An asset transfer represents the acquisition of one asset and the retirement of another asset. Therefore, you’ll need to configure asset transaction types for acquisitions and retirements that will be used during the transfer process.

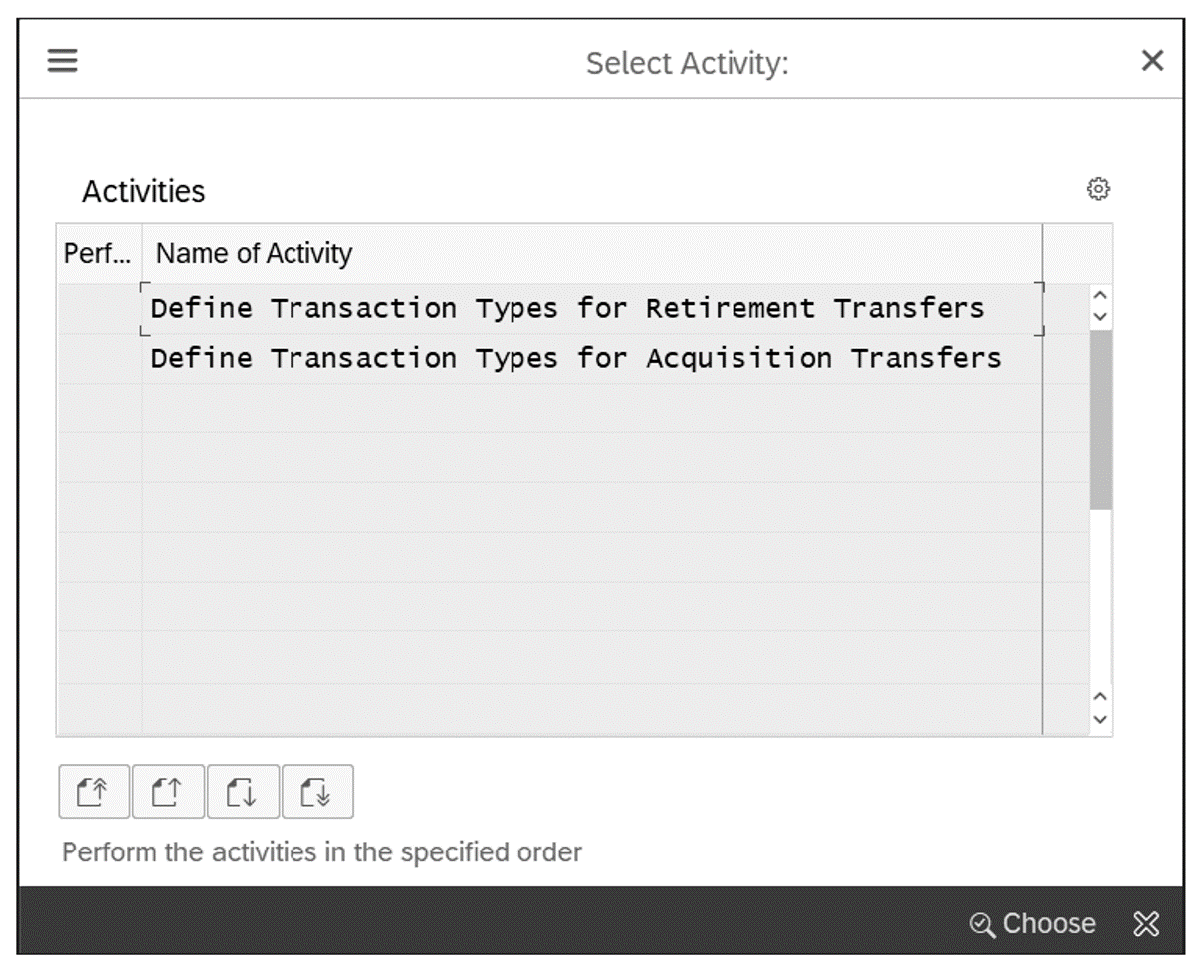

To configure transaction types for transfers in SAP S/4HANA Finance, follow the menu path Financial Accounting > Asset Accounting > Transactions > Transfer Postings > Define Transaction Types for Transfers. On the first screen, shown below, choose between asset transaction types for acquisitions and retirements.

