentages are entered into the ownership model.

Currency Translation

Local currency is translated into other reporting currencies if necessary.

IC Matching

IC AP/AR differences must be identified and booked.

IC Eliminations—US Method

IC revenue and COGS, for example, are eliminated.

Consolidation Monitor

The Consolidation Monitor is used to run group currency translation and ownership eliminations, for example.

Publish the Group Financials

The final set of financial statements is published.

The steps in your month-end closing process may vary from this example. For instance, you may not use the IC Eliminations—US Method. Also, the sequence of the steps may vary; for example, you might update the ownership data in the very first step.

At this point, you should have a better understanding of the reasons for consolidation and what the process entails. Because the business rules are the center of attention when it comes to consolidating financial statements, let’s discuss those next.

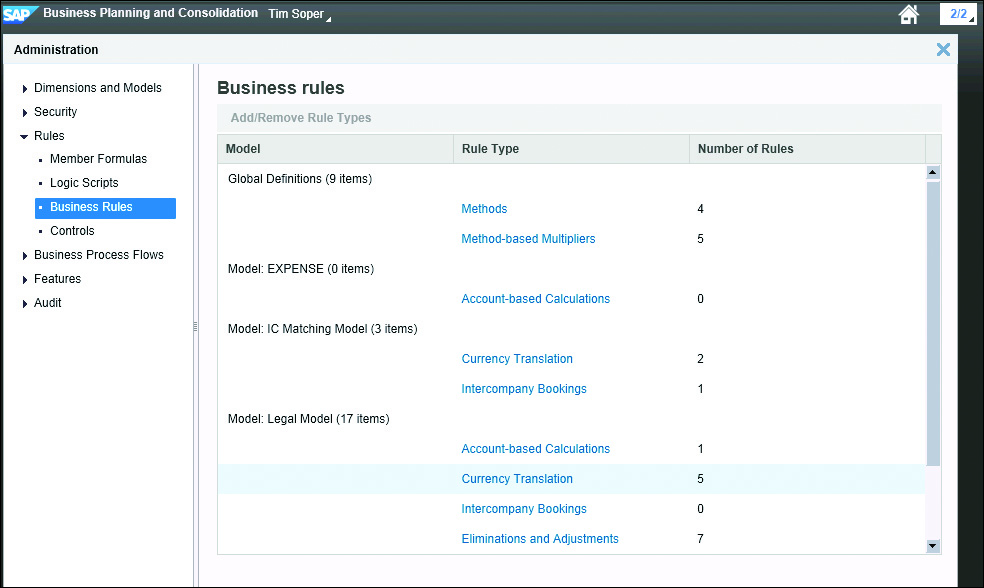

Introducing Business Rules for SAP BPC

First, let’s define business rules and discuss how to turn them on. At the 50,000-foot level, business rules are defined as the planning and consolidation user interfaces to enter metadata into database tables. The metadata includes, for example, source dimension members, target dimension members, filtering criteria, and settings that are used to control the calculations. The system uses ABAP code to read the business rules to perform calculations and ultimately write data records into the InfoCube.

Business rules are defined at the environment level, grouped under the Global Definitions and at the model level. There are two environment-level business rules:

1 Methods

These are different types of consolidation methods such as the 86-Purchase Method, 70-Proportional Method, 90-Holding Method, and 30-Equity Method.

2 Method-based multipliers

This table contains rules that are used to select entity source values and apply percentages to those values to ultimately book new data records.

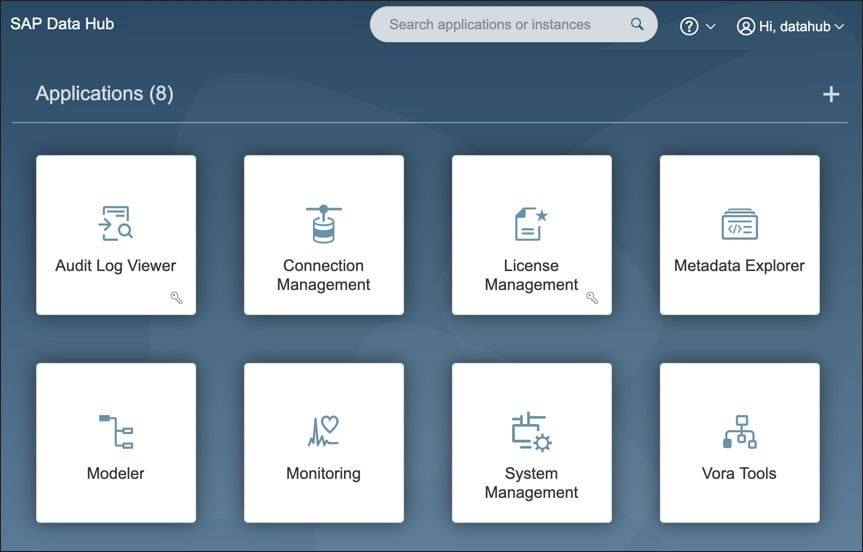

On the Administration tab, the Methods and Method-based Multipliers are grouped under Global Definitions, as shown below.

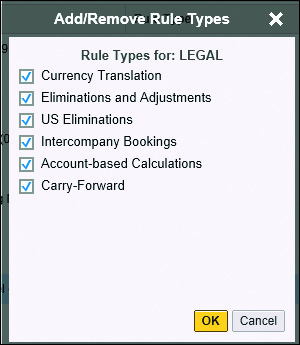

There are six business rule types for consolidation-type models, as listed here and shown in the figure below:

1 Currency Translation

This rule is used to translate local currency values into reporting and group currency.

2 Eliminations and Adjustments

This rule is used to eliminate ownership, as well as other intercompany activities.

3 US Eliminations

This is used to perform simpler IC activities, such as revenue and COGS.

4 Intercompany Bookings

This rule is used to book IC differences, as mentioned previously in the IC matching step.

5 Account-based Calculations

This is used to perform reclassifications.

6 Carry-Forward

This is used to carry forward prior period closing balances.

To use a business rule for a model, you must activate it by going to the web client and choosing Planning and Consolidation Administration > Rules > Business Rules > Select Add/Remove Rule Types.

Conclusion

When it comes time to consolidate financials for month-end close, using a solution such as SAP BPC to perform the consolidation can save you time and make your statements easy to read. This ensures a holistic picture of your financial status and properly reported information. This blog post introduced you to basic consolidation with SAP BPC, including the four steps, and provided you with business rules to follow when combining statements.

If you’re planning on making the move to next-generation SAP, check out this blog post on the key changes to period-end closing in SAP S/4HANA Finance.

Editor’s note: This post has been adapted from a section of the book Implementing SAP Business Planning and Consolidation by Peter Jones and Charles Soper.

Comments