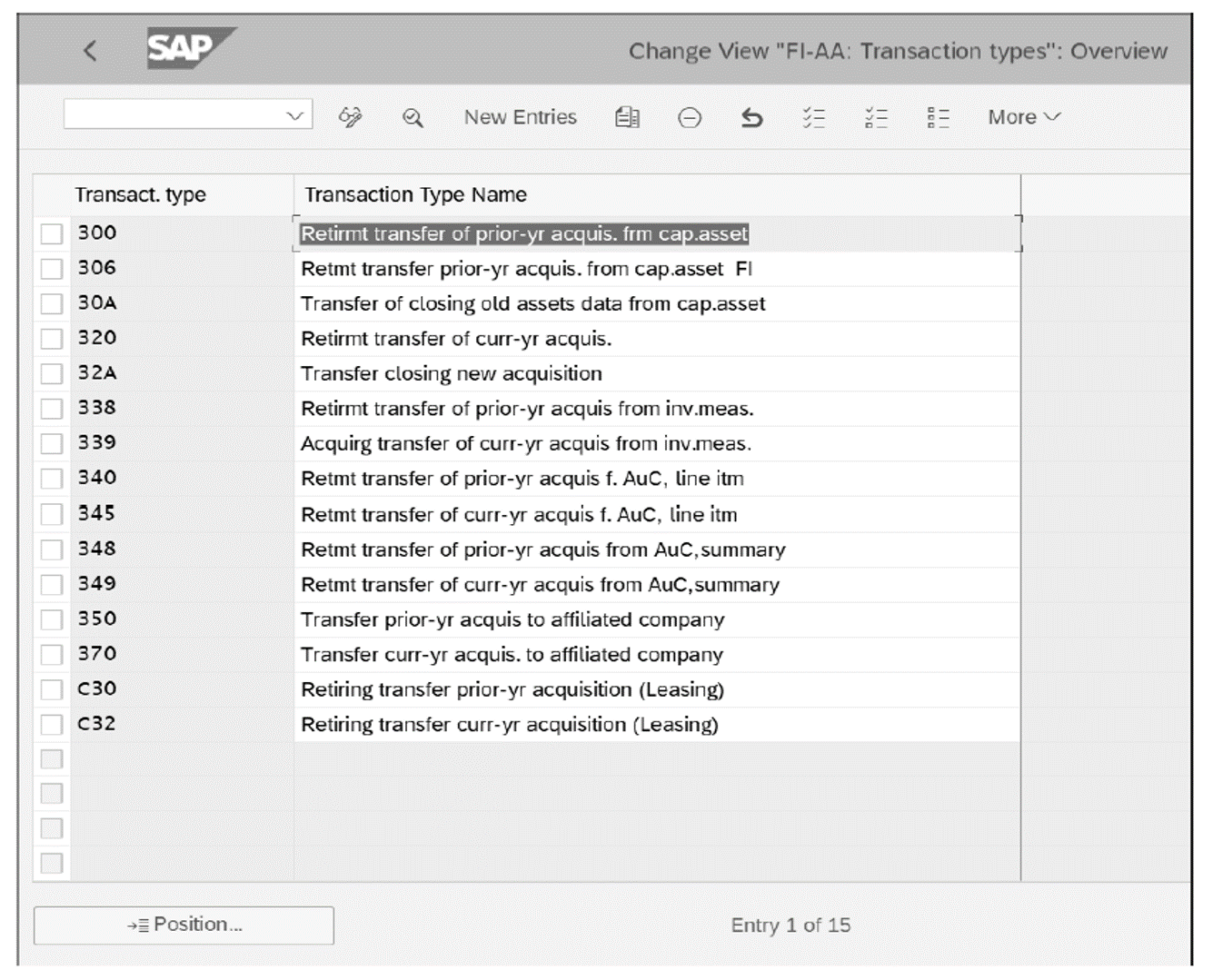

Double-click on Define Transaction Types for Retirement Transfers see a list of the standard retirement transaction types for transfers, as shown here.

You’ll see various transaction types that have been defined for various situations, such as prior-year or current-year acquisitions, assets under construction, and so on.

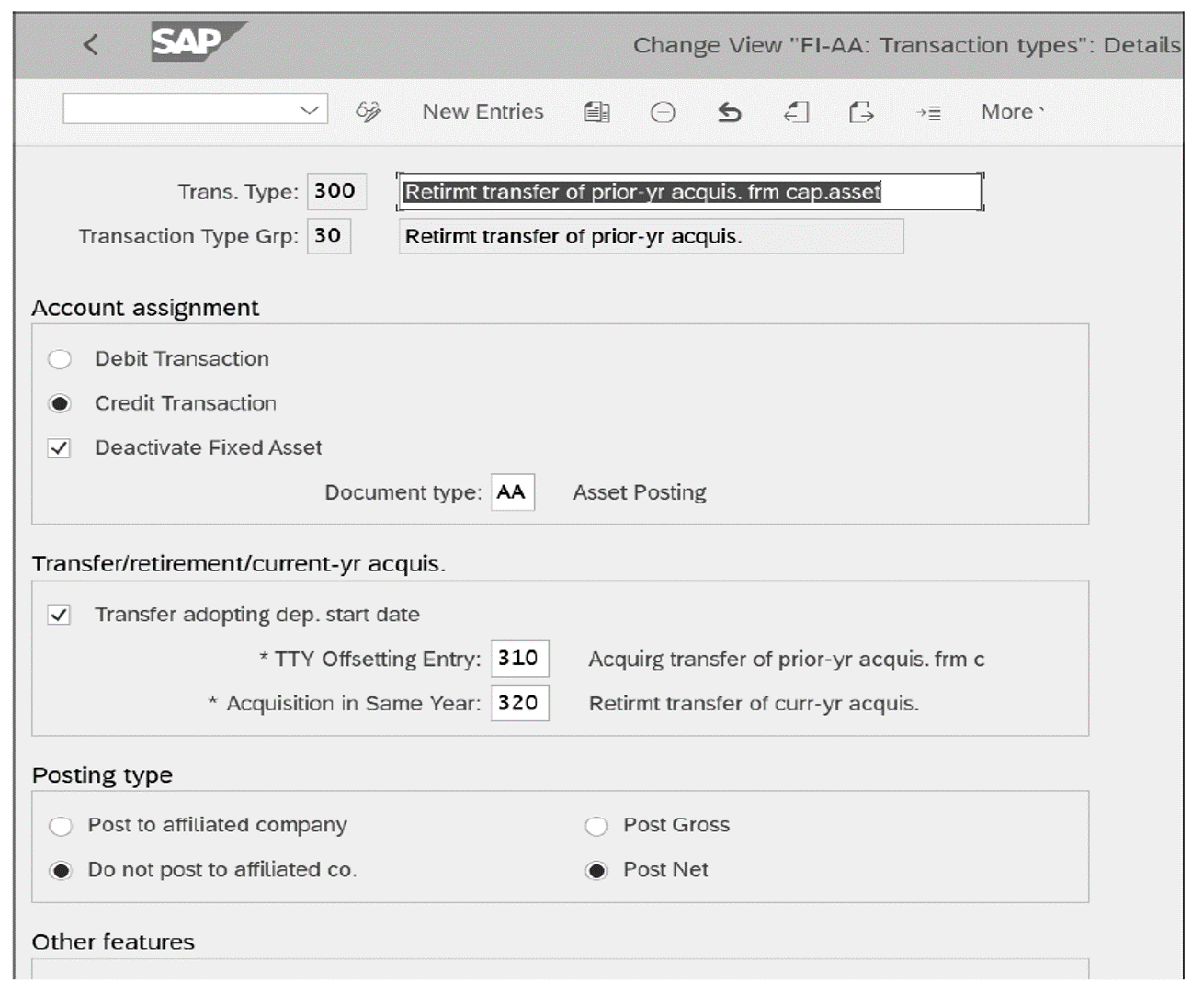

Double-click transaction type 300 Retirmt transfer of prior-yr acquis. frm cap.asset to review its settings. Its configuration details are shown in the next figure.

Notice that we’ve selected the Deactivate Fixed Asset checkbox because this transaction type is for retirements. Also, this transaction is a credit transaction because the retirement process credits the fixed asset. Notice also that the transaction type does not post to an affiliated company as indicated in the Do not post to affiliated co. radio button since this transaction type is intended for transfers within the same company code. Also important is transaction types 310, assigned as the offsetting transaction type, and transaction type 320, assigned as the transaction type to be used for acquisitions in the same year. Also, this transaction type posts a net value, which means that no accumulated depreciation will be transferred.

If you need to make any changes to this or other standard transaction types, copy the standard transaction type that most closely meets your needs and create a new transaction type in the custom name range, starting with Z or Y.

4

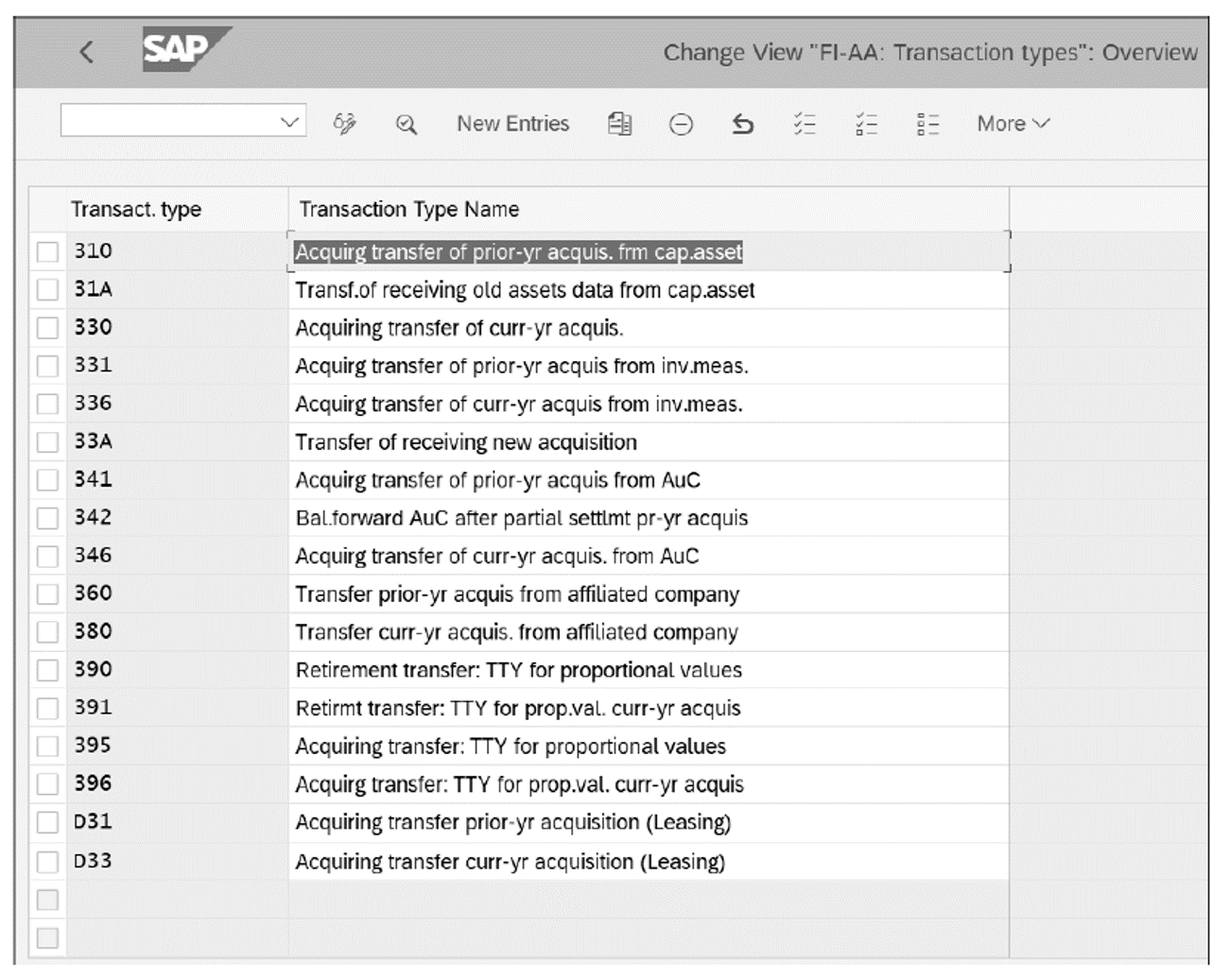

Going back to the choose activities screen, shown earlier, double-click on Define Transaction Types for Acquisition Transfers. Then, you’ll see defined transaction types for acquisitions in the transfer process, as shown below.

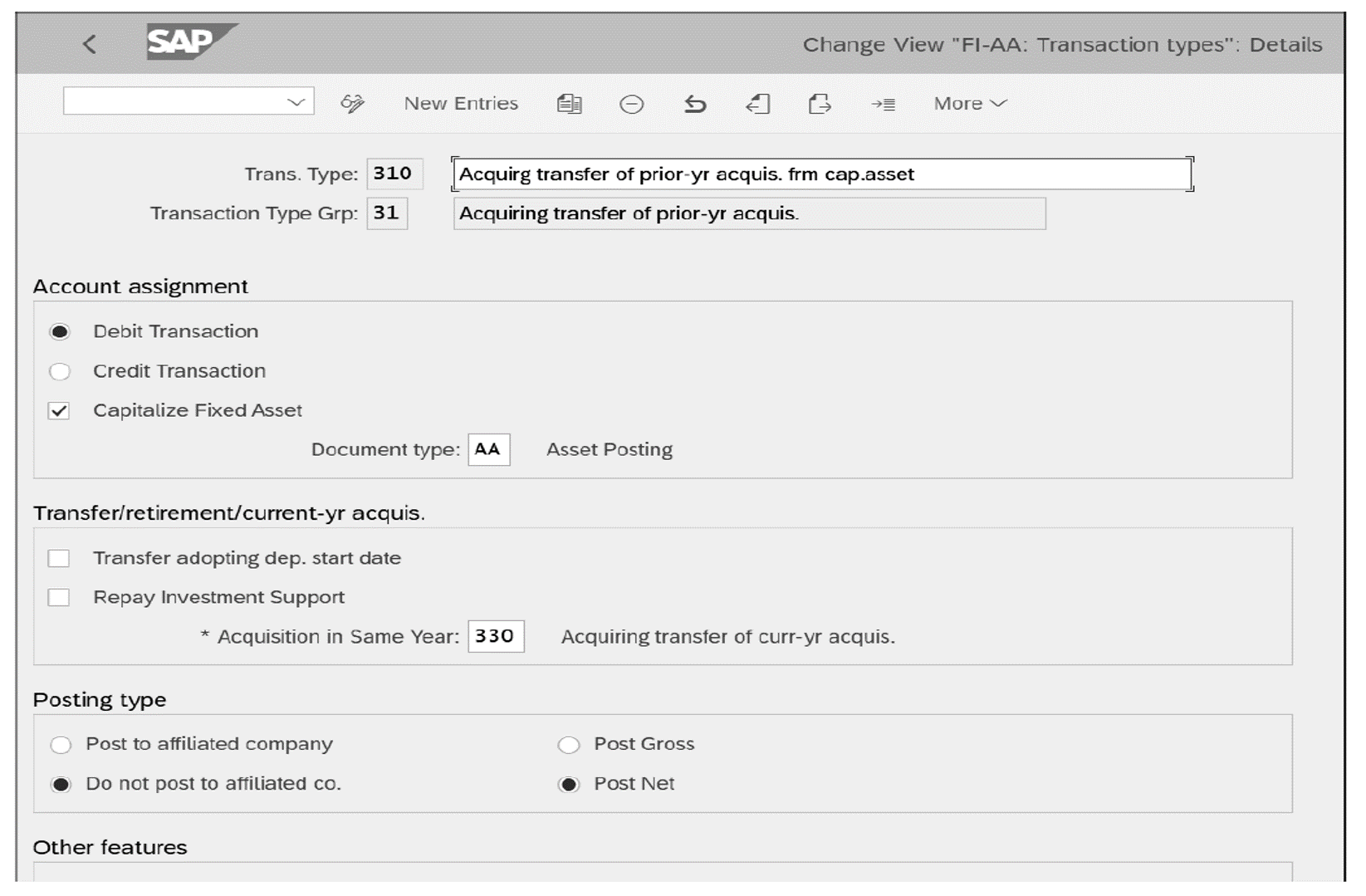

Double-click on type 310 Acquirg transfer of prior-yr acquis. frm cap.asset revelas to review its settings, as shown in this figure.

Notice that we have a debit transaction type, and the Capitalize Fixed Asset checkbox is selected. This transaction type doesn’t post to the affiliated company and posts net, which means that no accumulated depreciation will be transferred.

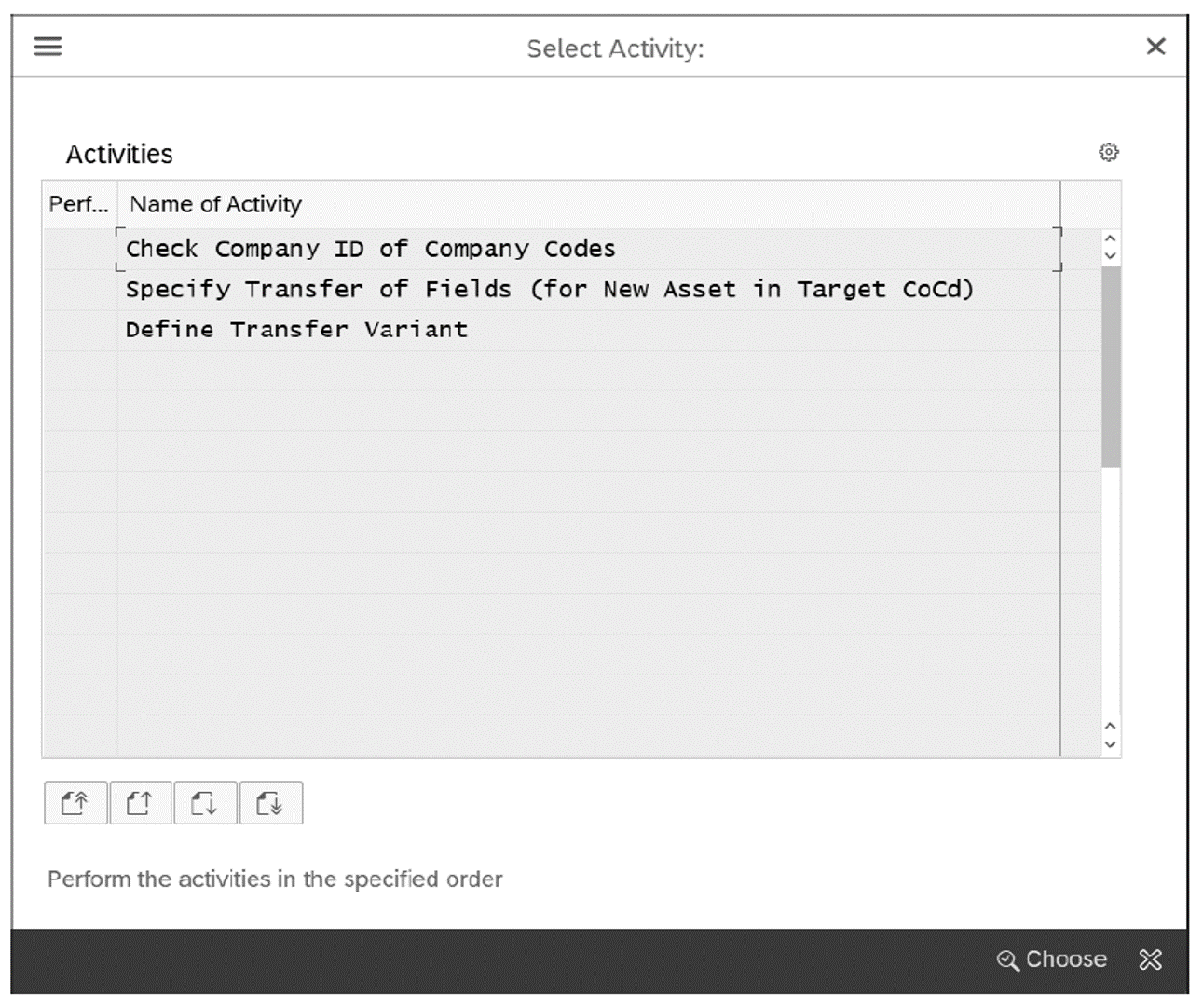

For intercompany asset transfers, you’ll need to define a transfer variant, which determines which transaction types are used in the sending and receiving company codes and the transfer method. Start by following the menu path Financial Accounting > Asset Accounting > Transactions > Transfer Postings > Intercompany Asset Transfers > Automatic Intercompany Asset Transfers > Define Transfer Variants.

On the activities selection screen shown in the next figure, double-click on Define Transfer Variant.

4

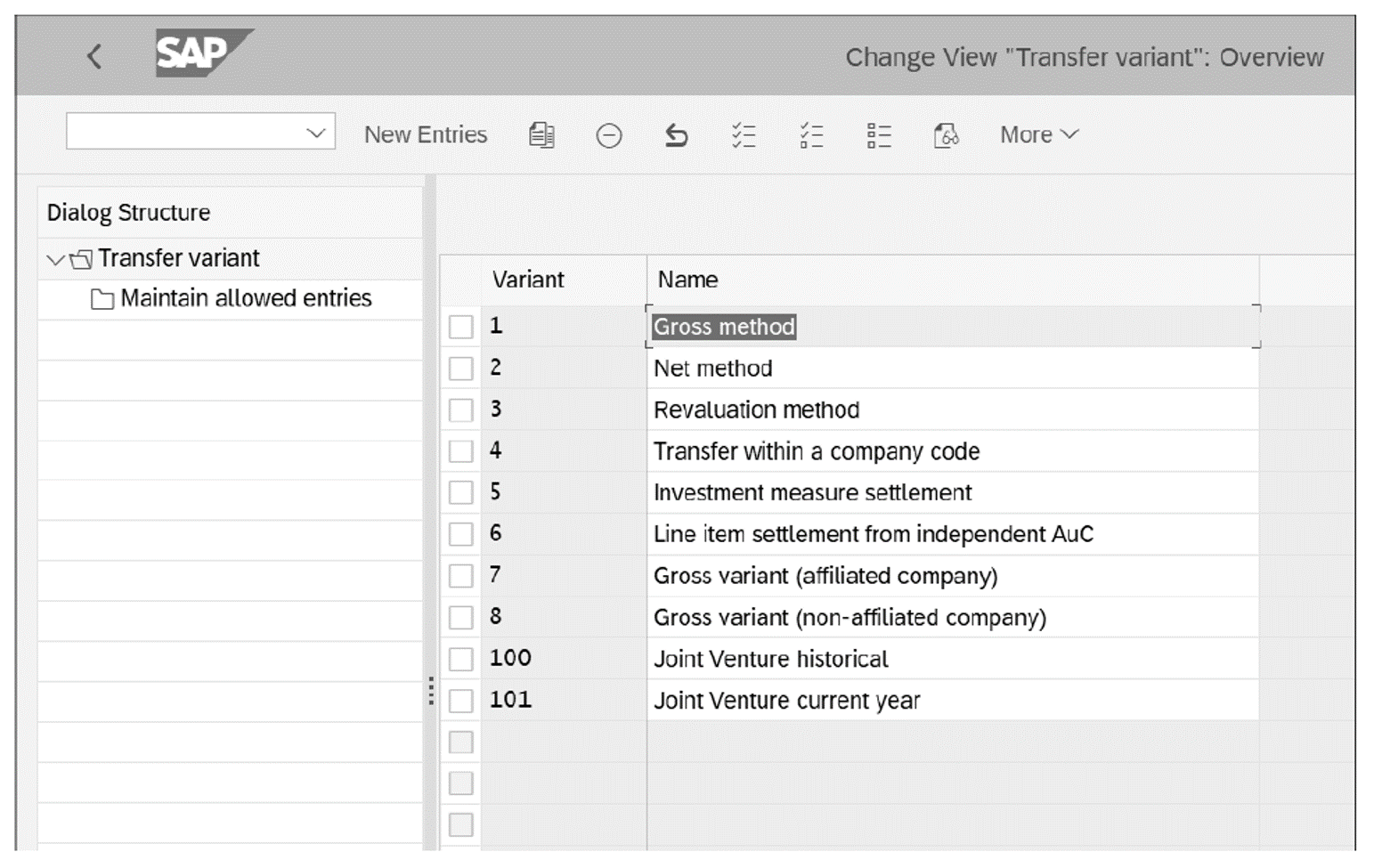

You’ll see a list of the defined transfer variants, as shown in the next figure. Notice that various transfer variants have been defined, for example, for the gross method, where depreciation values will also be transferred, and the net method, where only the net book value of the asset will be transferred.

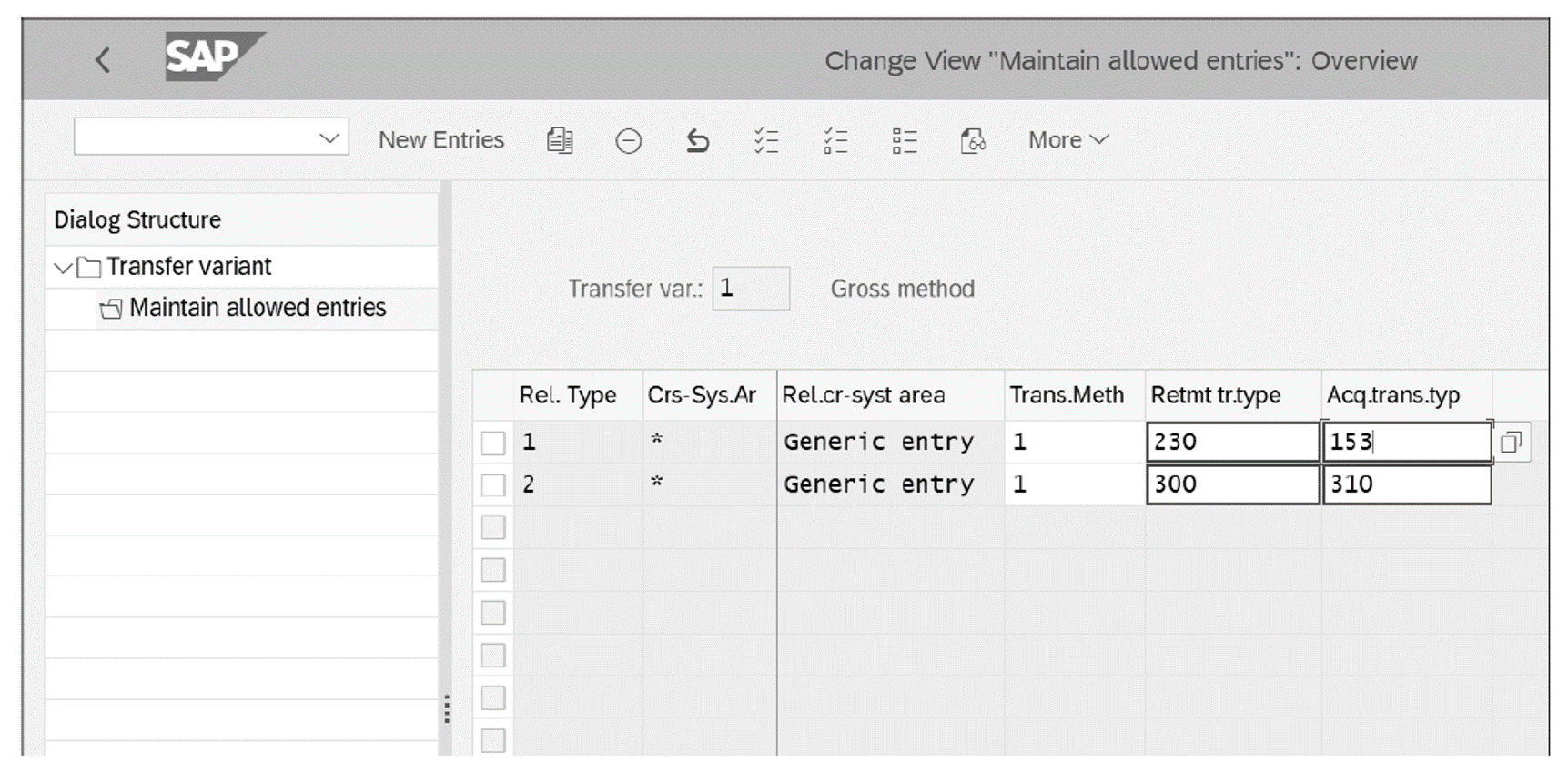

Select variant 1 and click on Maintain allowed entries, which takes you to the variant configuration screen, shown in below.

Two separate sets of entries are based on the Rel. Type field, depending on whether the company codes involved in the transfer are independent units or not, as follows:

- 01: Legally independent units

- 02: Legally one unit

The Trans. Method field defines the method of transfer, such as gross, net, with adoption of values, and so on.

In the Retirement tr. type and Acq. Trans.typ. fields, enter the transaction types for retirement and acquisition during the transfer.

If you’re going to make changes to the standard transfer variants, again a best practice is to copy them to create new custom-made variant in the custom name range.

Learn Asset Accounting in Our Upcoming Rheinwerk Course!

Take ownership over asset accounting! Blending detailed business processes with high-level configuration, this four-day course walks through the full lifecycle of asset accounting, from acquisition and transfer to capitalization and retirement. Click on the banner below to learn more and order your ticket.

Editor’s note: This post has been adapted from a section of the book Asset Accounting with SAP S/4HANA by Stoil Jotev. Stoil is an SAP S/4HANA FI/CO solution architect with more than 25 years of consulting, implementation, training, and project management experience. He is an accomplished digital transformation leader in finance. Stoil has delivered many complex SAP financial projects in the United States and Europe in various business sectors, such as manufacturing, pharmaceuticals, biotechnology, chemicals, medical devices, financial services, fast-moving consumer goods (FMCG), IT, public sector, automotive parts, commodity trading, and retail.

This post was originally published 4/2021.

Comments